March 20, 2023

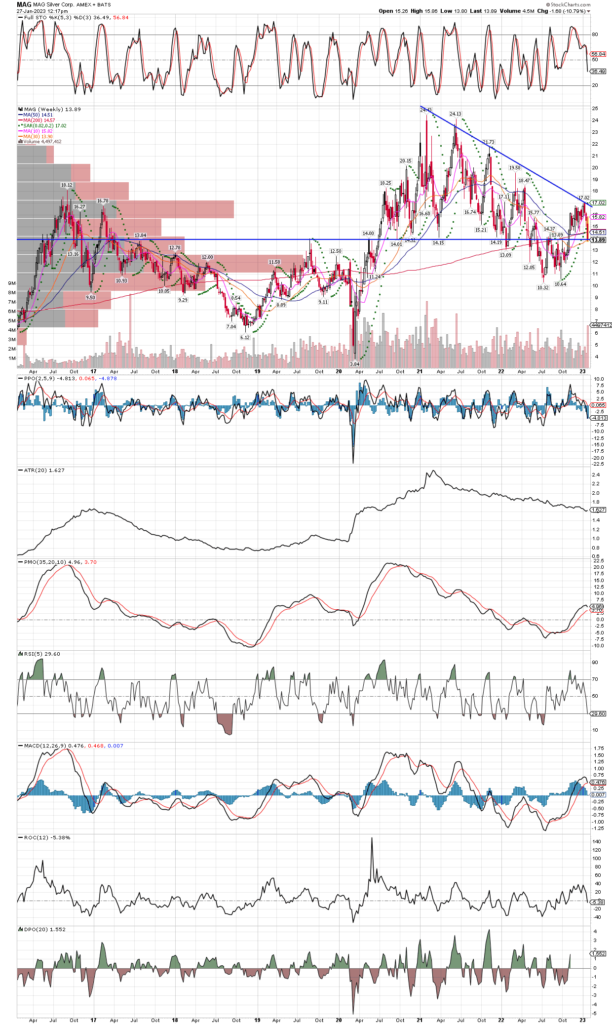

There has been so many headlines lately that its hard to keep up! It doesn’t matter, when one has a plan. Gold, silver, and miners have been the only things rising lately, so will likely entice investors to get involved at some point soon, and considering we are very early in the new intermediate cycles for metals and miners as we are probing breakout areas, this could be the start of something big.

Besides adding to several precious metals positions over the last few weeks, I just started to nibble on uranium miners via the URA, URNM, and URNJ etfs. I will cover the new stake in uraniums in the next posts, but I have only started and my major focus in on precious metals and their miners at the moment. The fundamentals are in place with big banks going belly up daily, and while the central banks so far are still getting involved with printing money to soften the blow, there are other things vaporizing overnight like crypto bank Silvergate Capital, institutions that are unlikely to get bailed out. The Fed is now trapped, plain and simple, if they choose to continue to fight inflation by raising rates, that will continue to bury the banks and the economy. And if the Fed changes course and starts making more fiat currency out of nothing, with inflation rates already very high, this tact will cause inflation to get much worse. All one has to do is ignore the distractions and panic, and be out of banks and most paper financial assets, instead be invested in real assets, tangibles like gold and silver, as well as their miners since they also own the physical commodity already safely buried in the ground. Other commodities are fine as well, like uranium mentioned above, but in the immediate future as the economy tanks, things like energy and base metals will see demand destruction and pressure on prices quite possibly. I want to own copper miners at some point, but unlike uranium miners, coppers have not yet pulled back enough and consolidated long enough yet to turn me into a buyer. Still I would own just about anything commodities over financial assets at this stage of the game, though I would not trade futures contracts any longer with the credibility of the exchanges in serious doubt. I will stick with the miners of commodities, and physical metals when it comes to gold and silver.