July 16, 2021

Miners were weak enough that I was stopped out of 5 miners, and decided to trim a portion of my SILJ holdings. Members can check daily account screenshots for specifics on total holdings remaining, average cost, etc. I was stopped out of the following today….DV.V, PGM.TO, AAG.V, ISVLF, and AMXEF (though AMXEF was not actually a stop out, just close enough to the stop price and small enough position to jettison it). I also trimmed some SILJ, but still maintain heavy exposure at the moment.

When I stop out of positions like this, it does not mean I’m negative on the group or anything in my analysis has changed, its simply that the stock has dropped to a level where I no longer want to hold it to wait and discover what is “wrong”. My suspicion is that none of this is related to the miners specifically, they are down without company specific news to justify it in each case. That doesn’t mean we don’t sell, but it does mean we might even buy them back at some point. I typically like to give them some time before hopping back in, however, of the 30 positions or so that I manage, these 5 have proven to be weak enough that they came down to their stop-out levels.

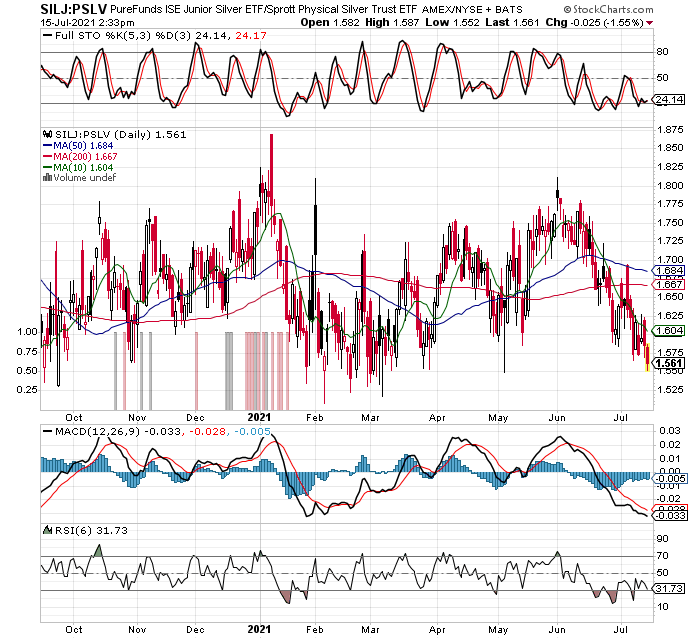

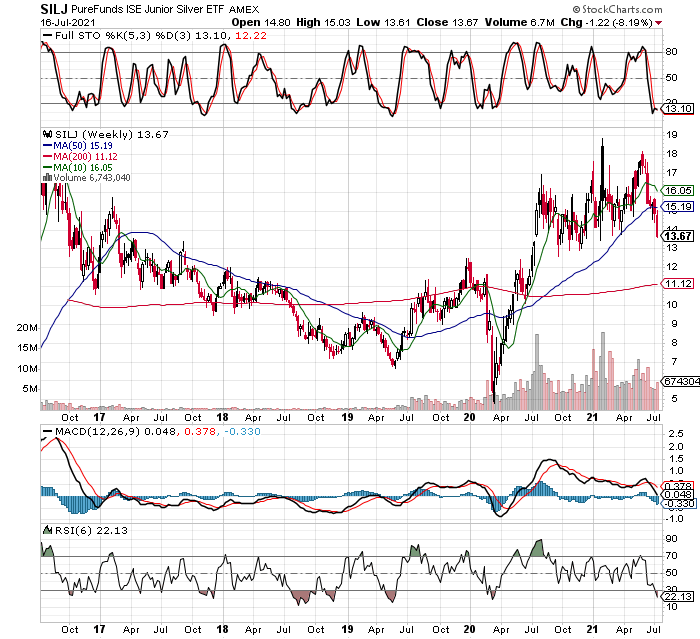

It was a tough week, with SILJ down over 8%! I’m going to leave you with the WEEKLY chart of SILJ, then get away from the computer to keep my sanity! LOL I will have more observations to share this weekend, after I have a chance to digest how the markets are transitioning. It’s possible I might need to make some substantial portfolio changes, for example if the new “delta variant” of Covid is used as an excuse to shut down the world economy again, or shutter mines. For now, I won’t act on fear or emotion, instead will wait for this stretched extreme short term to normalize, then assess how things are shaping up. Losing is part of the game, we must do it gracefully so it doesn’t get out of control, let your stops do their job!

While SILJ stochastics are oversold on the weekly chart, one could argue its heading down to test its 200 week MA (moving average). I trimmed about 15-20% of my SILJ holdings today, members can log in to see the exact figures, but I remain bullish. I will look to put the proceeds to work again, perhaps at lower prices, or in my best performing miners, maybe in entirely different groups. I need to see if I can figure out what is driving this perceived turn in markets, is it more covid fears and economic slowdown that comes with it, or maybe just a correction in commodity and value stocks? We will know more before Monday, and I’m prepared to make any necessary changes, as long as they are necessary and not driven by fear or emotion!