Friday Recap- Important Confirmation Day and Sunday Chart-fest!

August 29, 2021

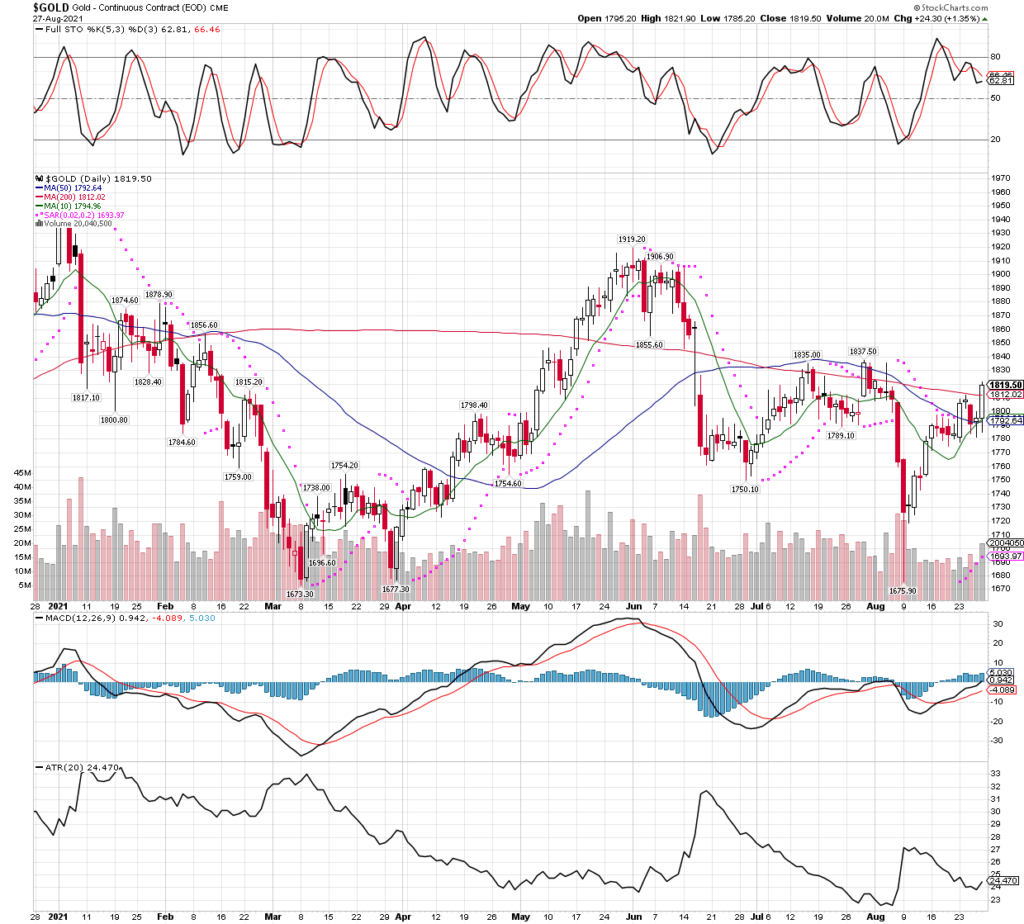

Friday was not only a huge up day for our accounts as the miners decided to take off higher to end the week, the more significant event is that the day appears to have confirmed we are in a new intermediate cycle for gold, silver and miners. This suggests we should have around 6 months of higher prices, how much gains could be had we cannot know, but it is very much time to be heavily long precious metals miners. I will not be the least surprised if we take out the highs of last August in the GDX and HUI index, for example, and by a wide margin. The setup seems about as perfect as it can get, and we are betting big on this outcome. Stay tuned and see how we do, members can see just how much we made on Friday alone by accessing our daily account screenshots in the tabs above.

Many would be bulls have not yet bought, after being punished the past 12 months they are scared into inaction, or more common is they are buying way too lightly. Opportunities like this don’t come by often, when they do its important to recognize it as soon as possible and get substantially invested. A trade setup like this can change your whole life, so don’t wait if you see what I see, each day one misses that miners jump 10% really cuts into their overall returns. The way to make the big money is to be in big, and early, so as to benefit from compounding, and there are still many miners that are just leaving the gate. Let’s look at some charts, many are just now jumping back above their 200 day MA (sign of a bull), and taking out recent highs confirming we have an intermediate cycle low behind us now. In addition, long term supports on many weekly and monthly charts held up after being tested recently.

I frequently get asked about my allocation to gold miners versus silver miners as I get invested. I am more heavily into silver miners at this time because I think silver has more upside potential and I want to take part. However, I really like the silver miners for another reason, its because they are almost all 50% or more gold miners too! There are very few purely silver miners, so when we buy in SILJ, for example, we have roughly 35-40% exposure to the silver side, and 55-60% gold miners. The point is stocks like PAAS, HL, MAG, AUY and the other large holdings in the SILJ etf will be flying along with gold miners, even if silver takes some time to take off as a lagger. Of course, later in the move we would expect silver to take the lead, and that is why I want to be sure to have my miners taking silver out of the ground as well.

I also get asked about allocation to junior explorers, miners like MGMLF, BKRRF, IRVRF, MXROF, and similar stocks. While I own each already, at this early stage in the resumption of the bull move higher, we would expect the “bigger juniors” and even the big cap miners to move higher first, and with less risk. It doesn’t have to play out like that, but it is what history suggests, and it can get frustrating to watch things like GDX rise in an uptrend when a junior still isn’t yet finding lots of buyers. I think they will almost all go up a lot in this bull move, but I also like to have a good size position in something like SILJ which will definitely rise if the group and gold/silver rise. My point is we might still have time to buy more into the junior explorers, maybe even after taking some decent profits in the bigger miners first. That said, we did just buy IRVRF this week, but my focus remains on SILJ, GDXJ, and their component stocks.