February 2, 2024

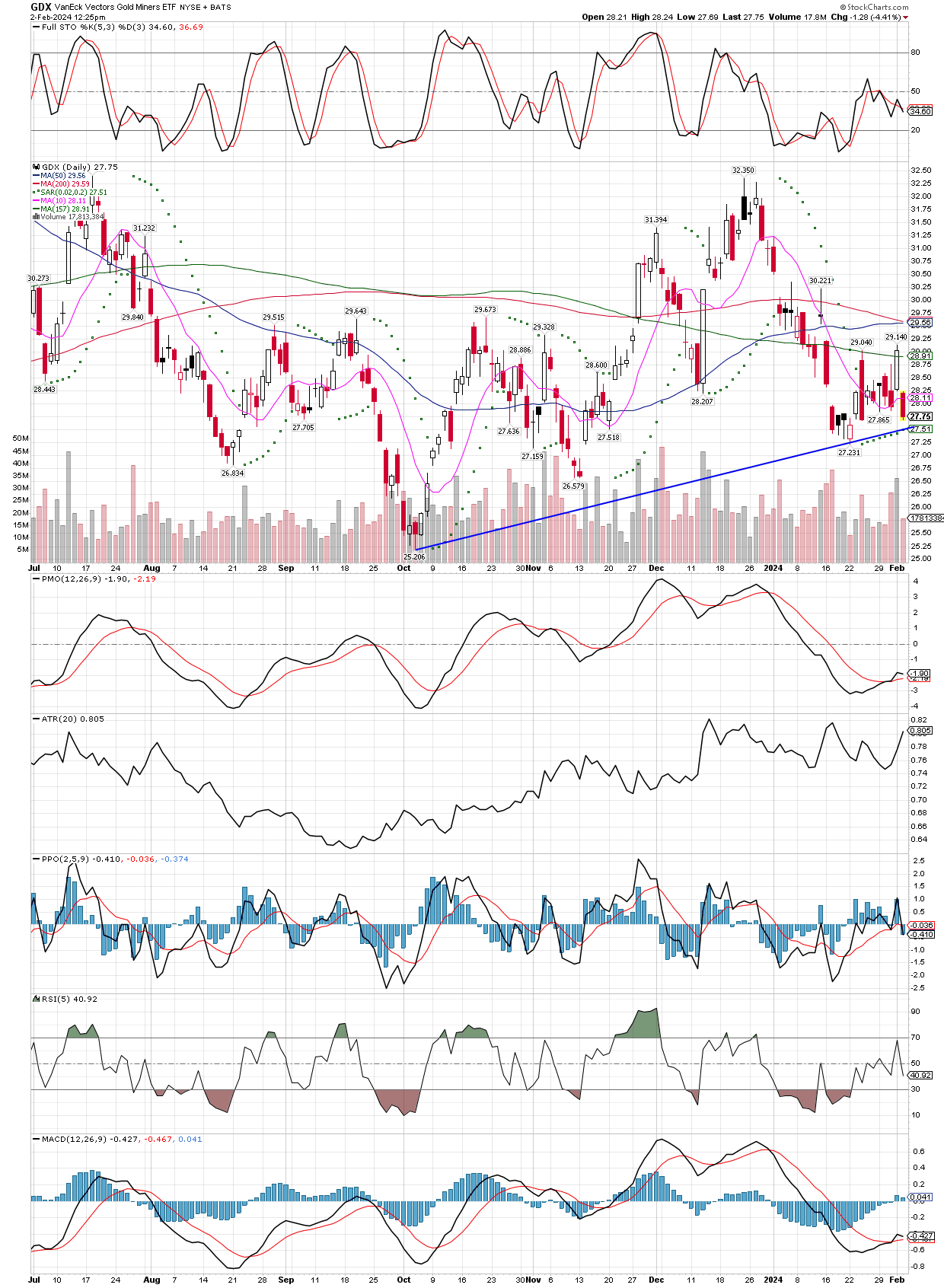

Just a quick daily chart of the GDX, they say a trend line isn’t valid unless it has at least three points of contact. I took the liberty to draw one, wondering if the third contact it is nearing now, will be where it halts it’s recent decline? In the meantime, I took advantage of the pullback today to nibble here and there on several of the holdings in our portfolios, keeping my overall TR fixed as a percentage of my portfolio. Essentially this give me less room on the downside before I have to stop out, because I have the same amount of dollars at risk over larger position sizes, but it also gives me more shares to ride higher if I am correct and they change course soon.

February 1, 2024

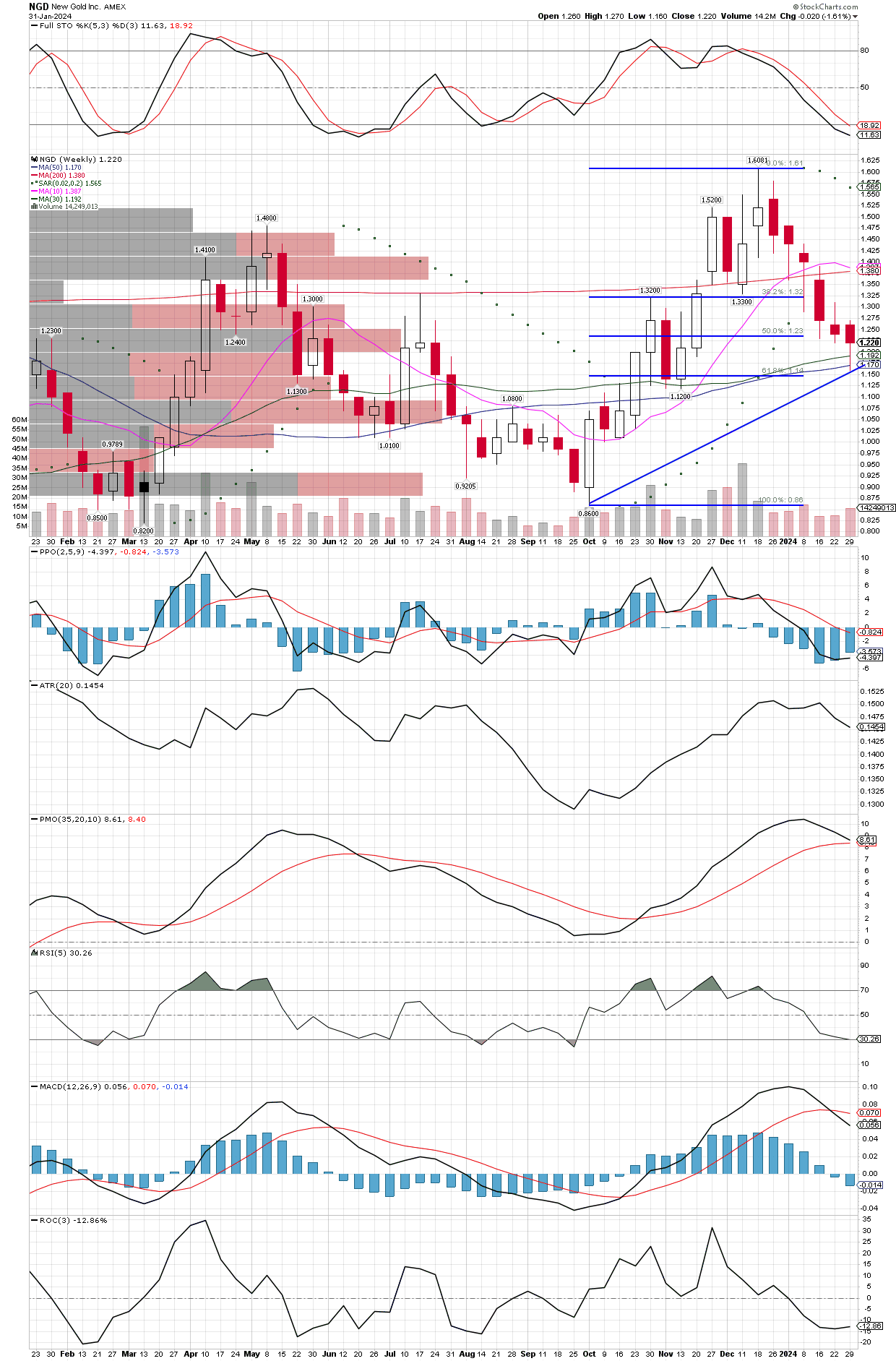

New Gold was bought yesterday before the close of trading, below are both daily and weekly charts. In the current price zone seems like a good area for the stock to find support, both the trend and the stochastics suggest. I also like how the moving averages are shaping up on both charts. Essentially, we are buying a strong stock after a good-sized correction, realizing that metals prices (fundamentals) will still be the most important factor driving the stock price. I consider this a mid-cap producer with exploration potential that could increase reserves.

January 31, 2024

Yesterday I shared the portfolio changes, but when I want to clarify how I invested the SILJ proceeds. The equal-weighting I mentioned was within similar companies, the mid-caps vs. junior explorers, but I invested 75% of the funds into the mid-cap producers, only 25% in the junior explorers, and in each group the fund were equal weighted in each miner. So the bigger miners split 75% among them, the juniors only 25%, and I chose to equal-weight the positions in each, meaning the mid-caps’ positions are 3X more each than the amount invested in each junior explorer. I figured the 75/25 split was appropriate to compensate for the higher risk in the juniors.

January 30, 2024

Today I decided to sell out of SILJ after the fund was changed over to Amplify funds from the ETFMG managers it had before. I didn’t like their new portfolio as much, so I put the proceeds from the SILJ into a basket of 16 individual miners I prefer and some PSLV, the physical silver etf managed by Sprott, Inc. Many of the miners I bought have been mentioned here in articles over the last year, but some are new.

I equal-weighted the following names, HL, CDE, EQX, FSM, PAAS, SBSW, SVM, DSVSF, SILV, AYA.TO, ORLA, GLGDF, EXK, JAGGF, GATO, and DV.TO plus the PSLV. I will add to these positions into declines, and might buy some new names if the opportunity presents. I have some other junior explorers/producers I did not add to today, like NSRPF, MGMLF, and IRVRF, but I want to stay focused on the mid-cap producers at this point.

January 29, 2024

January 26, 2024

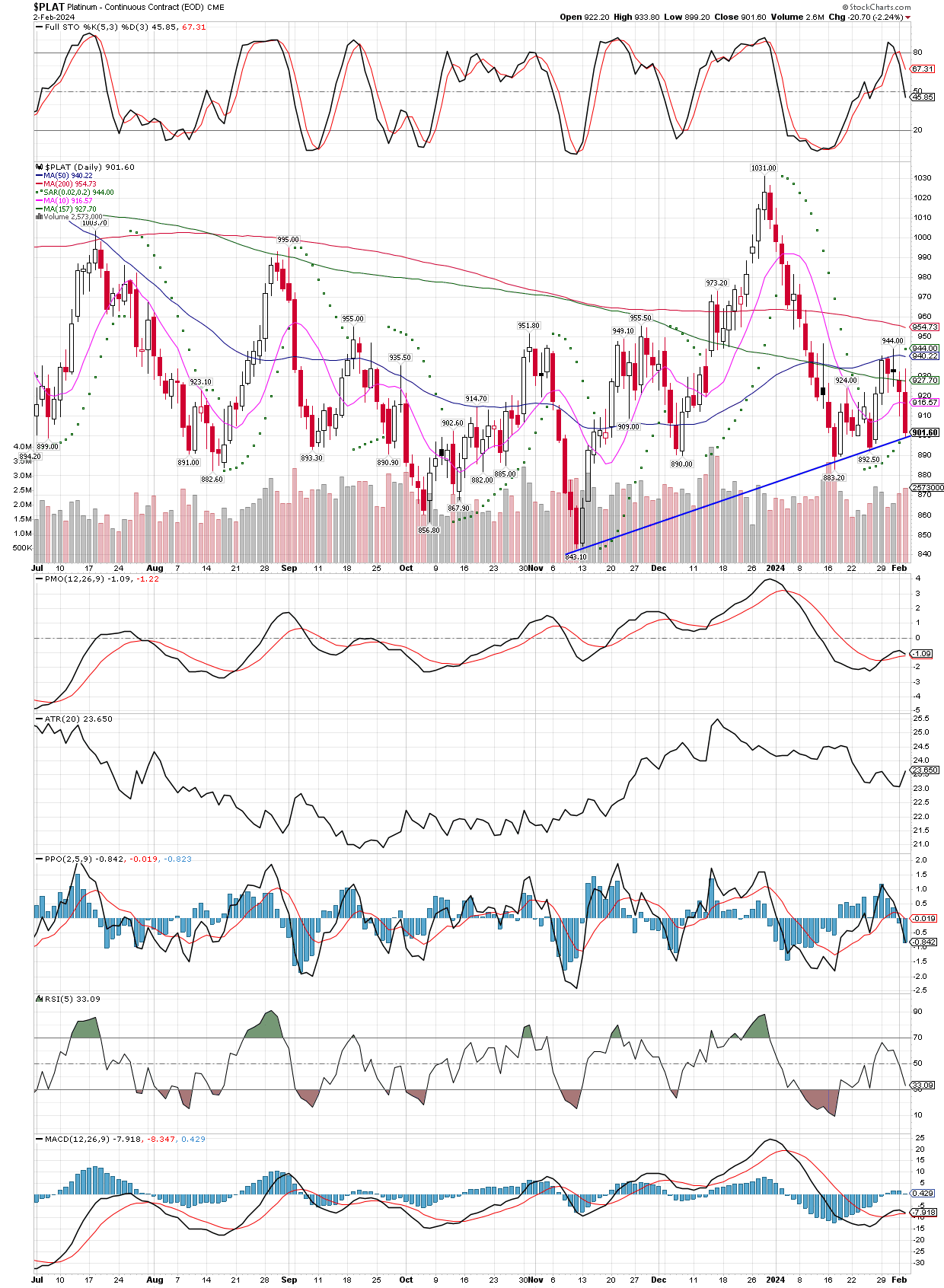

I was looking to place a horizontal trend line at the area with most contacts, and it looks to me that platinum might now be at the lower end of a wide range, and a possible buy. I will also look into palladium this weekend, and if it is similar, will be inclined to buy some miners in that group as well. A stock like SBSW is trading at just 4X earnings of $1.05 last year, a valuation that is hard to ignore.

January 25, 2024

The gold vs S&P 500 ratio is the lowest it has been in the last couple years, and while the SPX is mostly just seven stocks, even those seven will correct at some point. Doing the rounds today, I couldn’t help but notice how many metals bulls are on the sideline, expecting the miners and metals to get hammered along with the stock market first, before they can start a serious bull run. While this might turn out to be the case, it doesn’t always work that way, and with so many people singing the same tune, it makes it more likely that it won’t play out that way.

With that in mind, I pulled up a chart of gold vs. the S&P, and either everybody else is correct, or we could be witnessing a classic false breakdown in the ratio. I cannot say which it will turn out to be, but I am more comfortable with my mining stocks after seeing this chart, and the stochastics are very oversold as well. So a bounce in this ratio should see gold start to outperform stocks in the near term, then we just have to wait and see by how much and for how long. If its a strong enough reversal in the ratio, the patiently waiting bulls will have to make a tough decision whether to chase higher prices, or wait for a pullback to buy. With so many people in agreement that miners going lower before they mount a big run, its possible they get left behind, its exactly how bull markets shake off as many riders as many riders as it can. Many see the bull coming, but can’t ride it.

The copper stocks are rebounding after four weeks of selling lower, and if they close the week right here or higher, will give a buy signal. Let’s see what Friday afternoon brings, being a strong close would get me to buy them Monday morning. There is also junior copper mining etf COPJ, that I will look at, but this signal applies to COPX.

Additionally, the base metals etf DBB has had a solid enough week to put it back up over all its weekly moving averages, so maybe they ending their year long consolidations after a large pullback?

January 24, 2024

The MJ etf continues to hold strong, will look to start a position at some point into a small selloff, preferably with oversold stochastics or other technicals on a short term chart. Natural gas has not yet triggered a buy signal for us, but looks as though its trying to establish a bottom. It could be worth a shot right here, but to get larger positions, I would want to see an uptrend get started. The violent spike the selloff might be the start of a trend change, more so with that lower low that looks to have reversed itself, if it can stay in this area or higher by Friday’s close.