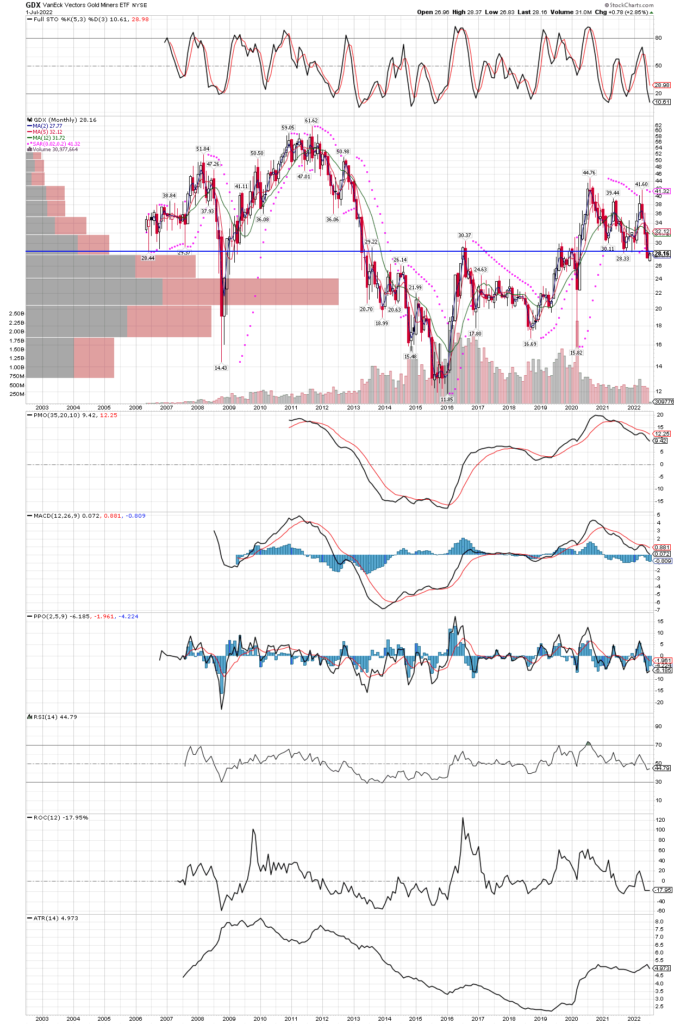

GDX Monthly

July 4, 2022

I drew a horizontal trend line where GDX could find support, and if it does soon, the recent decline below the trend line would become a classic “false breakdown”. Professionals know that more often than not, support and resistance will hold, so they use these apparent breakdowns and their accompanying higher liquidity to acquire large positions into the panic. The stochastics could go a little lower to be an ideal buy signal, but does not have to being the last rally out of oversold has not yet reached an overbought level, which last occurred in August 2020. The last oversold reading was in early 2021, so the GDX is due for a voyage north, and our bet is that one needs to be in them now, before the move occurs since miners can jump 10% plus in day when they start higher. Waiting just two or three days in that type of turn will really dampen returns if one understands compounding and its effects on a portfolio.