February 17, 2024

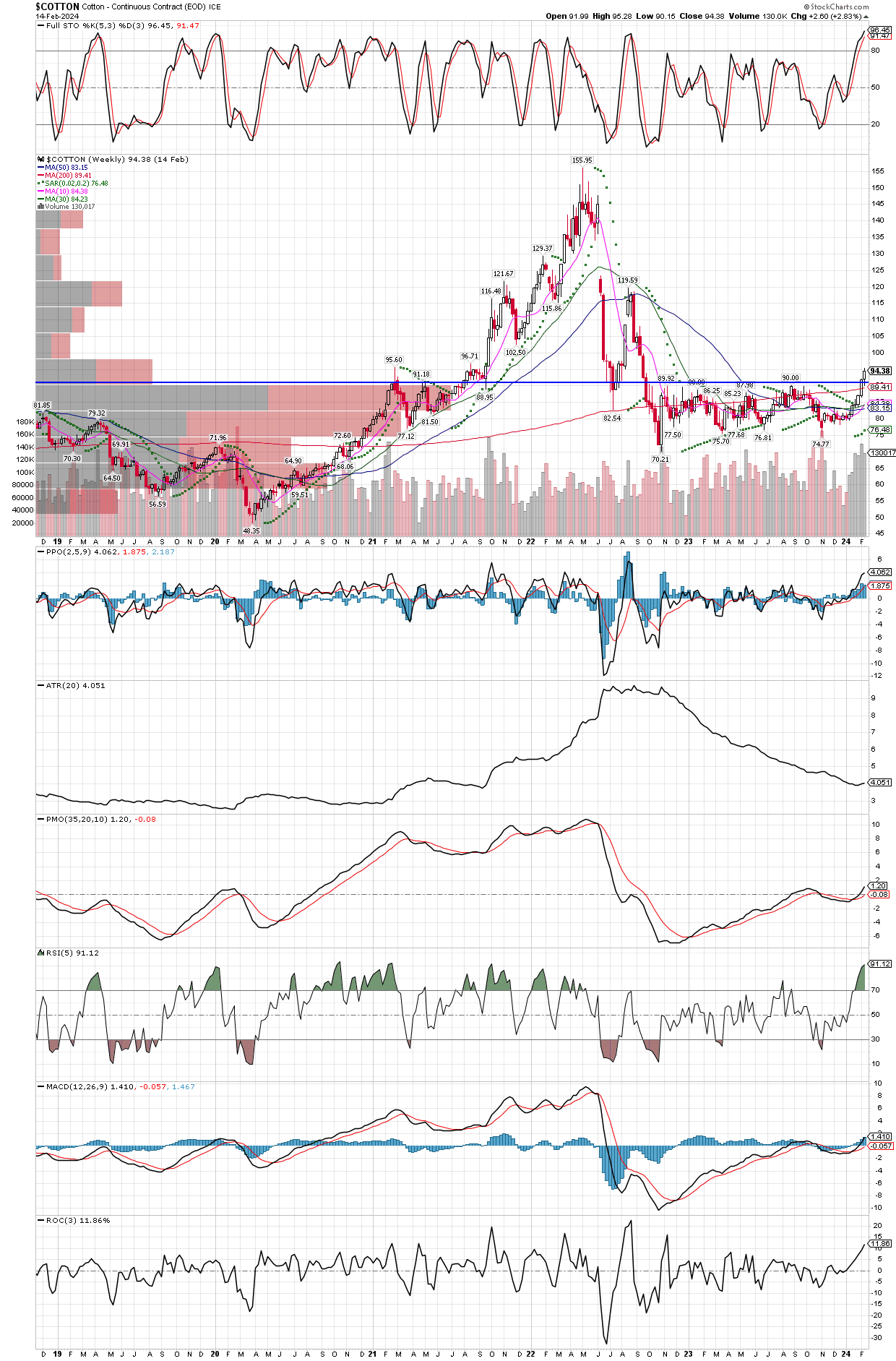

I have been waiting patiently for cotton to rise and hold above the 90 area, which has now occurred. While it has overbought technicals on the daily and weekly charts already, we will be looking to buy cotton futures into a decline to around 90, with technical indicators well out of overbought, but preferably into oversold zones.

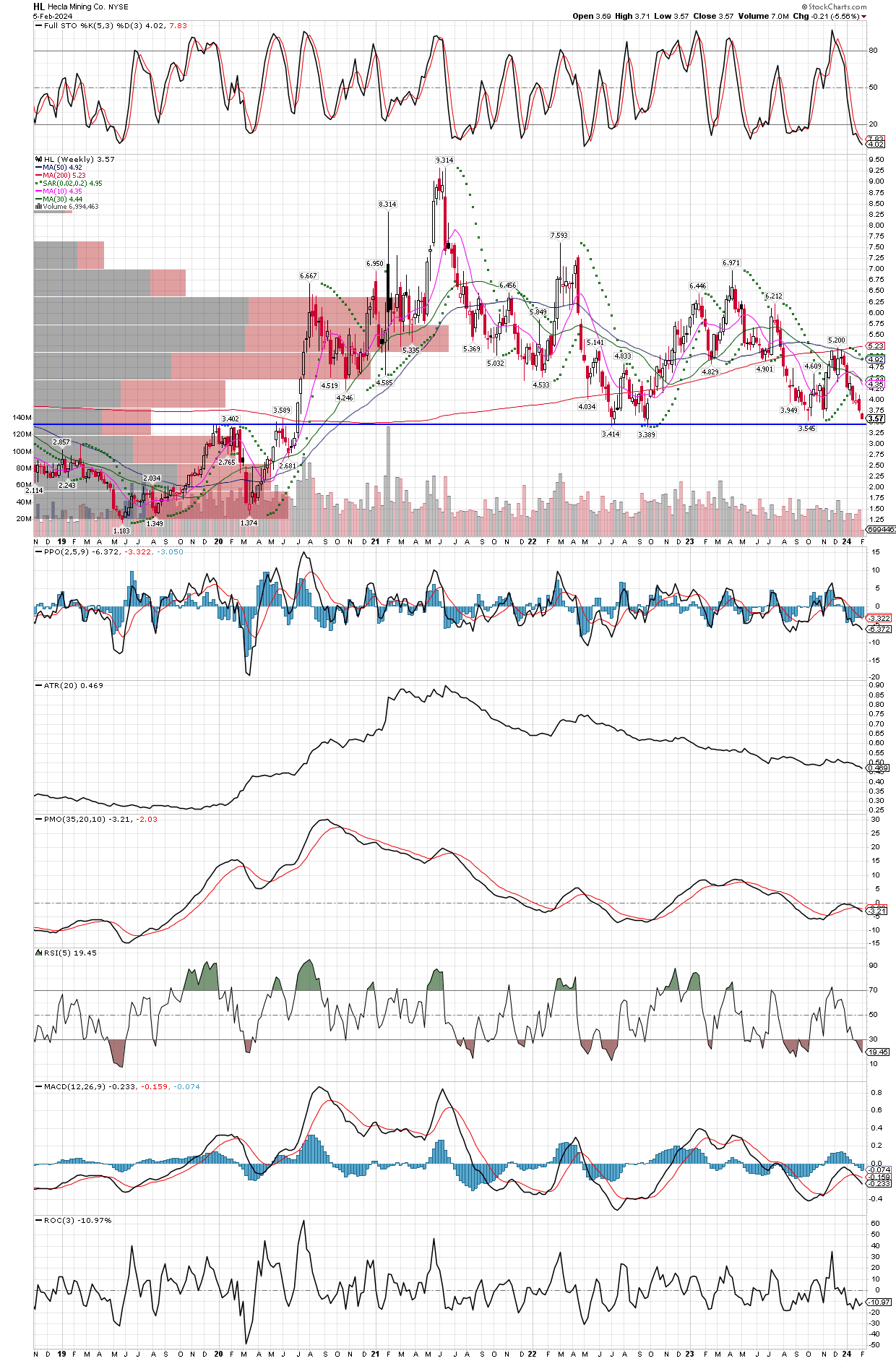

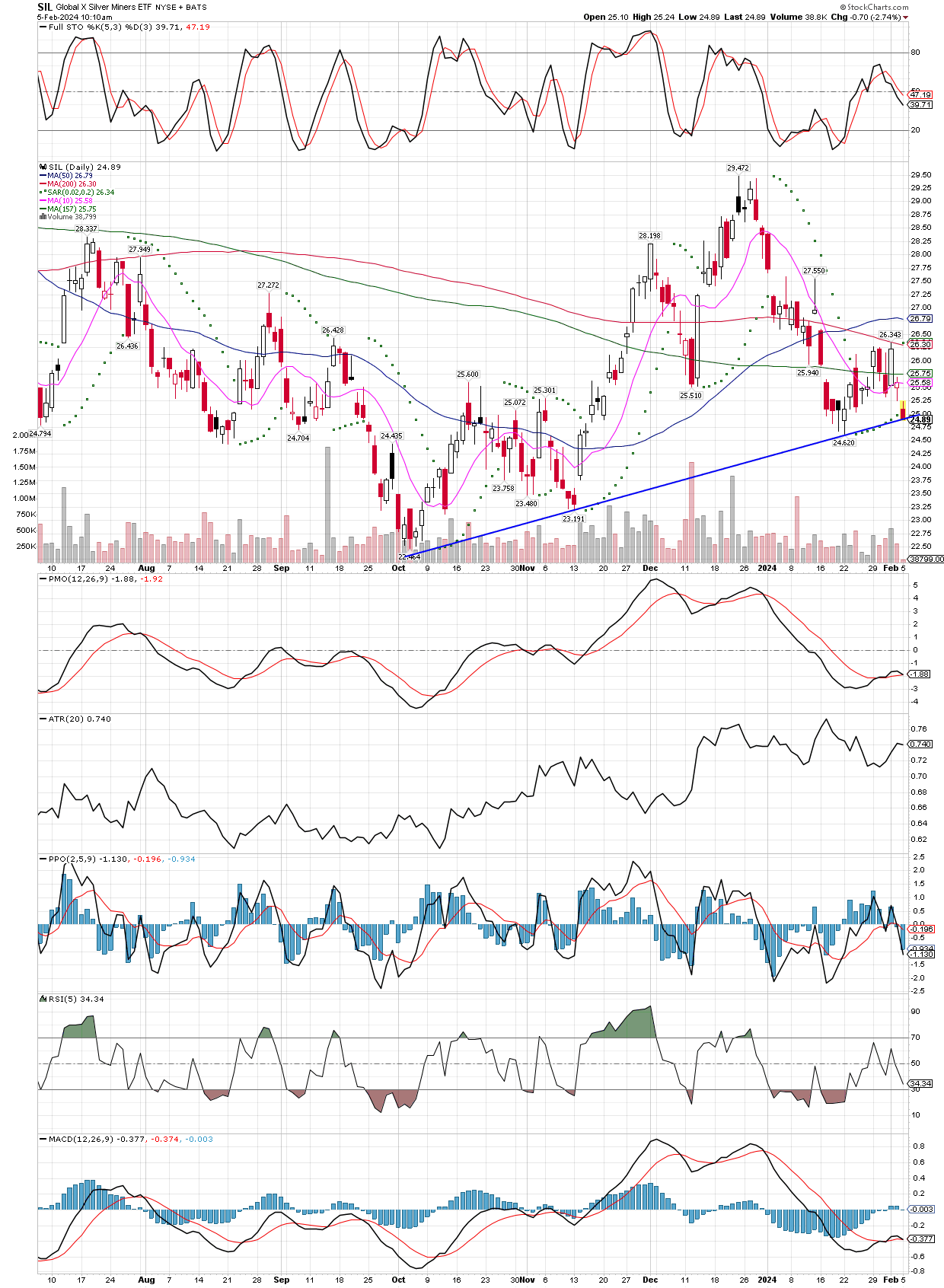

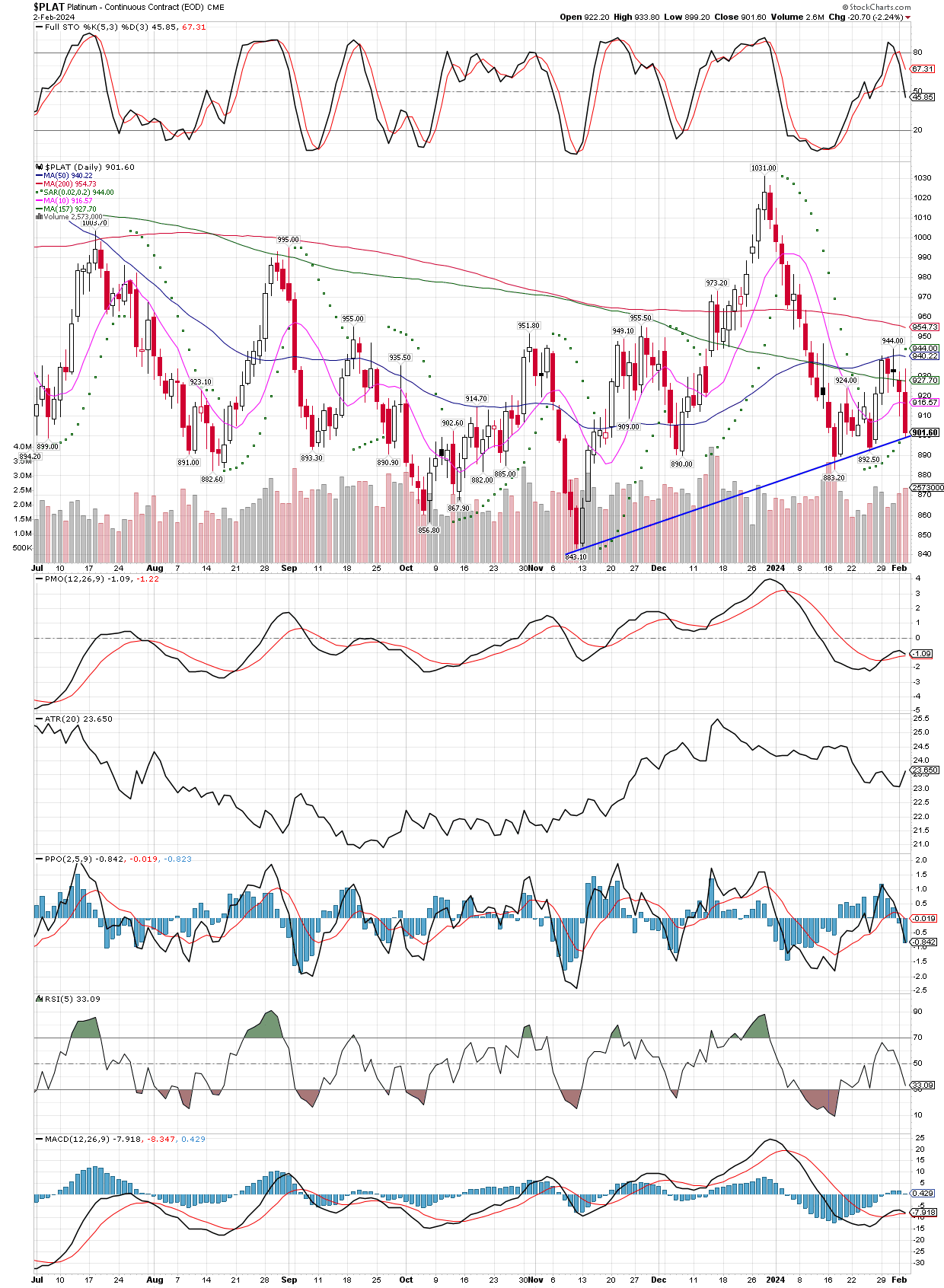

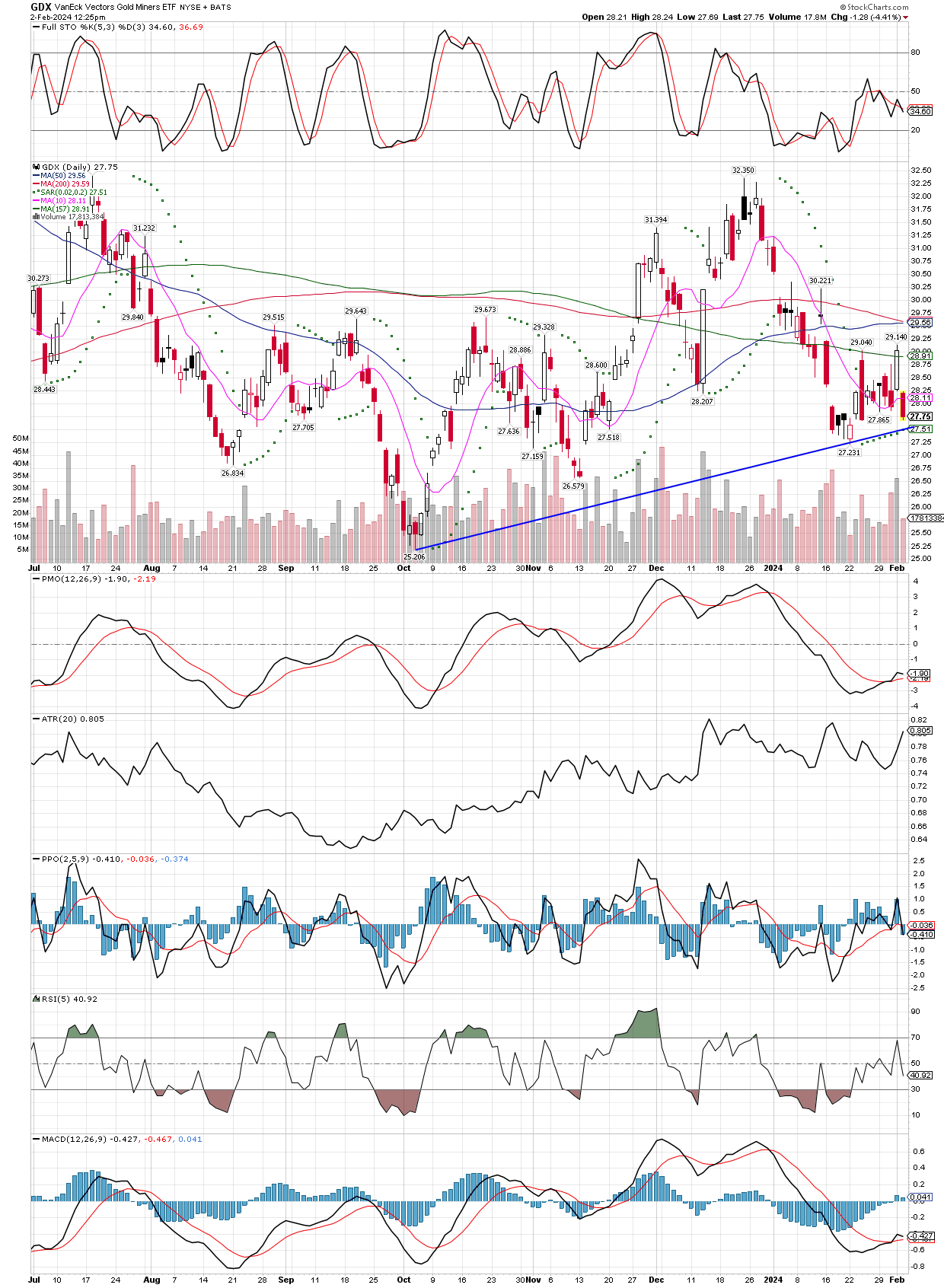

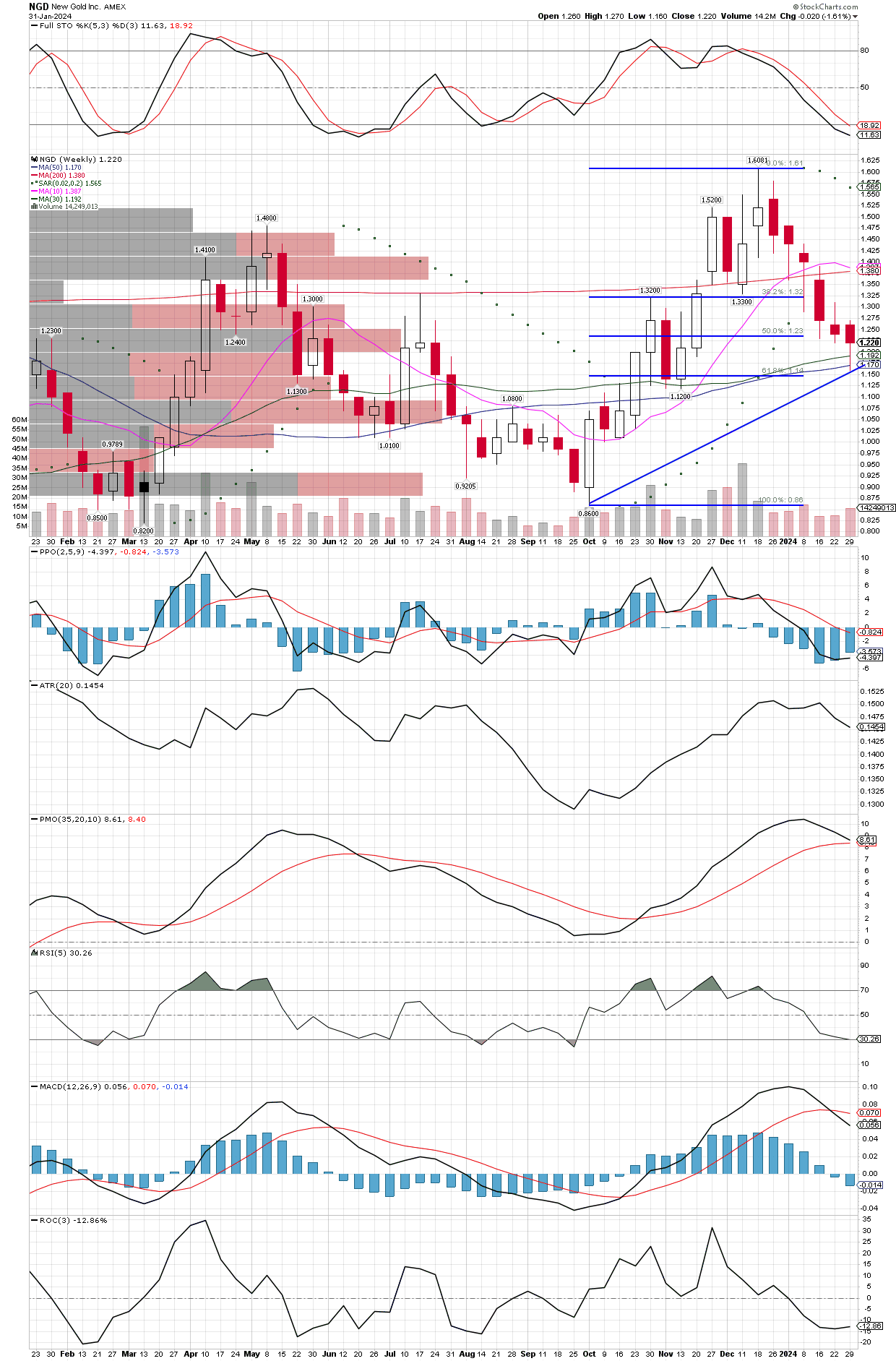

Aside from looking to enter cotton and the MJ etf, we also made some small additions to our mining positions, while they are still weak.