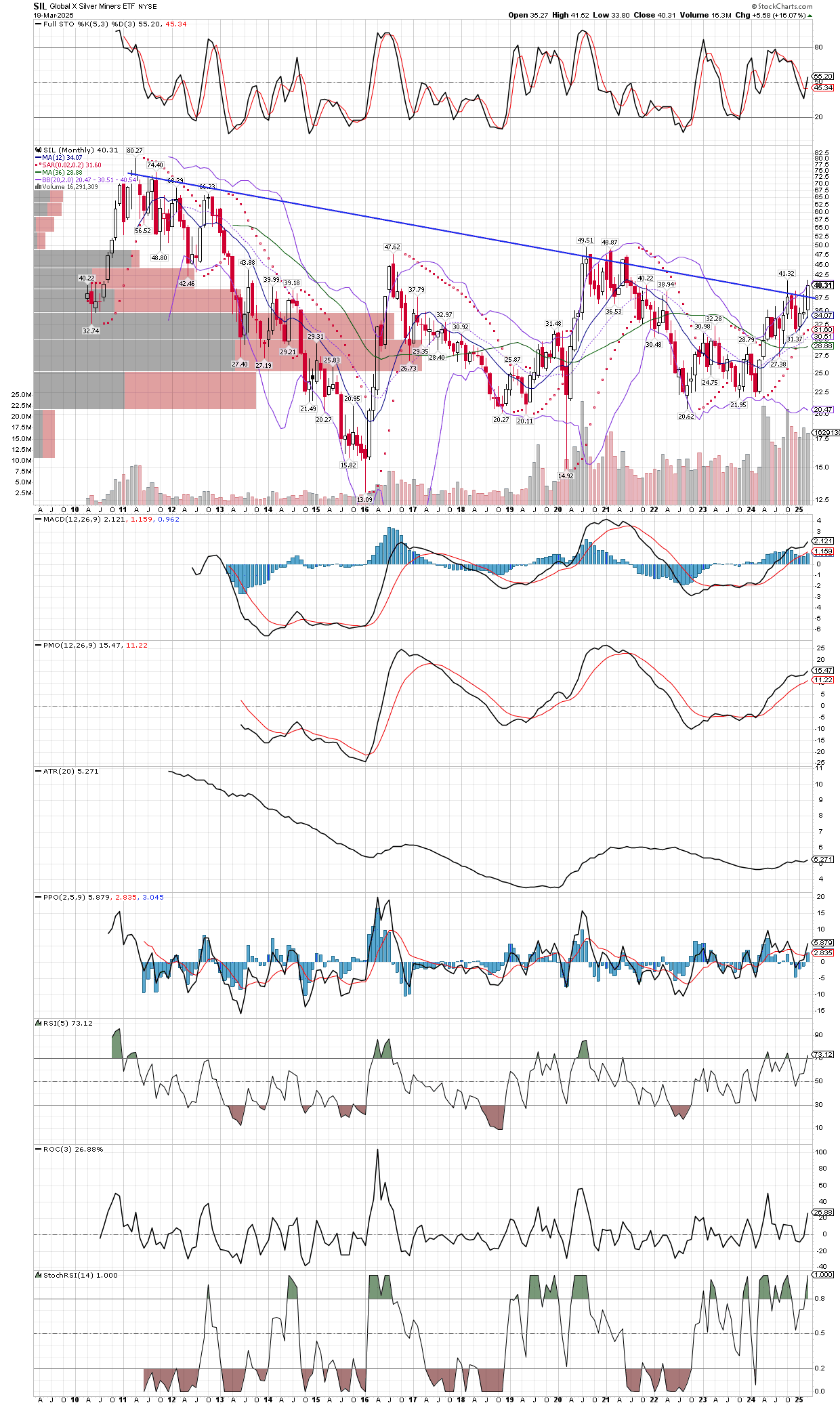

SIL Chart Breakout

March 20, 2025

Longer term chart breakouts have more significance than nearer term charts, but they don’t help much as far as timing. SIL has broken its long term downtrend, very clear to see, the only question is when to get long? We are already heavily long here, but if we weren’t, it would be tough to know when to buy since miners have had a massive run over a short period of time. Usually that is not the best time to buy, on the other hand, the strongest moves with the largest gains typically occur in dramatic fashion, up day after day, and certainly week after week, with only a sharp one or two day pullback here and there.

On that note, we have had a two day retreat in miners, and while I would normally like to see technicals reset before entering, this might turn out to be as good a time as any, to buy so one can enjoy the rest of this move. I refer to the expected move in silver and miners (gold too, but to a lesser extent since it has already rocketed), that should move silver up to the $45-$50 range. One has to be prepared for further downside when they buy up here, but with proper position sizing and the confidence brought about by all these breakouts we are witnessing, this should prove to be another opportunity to get long for the ride. The chart below is the SIL (larger cap silver miners) etf. We don’t own this one, but have several of it’s components as holdings in our portfolios. As a side note, I will look to short some groups like technology, cryptos, and other things that have run too high during the period of easy money from the Fed. But that is for a later date, and I will only short into bounces. Thus far, the miners have treated us very well and my focus remains there. I might even add to our PSLV etf, as well as our silver futures before the week is over.

SIL has a solid breakout if it closes over this 14 year down trend line, which looks very likely at this point. One more confirmation the big bull is in force, and I will remind readers that there is no bull like a silver bull market.