June 2, 2019

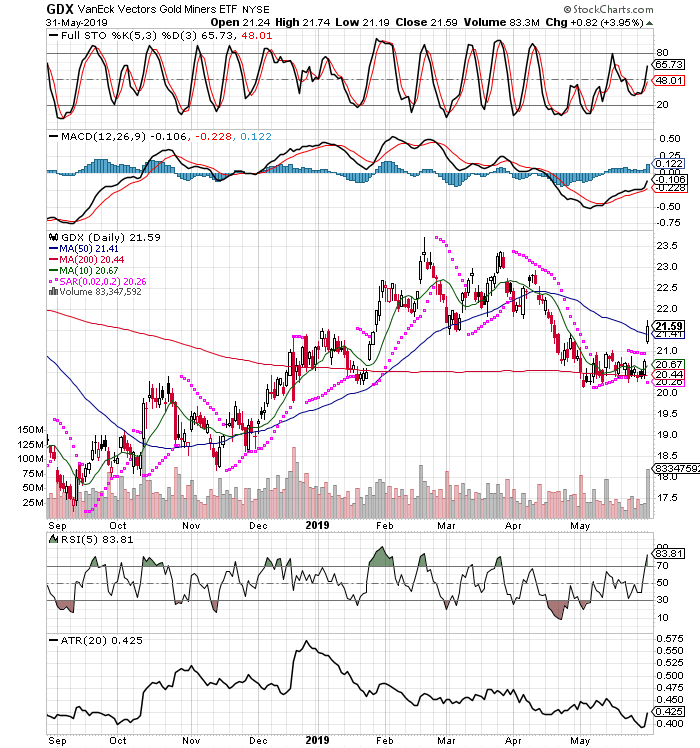

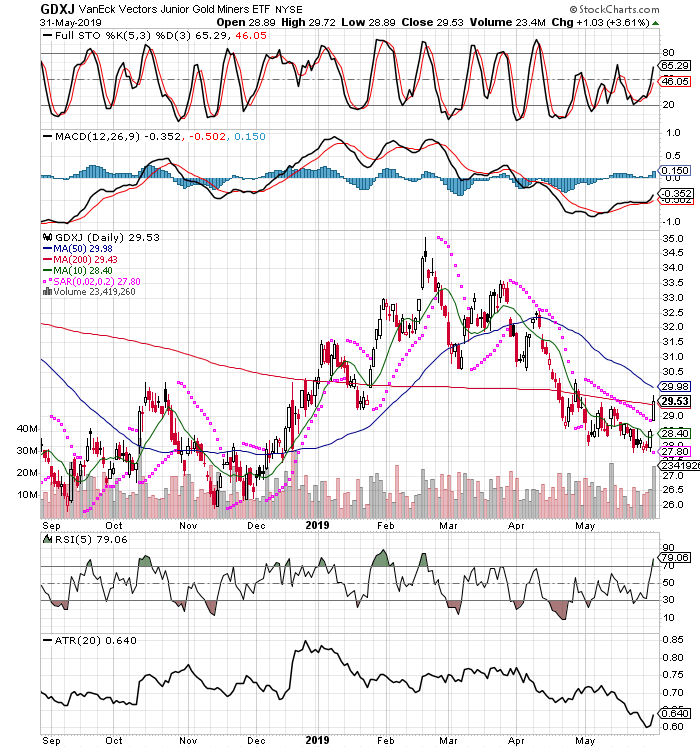

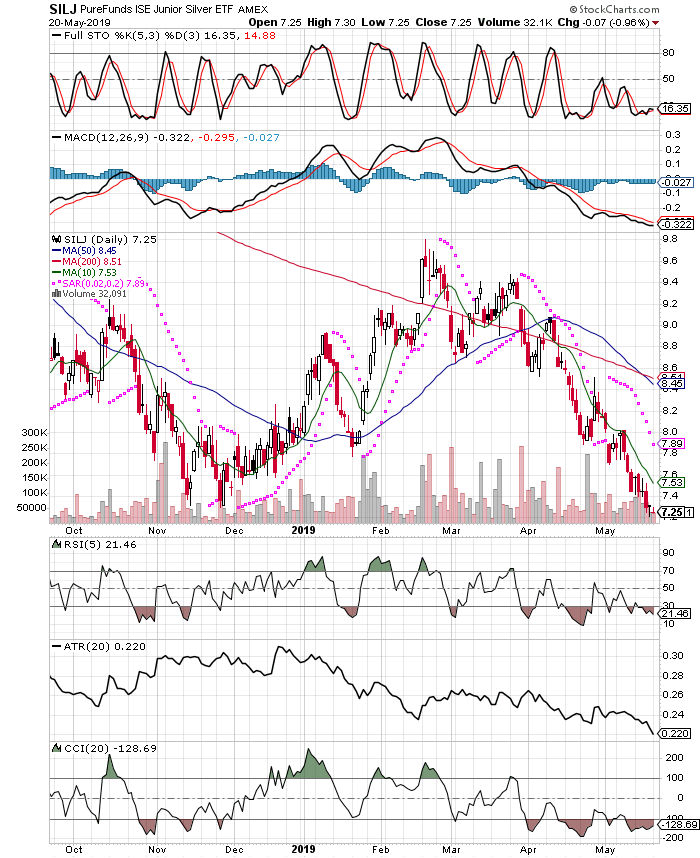

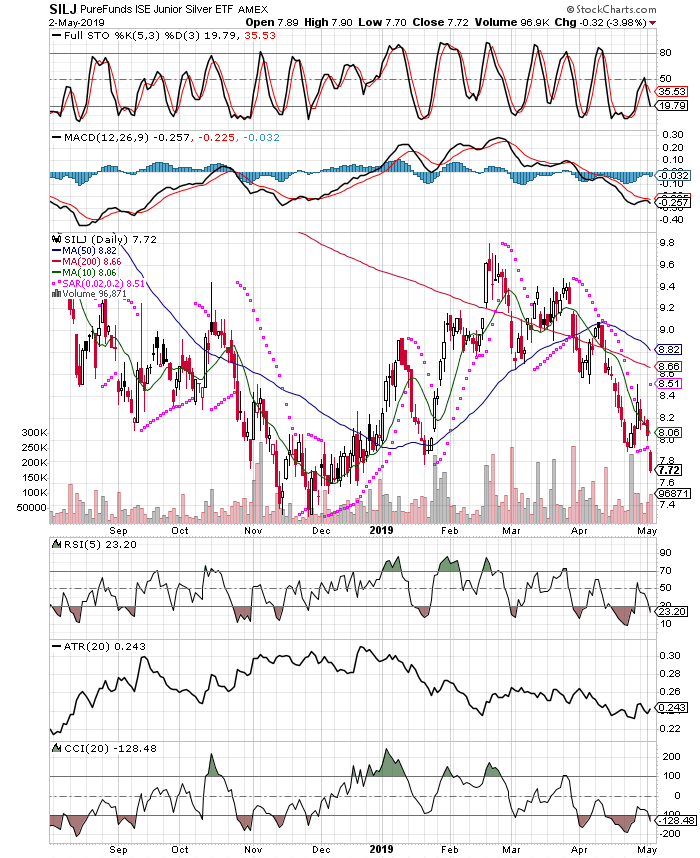

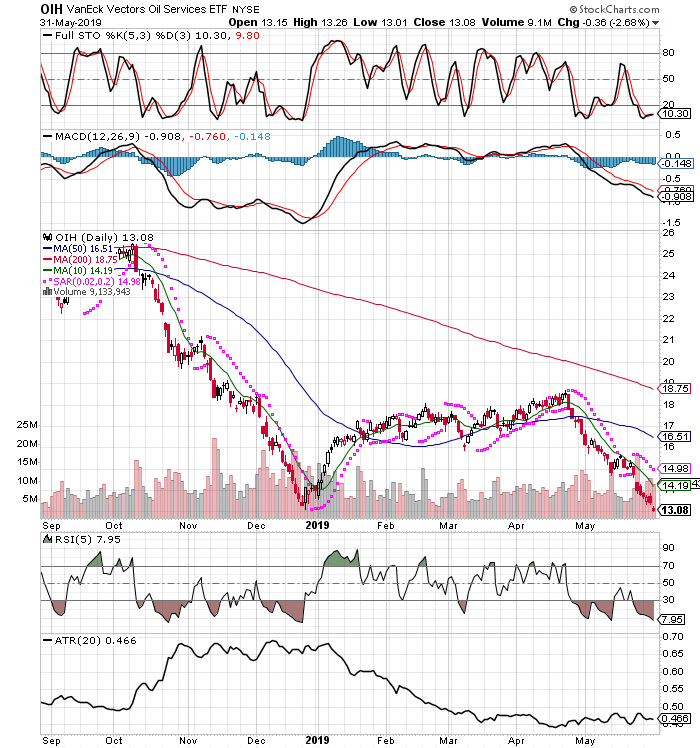

Much of the strength in metals can be attributed to the weakness in stock markets, which is also reflected in the industrial commodities and oil, which has taken a severe beating lately, so bad that the OIH etf is now at lows not seen in a long time (at least since 2006 or more, if I recall correctly). We are seeing that the stock market, once being bought up at every opportunity and closing positive every day for months on end, now doing the opposite. While we look short term oversold by technical measures, and a bounce could ensue at any time, it seems that all rallies are being sold into, and many days the market starts positive, it still finishes the day weak and often near the lows. “Sell in May, and go away” seems to be in full force this year. Note the SPY is sitting close to its 200 day MA, but that the MACD indicator sports a wide open “mouth”, suggesting more downside, which if the SPY cuts right through it’s 200 MA like a hot knife through butter, will renew fears of a bear market on the horizon. My precious metals miners should benefit with higher gold, in a flight to quality. There simply aren’t too many attractive options to compete with at the moment, which could possibly cause the metals to really ignite and accelerate to the upside. This is not a prediction, as nobody can know, but the probabilities suggest more upside and I will be there for the ride if it only goes a little, or a long way higher. One step at a time, sit and let things continue to fall into place. I will sell at overbought levels on the longer term charts, but we have no idea how high the prices will be at that time. I will not exit anything based on price alone.

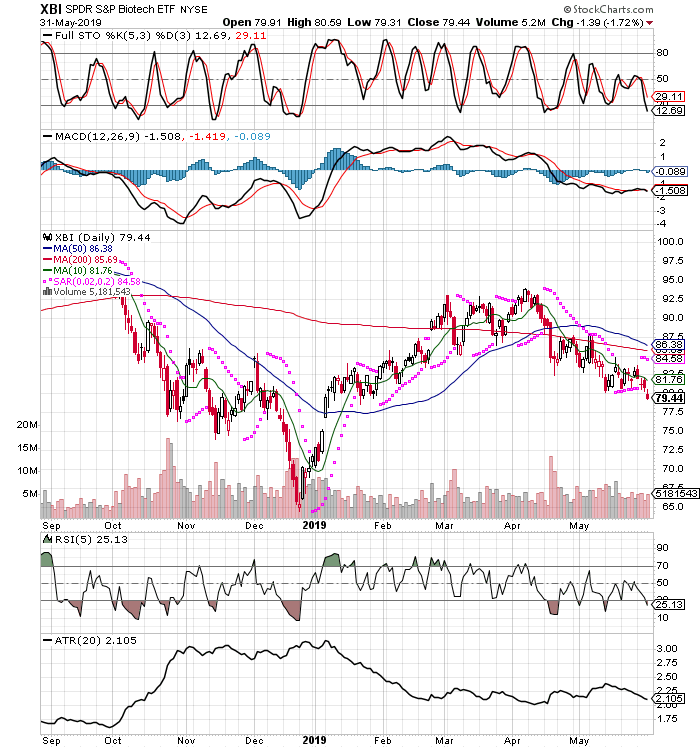

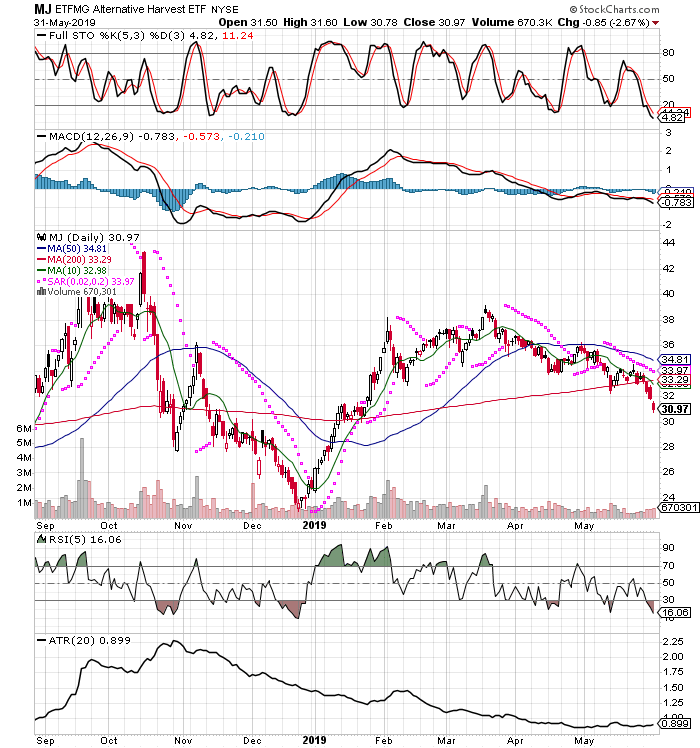

A wise investor is always looking down the road for new setups and catalysts. With that in mind, I will keep and eye on other commodity stocks, specifically oils (OIH), copper stocks as well (COPX), and even Uranium stocks (URA). I think it is too soon to get involved in those just yet, so will sit and watch for a long term bottom to be put in place. Why the focus on commodity stocks? Simply, The US dollar has been on a tear higher and could be turning the corner lower, and commodities vs the S&P are way undervalued on a historical basis. These type observations have nothing to do wtih short term trading or timing, they are just things to know as we look for other technical signs of a bottom being formed. I will also keep an eye on past leading groups in the stock market, as they often rebound the hardest once a turn comes. In that area, I will watch the XBI biotechs and the MJ marijuana stocks, but so far they have been in a very strong downtrend, again too early for me to want to invest. I want them to wash out so hard that nobody wants to hear those symbols mentioned ever again!

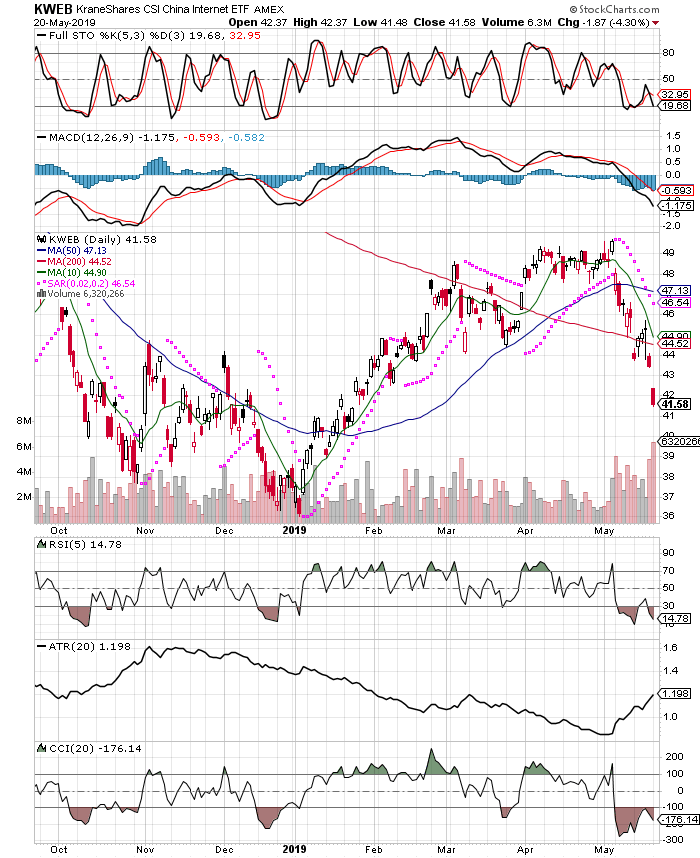

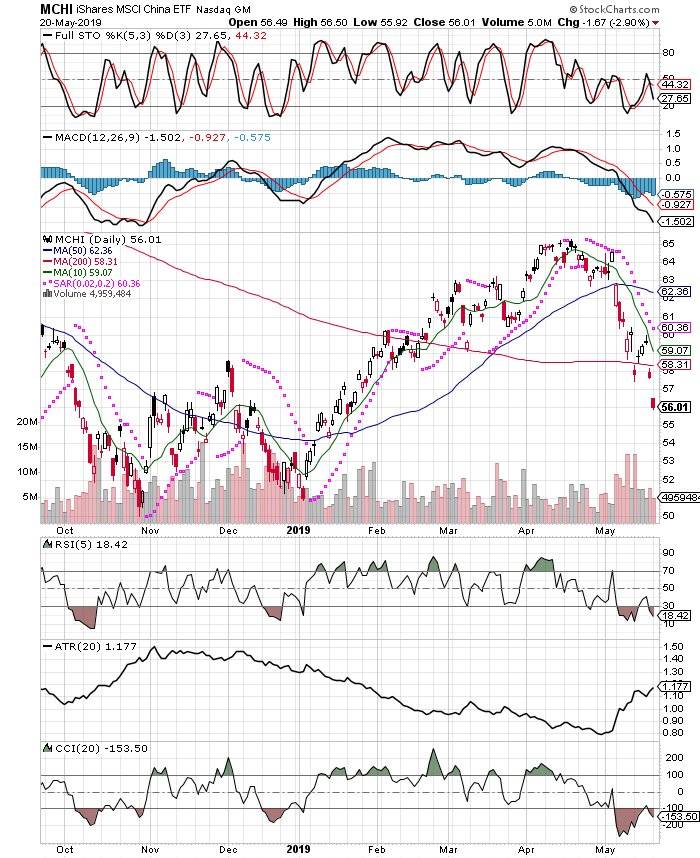

No doubt these stocks are due for a bounce, as they are all well oversold on most technical measures, but I will stand aside and not try to play the long side in these. It is HOW THEY BOUNCE (strongly, or barely at all) that I am interested in, and if I was looking to do a short term trade, considering the lower highs and lower lows (downtrends), I would instead look to possibly sell short into the rallies if they are weak. This is similar to being long miners as they often move opposite the stock markets. So, a weak bounce in these groups that rolls over quickly, will have me pushing aggressively long on my mining positions rather than trimming or taking profits into a bounce.