HUI And GDX Continue To Pile Up The Gains

March 18, 2025

A quick look at the two major gold miner indexes, shows HUI having just cleared the 351 level, significant as its the highest WEEKLY close in many years. After that, not much resistance until it gets up to the 639 area, an extra 82% rise from already excellent gains. Lets see where the HUI closes the week, but it sure looks like we will easily visit those all-time highs and take them out, maybe sooner than later.

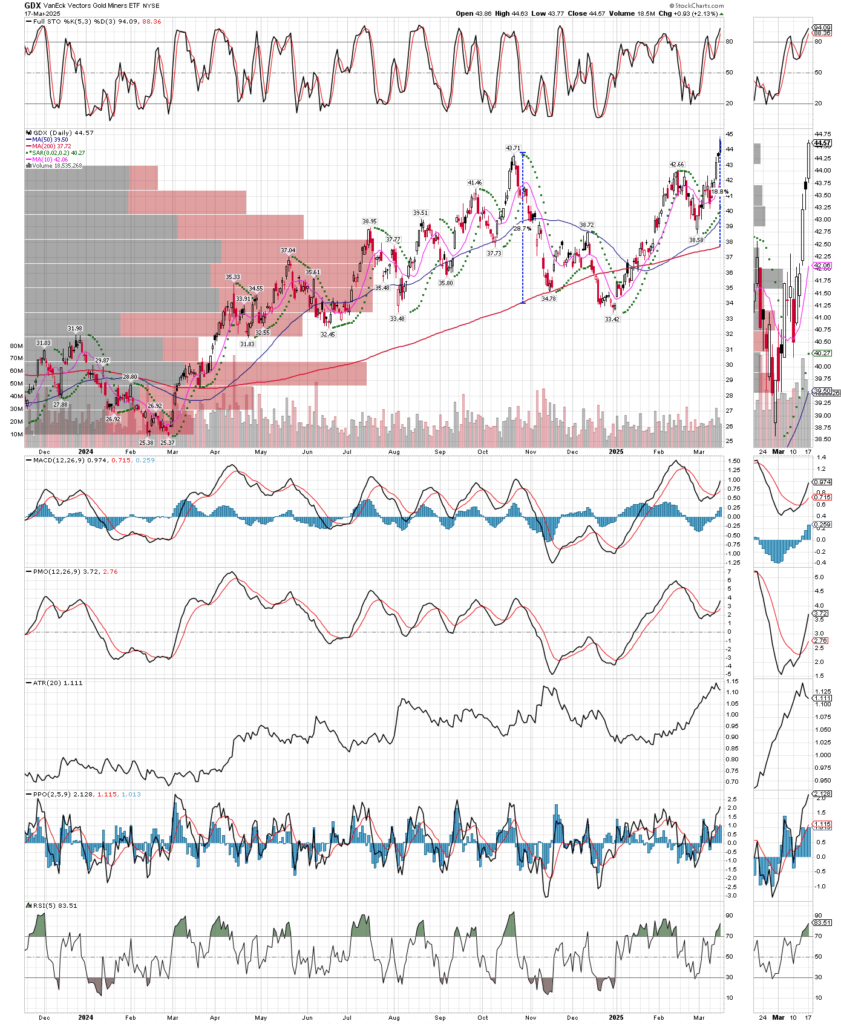

The GDX etf is shown below, for those that are concerned about how far and fast the run higher has been, know that GDX can get 50-60% above its 200 day MA before its time for a substantial (10-20%) correction. Currently, GDX sits only 18% above its 200 day MA, and it stood at 28% above the 200 day just a few months ago in late October, so it could easily still run much higher from here. And SILJ can rally between 105%-200% before a 20% correction occurs. Confirmation that we are now in a strong bull market can be seen on days like yesterday, where the silver miners via SILJ were up nicely on the day, despite the metal finishing the day lower. That is very bullish action, and since everybody loves to hate miners, or is too afraid to touch them, this bull has the potential to make investors very wealthy. If any of these pull back 10% or so, I would buy with both hands!

We remain loaded in metals and miners, from the mid-cap producers down to some tiny junior explorers, which also seem to have joined the party lately. The last several weeks have been nothing short of spectacular, and there is lots more to be had, don’t miss out!