June 26, 2021

To get back into the habit of posting my transactions, I am updating my current holdings. Most readers know I have been focused on precious metals and their miners for the great macro-economic backdrop they have, with all the money-printing going on the last several years. However, I am always active and willing to take any trade signal in just about any group that presents one. Today I want to show a few charts of other holdings I have outside of the mining sector.

Let’s start with the big Chinese internet companies, like Baidu, Alibaba, Tencent, etc. These are basically the Google, Amazon, and Whatsapp of China, the biggest and the best in Asia, well-represented in the KWEB etf. From the chart below, you will see it’s already had a huge correction, something I want to buy as long as the fundamentals are still positive. Short term concerns of government crackdowns and controls aside, the fundamentals for these companies remain quite strong, so the question is when to buy?

About the only thing I don’t like on this chart is the breakdown below the 200 day moving average, and the “death cross” where the 50 day MA has crossed below the 200 MA, considered a negative sign. In trading, we rarely get everything to line up perfectly, and the fact KWEB has pulled back a substantial 33% is enough for me to go ahead and take a trade with limited size and total risk, as always. This is a daily chart, but as the trade is just starting to work out, in future posts I will cover longer term charts (monthly bars) and the potential hold time I expect for this position. For now, I’ve only purchased LEAP call options on this one to limit my total risk, and as its just starting to head higher, I will look for areas to add to the position as I don’t expect to close this position for at least several months if it continues to work in my favor.

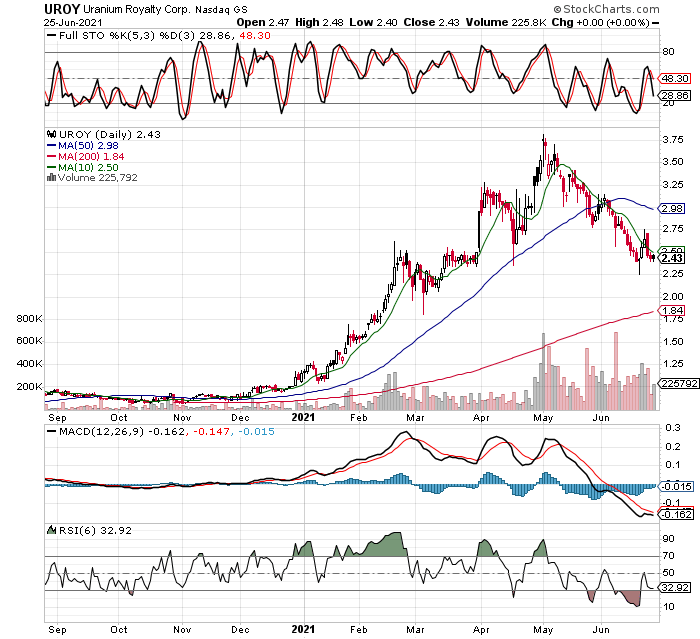

Now, let’s take a look at another newer holding, Uranium Royalty Corp., symbol UROY. The stock and its group of uranium miners has been on fire this year, and like KWEB above, has had a nice correction of around 35% off the all time high just reached in early May. I have taken a larger position in UROY already, since the stock is in a firm uptrend, the 50 MA is above the 200 MA, and the stock is still above the 200 MA, all signs of strength. Also note the MACD is about to cross higher on the daily chart, and while I have not shown the weekly chart here, the stochastics are well oversold and also about to cross higher. I really like this simple setup, all one has to do is size their position correctly and let the stock go where it wants. As this trade starts to work i my favor, I am prepared to buy heavier while keeping my overall risk on the position fixed. This can only be done by having the stock rise and showing me a cushion of unrealized gains, in short it often pays to push winners for what they are worth. Of course, there are fundamental factors I consider in any trade, but I will save those discussions for future posts.

There are many others I have to post, and other reasons for owning these positions besides just the chart setups, but I cover those in future posts, as my intention is to be more active here and report my trading decisions consistently. Its better for readers, but most importantly, its better for my trading. It keeps me accountable, and forces me to review my positions, reasons for owning them, stop levels to limit risk, etc. If a trade is truly justifiable, it should be easy to explain.

I will cover my mining stocks in future posts, and provide updates on some of the trades I have been in for awhile now, usually these will be winners where I am pressing for more gains. I will also cover some precious metals miners I am down on at the moment, including some that are close to my stop out point where I will cut losses if they hit that price. The key is to have our winners much larger than our losers, because we will all have losers at some point in our trading careers. We limit our risk, while opening up our upside, trying to keep it as simple as possible to follow. Please check the link to my current positions, including unrealized profits and losses, something most letter writers are not comfortable reporting, because most don’t make money from trading. It’s just a fact, if they truly made money, and are asking you for your money to get trade ideas, ethically they should provide you with copies of their account statements!