Shoveling Money Into Your Accounts

March 14, 2025

There are times when things are working so well, if feels as if you have a team of men working as hard as they can to shovel money into your accounts. I have learned its best to just let them be, no interruptions or changes in plan, just let them continue at work! We have had as string of big winning days here, and expect many more in the future. Except for a few sharp, punishing days here and there, I don’t expect declines to last for long, and they should be bought aggressively if one isn’t already invested in the best and only group out there. While its a commodities bull, many commodities are struggling, like energy, so it’s important to stay focused on the strongest bull which is precious metals. The others will have their day in the sun, maybe sooner rather than later, but we have time to add those to our portfolios, we don’t need or want them today.

As a side note, copper has also broken out, but has conflicting fundamentals to my eye. For sure, coper production is falling far short of demand in the coming years, yet copper is also economically sensitive so will have sellers as the government starts to admit not all is rosy in the economy. This is common early in a new presidency, when he wants to shed light on as many negatives the prior president left behind for the new guy to fix. We are seeing this now, so I only have one copper holding, Sprott’s physical copper etf (COP.U or SPHCF in the US), since it seems a layup, trading at a 23% discount to its NAV! I also continue to monitor uranium stocks, as there is a bull market under the surface there too, with its fundamentals, but again it isn’t necessary to focus there at the moment. Other groups I’m watching are the coal producers, I own just one, Yancoal in Australia (YAL.AX) which just paid a fat dividend our of its enormous free cash flow. I also keep an eye on agriculture stocks, as I expect all of these will rally out of the bases they are forming now. Ideally, I could take profits in the future on all our precious metals holdings, and roll into the things I’ve mentioned above. For now, first things first.

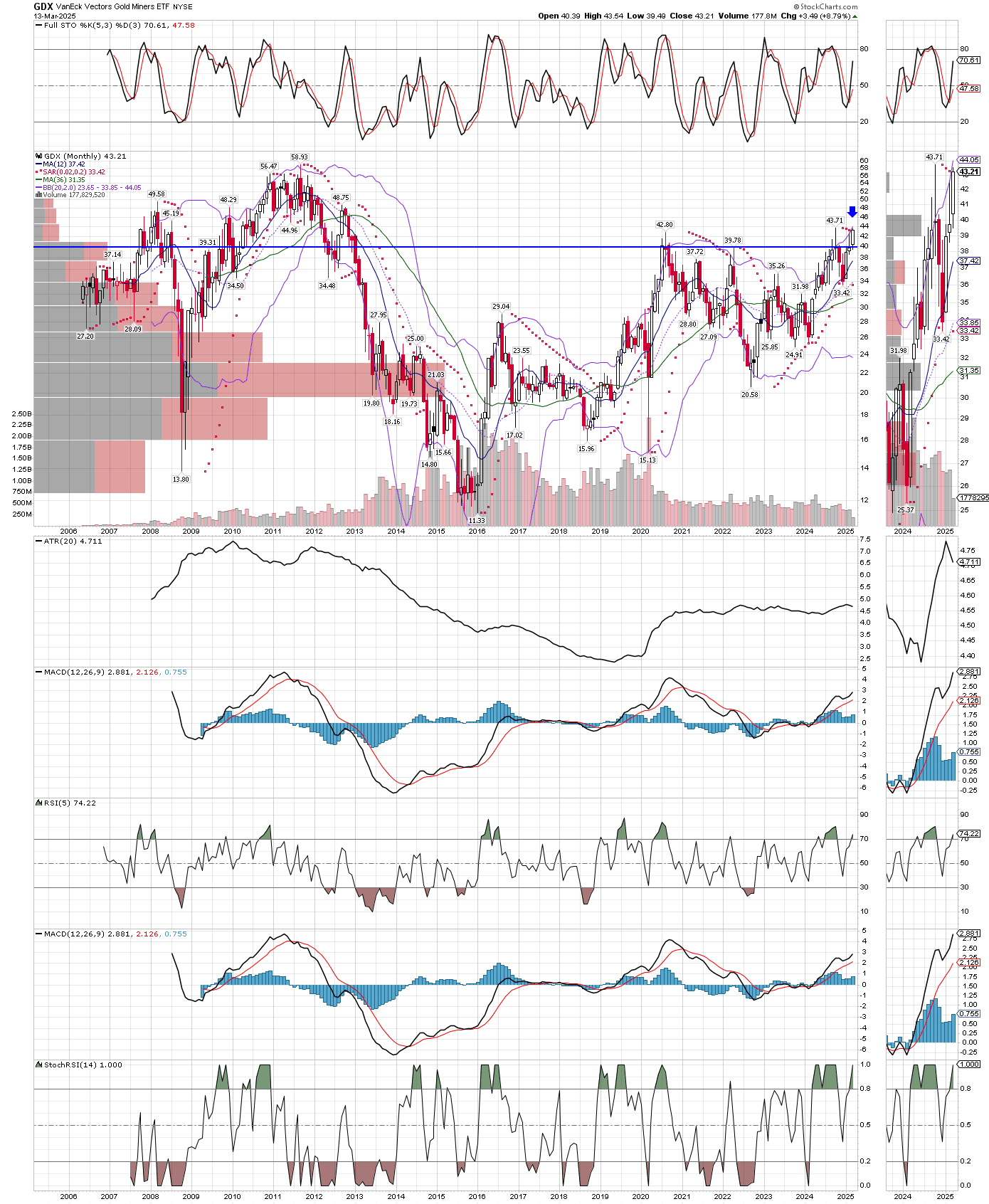

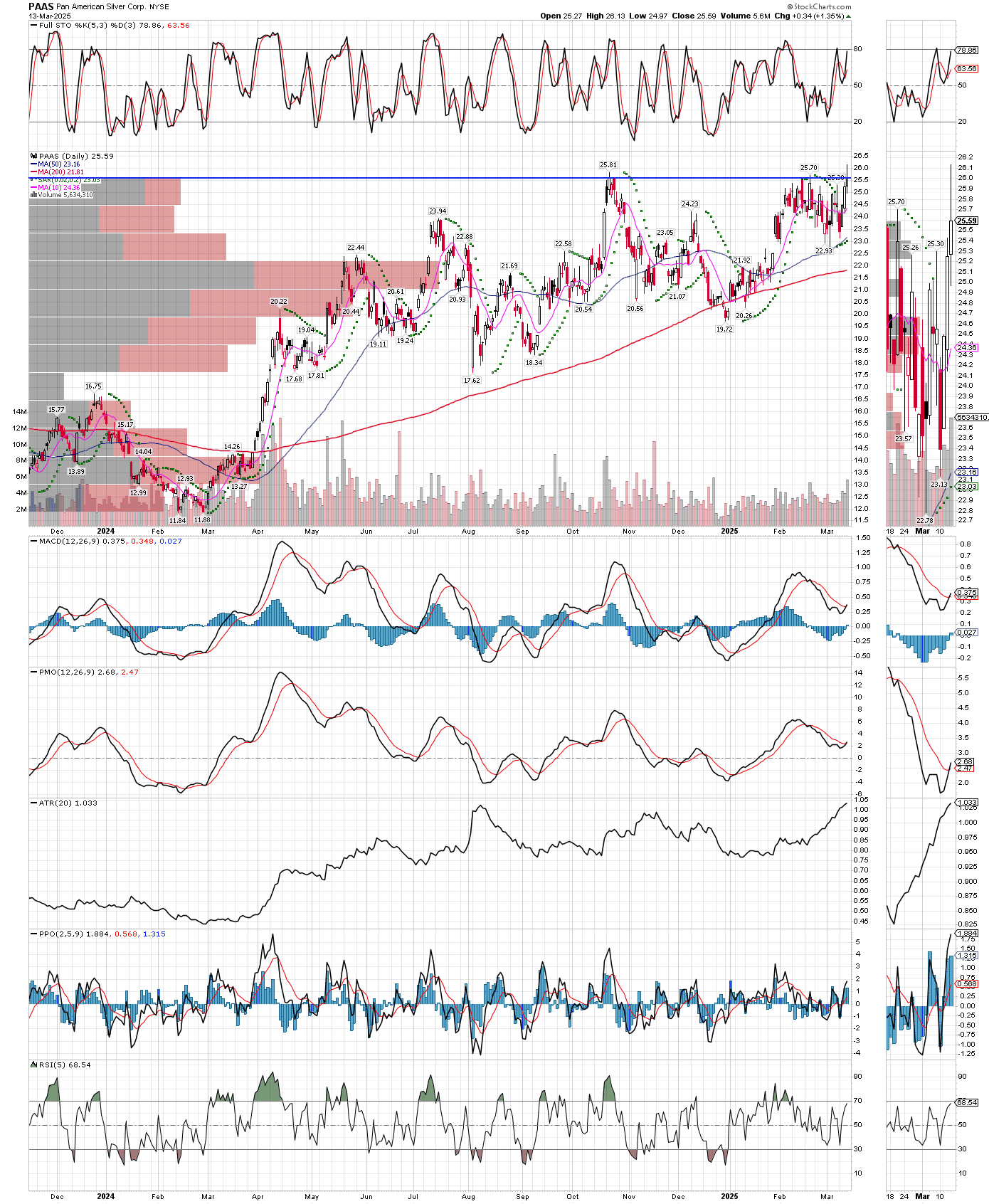

Below I have posted a couple simple charts that show clear breakouts, and all time highs in focus for the GDX etf. Keep in mind the monthly chart is log scale, so it won’t take much for GDX to reach it’s 2011 highs from here. I’ve also posted another holding we have, PAAS, which has just made new bull market highs. I didn’t PAAS for any particular reason, we have many stocks with similar charts, some much stronger like ORLA and DSVSF. If I were not loaded up in miners already, I would not wait to get some exposure. As always, proper position-sizing is key. Just remember it gets harder to make exponential gains the further a stock is from its bottom. Best not to wait much longer, and for sure use the dips as buying opportunities as they typically don’t last for long in strongly trending bull markets.

Charts don’t get much prettier than these, all the more so when everything else is sinking!