December 2, 2023

I was wrong, SILJ didn’t just visit $10 again, it went down to $8, in one of the worst maulings miners have seen, defying all logic on valuations, focused only on the Fed’s tightening (raising) of interest rates. We were stopped out of some positions, but remain very heavily invested as we recently bought back in, even added to positions via LEAP options that expire in January 2026. It was a rough ride and unexpected on my part, as each time they looked as if they turned the corner, they were beaten lower again, even greatly underperforming the metals themselves. I will get into the details more soon, since we have gotten mostly re-invested for yet another try, I have more time to share observations here as we head into the end of the year. For now, let me just post two long term (monthly) chart going back twenty years each, to give the reader an idea as to why we went back in heavy recently on SILJ and some individual miners.

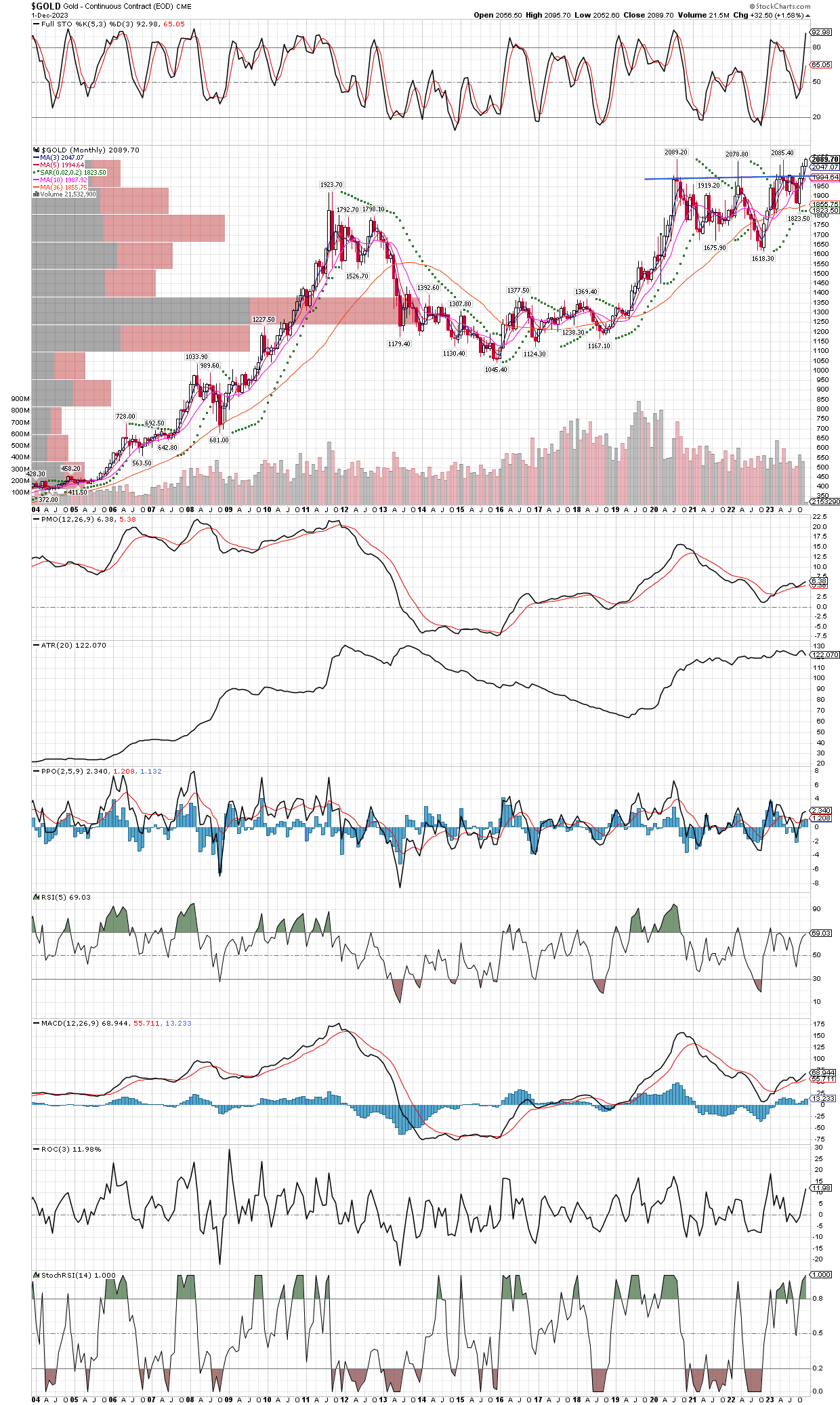

$GOLD has a very clear, long tern cup and handle pattern that has finally culminated in an all time monthly closing high. Its a clear breakout, and while I won’t surprised nor the least bit concerned if gold pulls back some time soon, this chart tells us gold is making its move to a new, higher trading range that has yet to be defined on the upside. It’s very bullish.

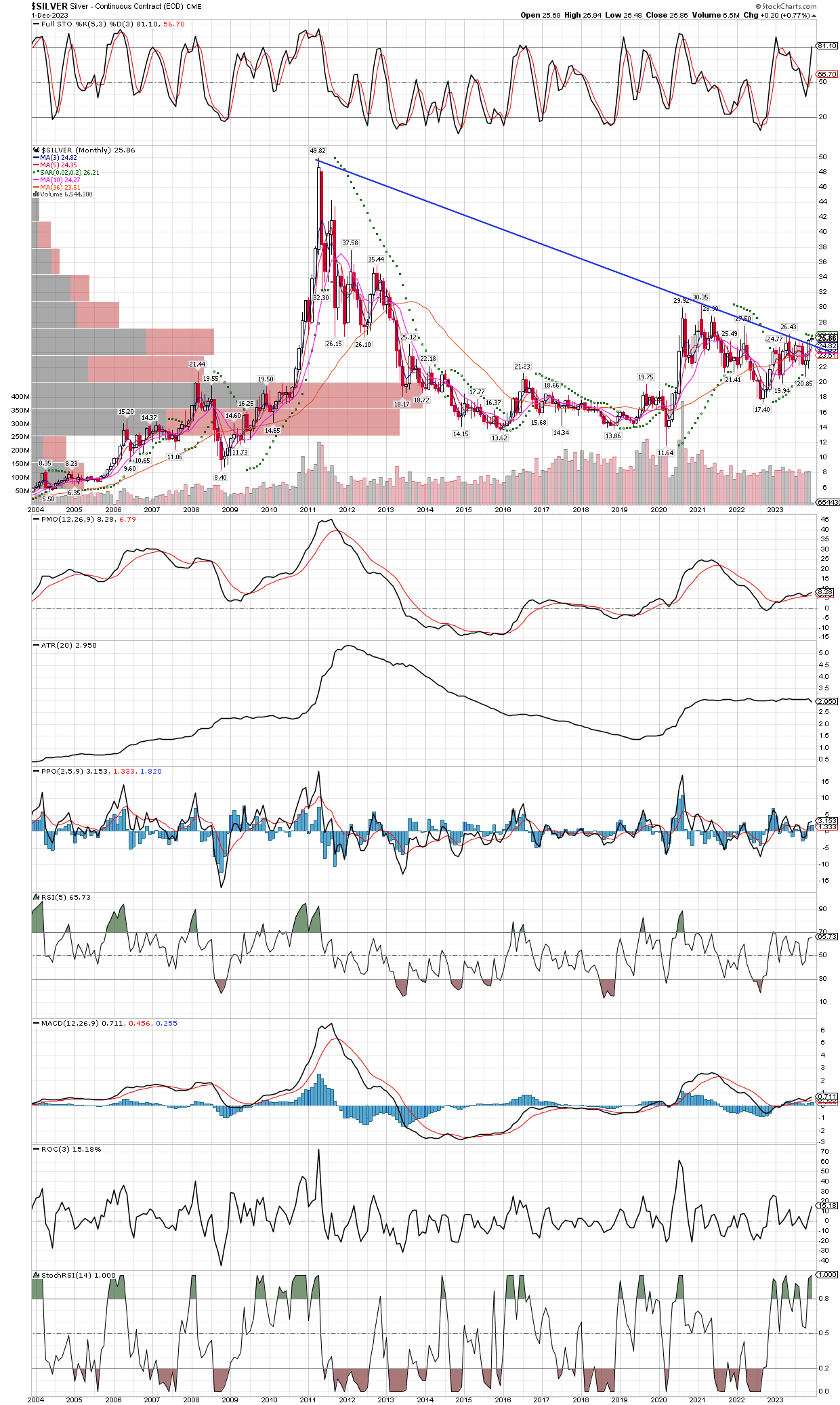

$SILVER is doing some tricks of its own, and just recently started to outperform gold, another sign the secular bull market has kicked in again. As many have pointed out, silver goes up later than gold, but much farther and faster. Considering it is still only half its all time price high seen twice before, in 1980 and 2011 at $50, silver could truly make some eye-popping gains of several hundred percent. I will remind readers that in 2016, silver only rose 50% from the lows, but maybe of it’s miners were up 500% or more, even the SILJ etf rocketed over 380%! This is why were are heavily invested in silver and gold miners (most silver miners get half their revenue or more from gold, so they are diversified between the two), and the best part is that they are the standout group when everything else is getting demolished. I have little doubt that while silver might take a breather and consolidate even for a year or two around $50, it will likely go way past that level ,offering several hundred percent returns just on the physical metal, imagine what the miners will do in that scenario? Best to own some, if not a lot, like us.