February 29, 2024

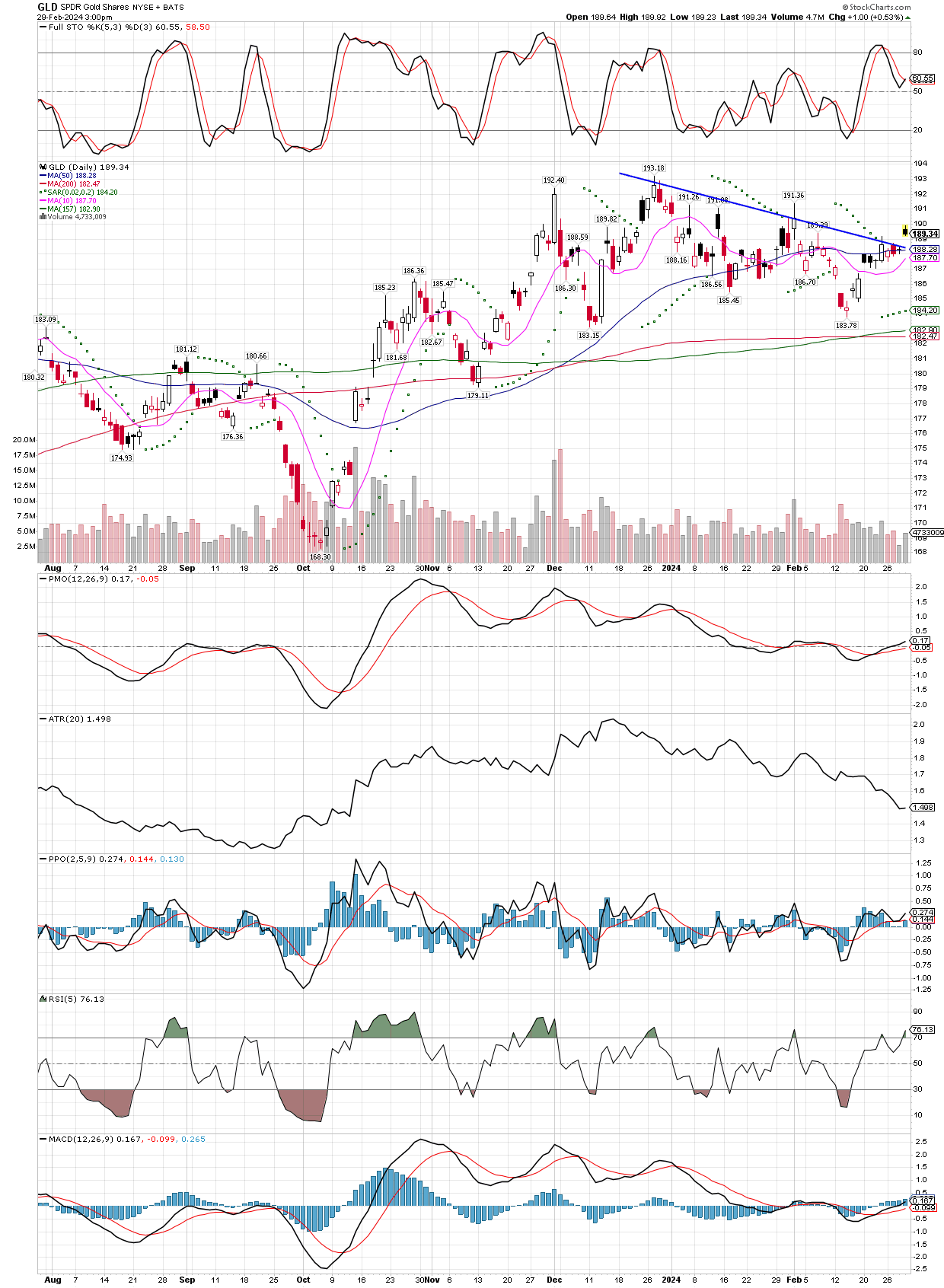

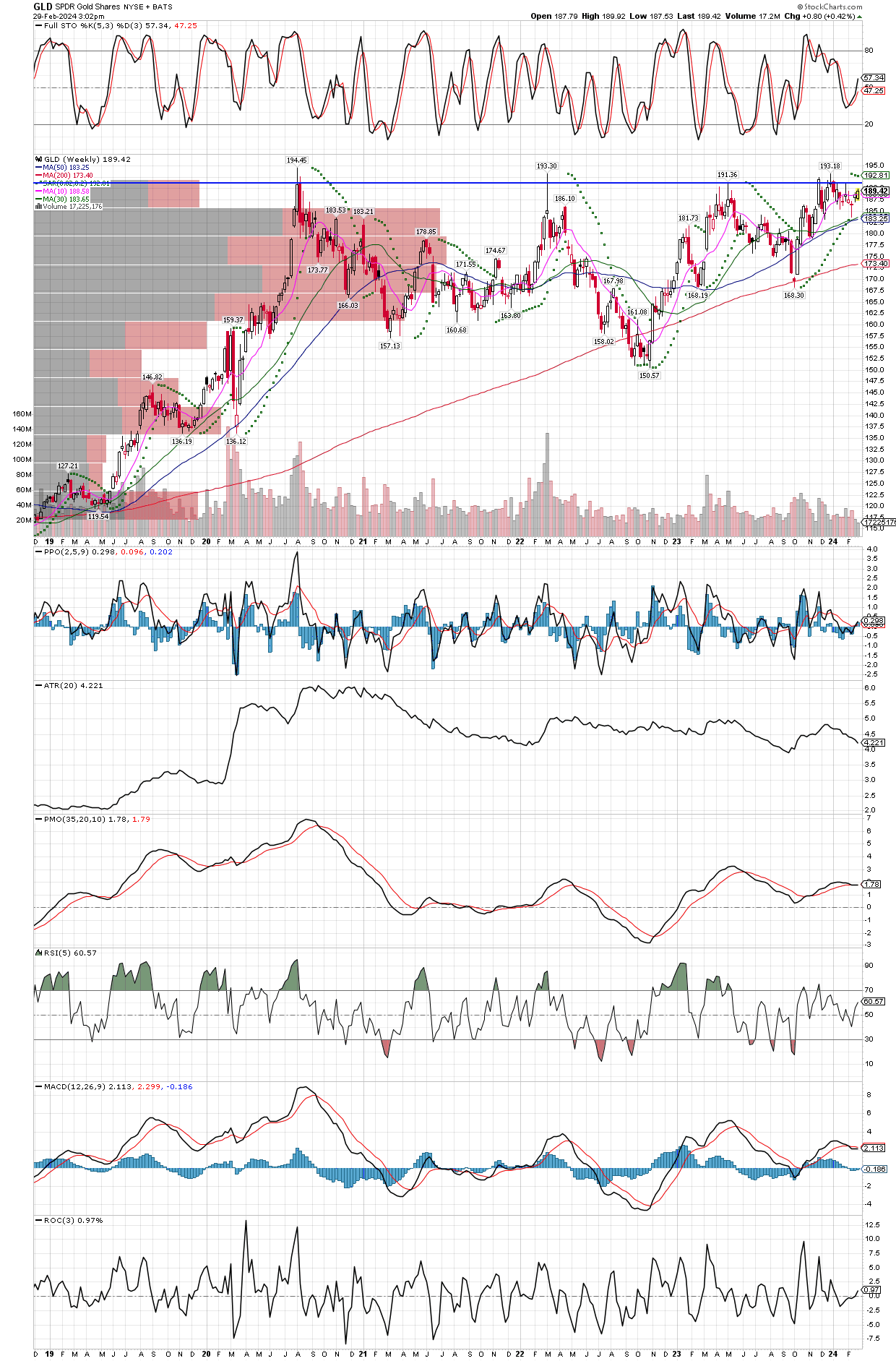

I will use the GLD etf for my charts, since they are up to the minute including today’s move higher. Below are the daily and weekly charts for GLD, and not only is gold above all the moving averages I use, its the same on my monthly charts as well. So we have a definite trend higher, and the only thing that could hold it back from making new all time highs might be the horizontal resistance in this general area, going back to 2011. It has tried several times to get through these highs, in fact did so recently before pulling back to test the break out. The ceiling has slowly turned into a new floor, providing a launch pad from which to mount the next significant run higher. How high? I’ve learned nobody can know for sure, but spot gold could easily go to $2500 in this move, which would be in the area around $250 on GLD.

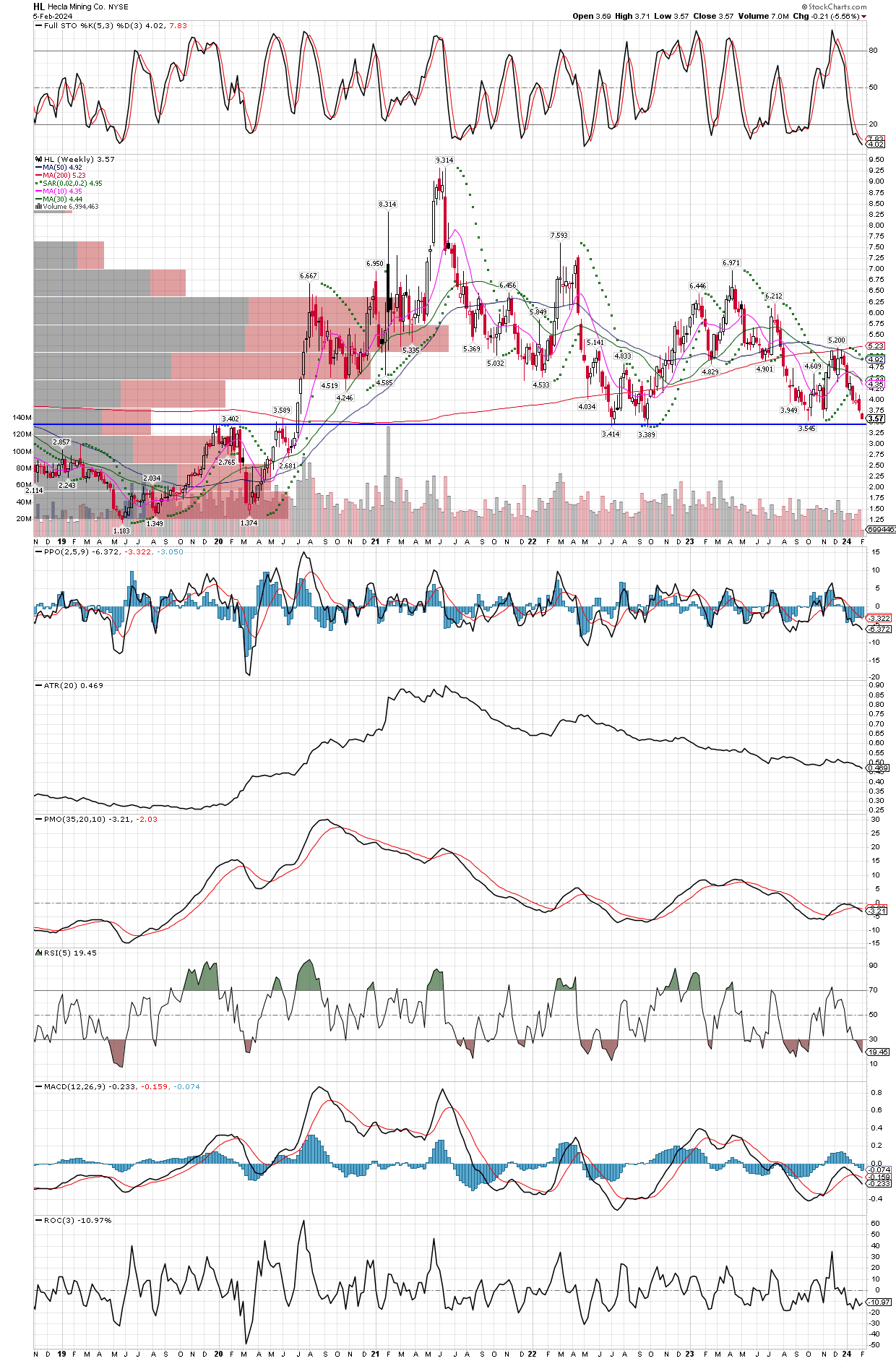

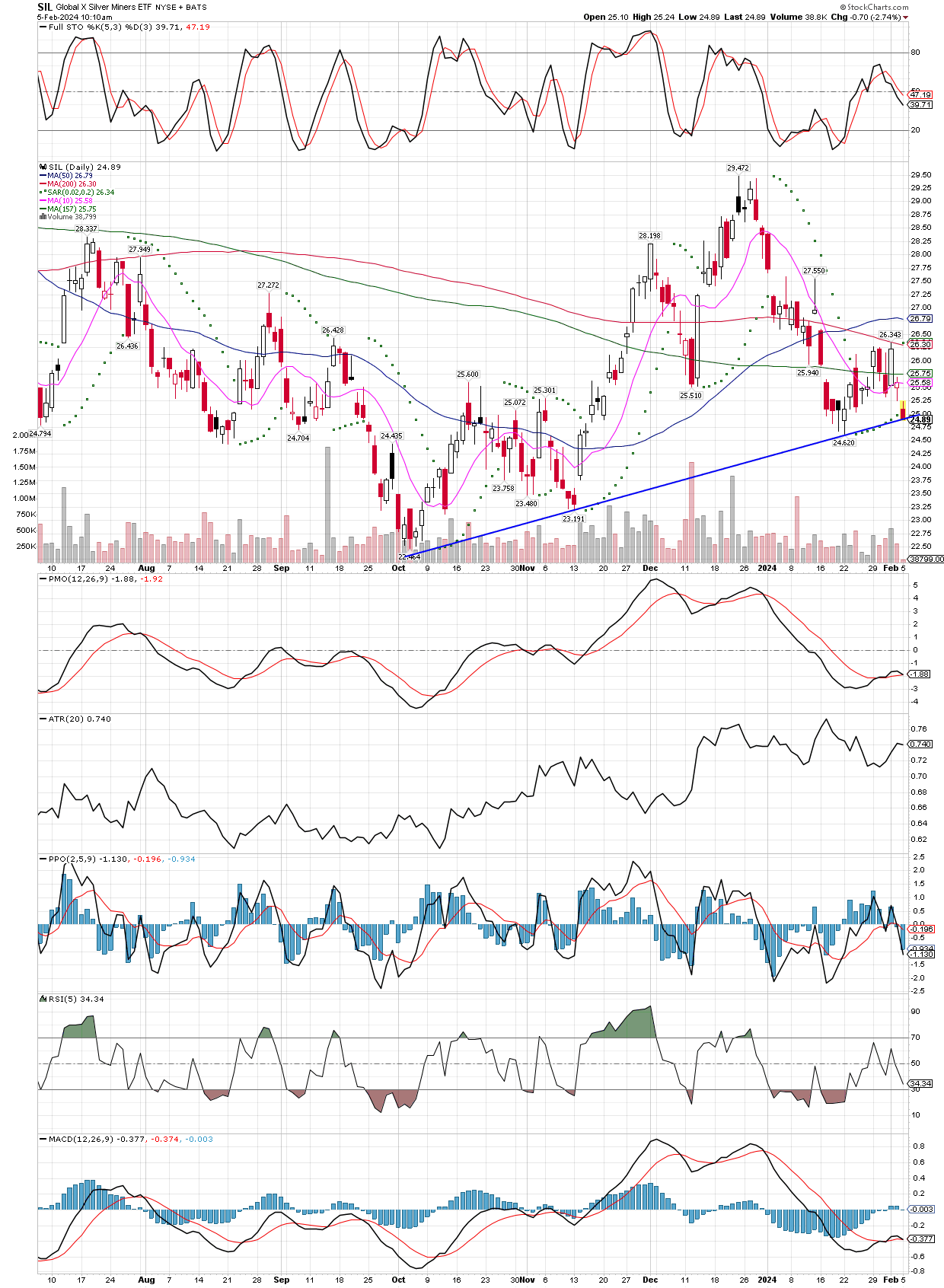

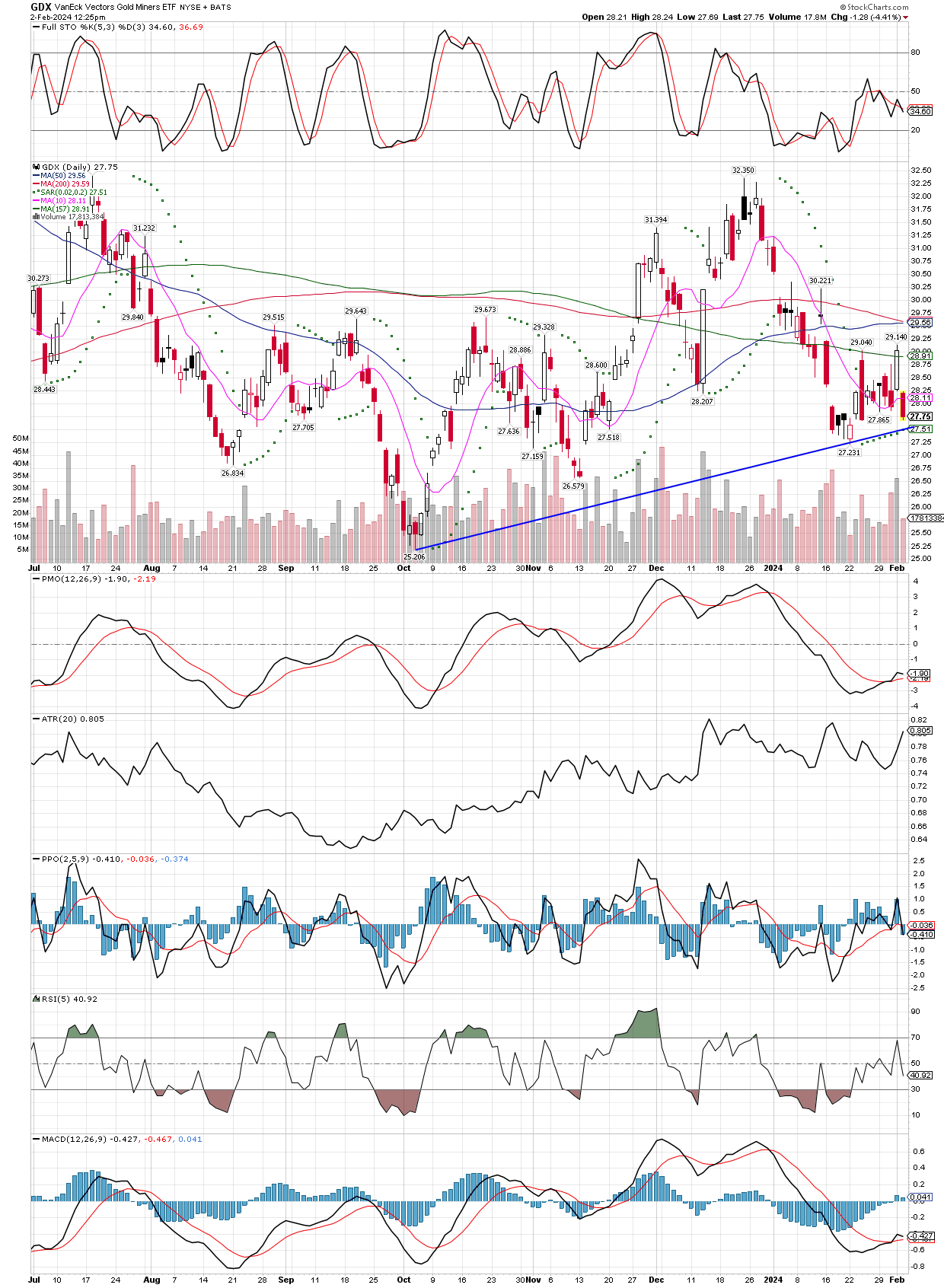

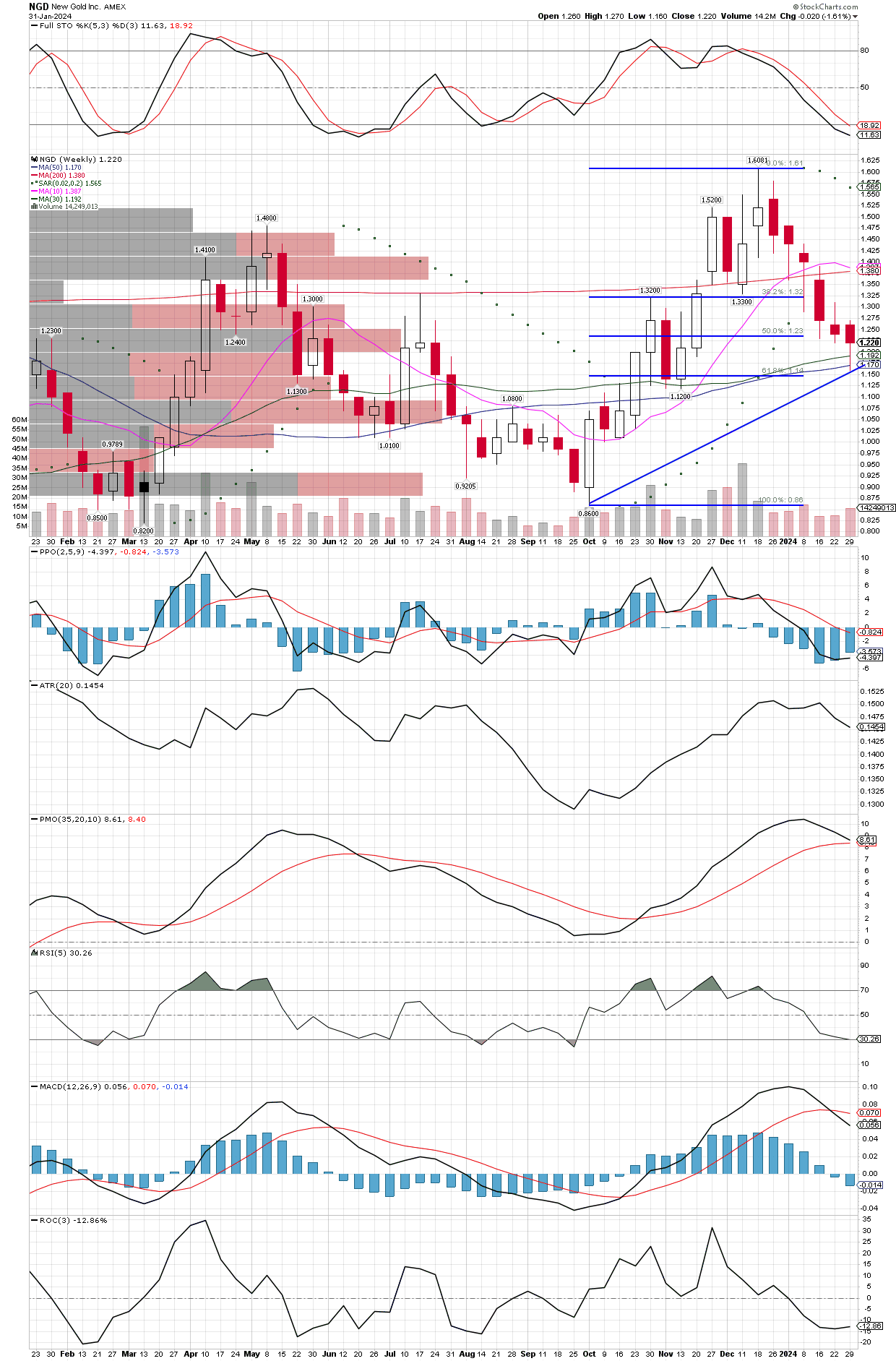

Everybody hates miners, refusing to touch them ever again. They post charts showing how poorly they perform over time as investments, and I can’t argue with that. I also know the group can fly faster and farther than most can imagine, often in very short time periods. These can be life-changing moves for those that realize it’s far better to be a buyer with the mood so grim, than any other time. It won’t surprise me to see such fierce negativity remain, after the double from here, providing the fuel for a 300-400% returns in just the “slower” moving big miners, and 600-1000% gains in many junior explorers. Maybe I will be proven wrong, but its always darkest before dawn, and I have seen what miners can do in the past when everybody despises them.