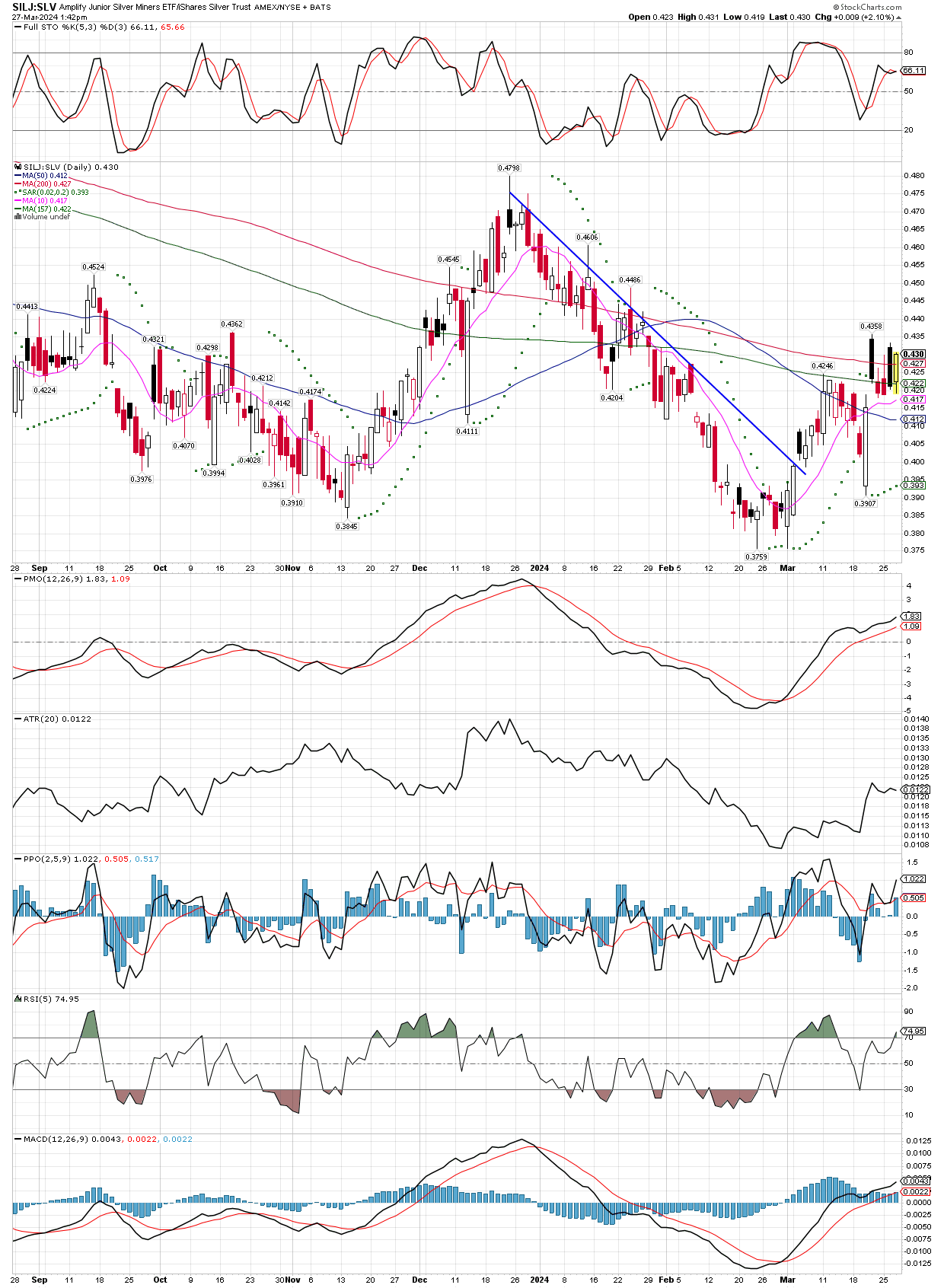

SILJ vs. SLV

March 27, 2024

The down trend in this ratio was broken convincingly earlier this month, suggesting it was time for the silver mining stocks to outperform silver, which has occurred. Today, it’s good to see a strong bar higher, boosting the ratio over its 200 day moving average, after dancing around on either side of it the last several days. It’s still early in the move, and once the ratio can turn, all its moving averages to trending higher, the silver mid-cap producers and juniors will really fly.

The precious metals miners group in general is performing quite well, with stocks like EXK, FSM, NGD, JAGGF, and AYASF all making new recovery highs, with many others very close to doing so, such as GATO and SVM as they hang up near their recent new highs. Today we also saw GDX make a new recovery high, with GDXJ, SILJ, and SIL all in hot pursuit. Even recent laggers AG, PAAS, HL, and MAG are in the game again, MAG is up just under 10%, while AG is back over its 200 day MA, with PAAS and HL looking to do the same, as they sit just under their respective 200 day MAs. All in all, the move looks great, more so because its hardly getting any press, its still as if nobody cares! These have a long way to run, in my opinion.