March 27, 2025

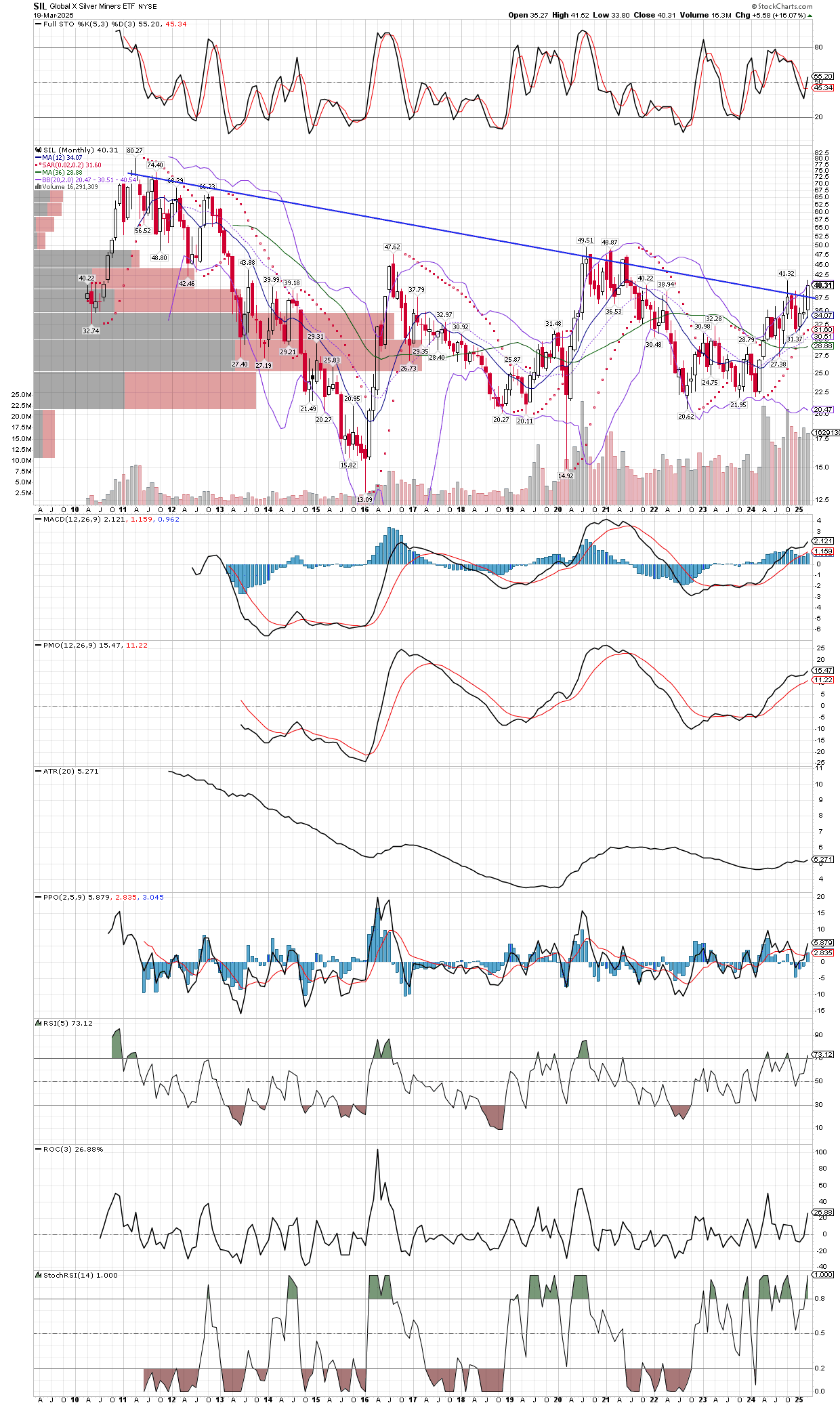

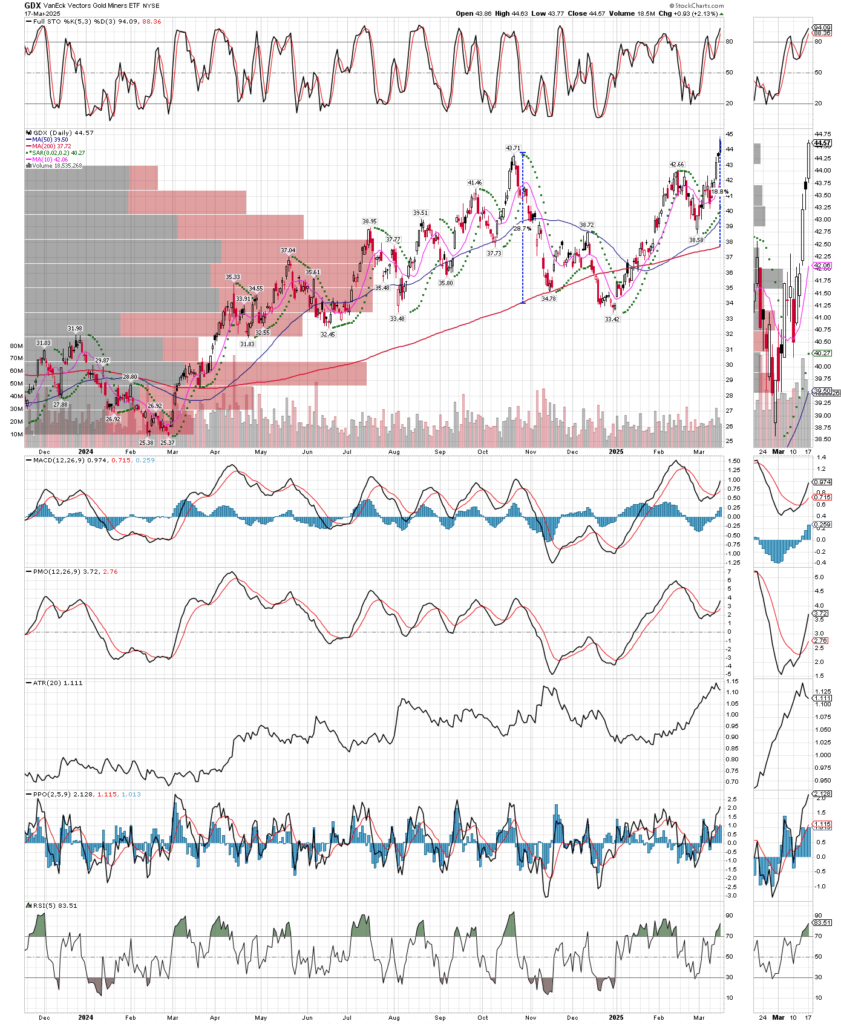

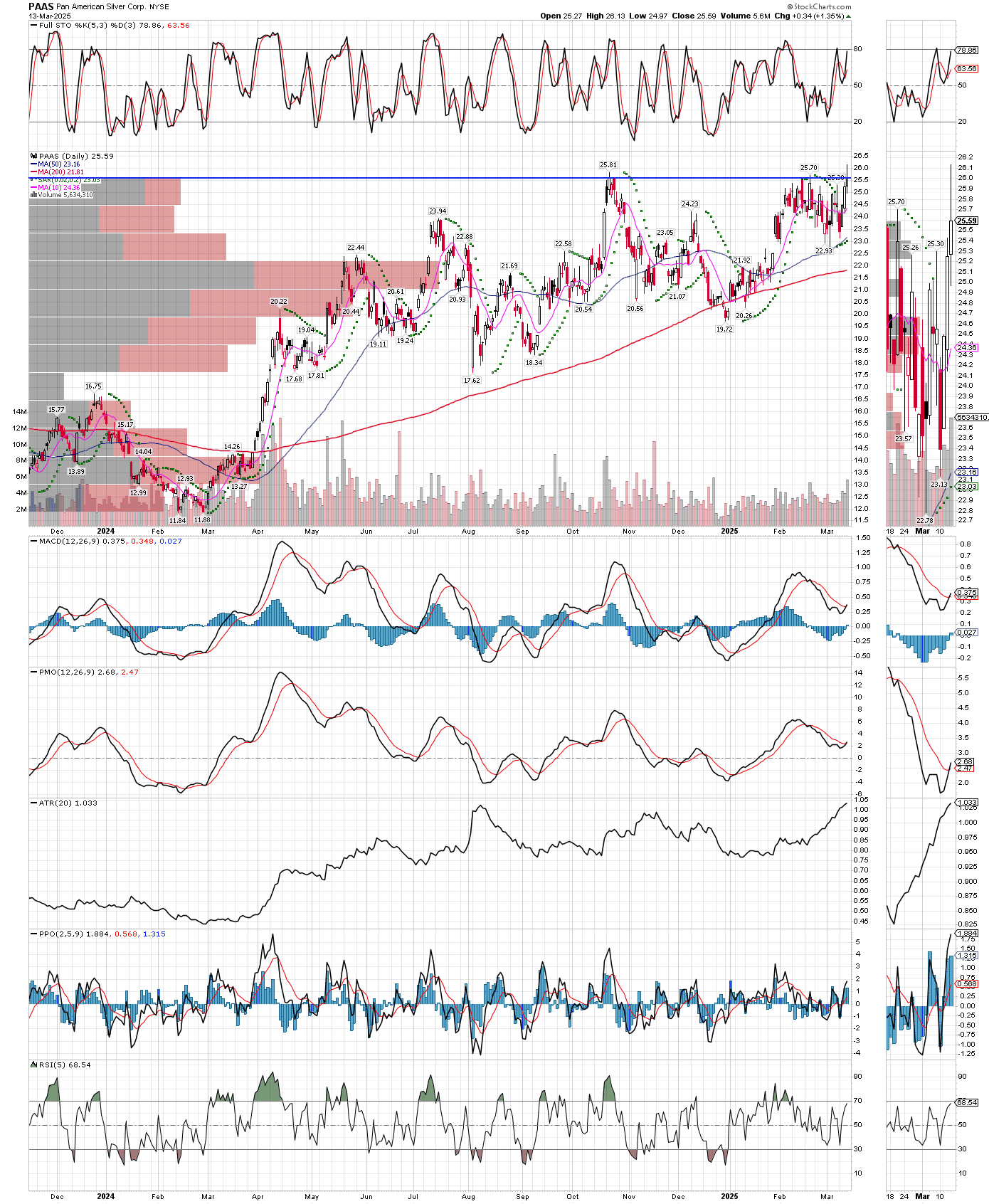

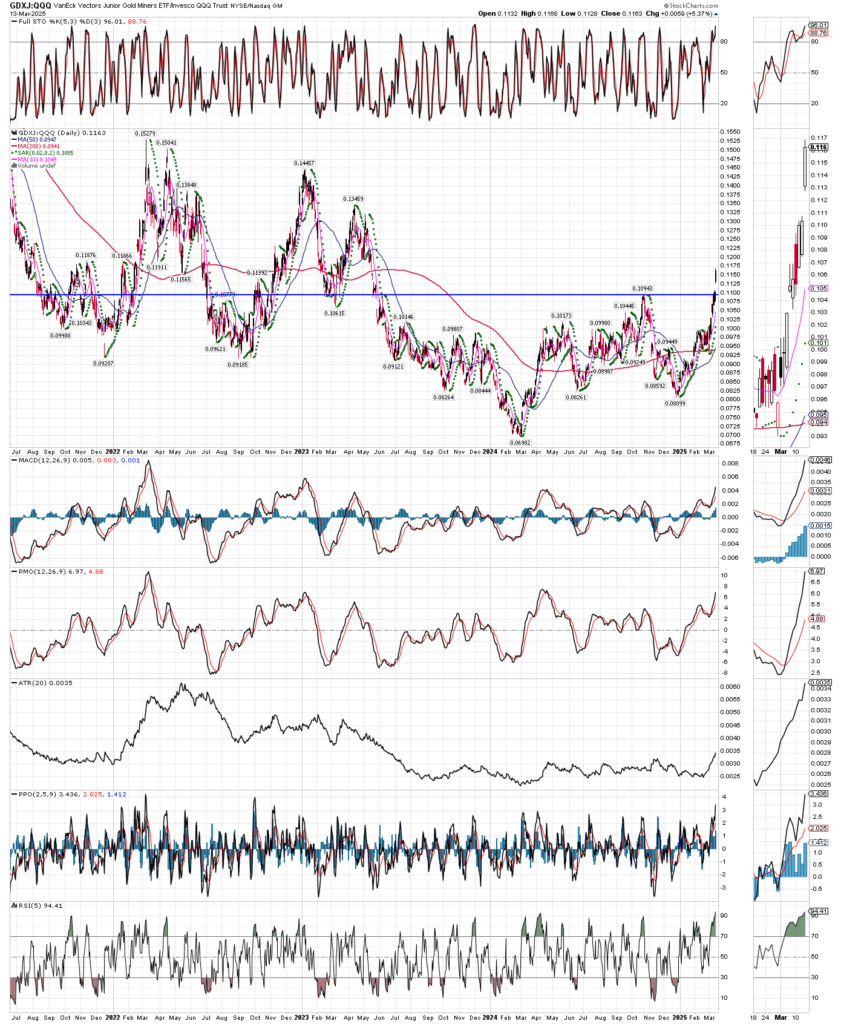

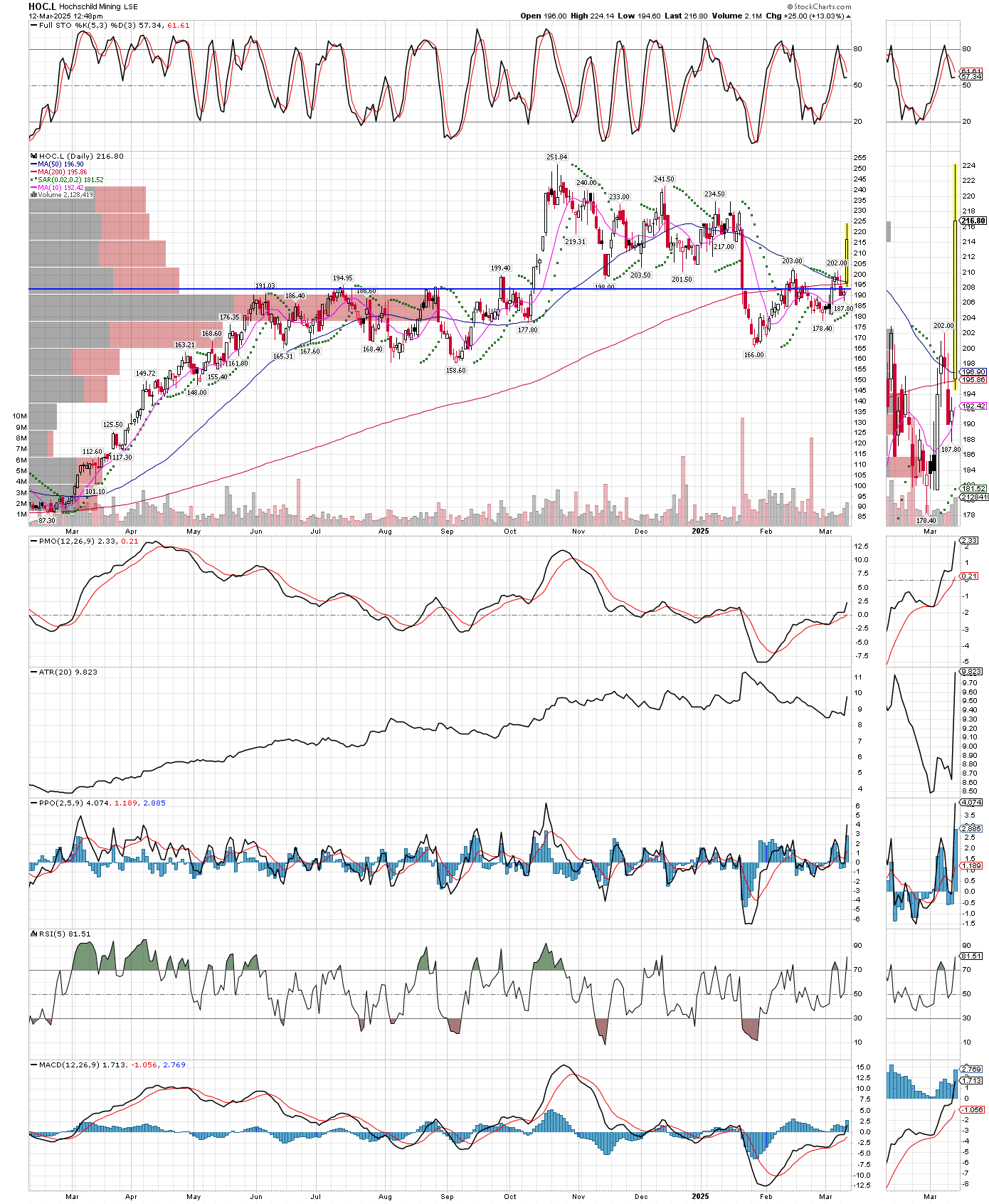

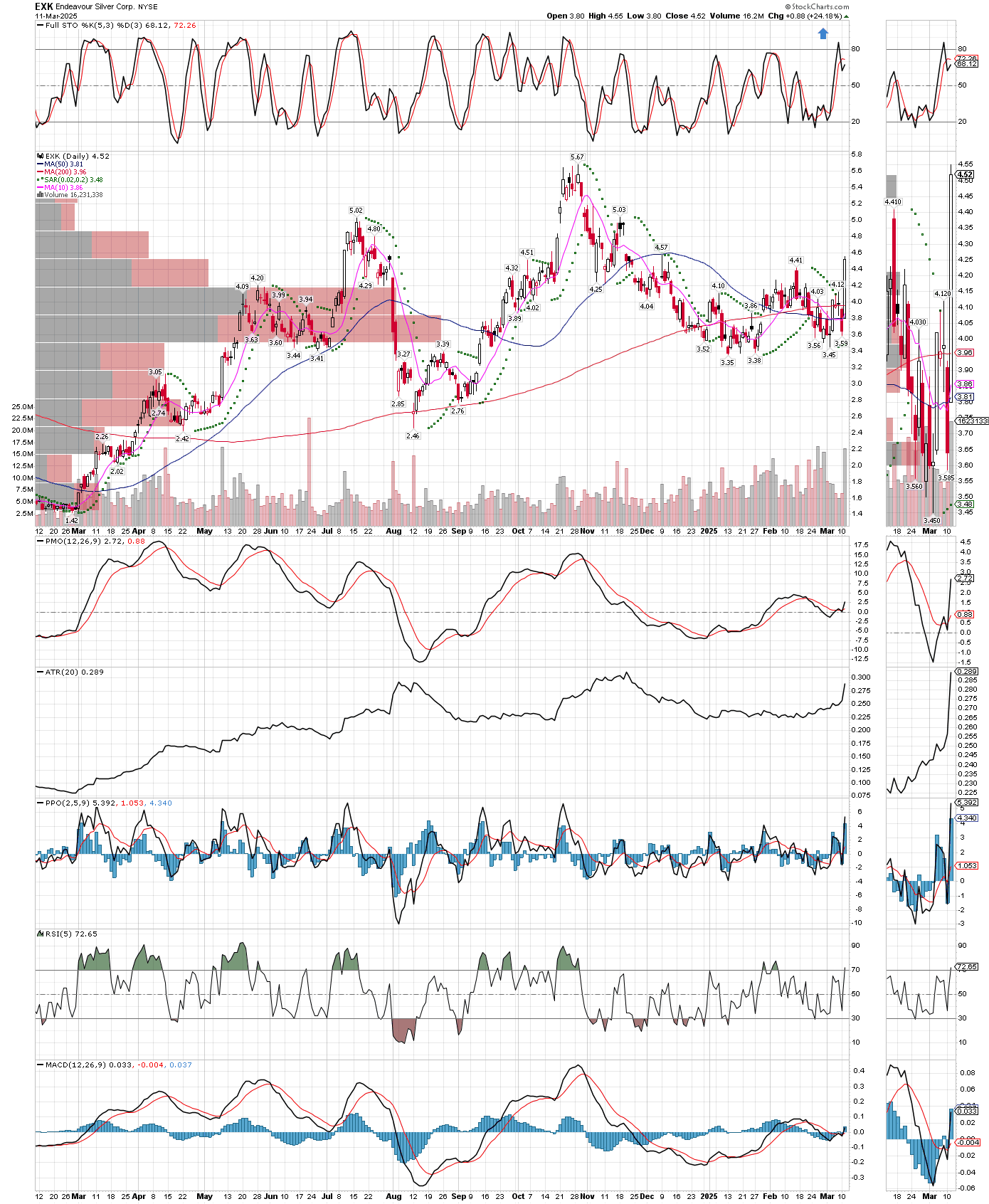

The charts speak for themselves, miners, gold, and silver are the place to be. Sitting tight with everything, after having added small amounts here and there over the last several day pullback. Subscribers can access actual account statements that include all trading activity, current positions, and both realized and unrealized gains and losses, information worth its weight in gold, and something no other site is willing to do. If they really make money alongside their claims, why not show their subscribers the actual data instead of making outrageous claims and expecting people to believe and act on it. Before you follow anybody’s actions or advice, shouldn’t you be sure their claims are true? Just a thought, as almost nobody wanted to touch miners in the last year and longer, but the higher this bull runs, the more people you will notice are out there touting themselves as having been in front of it the whole time. Just ask to see their statements, and watch what happens!

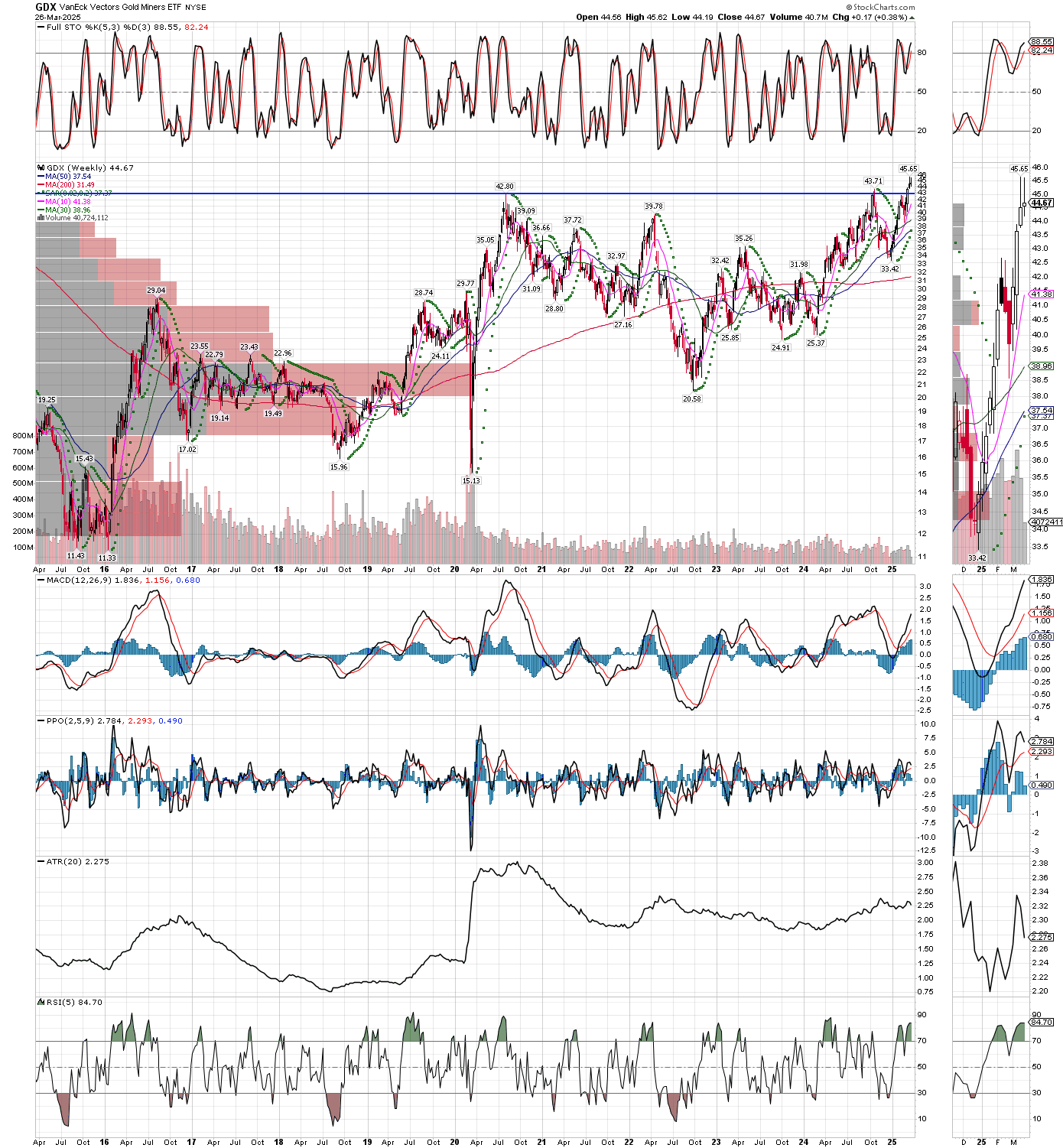

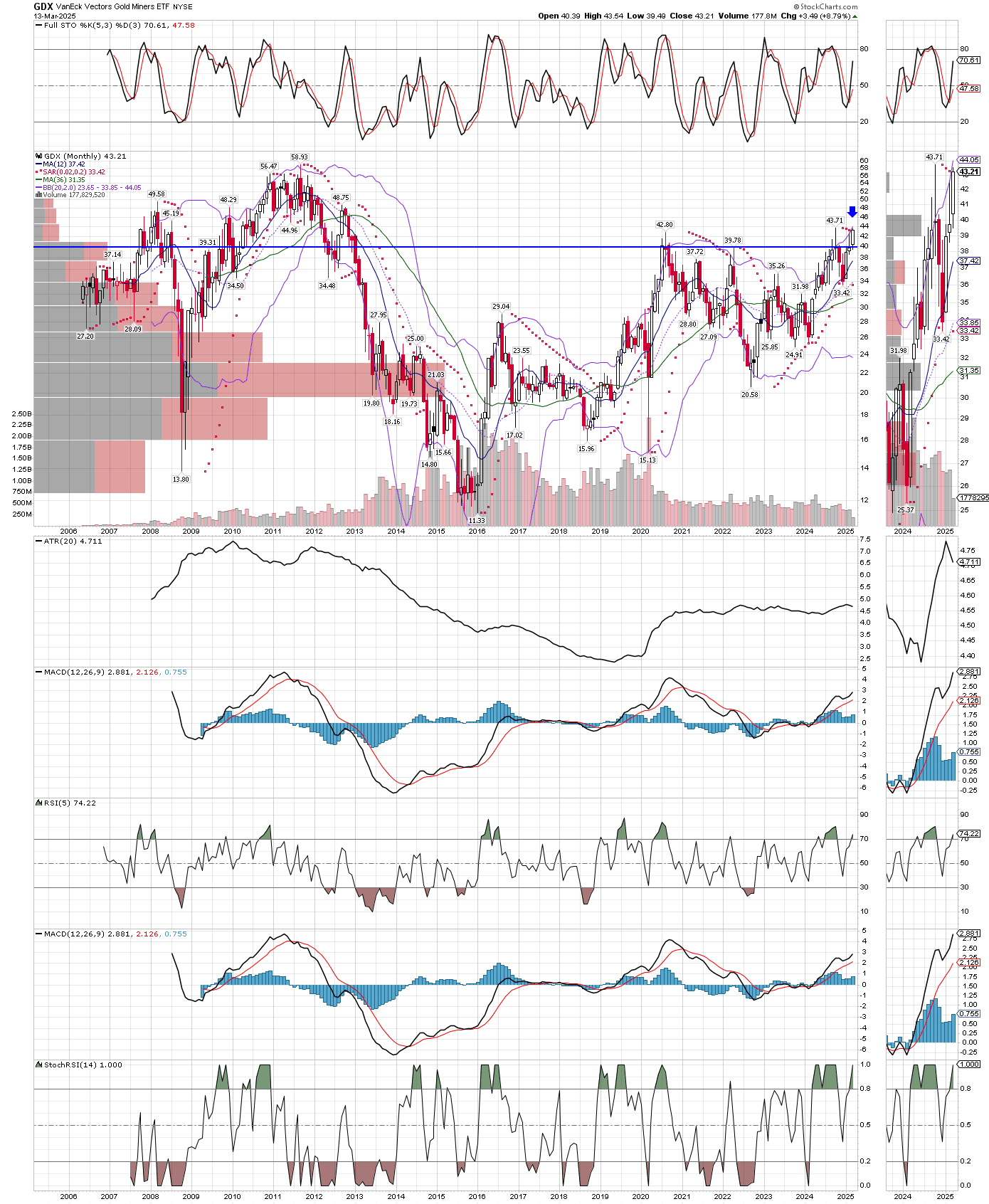

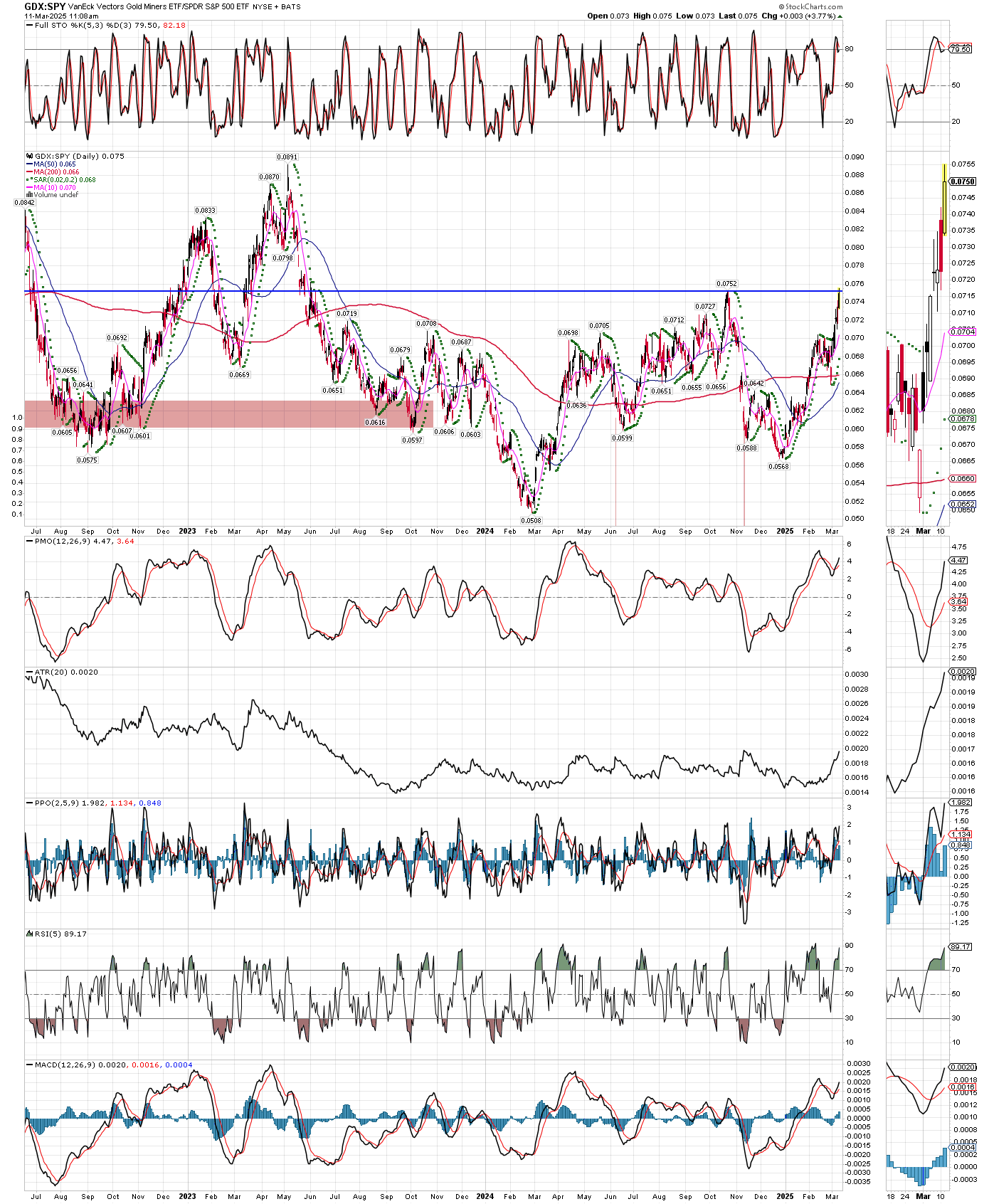

Today is Thursday March 27, 2025, and the metals and miners look like they are going to gap up higher when the markets open. Today, tomorrow, and Monday are especially important because Monday will be the end of the month and first quarter of 2025 as well. The way things are shaping up, if gold, silver, and the miners can hold up or make further gains, the longer term charts are going to be as pretty as the GDX chart below. As I recently mentioned, longer term break outs and trends are more significant, and thus have larger implications for the future direction and distance of potential moves. It’s time to buckle up again, as more people realize that SGDM (Sprott’s miner etf) was the best performing etf of all in Q1 (according to Zacks, it was up 31.6%!), it will bring in more buyers to the group, and we might get a real rocket ride!