April 21, 2023

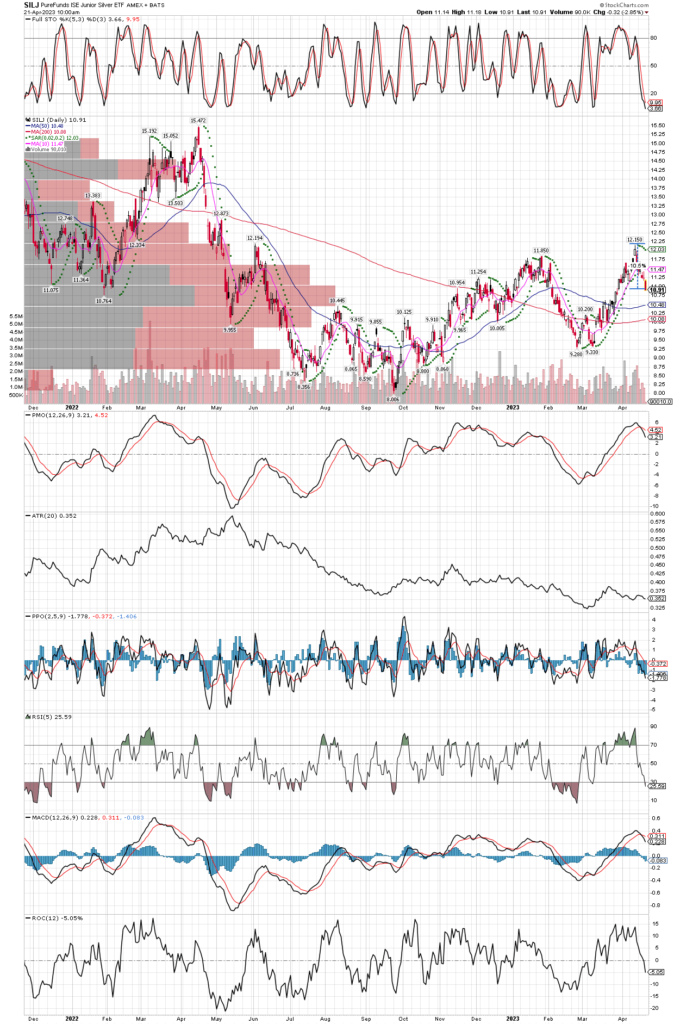

Miners are experiencing a decent pullback on the daily charts, now sporting oversold technicals like stochastics and RSI which is usually a good time to add. I am doing some nibbling here on the SILJ and trying to add to some individual miners are well, like EXK.

While I don’t make trading decisions off the COT reports, I found this very interesting.