Too often I see traders and investors running from one indicator to another, or marking up their charts with twenty different technical measures, thinking it gives them the edge. After all, more is better, correct? Actually, no, it not only becomes difficult to follow, the more indicators and advisors one listens to, the more likely to receive conflicting signals and advice.

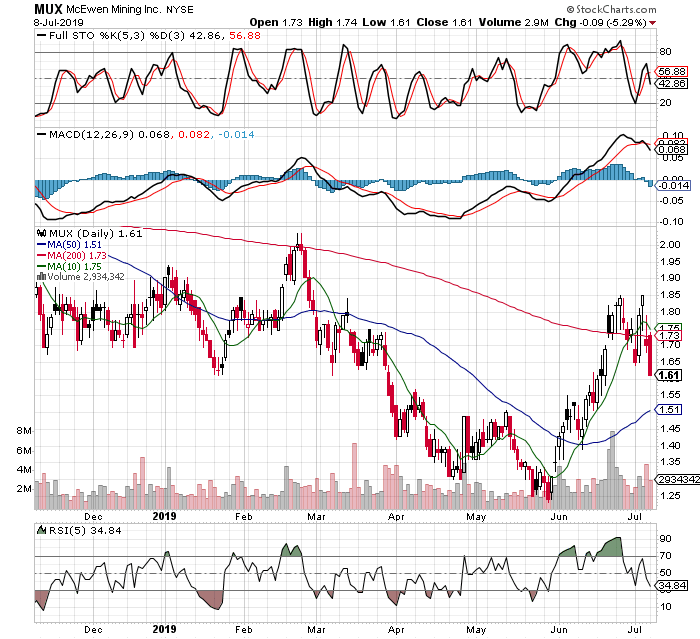

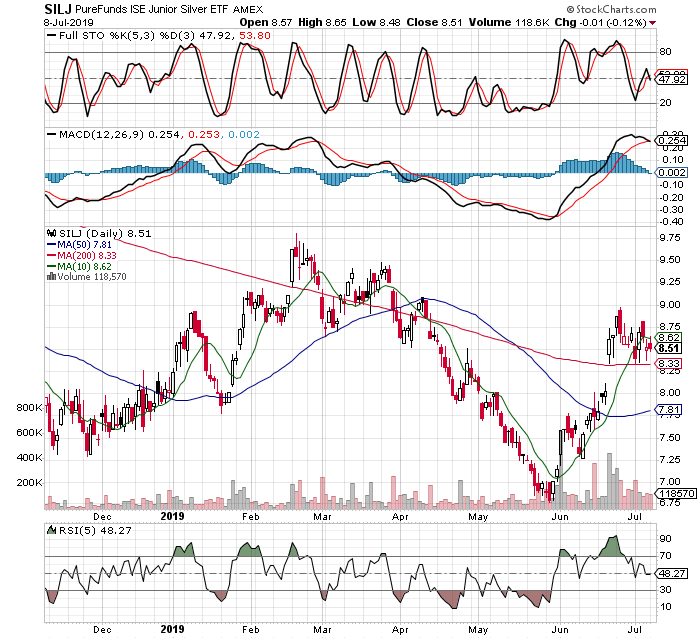

Why do I mention this today? Well, I find myself in a good trade right now with the precious metals mining stocks, and after a good run there are naturally many people looking for reasons to sell. Using sentiment can be very useful, but we need to remember in what environment the data occurred, for example, extreme negative sentiment is a good buy signal usually, but even more so if occurring in an overall bull market for the group. Applied to my current positions, I like the overall setup and everything seems to be falling into place, except for a couple negatives that are popping up. Suffice to say, I am NOT changing my positions by selling out, but I want to show you some crosscurrents and things that could easily shake a trader out, especially after nice unrealized gains have been made. It is too easy to find reasons to ring the register, nobody wants to see unrealized gains vaporize. This week’s negatives are the COT report (Commitment of Traders at the COMEX exchange), and some long time bulls are now calling for a substantial correction before the bull resumes it’s trek higher. These long time bulls still think miners go much higher, but they have decided to sell some or all of their miners, int the hopes of buying them back cheaper at a later date. Guys like Adam Hamilton from Zeal llc come to mind. I respect his in depth analysis, so this is not meant to pick on him as I find his work well worth reading, however we all have to make our own decisions and we must know that nobody gets it 100% right all of the time.

If we are truly in a bull market of for gold and silver, then it is not only just getting started, but we have a long way higher to go. To me, the risk is in being left behind, so while I agree with Adam Hamilton that a pull back could come at any time, I will not try to dodge it because it might not come, or it might not occur until we are already at much higher prices. The point is I don’t want to get too fancy and trick myself out of positions, since I think we see much higher prices over time. If Adam can get out, then back in again at much lower prices, his returns will be far better than mine. However, he has a big decision in when to buy back in. What does he do if miners pull back only 5% before heading up again, where does he buy, and even that is only known in hindsight that the correction was 5%. What if the miners go 10% higher next week, then start the correction? At what level will he know to buy back in, after a 5%, or a 10%, or 15% correction? What does he do if the group just keeps marching higher slowly, gaining 2-3% per week, after he has cashed out a month or two ago? To me, the risk of being out of positions on a good call is just too large to handle. Ringing the register feels good, as if you have “locked in” gains, but you don’t really know that until you discover at what prices you bought back in. Only then can the trader know if he made more money by hopping in and out.

Two quick points to wrap it up. First, if you want to be “big time” you have to think like the guys in the big leagues, and you have to make decisions like they make. I can assure you that most of the whales in the markets did not make their money hopping in and out, for proof just know that the markets couldn’t possibly digest their order sizes without pushing prices around to their detriment. The whales will always tell you that they need to get in and out when the markets let them, they need significant retail order flow to dump their huge positions. Warren Buffett is an ultra-long term investor so maybe not the best example here, but we can agree he is immensely successful and among the best investors, and he for sure does not sell a stock at every whim, just because he is already up 20% in an idea. He fully realizes that what goes up goes down some too, but he is willing to ride the move lower in order to wait for the next push to higher highs. Contrast Buffett’s trading behavior with any free investing forum online, where the little fish, at home day traders are talking all day about every wiggle in their favorite stock, counting the dimes made and lost by the minute. It will quickly become clear which is the better approach, jumping in and out, or riding a bull fully that you were “lucky” enough to identify early.

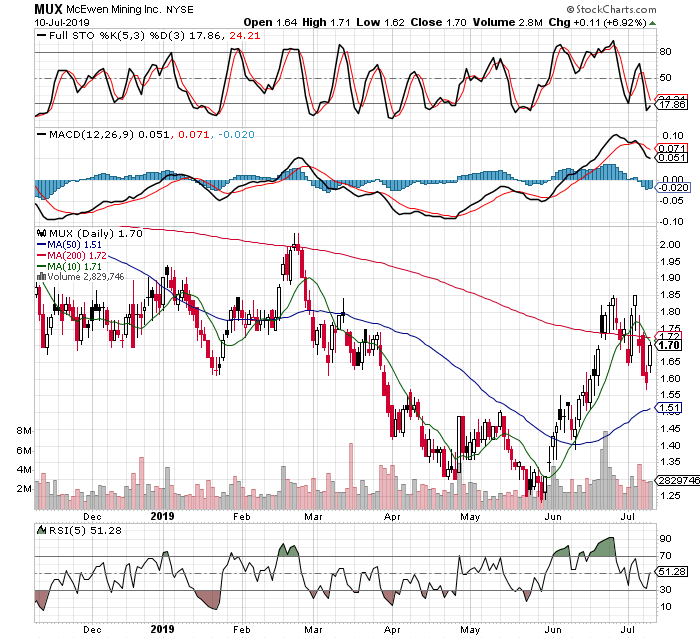

The second point to make is that I will follow my own rules to get me into and out of positions. If we constantly remind ourselves of this, it becomes easier to read unsettling opinions or predictions that are opposite of our own. I realize I know as much, or almost as much as anybody in the markets, and that is good enough to rely on. If I used the long term monthly stochastic to give me the buy signal on the miners, then I will rely on the same technical indicator to tell me when to exit. I let whatever indicators that got me into a trade tell me when it’s time to sell, it’s simple and refreshing because I don’t have to second guess my decisions. Yes, I see a good argument for the move higher to pause or even reverse for awhile, but I do not see a clear way to guarantee I am back to fully invested and on margin if I cash out my gains today, and since my indicators suggest we will see higher prices for miners in the future, all I need to do is stay invested!