April 4, 2024

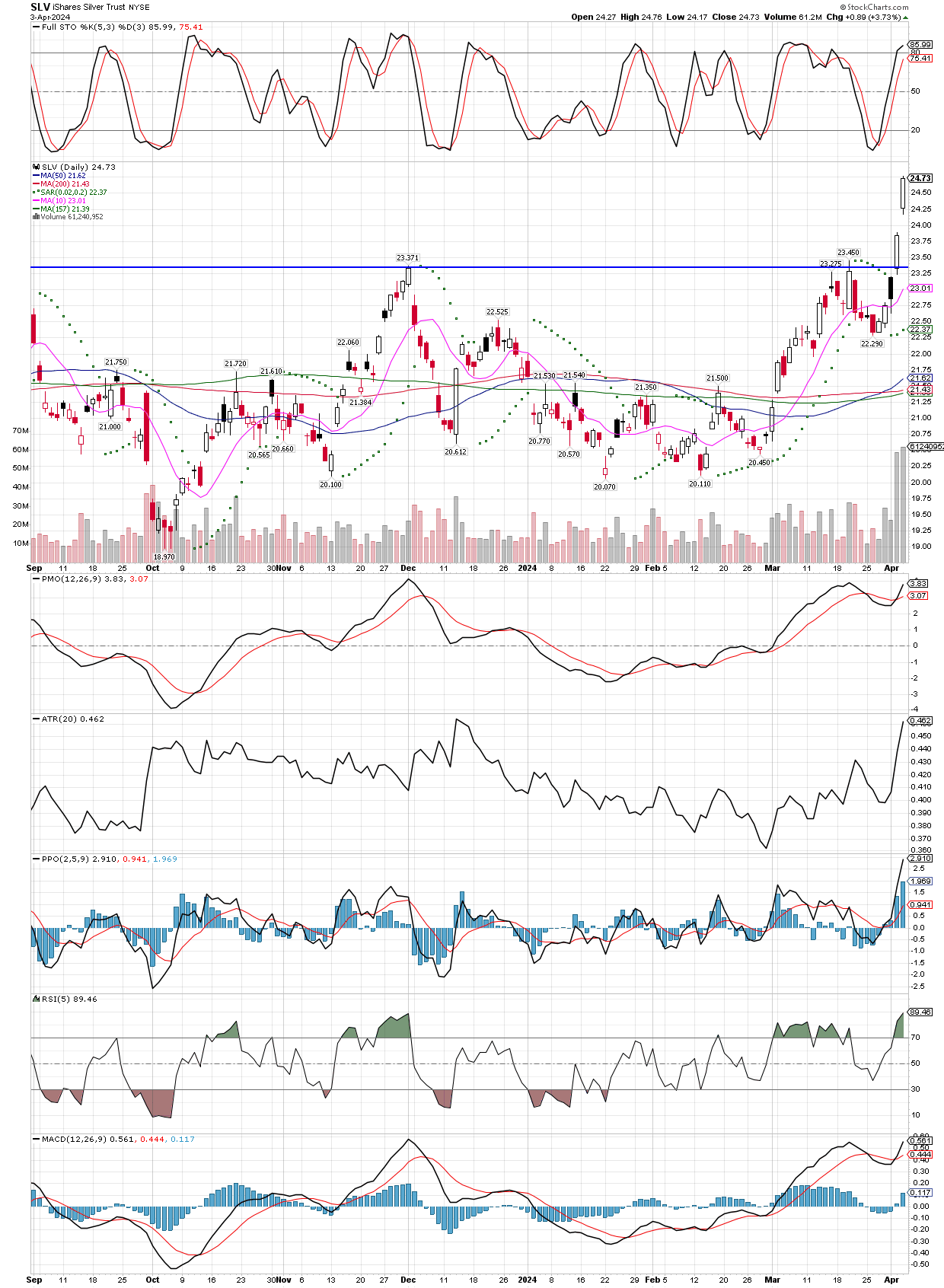

I have found Mr. Karim to be correct more often than not, and more so on his very long term observations, which I define as 2+ years. I have linked to his recent twitter post regarding the implications for much higher silver prices after the recent breakout, pay particular attention to his “volume defined base”, and the fact this indicator suggests its potentially clear skies ahead, up to the $40 level conservatively, or the $62 level on the metal if things get bonkers. Bookmark his site, they do some fine charting and get the long term trends correct.