August 12, 2021

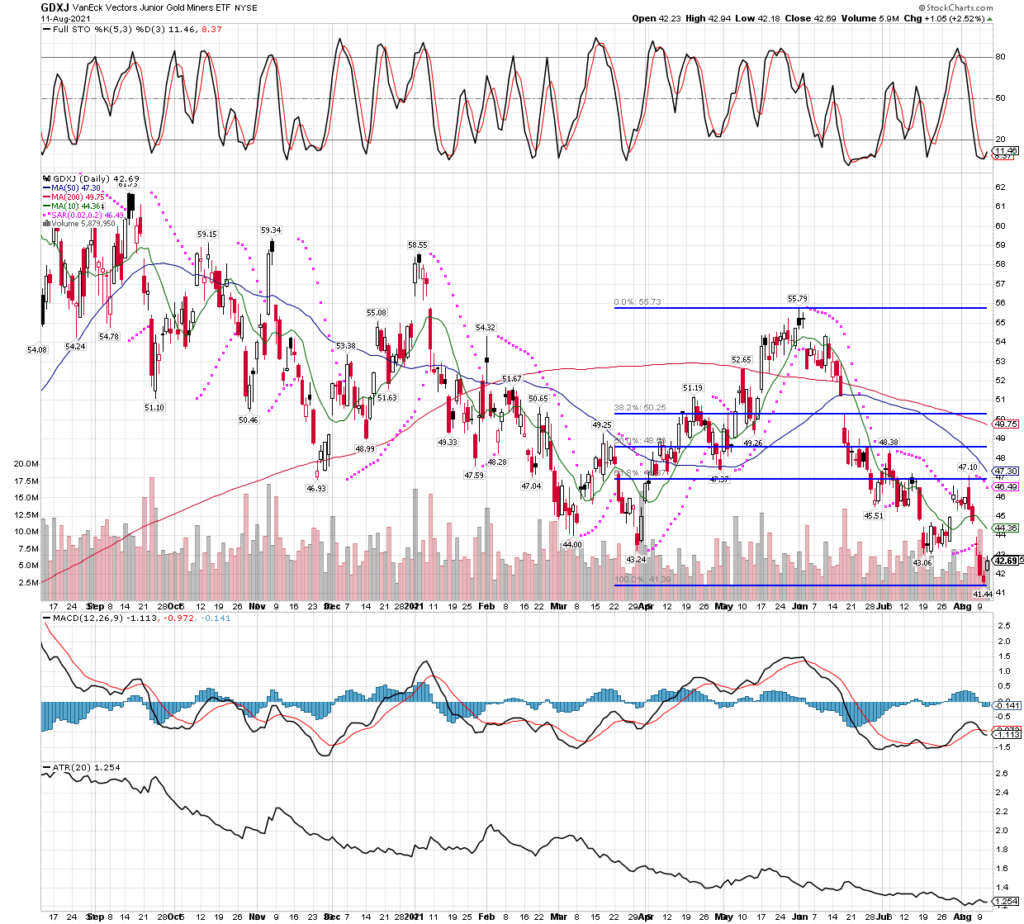

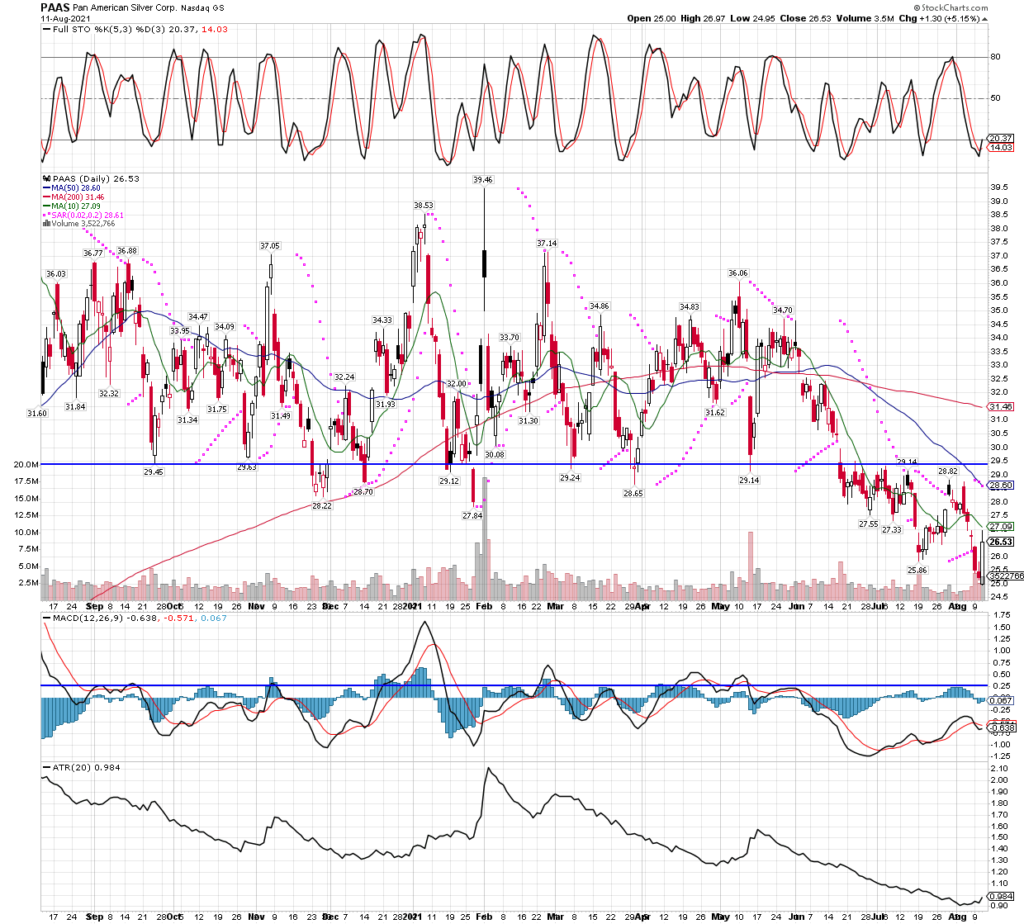

Until now, I have been wrong about the bounce following through. No sooner did we get a great upside day yesterday, and today it reverses! On top of that, we were stopped out of another position in junior explorer FVL.TO (FreeGold Ventures). We were also able to take advantage of the weakness in early trading, once the technicals got oversold about 10 am or a little after, to start buying the SILJ etf (Silver Junior Miners ETF) again, adding to our long-term holdings. While we didn’t surrender all of yesterday’s gains, we don’t have to tell readers how rough a ride it has been overall. I still maintain we should be heading higher before we go much lower, if we go any lower, but there is no denying the weakness persists, it isn’t fully behind us and until it is we will experience pullbacks like today. That said, I am a bit surprised to see 73% of yesterday’s gains given back after the first strong day, so I was careful not to buy heavy when I got the buy signal today. We might have to right this one out for awhile, the way it’s looking. I appreciate those who have had the patience and fortitude to stick with the program thus far, I know it isn’t easy, but I’ve been through it all before and will do what has always worked over time.

Let’s first look at what stopped us out today, FreeGold Ventures (FVL.TO). While I occasionally override a stop level, I generally try not to do it to often. I will admit I was tempted to do it today, but with the group so weak lately, and some junior miners getting annihilated on down days, I decided to ignore my hunch to stay in because I think a big percentage gain day or two might be close at hand. I say this because it’s happened to me a few times over the last several weeks, I stop out of a trade, and a day or two later the junior explorer is up 25%! It can drive one nuts if you let it. lol I am fine with my decision to clip the stock, since on a few occasions the junior miner has proceeded to lose 20-50% not long after I stopped out, so all in all, best to just follow our discipline and move on to the next idea. Here is what FreeGold Ventures looks like, a chart I hate to sell at the moment, but the rules are the rules and they exist for very good reasons.

I bought a little more of the SILJ etf, I don’t have any worries about this one longer term, but still kept my buy orders small since we already own a lot. Since this is a longer term holding, I will post the weekly chart, which despite all the stress and fear in the mining sector, is still a fine looking chart. Nothing is broken here.

One big positive we have going for us, is the mining sector is posting the best earnings reports in history. Something will have to give, because the miners are raising dividends, and have exploding cash flow and profits, all this while the group´s stock prices are performing terribly. Either the quarterly reports will start to reflect just how terrible the fundamentals are, or the fundamentals are awesome and the stock prices will catch up with to the fact. We are betting on the latter, just be prepared that it might take some time. The best thing about trading miners is they make up lost ground very quickly, in fact not many groups can tack on the gains like miners, and they can keep on running after that as well.

I am not subscriber to Gann Global Financial and James Flanagan, but I enjoy hearing what he has to say when he offers material for potential subscribers. I will post a link to a video he released today, for those that are interested. I am in no way compensated or affiliated with Gann Global, I just find their work very worth the time to listen, and I like that he has a longer term approach than many of today’s newsletter writers, who seem to be interested only in calling the next day! Here is the link if you want to listen.