December 29, 2019

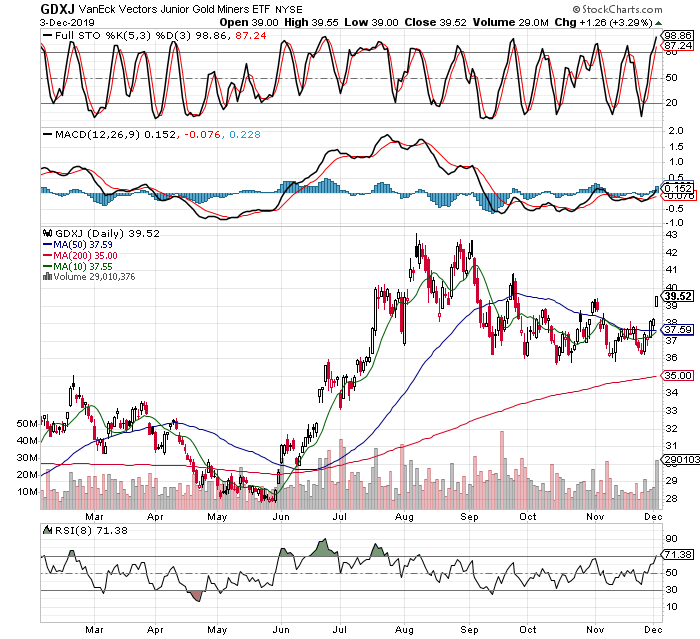

Christmas week trading is usually dull and low volume, but not this year! The miners took off to the upside, creating a “recognition week” on the charts, basically a standout move that is easy to spot on a chart from across the room.

SILJ was up over 10%, and even the slower moving GDX was up over 7%, and they had big volume as well. Let’s take a look at the charts.

I like to focus on the weekly charts because I am longer term focused in my trading, but now let’s check out the daily chart to feel how dramatic the moves were.

The daily chart above is simply splendid, I can’t envision a better confirmation that my betting long on miners is correct, not to mention being up around 40% on the position is the greatest confirmation of all. A clear breakout, huge volume in a typically low volume week due to it being holiday shortened with markets closed a day and a half. Simply put, nothing has changed except my adding slightly to my positions recently on the weak days (see account activity to confirm). I will continue to hold long and strong as we are now beginning the best time of the year seasonally for silver, and the miners in general. Several sites cover seasonality, such as Seasonax or Mish Shedlock wrote an article quoting a study where the average gain for the metal is 17% between now and the end of February each year. Of course, if the metal moves 17%, we can expect the miners to move at least twice that amount, so I will stay heavily invested for quite awhile longer.

I will report any portfolio changes as they are made, and you can verify holdings for yourself on my accounts or portfolio pages. It’s been a Merry Christmas, perhaps we will see a Happy New Year as well!