January 30, 2025

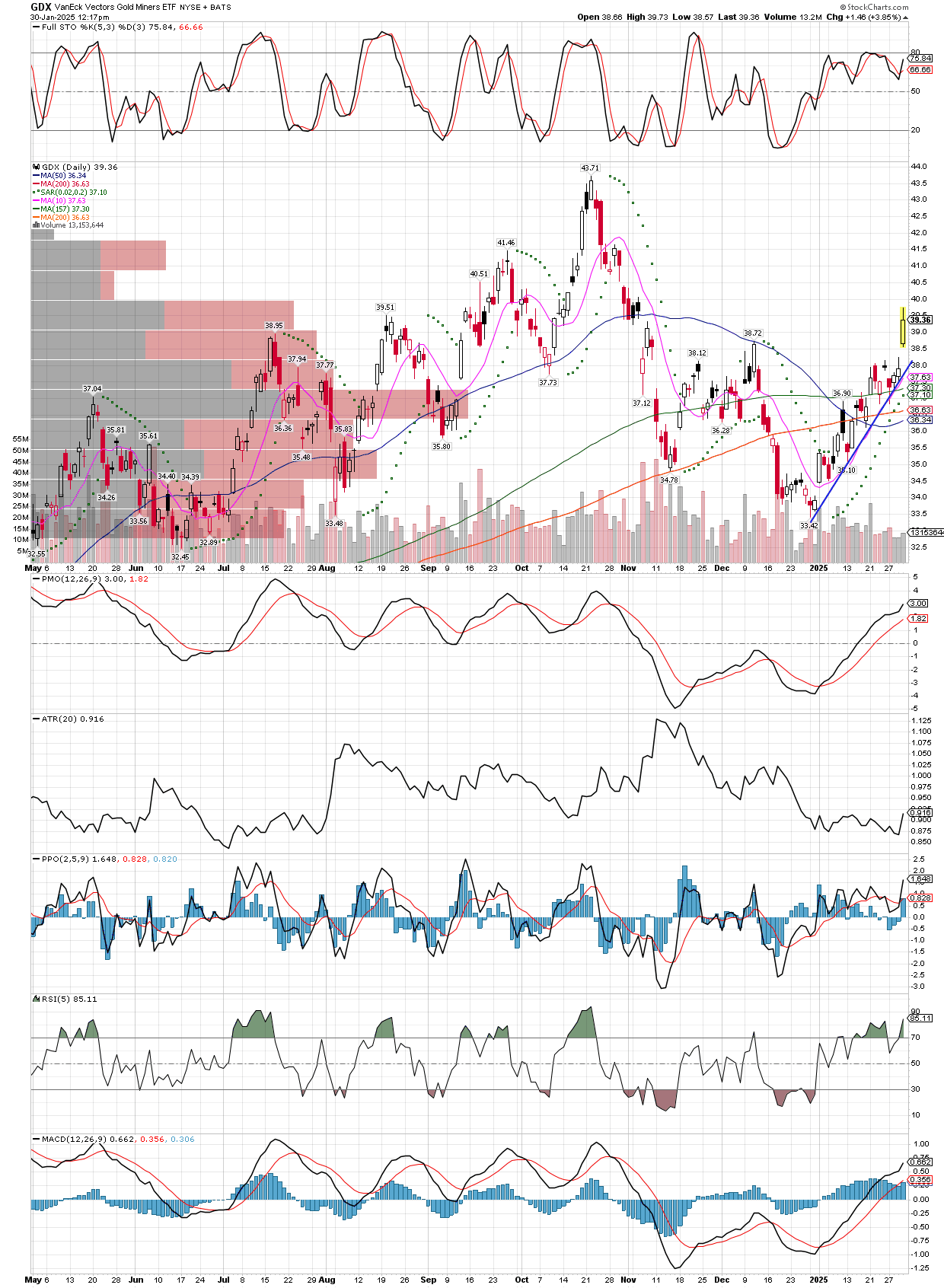

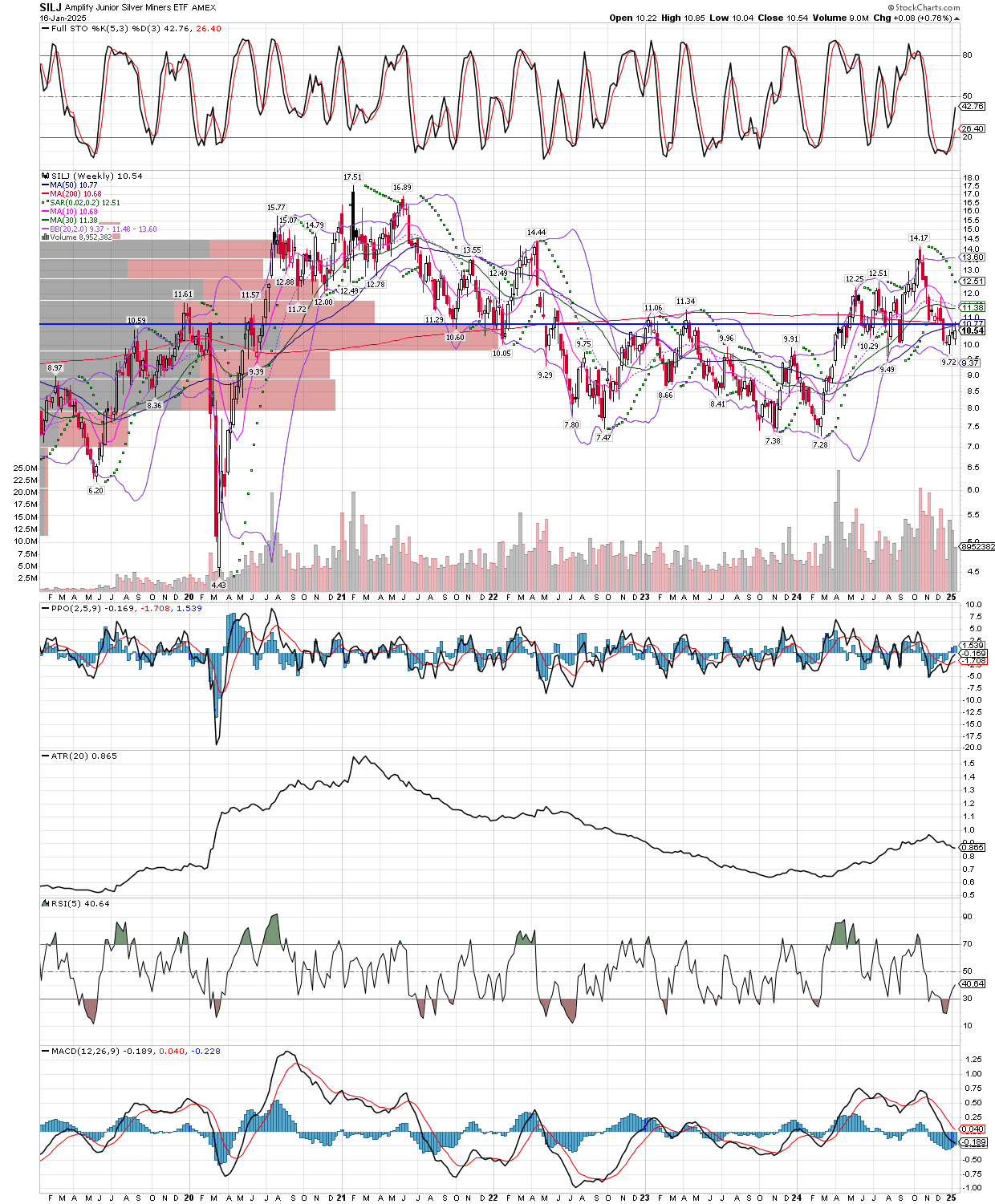

In time, we will look back at today and realize how important it was. As I write this just after 12 pm, the SILJ etf already has close to four million shares traded, more than double the volume of a typical trading day. Gold made all-time highs again today, and most of out miners are up 7-10%, while getting back over all their moving averages on the daily charts. On top of it all, the stock market can barely stay in the green today, and the digital junk like bitcoin can only rise 1%. Once these two things start to drop, it will be icing on the cake, as miners are the strongest group by far today, and its still the seasonal strong time for precious metals, albeit the miners got a late start this year. Below is the GDX, screaming to anybody left that will listen, “I’m going higher!”. Add in the fact miners will start reporting all-time record earnings and cash flow in 2-3 weeks, and there is no telling how high they could fly.