April 4, 2024

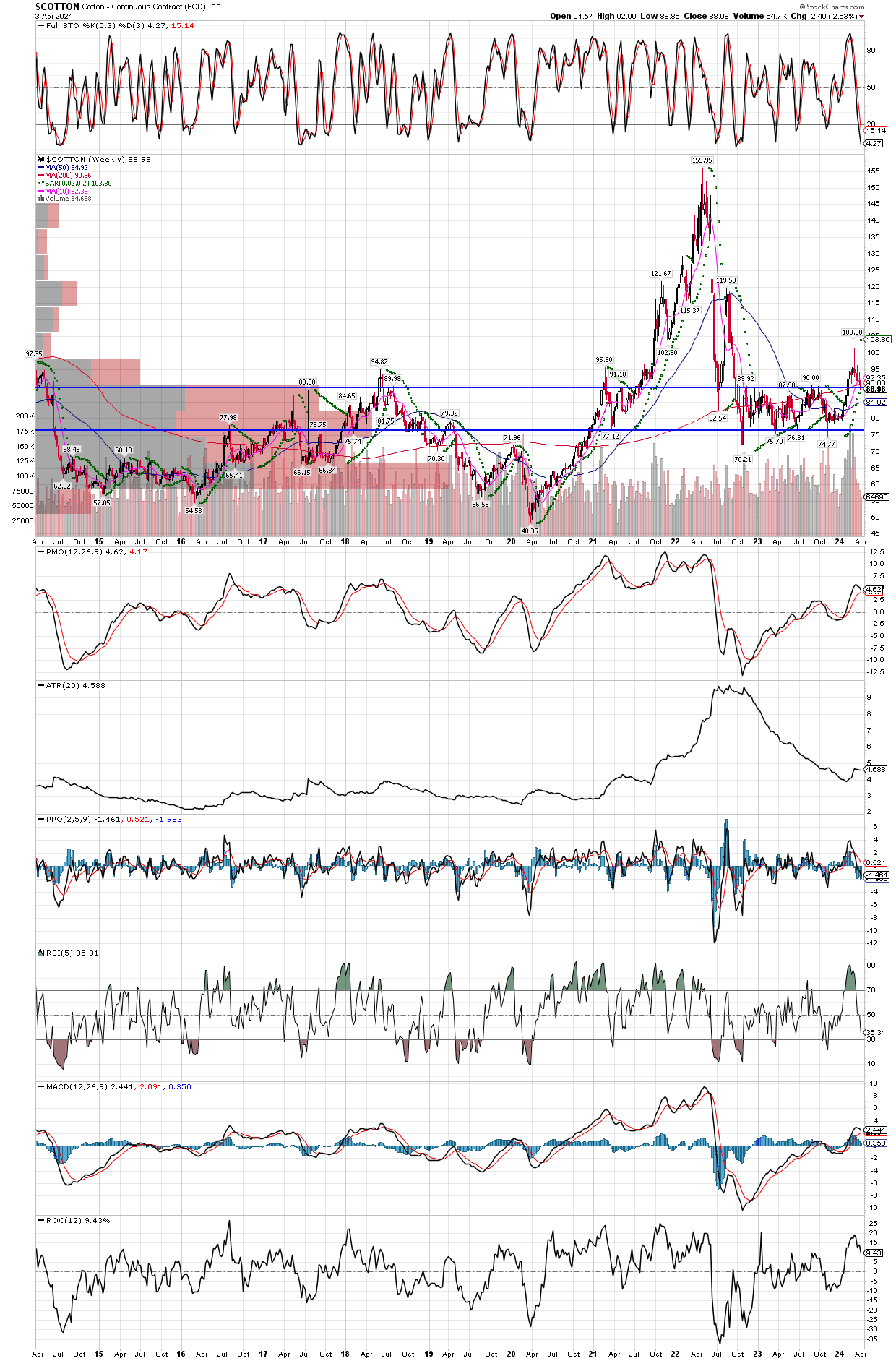

The chart below shows weekly data for the last 10 years. After a signifcant run out of the 2020 lows, cotton futures manages to triple over the next two years. Then we get the classic correction, followed by a correction lasting roughly a year and a half. Corrections can last longer, sometimes even three years, but the recent breakout early this year suggests the correction might be over. In that case we wait for a pullback to the breakout are of 90, then start acquiring a position. I am looking to add cotton futures for myself and client accounts in this area where it currently sits in the 88 region. As always, position sizing is the most important aspect of trading, and cotton has a weekly ATR (average true range) about $4.60, so size accordingly, knowing each contract trades in roughly a $2,300 range each week.