FOMC Raised Rates Another .75%

July 29, 2022

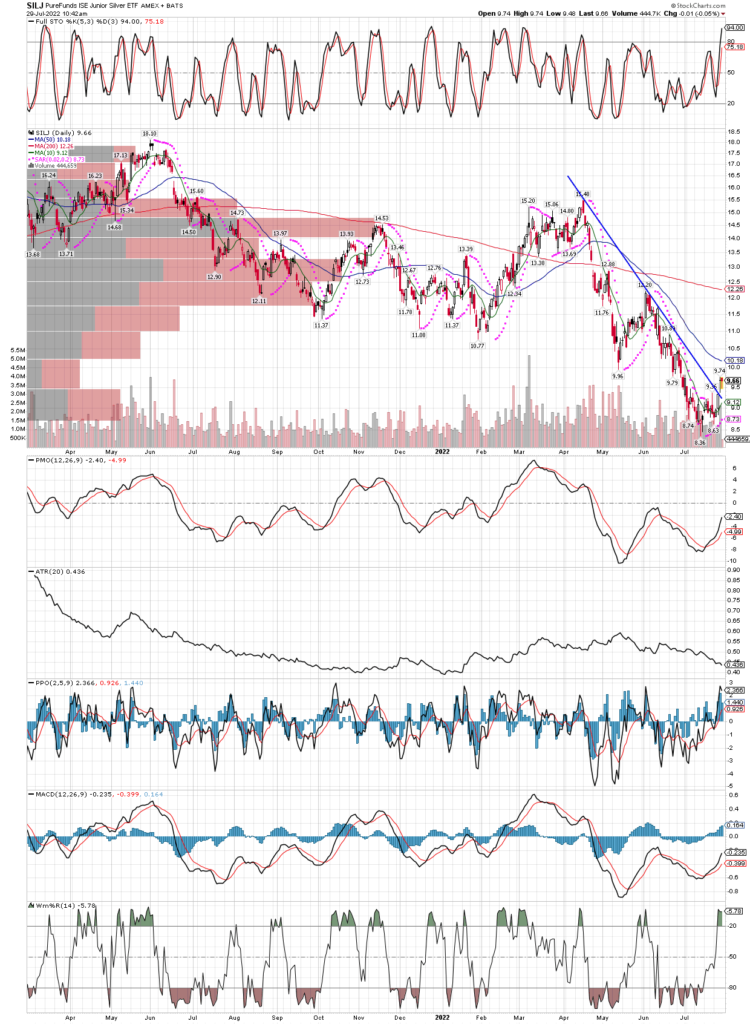

Now that the FOMC announcement is behind us, and the miners acted well in the face on another .75% rate increase, we decided to add to our SILJ holdings this morning on the early dip in the first hour. We didn’t place any trades yesterday, instead just wanted to observe the market’s response to the Fed decision. Several important things occurred this week, including the breaking of many downtrend lines in the group, on their daily charts. Cycles followers also will note we now have confirmed Daily Cycle Lows in place, another good sign the turn higher has begun. Lastly, we are now seeing the stochastics on the weekly charts emerge out of oversold, same with the RSI (5), again suggesting the bounce has begun. Now we have to wait and see how far the move higher can go, and if it can “stick”, that is to say, keep it’s gains. For now, with a new daily cycle confirmed, we should expect 6-10 weeks of generally higher prices in the miners, but if we can get a new Intermediate Cycle confirmed in the group, then we could look for 4-6 months of higher prices. The cycles only suggest the probable direction, how far and fast they move is something we can never know ahead of time. We will continue to look to add into pullbacks, but are likely done buying for this week, as we are loaded up and have already had a decent bounce over the last couple of days. Below is a chart of SILJ showing the broken downtrend line, but just about every mining stock shows a similar pattern.