July 9, 2021

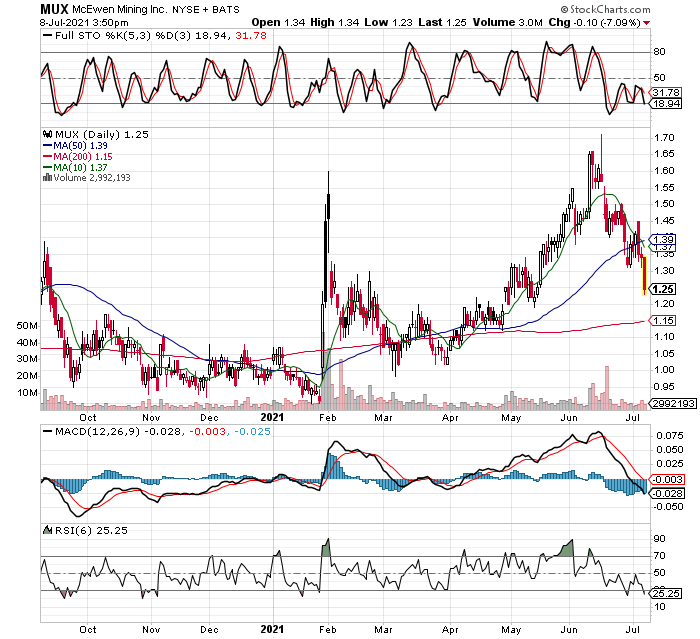

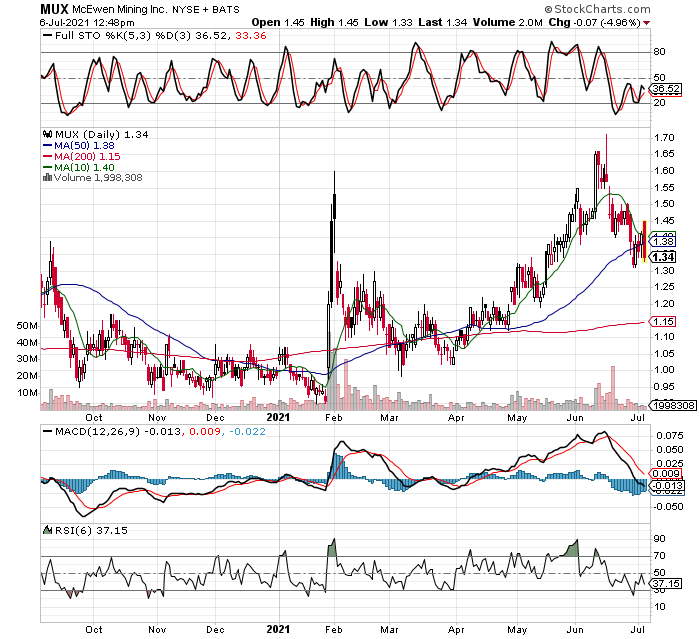

Members of the site already know I added to MUX again this morning, please check the Stops and Daily Account Statement tabs for details and how new trades affect overall numbers, stops, etc. Since almost all my holdings are taking a nice jump higher today, but have been in a weak trend lower overall, I have decided not to chase and add or buy many new positions as yet.

A quick review shows UROY up near 10% today, MGMLF (Maple Gold) up 6%, and almost everything else is in the green as well. Its a welcome performance after a tough week, and right before the weekend. In a few minutes the new COT report will be out, showing us what moves have been made in the futures markets, I pay attention to the gold and silver figures, though I do not use this data as a timing tool for trades.

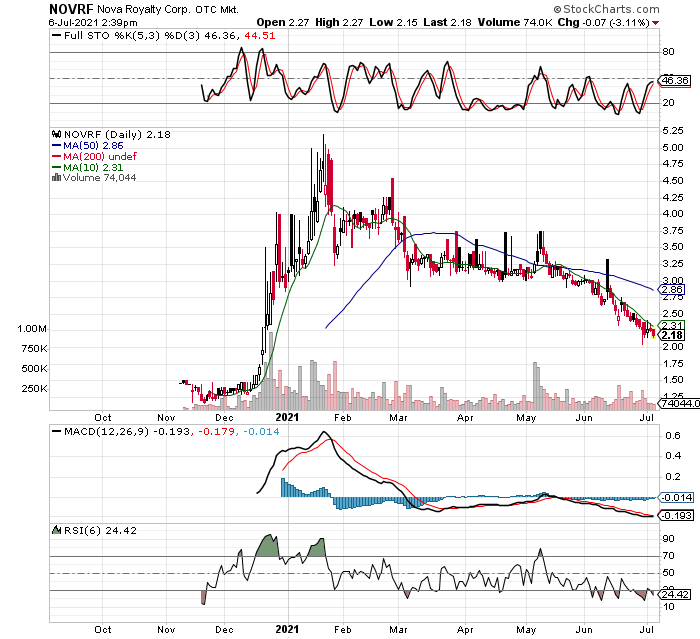

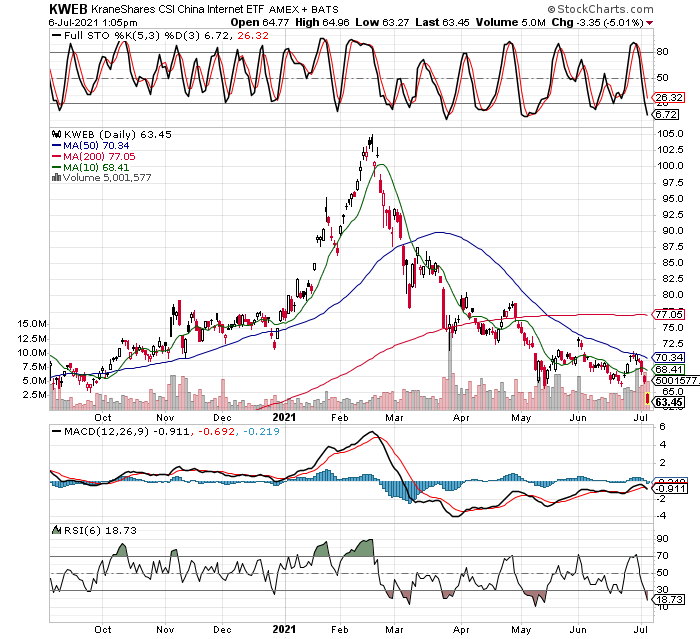

Its also good to see my recent KWEB buys getting some upside today as well, turns out overnight that China’s central bank eased monetary policy again. It’s almost comical, being just two weeks ago they were whining about inflation and claiming they will fight it at any cost (higher rates?). This is a great example of why we MUST ignore the news. It’s good to be aware of what is happening, but what they say is typically a better fade, that to take their words at face value! So KWEB is up 4.5% today and looking like it might want to make a substantial bounce. In any case, my signal is longer term (6-10 months on this etf), so I won’t be jumping up and down if my LEAPS gain another 50% in a few days, they are already gaining 16.4% as I type. I’m still looking to add to this position, but there is no rush, patience is a virtue. A couple charts to consider…

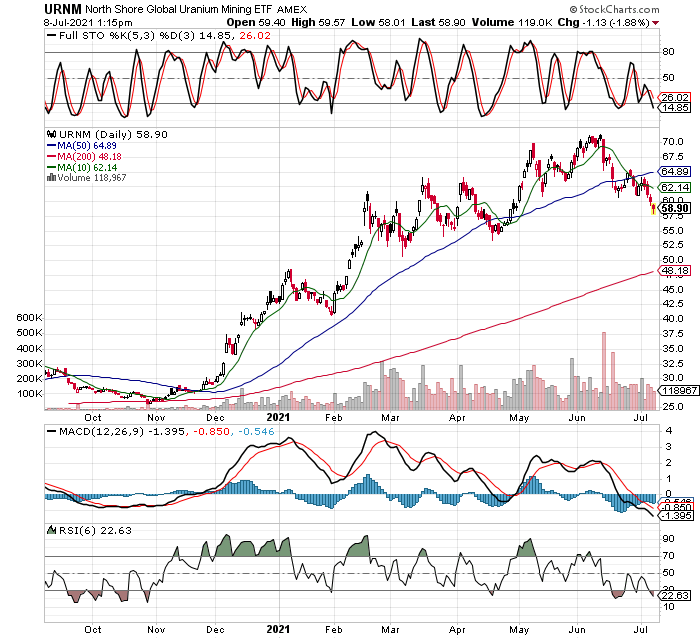

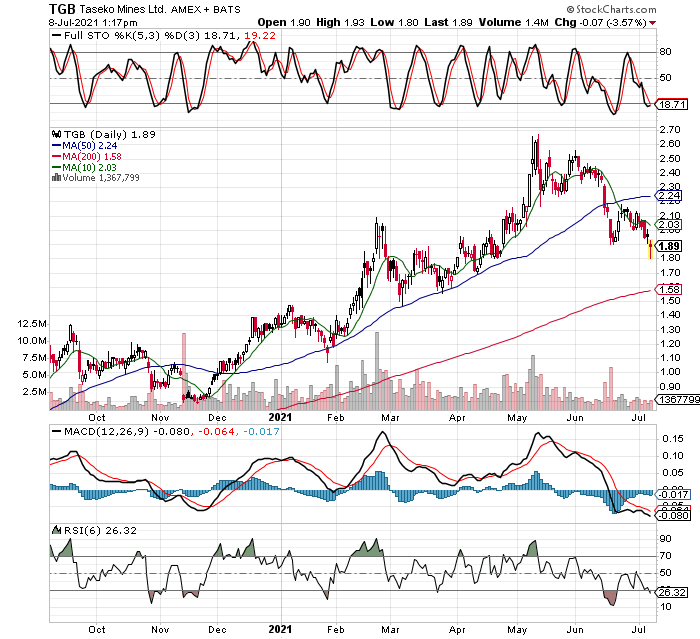

Is it time to bounce for SILJ and the silver miners?

Being a stock like AG (First Majestic, I own it individually, as well as in the SILJ etf) is the largest holding in the SILJ etf, with a chart like the one below where it’s now sitting on its 200 day MA, is what has me thinking its time for a bounce in the silver miners group. It will either break down soon, or resume its uptrend, we will find out soon!

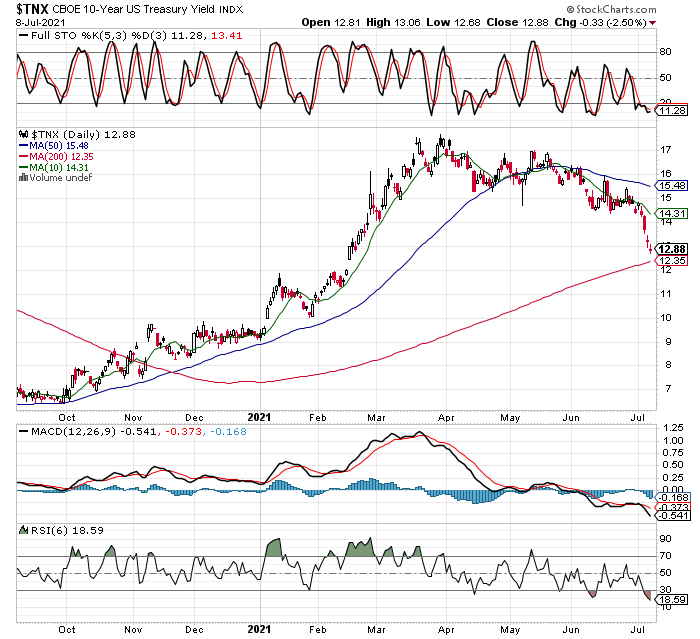

It appears the precious metals miners will define their next path very soon. Either the bull is done, and they are heading lower for a long time to come, or one believes the bull is very much alive and just catching it’s breath for the next big move up. Buckle up, and get ready to find out!