Bought Cotton Futures, Natural Gas Is Next

April 11, 2024

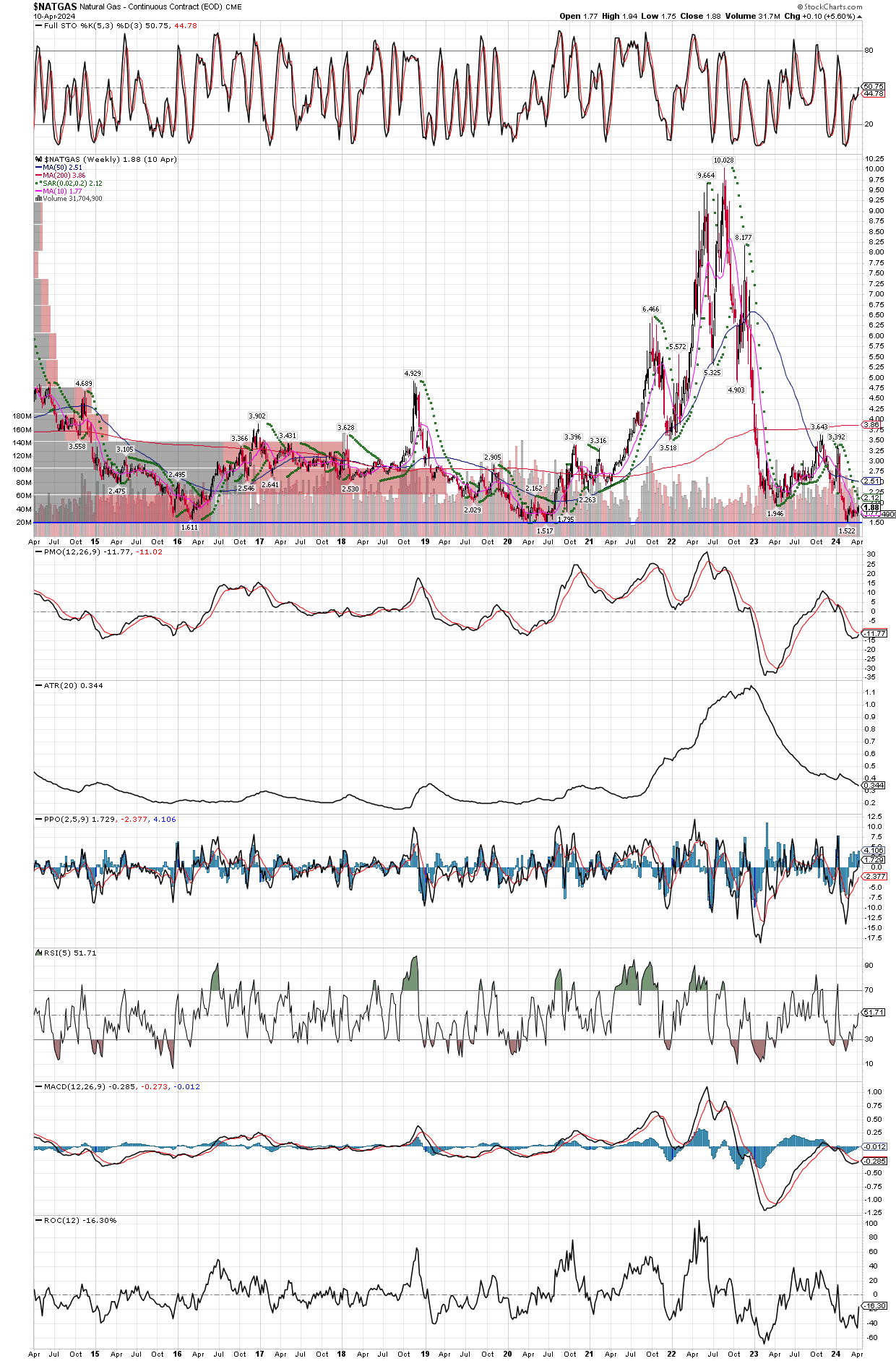

Both commodities have been hammered lately, and natural gas not just lately but for the last couple years. Both also exhibit seasonal tendencies to rally from early April until end of May for CT futures (cotton), and late March until early June for NG futures (natural gas). Being inflation is running hot and the commodities bull taking another upswing in various products, combined with the lower levels of risk entering a position after such massive bear mauling as seen in the natgas chart below, I am comfortable starting position here in both natgas and cotton, and will look to add if they can turn higher, while keeping Total Risk (TR) fixed. These trades will likely be ones I take profits on after an intermediate term rally, rather than hold on and pushing the gains like I am doing with the metals and miners, bc right now its the metals’ turn to shine, while the energy and softs I think should rally but it will be capped due to the weakening economy. However, that could change and I push longer for larger gains, if something like the $USD starts to weaken and exert a downtrend.