October 28, 2022

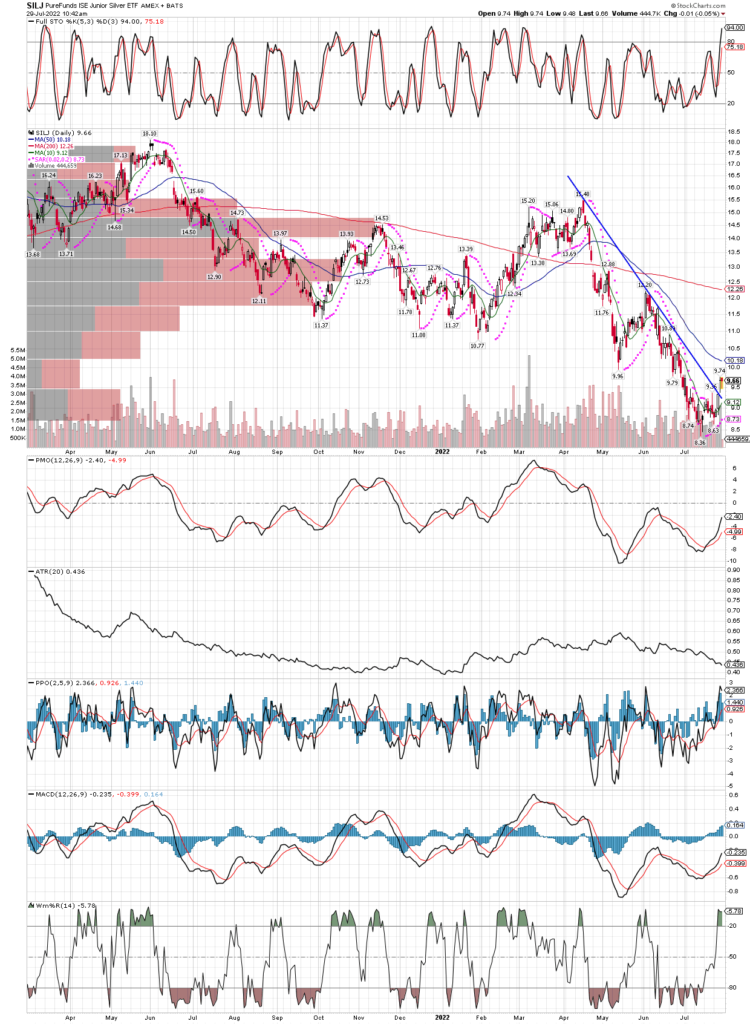

Besides adding to CDE, HL, FSM, and EXK, I also initiated a position in SLVP, another silver miner etf. I included the chart below, even though it looks a lot like SILJ, the only reason I started the new position is SLVP has some different stocks in the top 10 holdings, like NEM, WPM, and HL is the second largest holding at around 12% of the fund, than the SILJ, which oddly enough shares five miners in its etf with the GDXJ etf as well.

To try and catch readers up with all our recent activity, we have been buying and adding all week, but especially on down days, even picked up our first junior explorer in a long time. It’s a PGM (platinum group metals) play, that also has a nickel/copper project in northern Michigan on the upper peninsula. The explorer was brought to my attention by Bob Moriarty at 321.gold, and I couldn’t resist buying shares yesterday knowing I was getting them for half what Bob paid, and he thinks his higher price is a screaming bargain too! He has clued me into some big winners over the years, so I am not chiding him for paying more than me, instead I treat it as good fortune and luck for me. I will post the chart of Biterroot Resources below, as well.

And here is Bitterroot’s weekly chart, I like that their projects are in the US, should have less jurisdictional risk.