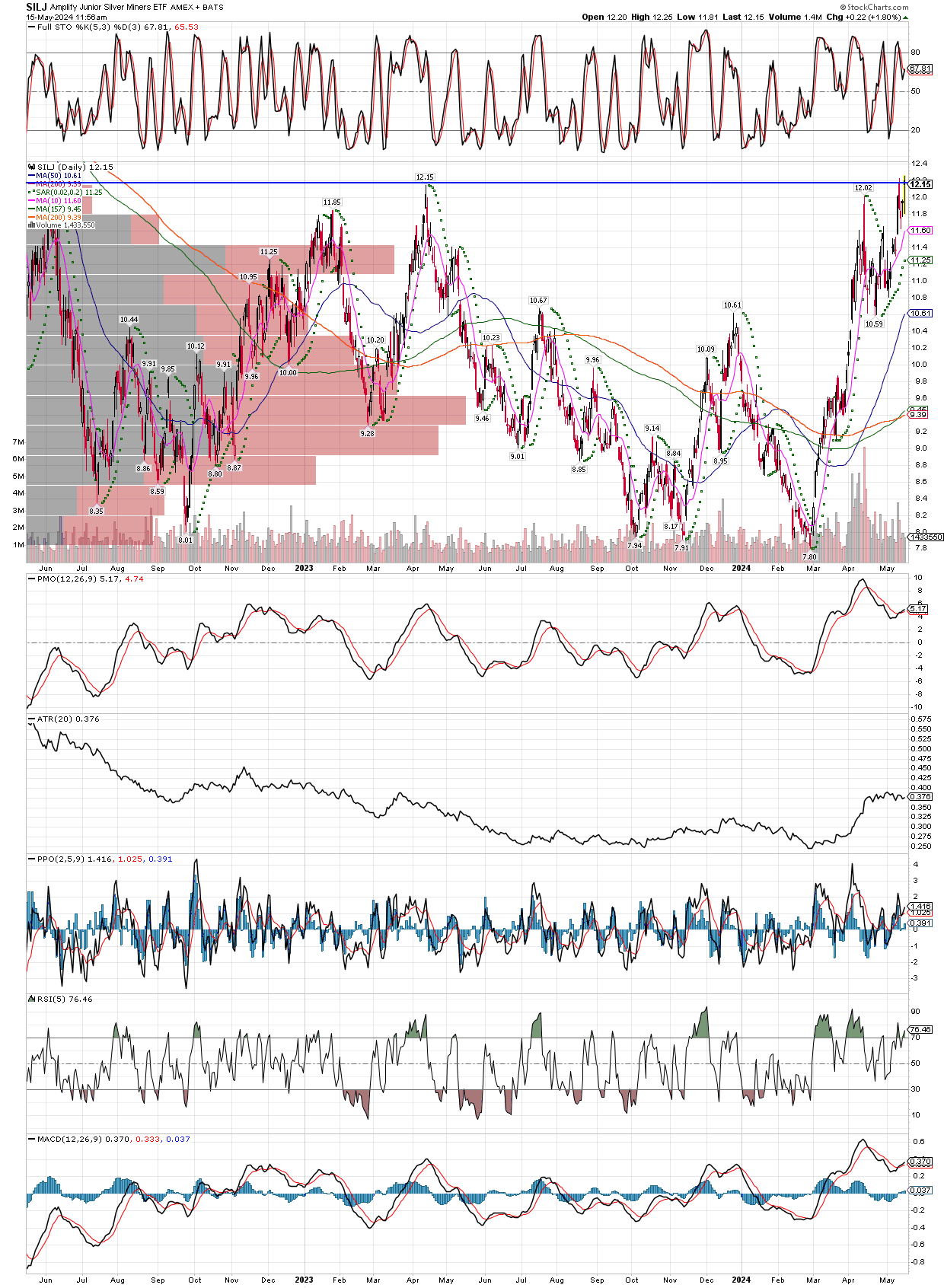

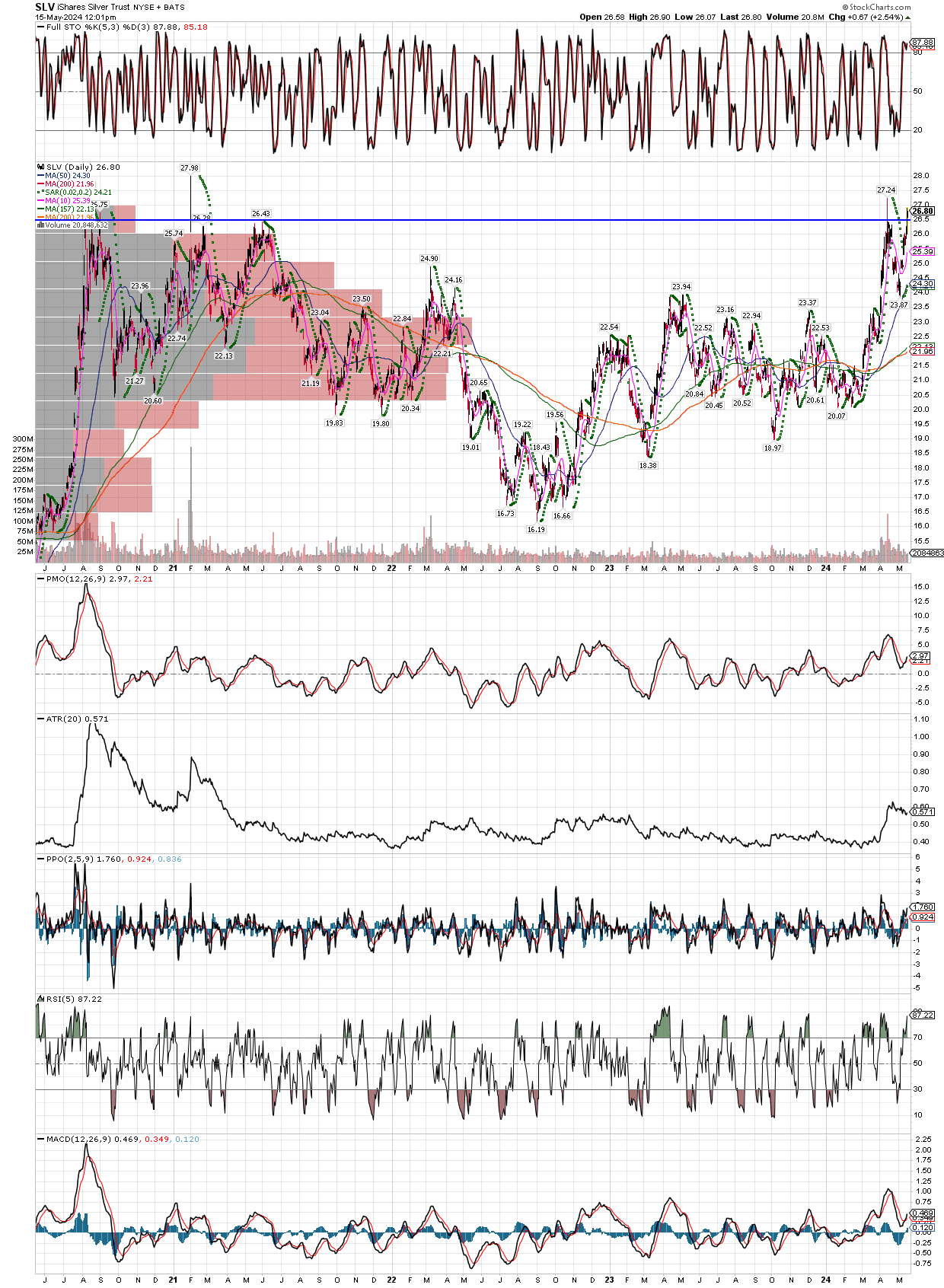

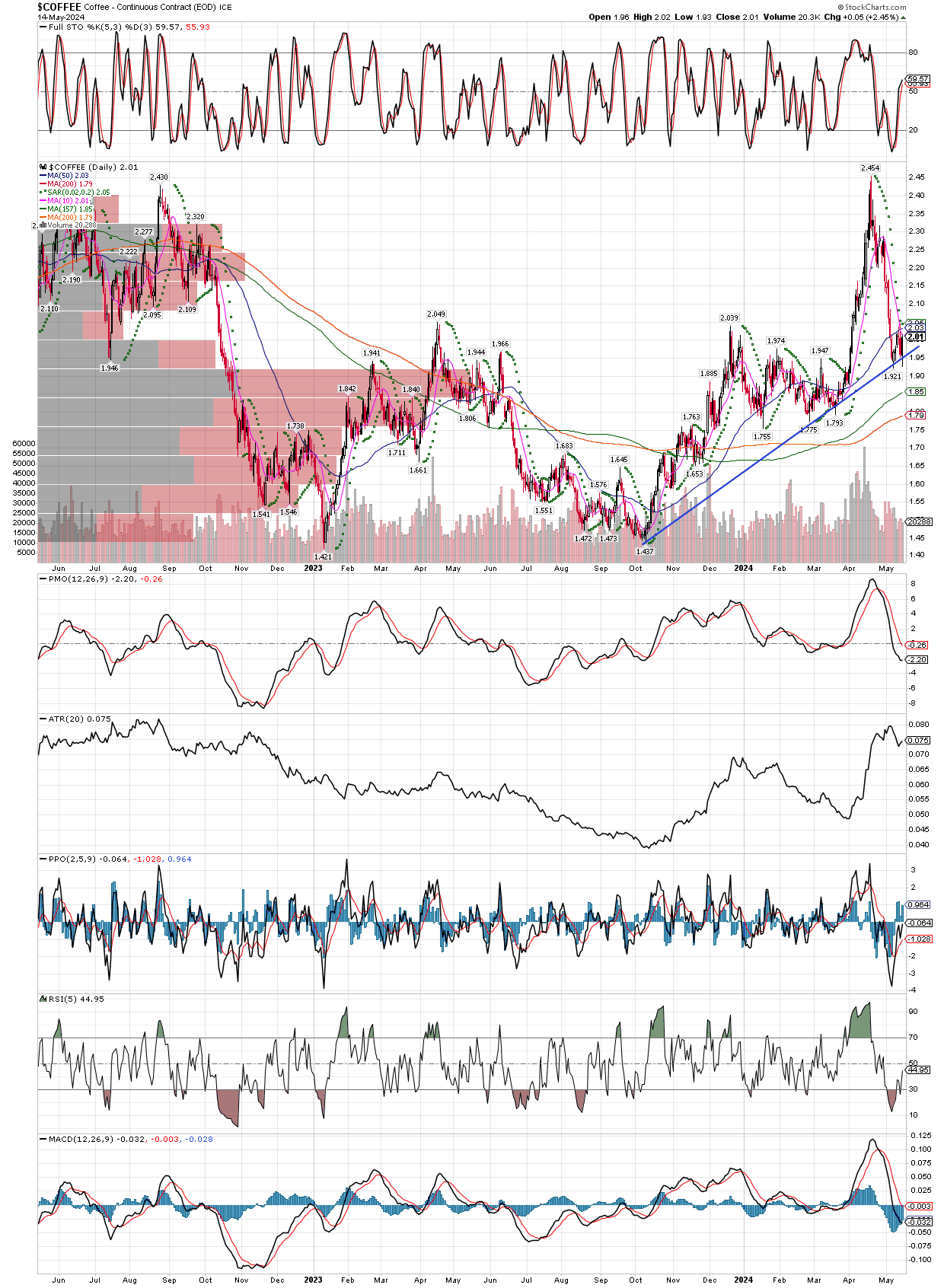

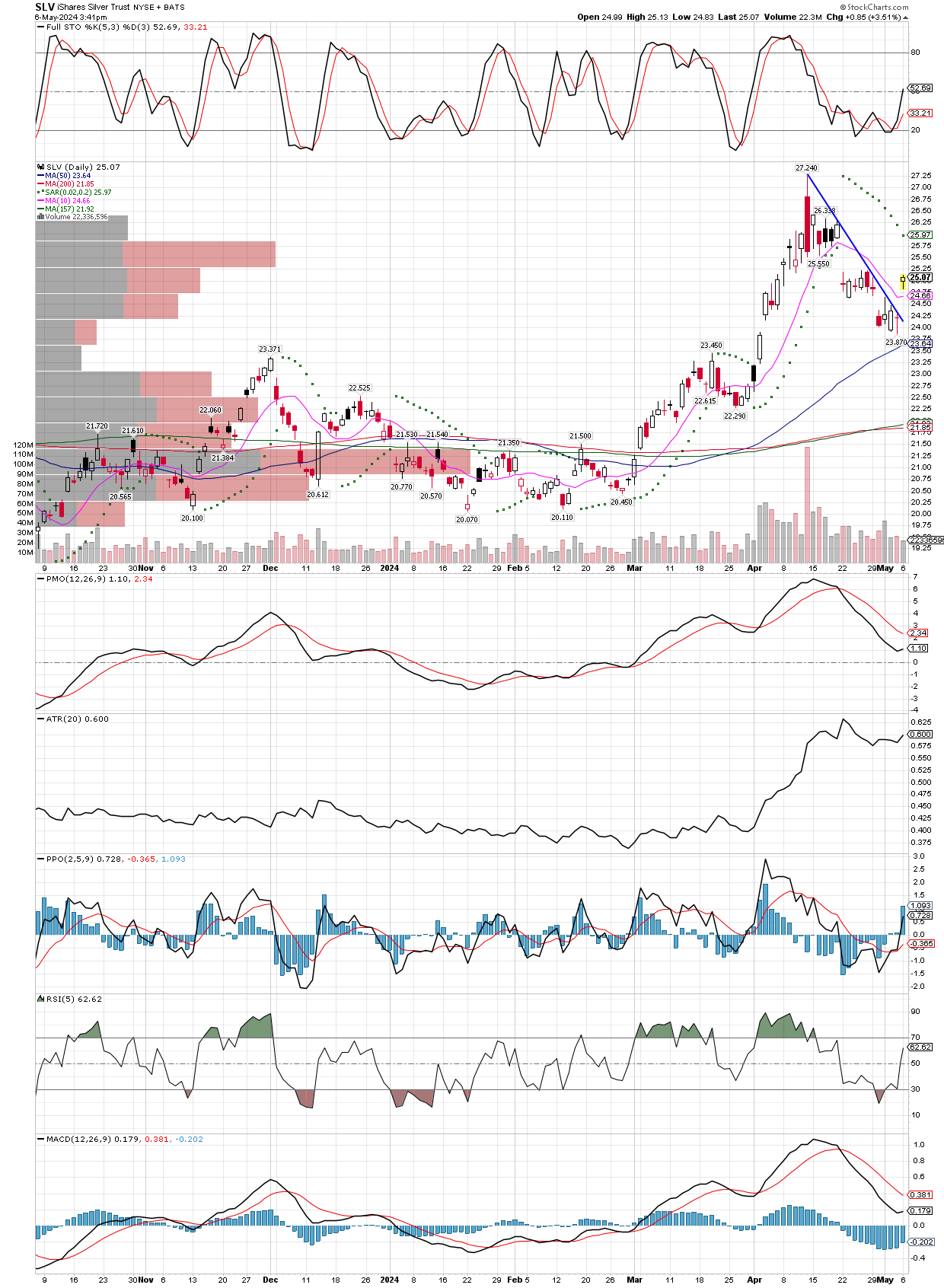

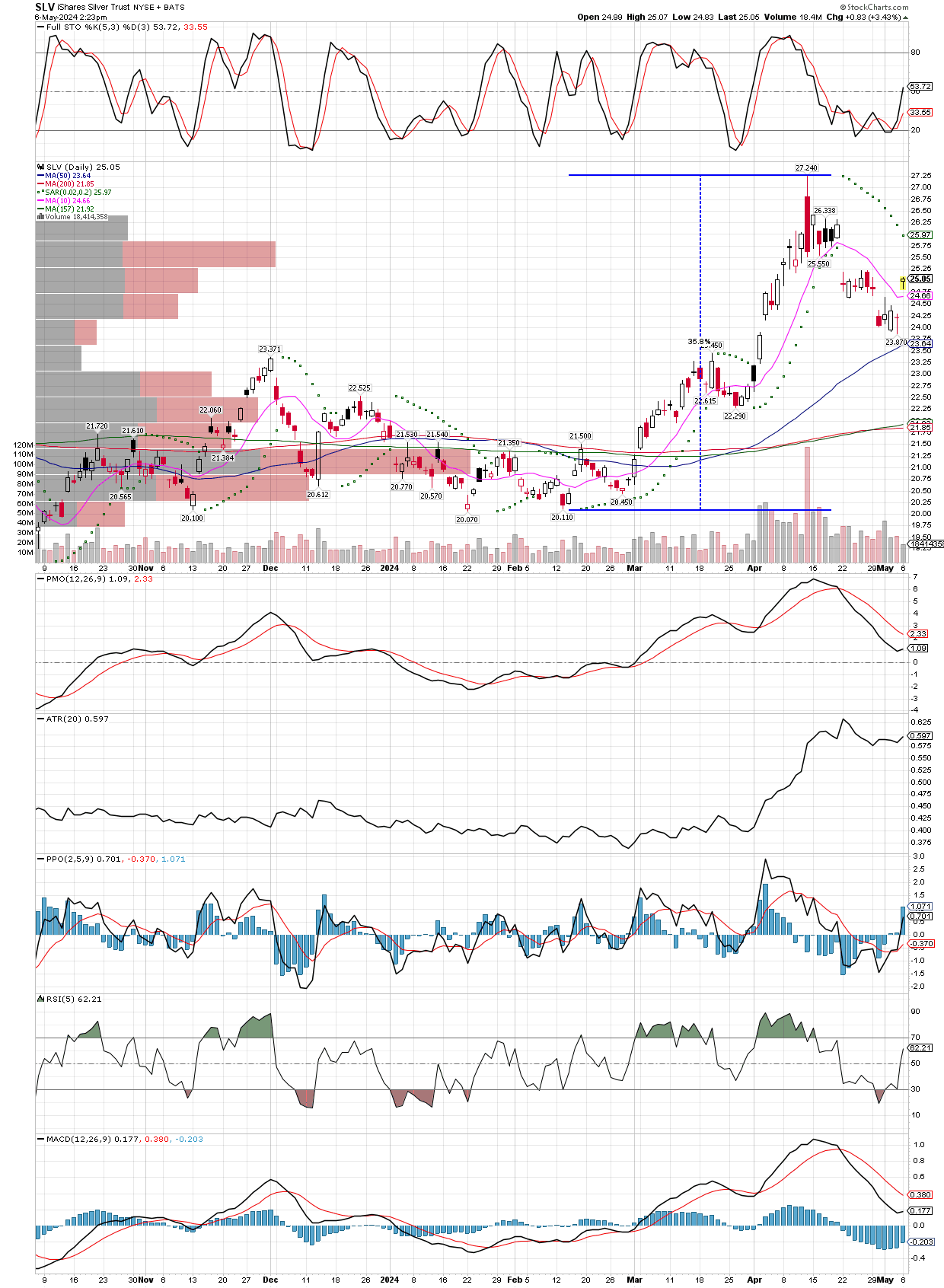

Coffee futures have had a big run since last October 2023, and a subsequent 20%+ correction into an area where I am inclined to buy. Anywhere below the $2.00 level offers a good risk/reward entry, in my opinion. We have seen many commodities take turns spiking higher, Cocoa was the most shocking rise and correction, but others like Orange Juice are breaking out to new multi-year highs, and now things like Wheat, Corn, Rough Rice, and even Silver look ready to start their moves up. Wheat has already done so, the only reason I didn’t buy for our accounts is that it’s not technically in an uptrend on the daily charts yet, but it is close to doing so, meaning I will then buy into multi-day dips or longer sideways consolidations. Copper continues its relentless rise, and platinum just recently started to put up a string of big daily gains, while not involved with these, I might buy the SI futures (July Silver contract), since it looks wound up and ready to explode higher. My favorite technical analyst, Michael Oliver, thinks silver is just in front of a huge 6-10 month rally that could take it to $50 this year. He has been out doing many interviews lately, for those that want to search youtube and hear his words from his own mouth, but suffice to say that he has been deadly accurate in his calls the last several years.

Here is the daily Coffee chart. I added the trend line, though that is not the reason I am buying here, since commodities often trade differently than stocks, they don’t always respect trend lines and more often have a tendency for sharp momentum moves, so breakouts are more important in commodities than in stocks. I just like that Coffee had the big breakout, then got smacked down for a decent correction that has already lasted 4-5 weeks, but could go as long as 6-10 weeks. There is no rush to buy, and the late buyers have been sufficiently punished, so that the downside could be limited from here. If it continues to hold in here around its 10 week MA (not posted here, but around $2.04), I will get long in the accounts I manage, and be ready to quickly add if it starts to move up again.