After Several Weeks Of Big Gains, A Correction Is Underway

November 1, 2024

After several weeks of spectacular gains, a correction is to be expected. Furthermore, I expect it to be sharp and painful, but not last too long, since that is usually how it works in bull markets. The declines seeing are deep enough to shake out late buyers, and painful enough to see big gains evaporate for the early buyers, that they question if it might not just be better to leave with the gains they have left, rather than lose them too? Both of those scenarios are what helps reset sentiment, and gets the market ready for another leg up, with as few people on board as possible. It’s how markets work.

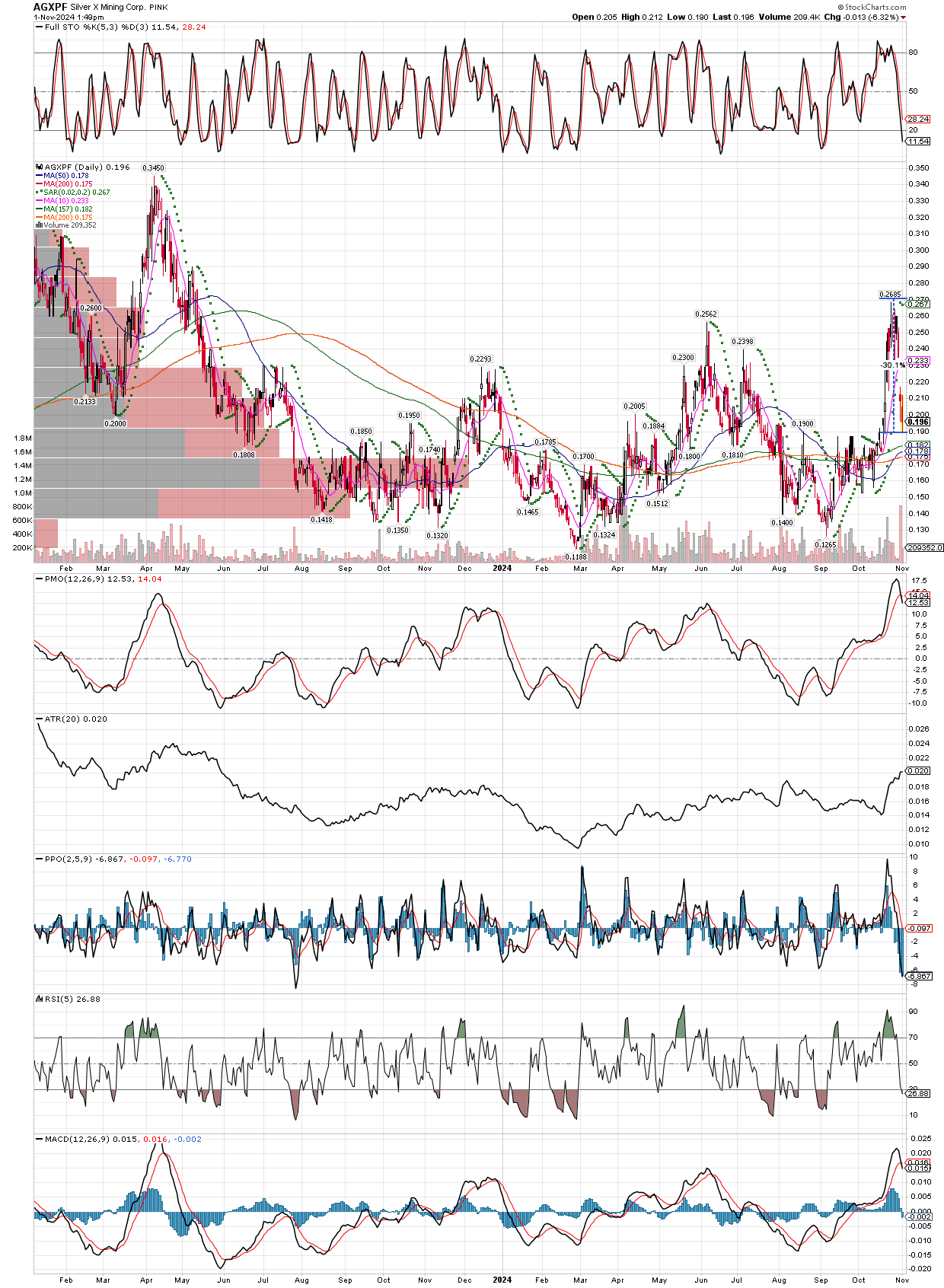

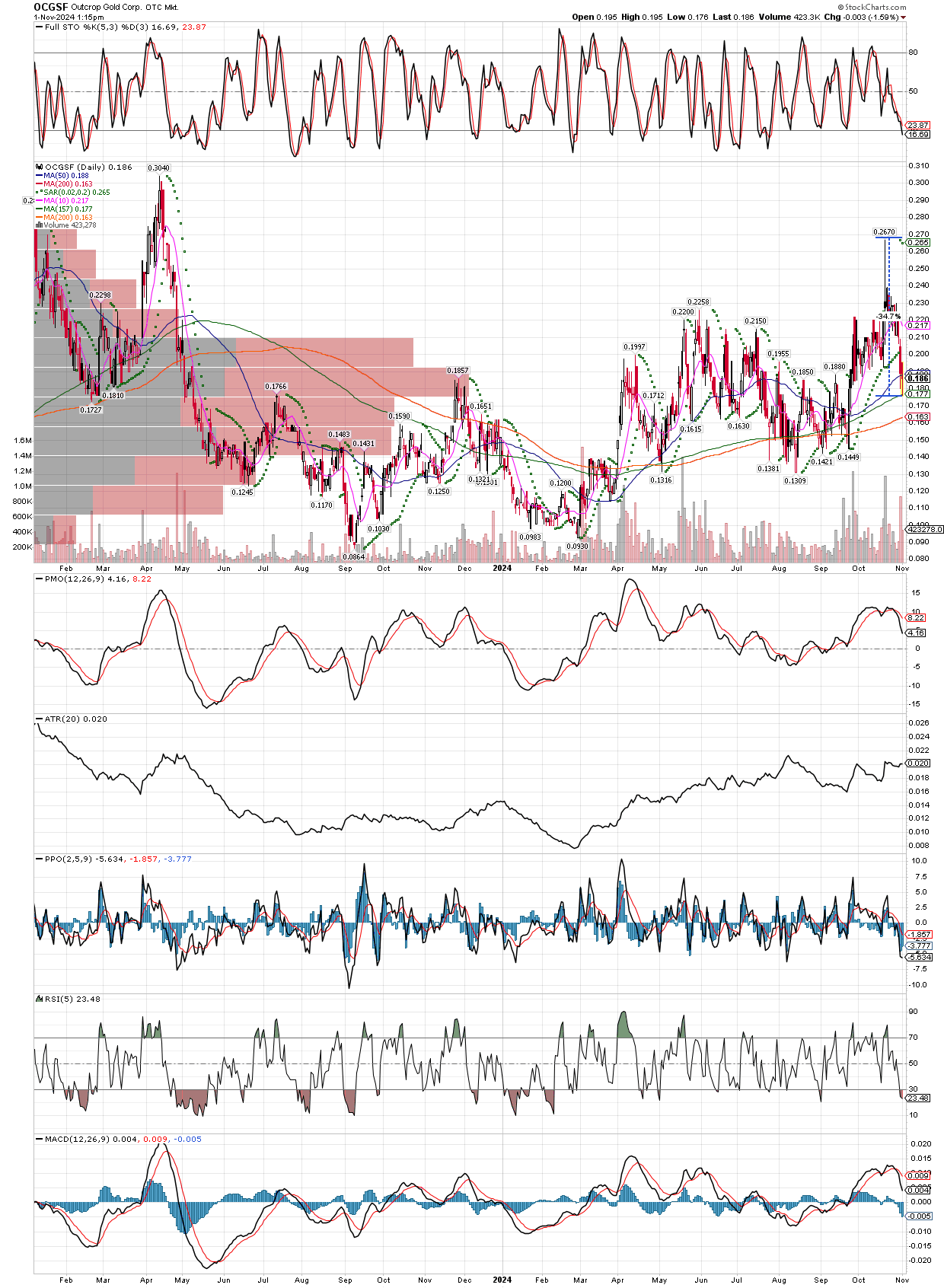

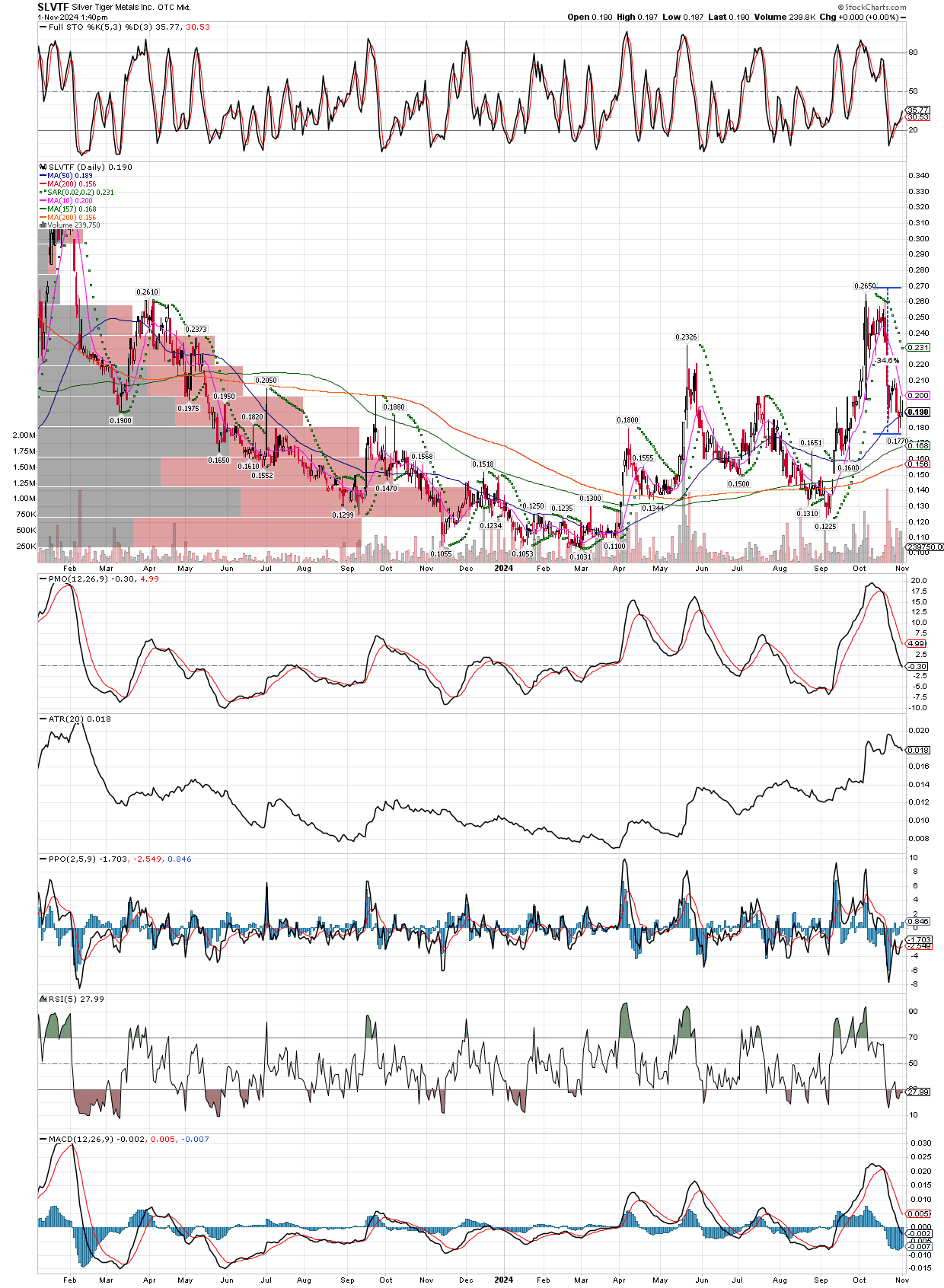

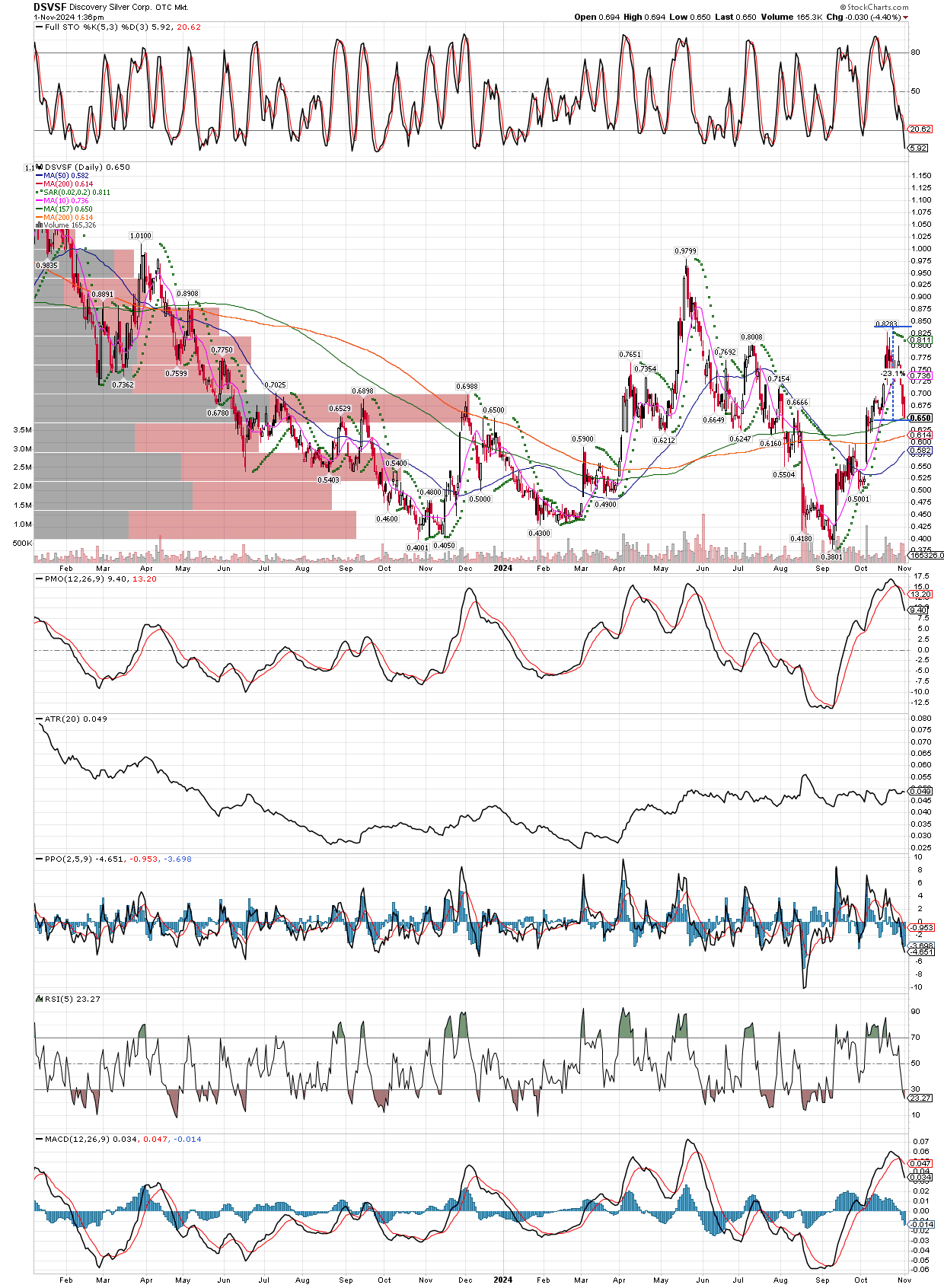

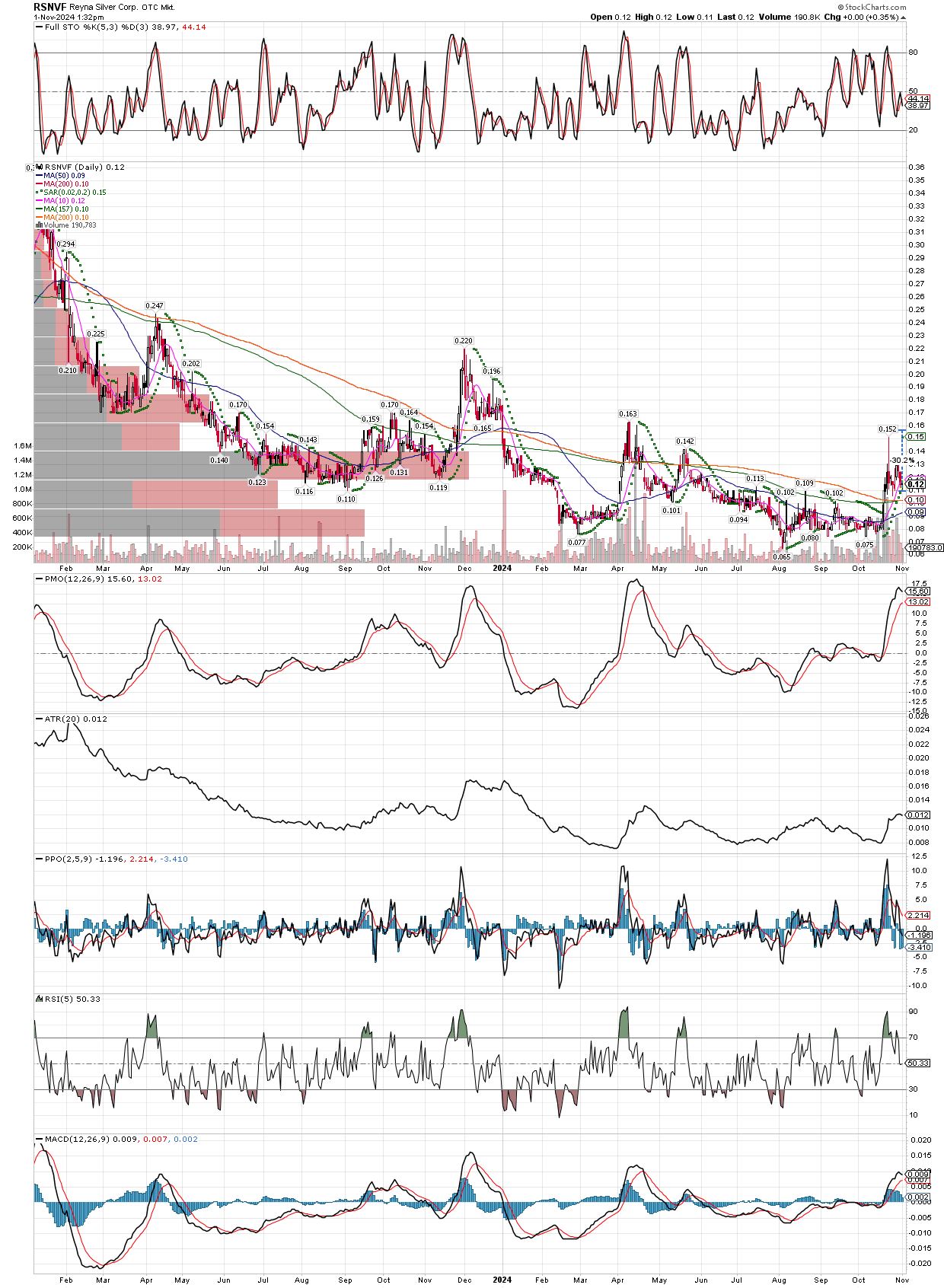

It helps if one can remind themselves of the facts, such as silver has not even challenged its all time highs as yet, and in fact has only recently broken out into new multi-year highs. This week we saw the world’s largest gold miner, Newmont (NEM) get clobbered on earnings that really weren’t bad, and certainly nothing like the market took them to be. The stock dropped all the way back to levels last seen in May! This was used as an excuse to sell the entire group, and many of the little explorers which I have not been invested in very heavily, also got smashed to the tune of 25-35%. The reason I mention these more risky explorers is that until now I have focused on owning the mid-cap producers, with exploration upside. They tend to do the best early in a new bull market, as money comes into the group and the bigger names have already moved up. Simply put, they have the best risk/reward in the group as a whole. However, as the group becomes more recognized as being i n bull mode, new investors coming in look for things that haven’t moved up yet, that brings us to the junior explorers, which often go up the most in a bull, but only by the end of the bull, since they don’t get into gear until later in the game after the bigger names have run up and even get tired. While I have not sold any of my mid-caps, since this is still early enough in the bull market, I have taken note of these large pullbacks in my list of juniors. More importantly, this decline is coming on the heels of them finally making their first, sharp move higher. Basically, they have confirmed their bull market mode, and have only given back their most recent gains, in many cases they still sit higher than they were a month or two ago, even taking into account a 30% drop over the last week to ten days. In my opinion, one can accumulate these names now, with less risk since they have shown they now are ready to go up, if the metals continue higher.

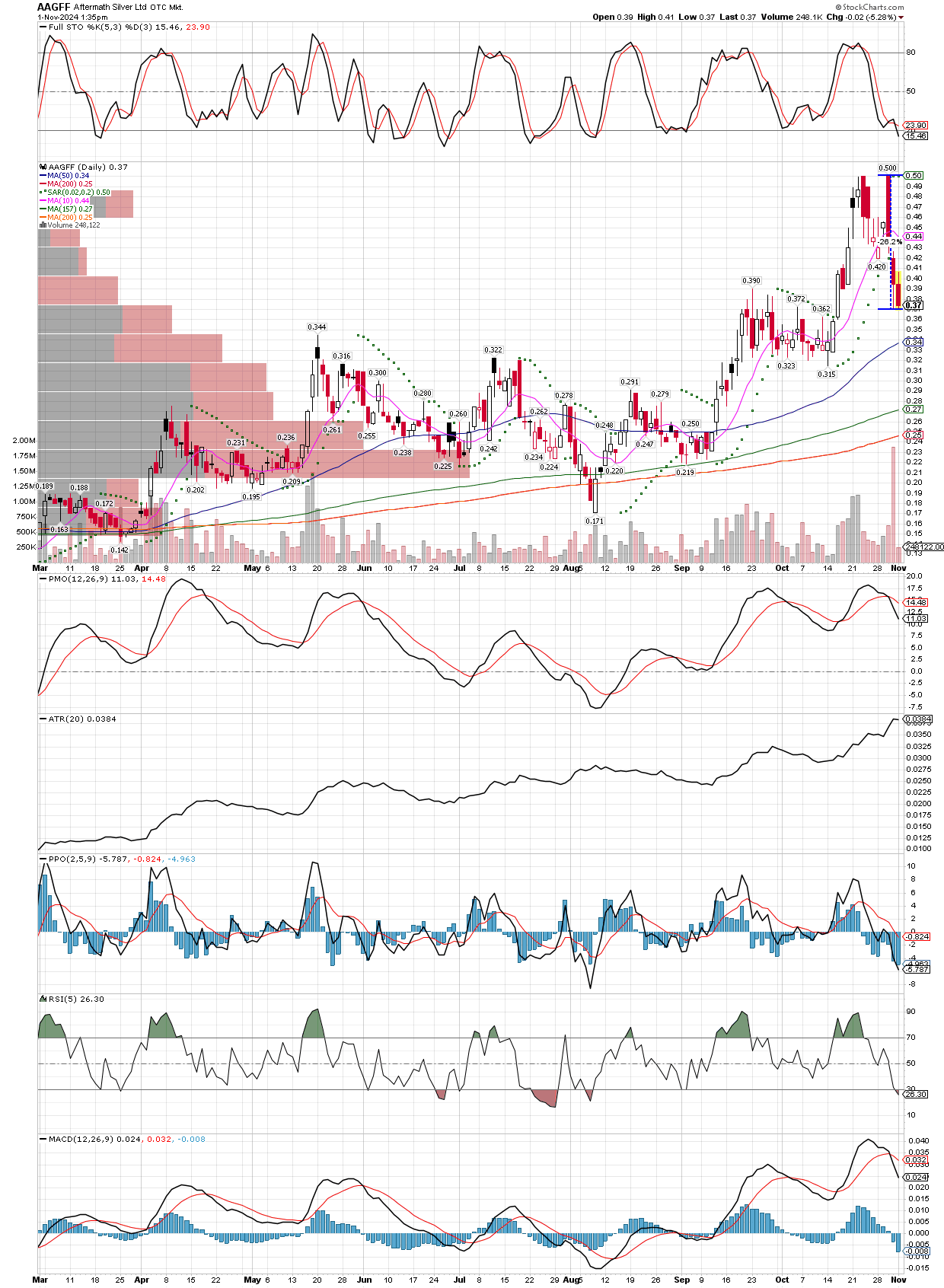

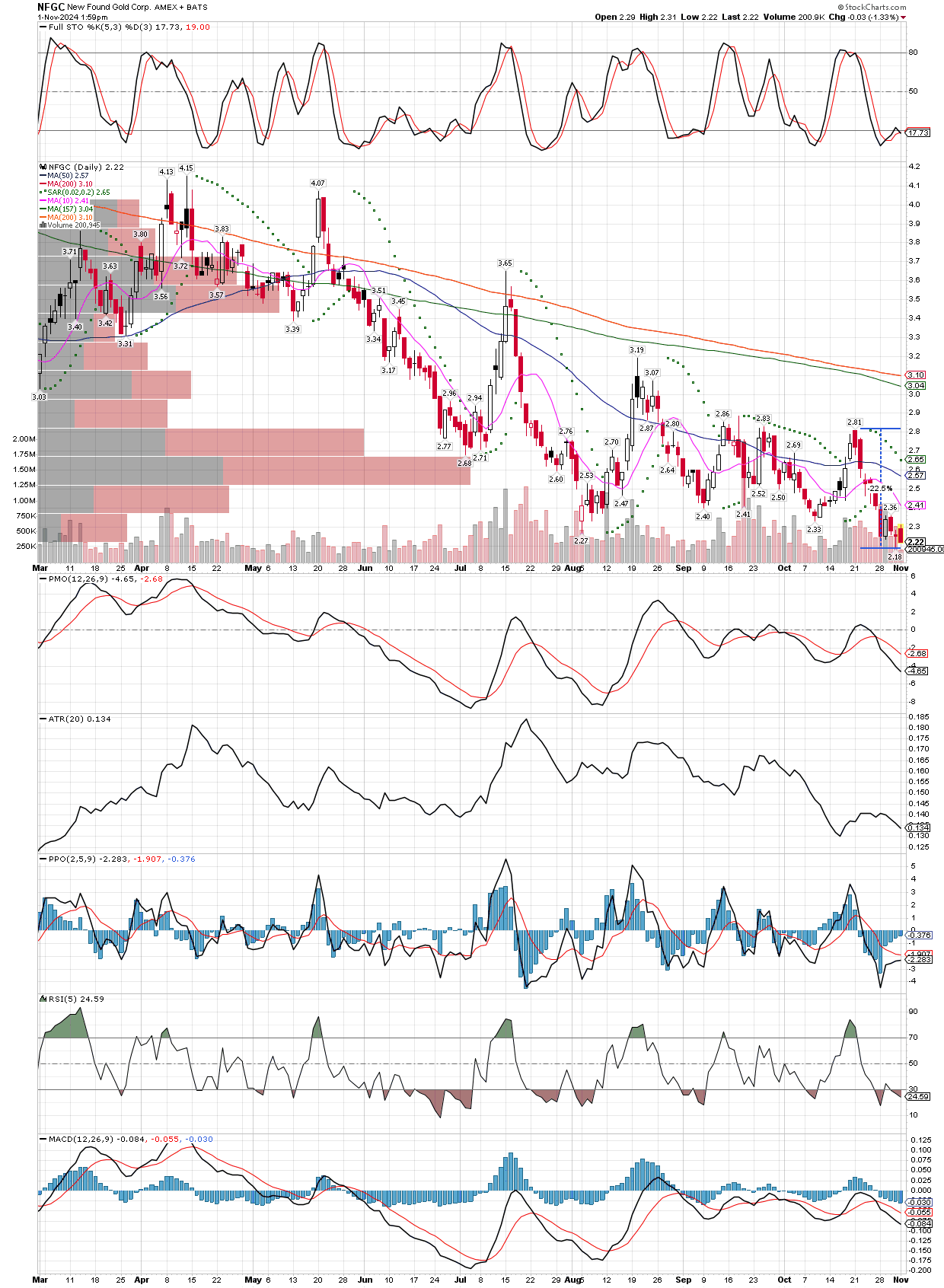

I have posted several charts below, some I already owned and have done great, a few others have spun their wheels, and a couple have dropped from my purchase price, but not enough to be stopped out, which is another sign the bull is intact. In short, I have bought more substantial positions in the names below, and will continue to accumulate until the next leg up in the group begins. I don’t expect that to be too long a wait, by the way. Only one name has not given positive price confirmation, which makes me a bit nervous about Newfound Gold (NFGC), but the fundamentals on this one keep me invested. The fact it is the largest investment ever made by Eric Sprott, and he owns it a prices double of what I paid, also movhelp keep me from getting out until we see a good run. Even though it hasn’t yet established a bull trend, notice that it has had several large percentage gains weeks here and there, that serve to wipe out all the days of little losses that pile up, so I will hang onto this one with a wider stop.

The others are more risky, in my opinion, but have recently shown they can fly fast and furious, when they get the focus of investors. Stocks like Aftermath Silver (AAGFF) are performing very well for me, for example, as we have a cost basis just over 18 cents/share, leaving us up over a double, even after its recent three-day, 26% decline. You get the picture, and just know these juniors have only just begun their bull run, hence my focus on them for new purchases, vs the mid-caps I was focused on before the bull started. I will continue to look to add to the following, and there are others too, about 25 names in total. I also have said that I have not taken profits on the mid-caps yet, either, I still expect them to at least double from current prices in this move, and could easily triple or more, before the bull is over. Keep in mind we are already up 100-200% in several of those mid-cap holding, so the overall gains could be spectacular by the time arises to take profits. The following charts are not in any particular order, I just like to own many of them, so as to reduce company specific risk. No one explorer is more than .5% total risk to our portfolios, and some are much less at just .2% TR.

As mentioned earlier, I have over 20 different junior explorers, most with equal weight total risk to our portfolios. I didn’t have time to post all the charts, but others you might want to look into include, IRVRF, DOLLF, WRLGF, FFMGF, ELRRF, and ANPMF. Most show similar charts, along washed out bottoming process, then sideways to slight trend higher, followed by a recent spike breakout, that is now a sharp pullback to buy or add to positions. The juniors are the last to fly in a bull, but they also make the largest percentage gains overall, just beware the risk they pose, and make proper-sized bets. The majority of ones pone’s portfolio should still be invested in the mid-cap arena, in my opinion, and I have my money where my mouth is.