January 9, 2024

January 8, 2024

January 5, 2024

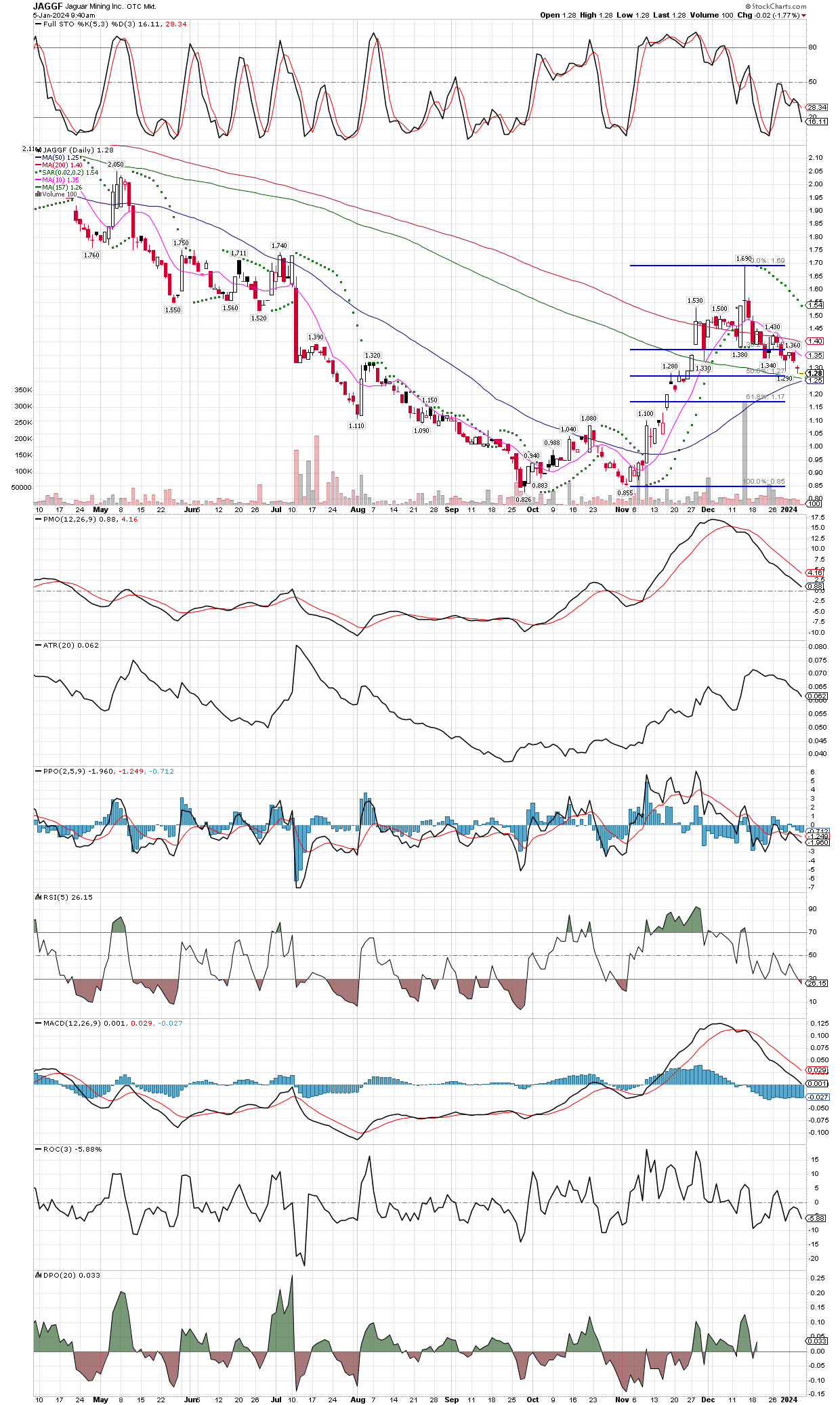

Starting a position in Jaguar Mining (JAGGF), as its pulled back to near it’s 30 WEEK MA, as well as a 50% retracement of the rally from the four year lows. it’s a miner in Brazil, and Eric Sprott is a big shareholder (over 44%), they have no debt and cash in the bank, producing gold since 2006. This entry allows for a very tight stop, so not much risk from today’s price. Note that this is a DAILY chart, so the closest thing to the 30 WEEK MA is the green moving average.

If the MJ etf closes above it’s 30 WEEK MA today, Friday, Jan 5, 2024, we will take a position. While this is just a technical chart setup, it offers an entry with fixed, and very limited total risk (TR) of just .5% of the accounts I manage. The stop-out level would be any WEEKLY close below the 30 WEEK MA at $3.18 and rising a little each week. Having such a close stop-out level allows us to have a large position size, and since we hold the position until a weekly close below MJ’s 30 WEEK MA, we could be in this trade for awhile as long as its working, the essence of the phrase “letting your winners run.” We won’t know if we are buying until just before the close today (Friday), in which case we might buy at the close, or even on Monday morning before 11 am or so.

January 4, 2024

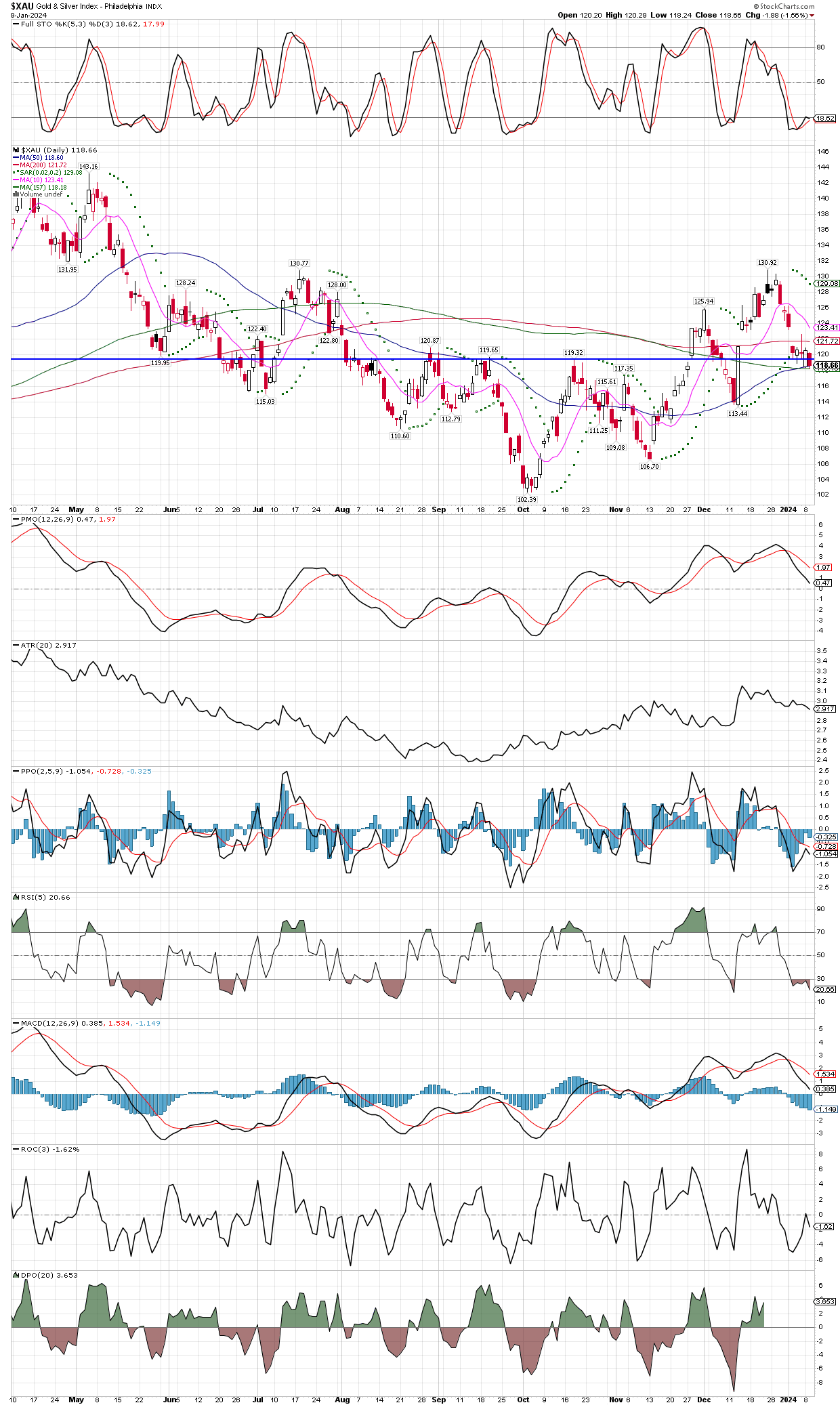

I’m taking advantage of this pull back early into the new year to add to CDE, HL, SILJ, FSM, EQX, SVM, AG, and several other miners. Many have retreated 50% or so of their recent rally, so this seems a good area to add to holdings. Weekly graphs below:

You get the picture. I have also begun to nibble on some junior explorers that were absolutely demolished in 2023, though I will stay focused on the mid-cap producers for the time being. I have a list of “penny dreadfuls” that I might buy into at some point in this bull market, but I am concerned that they will dilute shares to raise capital, after being starved for funds the last couple years. This could keep a lid on their prices. I also feel there could be general market weakness soon, maybe enough to drag down weaker stocks, so prefer established producers that are more of a safe haven.

There are some other groups that are flashing BUY signals or close to doing so, and I will cover those in a separate post.