Miners About to Launch a Huge Rally

June 3, 2022

That would be my guess, the precious metals and especially their miners are about to take off higher, possibly as much as 60% in just a few months. First, we are getting near June 13, historically the day of the year that proves to be the low for miners, before embarking on big rallies in July and August. Second, the group has been thoroughly washed out from mid-April until mid-May, only recently beginning to stabilize. My third observation is that gold has held up well in the face of a rocketing dollar (as measured by other trash fiat currencies), a sign of relative strength. Fourth, as the stock market appears to be rolling over and getting hit hard, the miners are starting to decouple as they usually do, when investor realize the fundamentals are strong and getting better, providing them a place to hide during the storm. This crisis, it appears bonds are no longer a safe place to hide as bonds can’t find a bid, many days lately both stocks and bonds get sold off together. There are other reasons to expect a big rally, at least on an intermediate time frame (3-6 months), like the weekly charts being very oversold and starting to find support, or the massive gains and outperformance of the group yesterday, where even the etfs like SILJ were up 7%! Then there are the “advisors” and newsletter writers out there, with my estimate of 90% of them that are usually bullish, now waiting and watching for the central bank (FOMC) to change course and quit raising rates, or at least stop raising them. Anybody paying attention to the economy can see its weakening at the same time we have rampant inflation, otherwise known as “stagflation”, the best of all worlds for precious metals prices. These are the reasons I think the recent sharp drop in silver and miners will turn out to be a false breakdown.

The news has been fast and furious the last couple years, most recently with the Ukraine war and the sanctions against Russia, which are failing miserably. In fact, the sanctions are blowing up in the west’s face, serving only to force prices of commodities higher for their own citizens, if their services aren’t shut off entirely. Meanwhile, Putin governs a commodity based economy, and as such, Russia is raking in money hand over fist. So far, Russia has doubled its sales of gas and oil, so far for putting a dent in their economy. They probably hope the west comes out with more stupid ideas, as Ukraine is getting annihilated in the war, and won’t be allowed to quit until NATO is satisfied enough Ukrainians have lost their lives. No matter what side one takes on the Ukraine conflict, it cannot be denied Russia is coming on firmly on top and in control so far.

I will try once again to keep up with regular posting to the site, I think it will be easier now that we sense a big move coming, one that investors will not want to miss. It is quite common in the mining group to see a big flush lower, before they let prices make a breathtaking move higher, and as this bull matures, we should expect to see new all time highs in the group, substantially higher than anything we have seen before. Basically, the FOMC is hiking rates into an oncoming recession, and on top of debt already being out of control since they used Covid as an excuse to essentially double the currency in circulation. Gold is making highs in just about all other currencies except the US dollar, and we don’t expect that to last. Soon, we should see gold, silver, and their miners fly because of their safe-haven status (now unchallenged by bonds), increasing cash flow, and their lowest valuations in history, even crypto-tokens are seeing the wheels come off! In short, it looks like everybody is just waiting for the Fed to change course, and while the inflation problem might be reason to keep hiking rates (if the economy were strong), that alone does not damage precious metals or miners. In fact, Volcker jacked rates up near 20%, and gold was screaming higher the whole time.

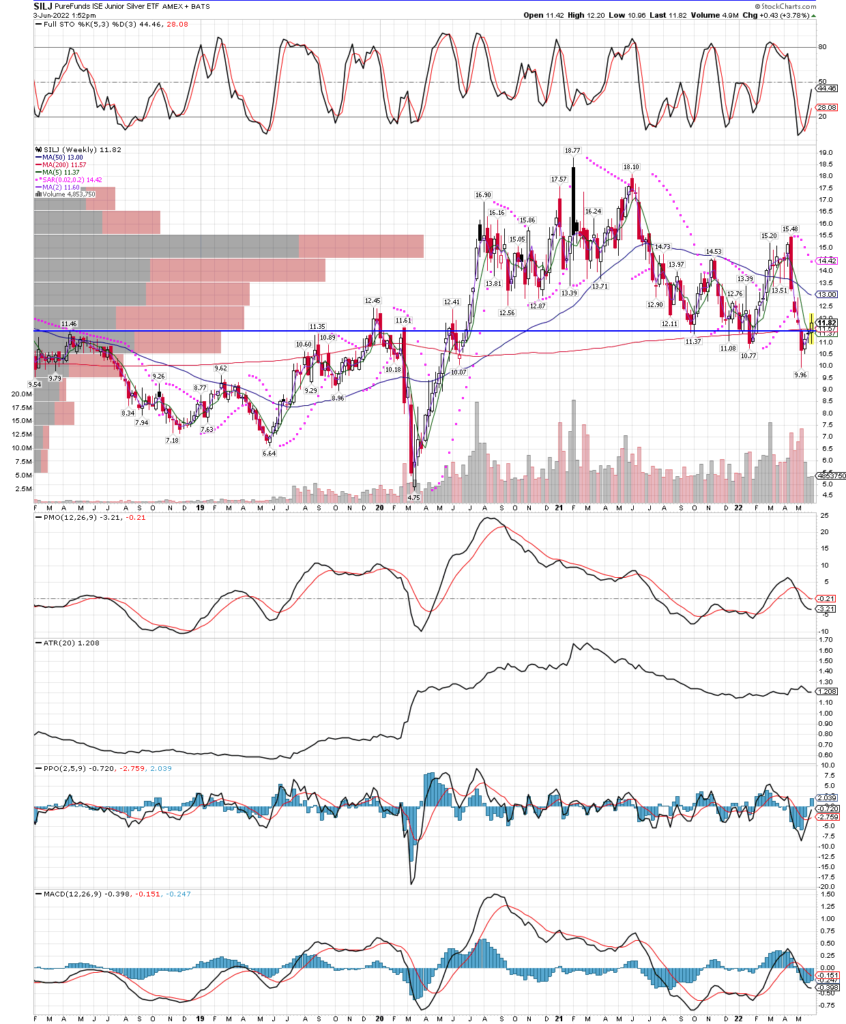

Let’s look at a couple charts, starting with the weekly SILJ etf, its the silver junior miners etf, which isn’t really “juniors”, but more mid-caps, the sweet spot of the group.

Next, lets look at the monthly chart of $TNX, the rate on the US ten year note, its the one most market participants pay attention to, and we see some interesting observations. To start, interest rates have already had a massive rally, and precious metals have held up relatively well overall. We also note that the $TNX is coming into strong resistance, being this chart goes back 20 years! Its worth pointing out that the stochastics are well-overbought, and while relative strength (RSI) has never been this high which some think suggests more strength is likely, we tend to think the message is that its more likely to normalize and come down. Lower rates should again light a fire under the precious metals and miners, and more so in the current environment with out of control inflation.

$TNX- The rate on the 10 year treasury note might run into resistance soon.

We won’t pretend that we haven’t been battered over the last month, as we wait for the investing world to realize miners and their metals are the best place to be, but we hold firm in our conviction, and if anything, our case has grown much stronger. Commodities across the board have been a great place to be, and gold (and silver) have mostly watched from the sidelines as oil, agriculture, and others have rocketed. That often happens, then as the recent standouts take a breather, gold and silver have their time in the sun. Yesterday’s huge gains might be the first confirmation we have that the turn has arrived. As always, members should check the portfolio link above to see what our accounts hold, with position sizes and current unrealized gains and losses. If you don’t have exposure to precious metals, time is running short to acquire them, in our opinion.