Recap for Wed., Aug. 11, 2021-The Bounce has Arrived!

August 11, 2021

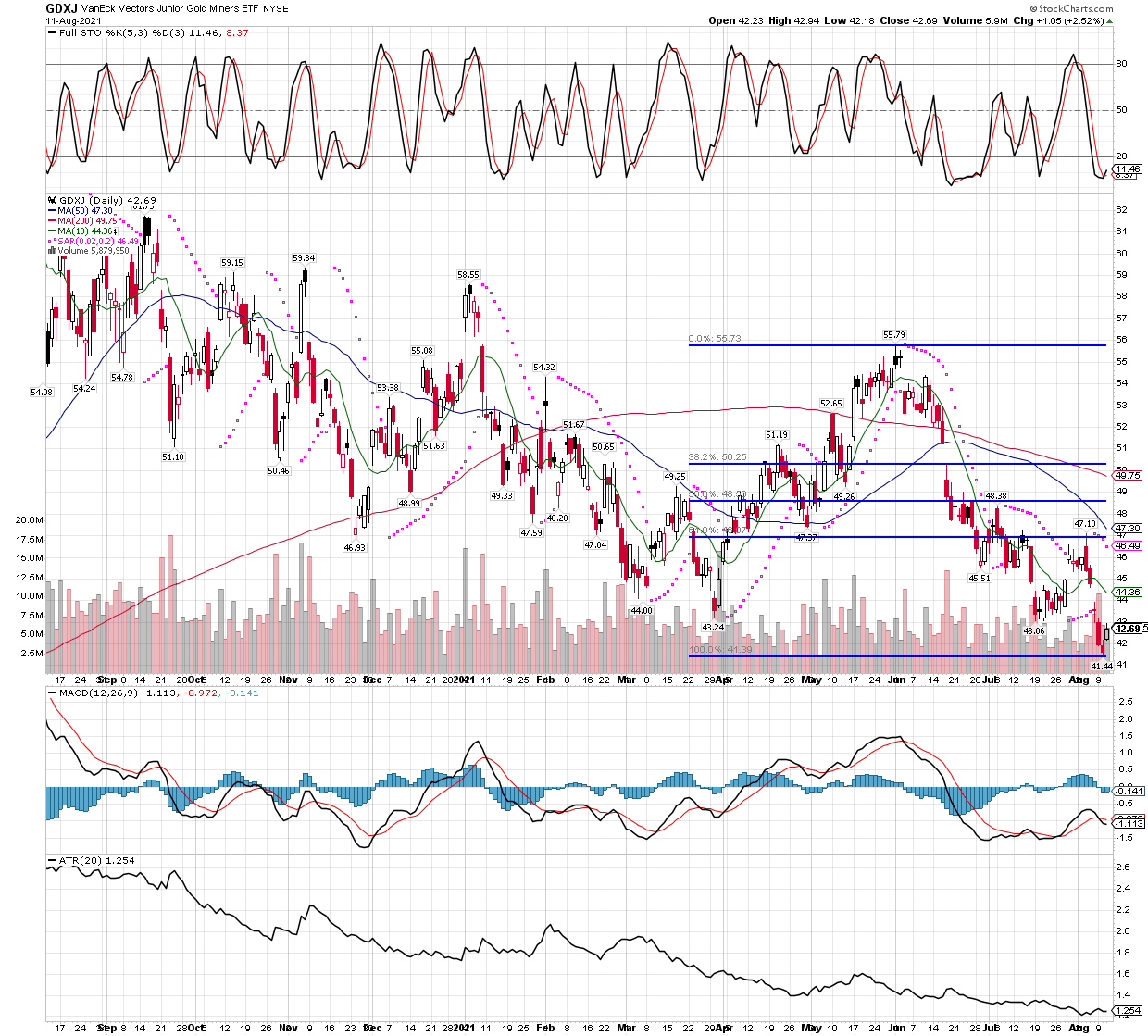

Finally, we get a respite from the non-stop slide in the mining sector. I will go out on a limb and predict more upside near term for a few reasons. First, the daily stochastics are deeply oversold and even with today’s strength, have not yet risen out of the oversold zone. Second, today was the first day in a awhile we saw just about the entire group rise strongly together, a change from the recent action where any strength the group did experience was concentrated in a few names, while other mining stocks continued to make new lows. I also read the DSI is now down around 8, it hasn’t been that low except twice in the last 3 years, if I’m not mistaken. Lastly, the miners were the strongest group on the board today, which will draw eyeballs of the short-term traders that only seek what is in play to trade. Whether this is THE bottom or not remains to be seen, but I think it’s a safe bet we see more upside before we head lower.

Today was easy as far as my trading, my intraday stochastics never reached fully oversold, so I didn’t get the opportunity of an ideal setup to buy or add to any positions. No trades at all. That’s ok, the way things closed today, the miners are working off today’s run and the technicals are approaching the oversold area. The plan is to be ready to add in the first hour or so, but only if the stochastics or other intraday technicals reach oversold, my guess would be about a half hour after trading opens. That is for a flat to weak open, but if we instead get a big gap up in miners, we might have to sit on our hands again until Friday, when we will again look for the technicals to get extended on the downside. In any case, there is no denying we re heavily loaded, so we will be fine with whatever the markets present tomorrow, a position I like to be in.

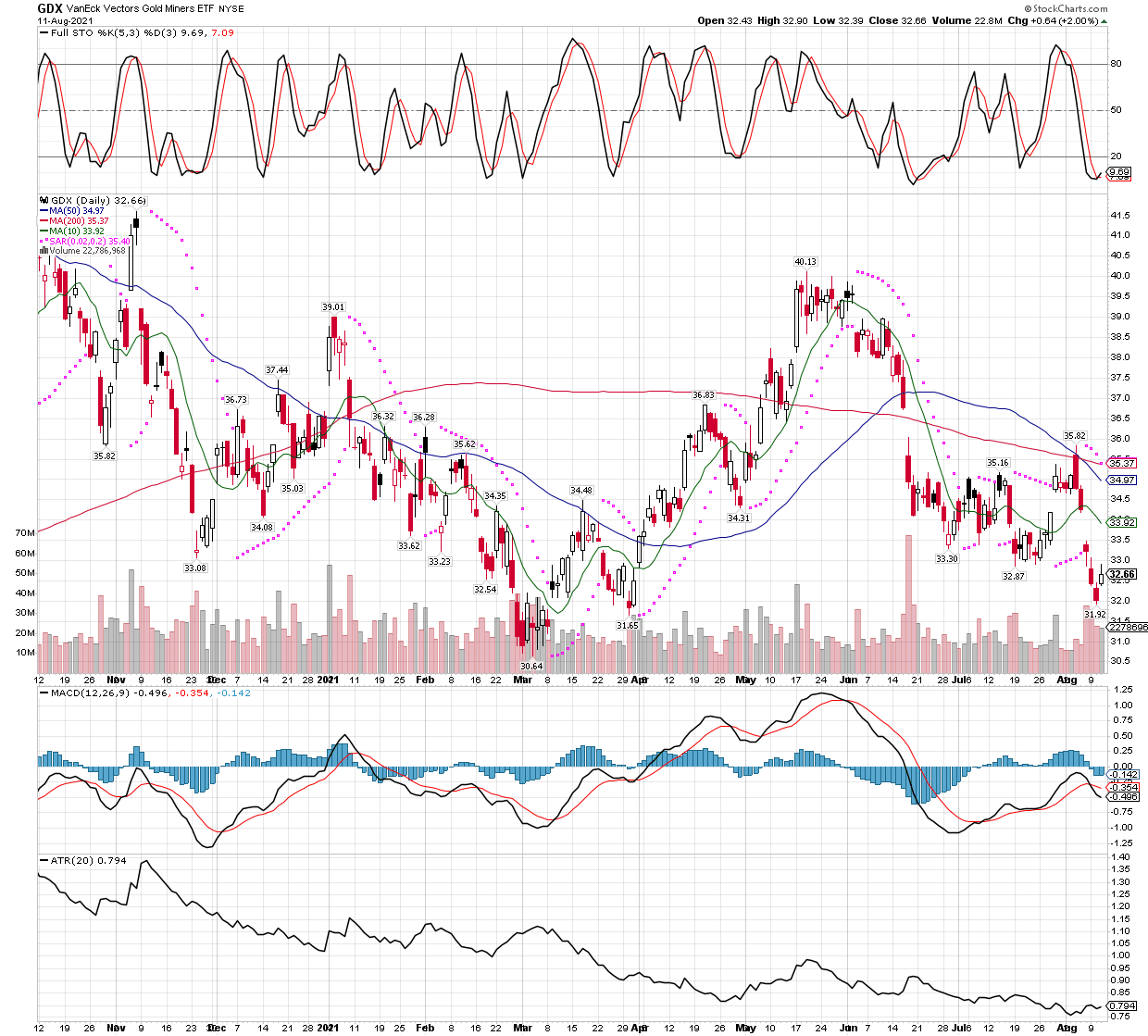

Let’s take a quick look at the daily chart of GDX to recall how oversold the stochastics are. Keep in mind I use the more sensitive 5,3,3 setting, so another’s charts won’t always look exactly like mine.

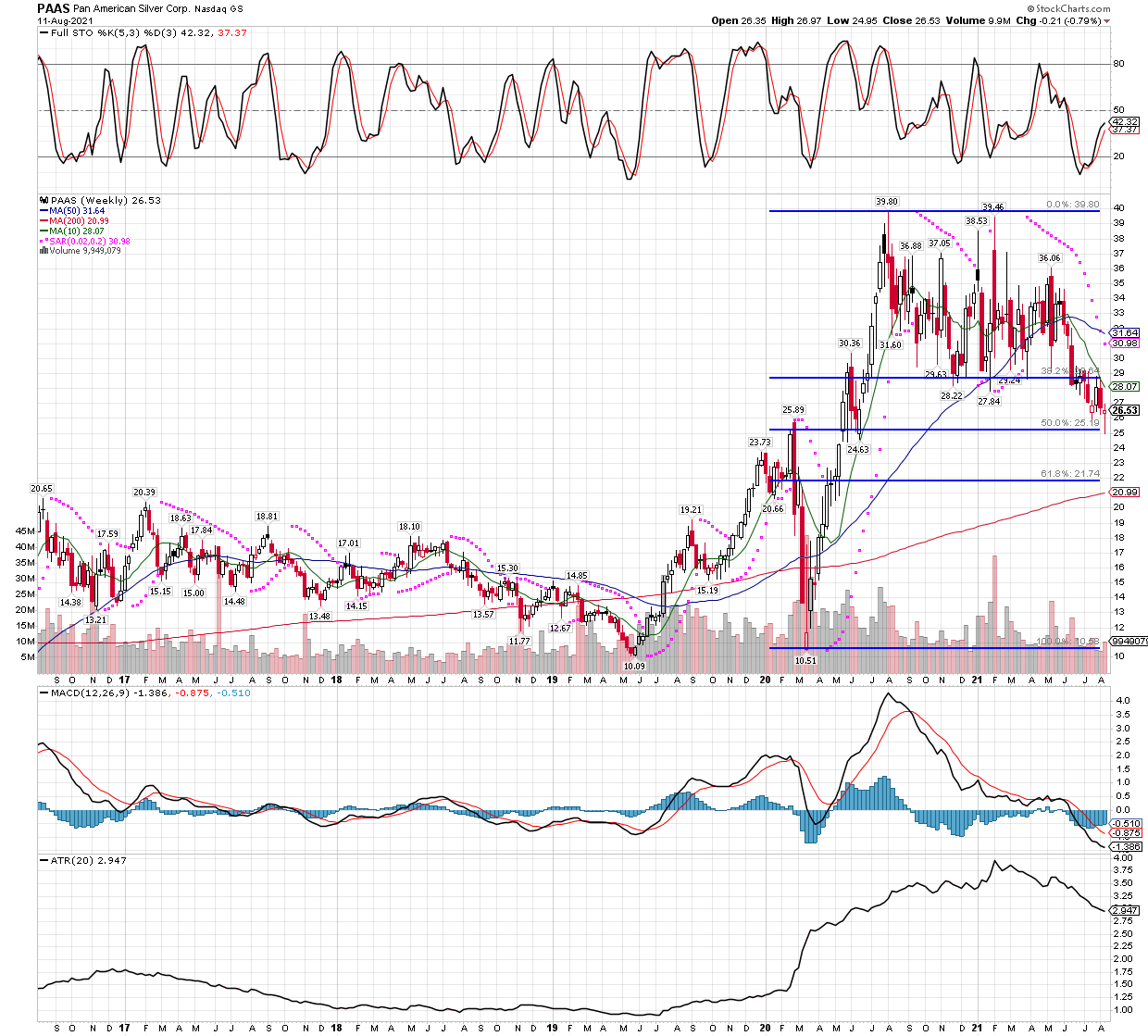

We also saw some bigger names that have been terrible lately start to pick up, in fact some had a standout day. This lends more credence to the idea miners have finally turned the corner. Let’s take PAAS (Pan American Silver) for example, also the second largest holding in the SILJ etf. I will post the WEEKLY PAAS chart first, to show what a fine 50% fibonacci retracement the stock has completed…

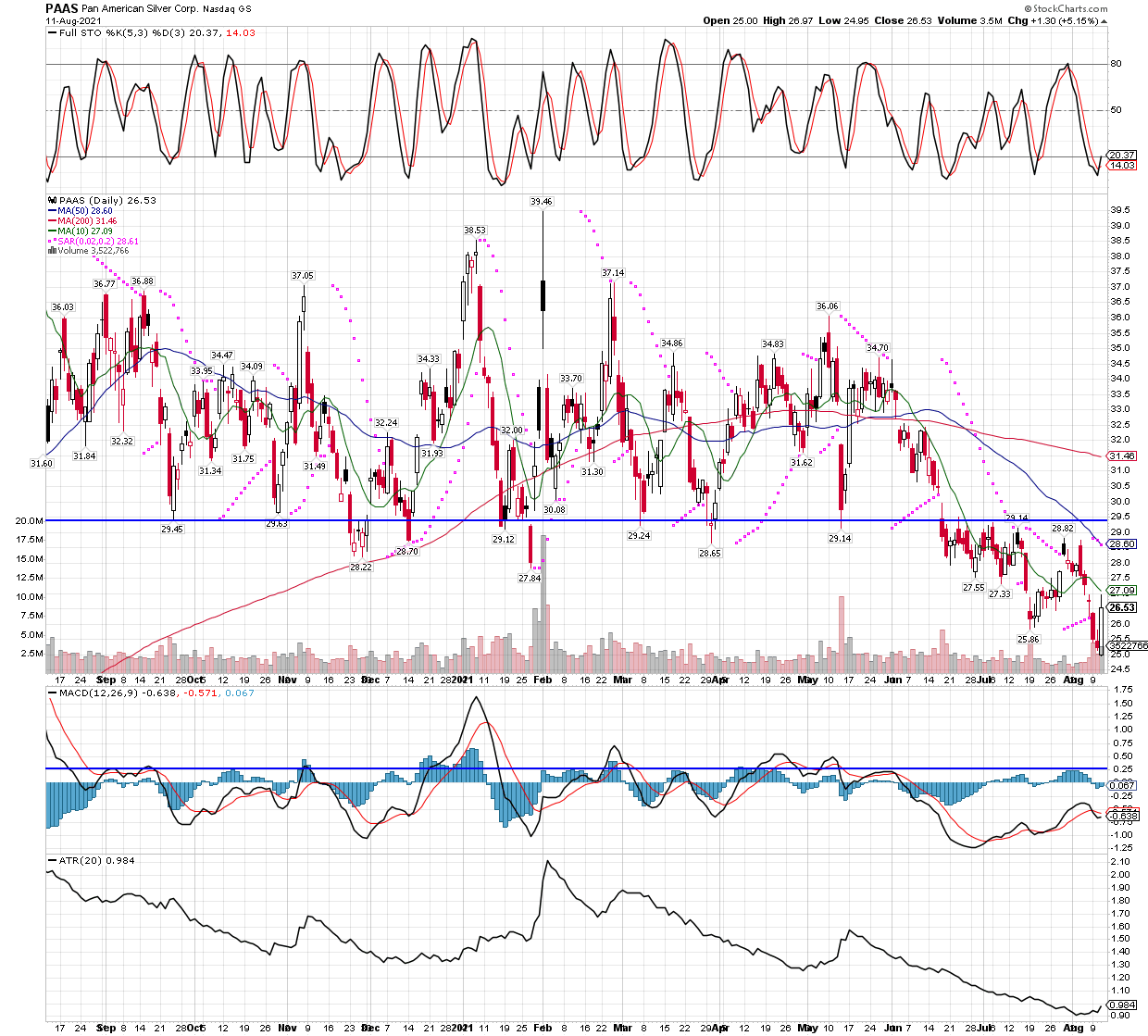

Now we will go to the DAILY PAAS chart, notice it shows the same technicals as the etfs above, but also note what a big move PAAS had today, normally stock that onl moves a couple of percent at most in a trading session, today was up over 5%.

So tomorrow morning we will wait to see if the intraday technicals can dip a little further from where they closed today, if so we have some buying to do. If they gap higher instead, we will sit with what we have until the afternoon, or Friday morning open works lower to oversold.