July 28, 2021

Today was the central bank’s FOMC announcement on interest rates, usually its very quiet a day or two leading up to the meeting, then investors step back into the markets and take positions, causing the volatility to come back into the markets. Personally, I typically do not try to sidestep these meetings as many traders do when they are nervous about the news event. I understand as the volatility can shake people up, but in my experience I have found more often than not, whatever trades I had on are still valid after the FOMC news. Yes, prices get crazy and can make one seasick if they haven’t seen it a million times before, but I’m used to it by now and today was no different. In fact, today was relatively calm after the news release, compared to the last FOMC meeting which kicked off the big decline we have seen in miners! One thing for sure, I never make trading decisions off the news release, as they are known to often reverse the original move. This is why I have found it best to just stick to my plan despite the gyrations, or reacting to how I feel at any particular moment in time. We have a valid plan, all we have to do is stick to it!

Today we saw the government of China step in and essentially ask banks to help them quell their markets after the Hang Seng lost 7% the prior day. While the politicians and regulators initiated the recent collapse, I think seeing their biggest and best Chinese blue-chip technology stocks lose over 50% in just a couple months was enough to begin to scare them as much as investors! So we got a BIG bounce today in the KWEB etf, up about 10%, and strong all day. We cannot know, but this could very well be the turn higher, at least for a little while as the PE ratios of great companies like BIDU got down to 7, while they have earnings of $21!!! It´s certainly worth taking a shot with numbers like that, and then things like the mood can change overnight. Nobody would touch the Chinese internet companies, then buyers come of out the woodwork in force.

We have looked at the KWEB chart so much lately that I hate to bring it up again, but since we finally have a big green bar and it could prove to be a pivotal day, not to mention I was able to bring accounts up to full-risk position sizes yesterday, its worth seeing one more time. Let’s use the weekly chart…

I must say that is one lovely hammer on the far right side of the chart, the handle created by the massive beatdown KWEB took the first two days of this week, now trying to reverse higher. I can’t say if it’s straight up from here, we could muddle around awhile depending on what other markets do, for example if the QQQ´s etf in the US starts to get very weak, I would expect that to drag down KWEB, or at least keep a lid on the upside. In any case, charts this oversold that reverse hard as KWEB has done today, are typically close to a bottom if it isn’t already behind us. This is a good trade for prospective members to watch play out, as it’s rare that a position goes so hard and fast against me right out of the gate. KWEB has required patience, focus, and courage, more than most trades this early into the investment. If it can hold its ground here or gain some, I will certainly look to increase my position size. Let’s let the market tell us what to do, for now we managed to get our full position and it’s heading higher, not bad for a trade that was looking to flush out not long after we started it!

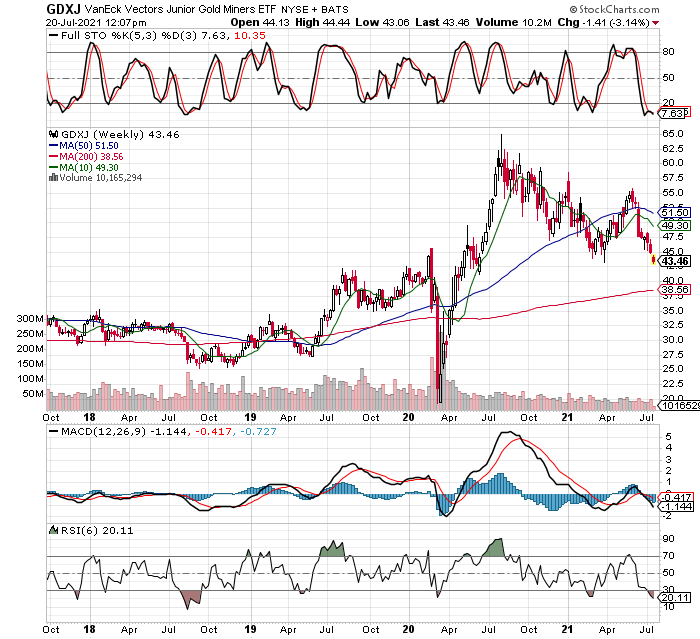

Moving on, I also added to my GDXJ LEAPS on the junior gold mining etf. I am not yet to a full position on this one, so will continue to add when given opportunities for good fills. It’s important when trading LEAPS (options) that we pick our liit prices carefully and stick to them, as spreads can be ¨wide¨on options, especially the farther dated expiries. However, we can use that to our advantage, if we are patient with limit orders we can sit and wait for the markets to come to us and give us some great fills that save us big money over time. Just think of an option that is bid at $5, offered at $5.50, which is quite common. The person that can’t wait has to pay $5.50, a full 10% more than the guy sitting at $5 patiently until he gets filled. Those numbers add up quickly, so its best to learn how to get filled on the bids or at least in the middle of the spread, rather than pay up every time we decide we want something. Of course, we could miss a trade by waiting on the bid, but there are other methods and ¨tricks¨ to help us be sure and get the position, like placing our buy orders only when the stock or option is in down movement, looking to buy from a current holder that might be panicking. Here is the GDXJ WEEKLY chart…

There are a couple things I like about this junior gold miners chart on GDXJ, for one, the stochastics are very oversold and just now starting to turn up again. We could get a solid 6-10 weeks of upside before it reaches overbought again. Another thing that excites me, although I have not drawn it on this chart, is the approximate 50% fibonacci retracement (pullback) we have seen, from the substantial March 2020 crash bottom, all the way to the August 2020 high, then back to current prices. Also note the pullback takes us to old resistance which is now new support, in the $45 area. This is as good n area as any to take a position, or add to one as I have done.

I also added to EQX (Equinox Gold), which used to be a darling in the sector, but fell from grace when the natives in Mexico put a blockade on the mine forcing it to shut down. I had already started a position, but chose not to add once that news came out, preferring to see how things shake out. I’m happy to say the mine is back up and running, and as the stock was responding positively today, combined with the fact the sector looks like it might be turning higher for a bit, had me thinking today was a relatively low risk opportunity to add to my EQX LEAPS. I am still not up to a full-risk position, in fact I am at exactly half of my desired position, so will continue to add to my EQX on dips as I am not near stopping out. If EQX can re-start an uptrend, these LEAPS could become big winners, especially now that the negative news has been removed for the time being. As as aside, the mining legend Ross Beatty has Equinox as his major project at the moment, they have 4 producing mines and are executing as well or better than any others. I don’t fall in love with positions, it can get very costly, but there isn’t anything I don’t like about this trade now that the blockade has been removed and mining has resumed, which was only on their Mexican mine anyway. I won’t be surprised if EQX makes new all-time highs again, but let’s take it one step at a time. Here is the WEEKLY EQX chart finally a green bar on the far right side!

So there was plenty of action today, and I’m happy to report our accounts had some very nice upside. More importantly is what happens next, and the charts are starting to suggest we could be turning the trend from lower to higher, in all the above positions. There were other trades today, members receive real-time trade alerts with sizes, prices, stops, and even unrealized gains and losses in the Daily Account Screenshot, so be sure to check those out for the details.