Correction Time Is Here

June 4, 2024

The last few days have seen the metals and their miners pulling back to their 10 week MA’s. For example, SILJ and Silver futures have both retreated around 10%, while some miners have had sharper corrections.

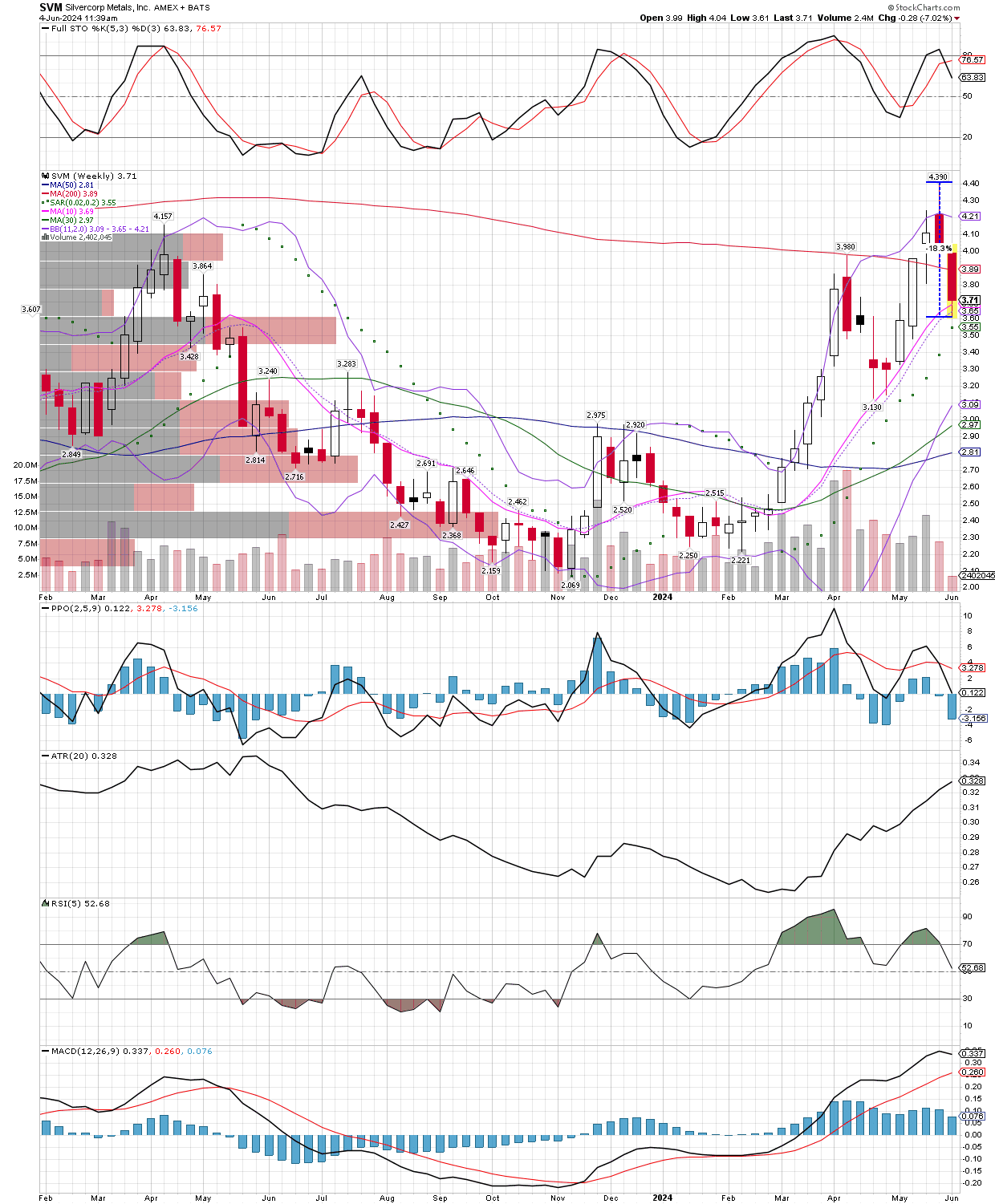

Now that the correction is here, the only question is how will you play it? Some weaker bulls, many of them late buyers into the runup, will be inclined to sell as they didn’t see enough gains to be able to hold steadfast into a decline. For those that bought in at much lower prices like we did, I am taking advantage and doing some moderate buying today, adding to various miners and the SILJ etf at their 10 week MA’s, which seem to get respected in a verified bull market. For no other reason than I just had this chart up, I decided to post SVM (Silvercorp), which I am adding to now, as the charts shows it’s already corrected around 18%. Can it go lower tomorrow? Yes it can, but more often than not, buying a stock that is in a bull market and has dropped 18% back to its 10 week and 50 day moving average, is a high probability bet.

Regarding other commodity groups I am watching with interest, such as copper and base metal stocks, they have also experienced decent-sized corrections. It will be interesting to see if they can hold, then turn higher from these levels, or if the weakening economy drags them lower. Energy is another group I am curious to see how it holds up, as its been relatively weak in the commodity arena. Are these rolling over, the XOP and COPX, or are they presenting an opportunity to get on the bull train again? We will know soon enough, but for now my focus continues to be on precious metals and their miners, as they can go up, in fact should benefit, from a weakening economy and stock market.