July 4, 2021

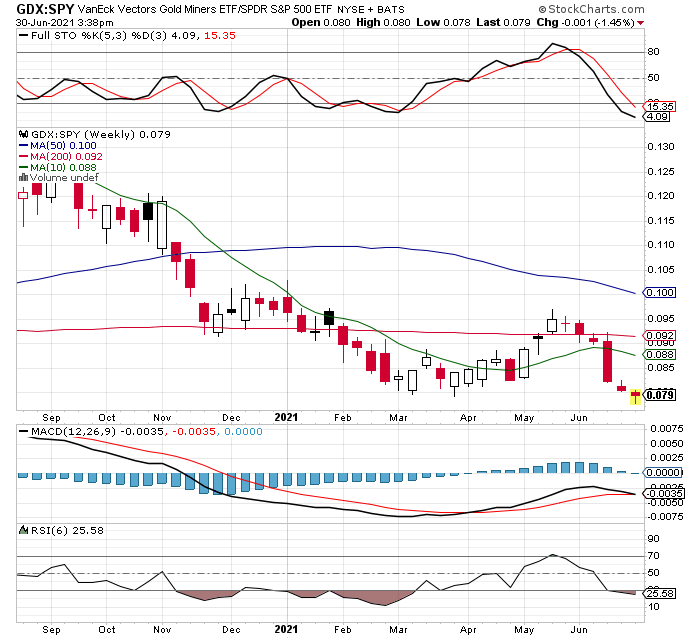

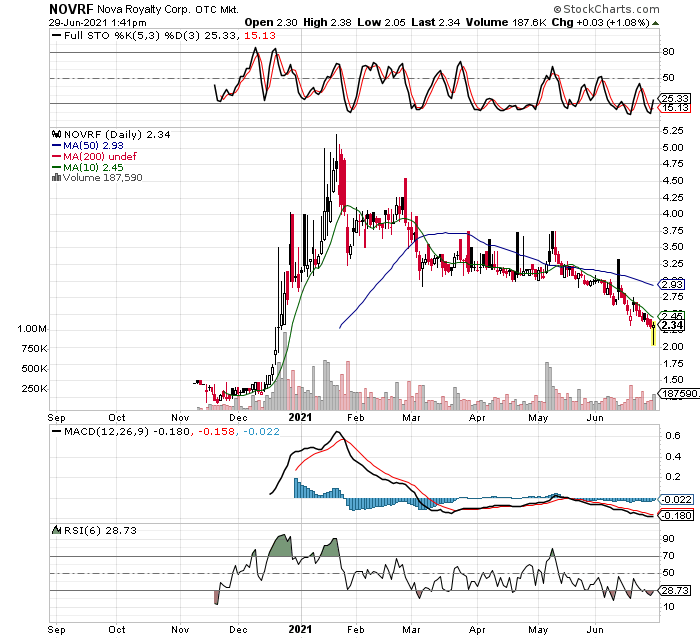

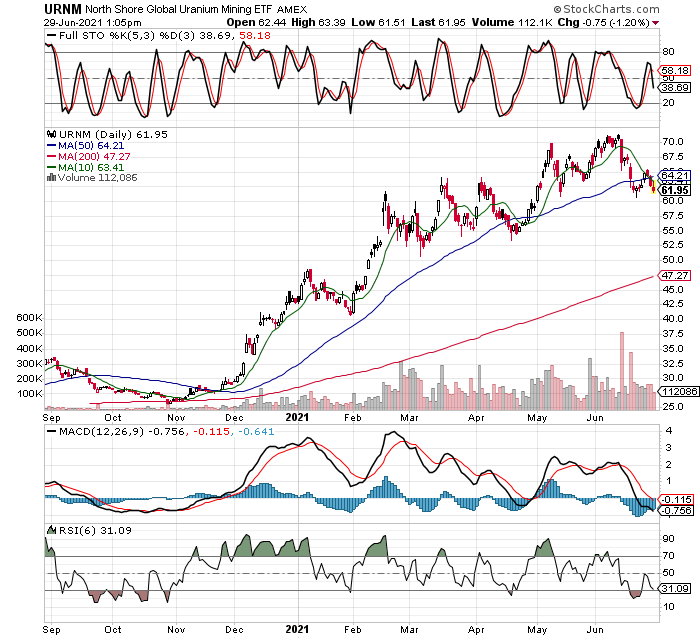

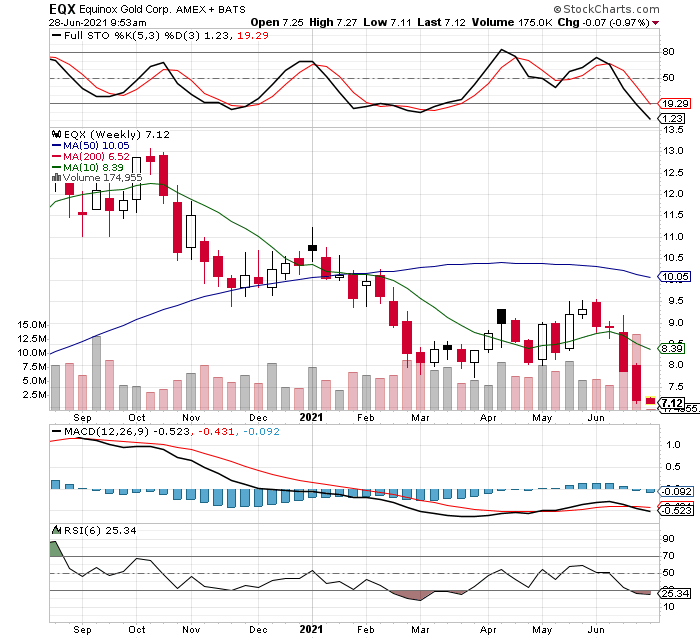

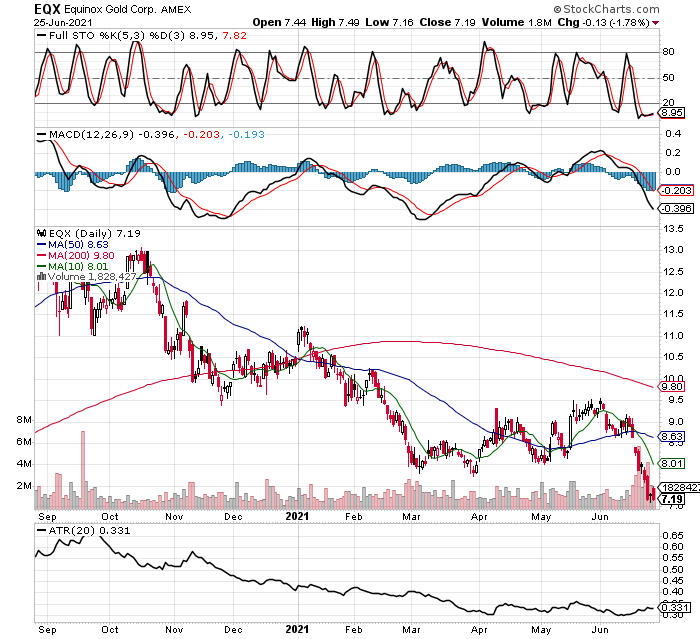

Today I want to put up a quick post of my intentions for Tuesday morning, as the markets are closed in the US on Monday, for the July 4th holiday. I will look for a window to add to both the KWEB etf (Chinese internet giants like Alibaba, Tencent, and Baidu), and NOVRF (Nova Royalty Corp). I might also add to some miners here and there, since I think we might be near an intermediate cycle low, if not we are at least at a daily cycle low. This means that we should have to pay higher prices if we want to wait to add for a week or two. If there isn’t much pullback, and the bull’s uptrend just starts higher from here, adding now seems like an even better risk/reward bet.

Please note the charts I’m posting are two different time frames. I typically like longer term charts and trades as they are more predictable and have larger potential gains, but at times we use shorter term charts like I’m doing with NOVRF today, since its a relatively new issue so doesn’t have enough data to fill the monthly charts (and weekly too, in this case). However, NOVRF is oversold on those time frames as well, so this is still a longer term (6-10 months) expected hold time for me, in order to realize the full potential of the trade signal.

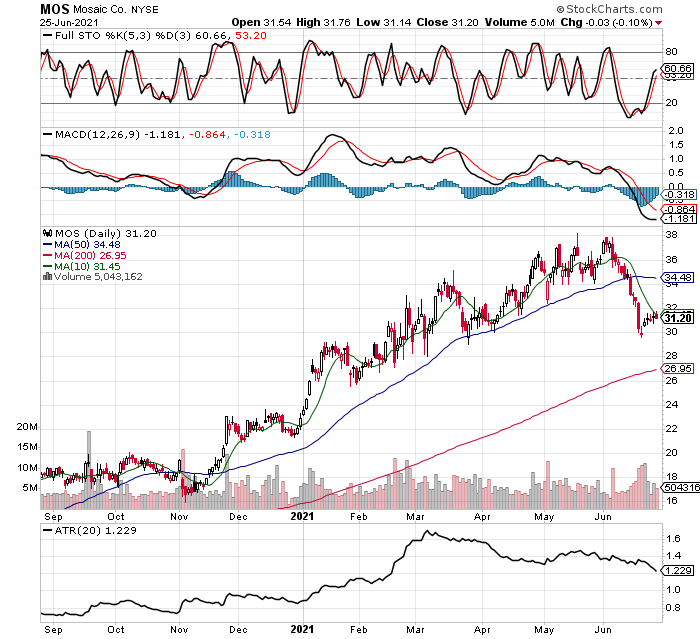

Moving onto KWEB, this etf can really move so I adjust position size accordingly in order to manage risk. I have posted the monthly chart today since this one has “fully painted” charts, being its been around awhile. I expect this to be a 6-10 month hold time as well, being its most oversold on that time frame, but a trader could take the trade for a shorter time as well, I just find it best to push for the full gains when I have a signal working out as planned. Taking profits too soon is a huge mistake, in my opinion. One of the hardest parts of trading is when we have a nice gain on something, but are expecting a near term correction. These can be hard to hold through, but to win the big gains and find your true worth in this business, its a necessary step to learn to hold winners.

There are times when I hold a long term trade setup longer than the 10 months I originally expected, but we will cover that when it arises, because it’s not that often I am in a trade of ANY time frame setup much longer than the original expected hold time. If I had to guess, I would say besides positions that stop me out, I stay in winners for the time I originally expected around 90% of the time.