Recap for Tuesday Aug. 10, 2021

August 10, 2021

Another day, and only a small respite from the pain we have had to endure. It’s ok, we can take lots more, if that is what the market has planned. Since I’m still not feeling all skippy and happy due to what feels like a never-ending drop, I will dedicate today’s post to a “chart-fest” as I didn’t post any charts yesterday.

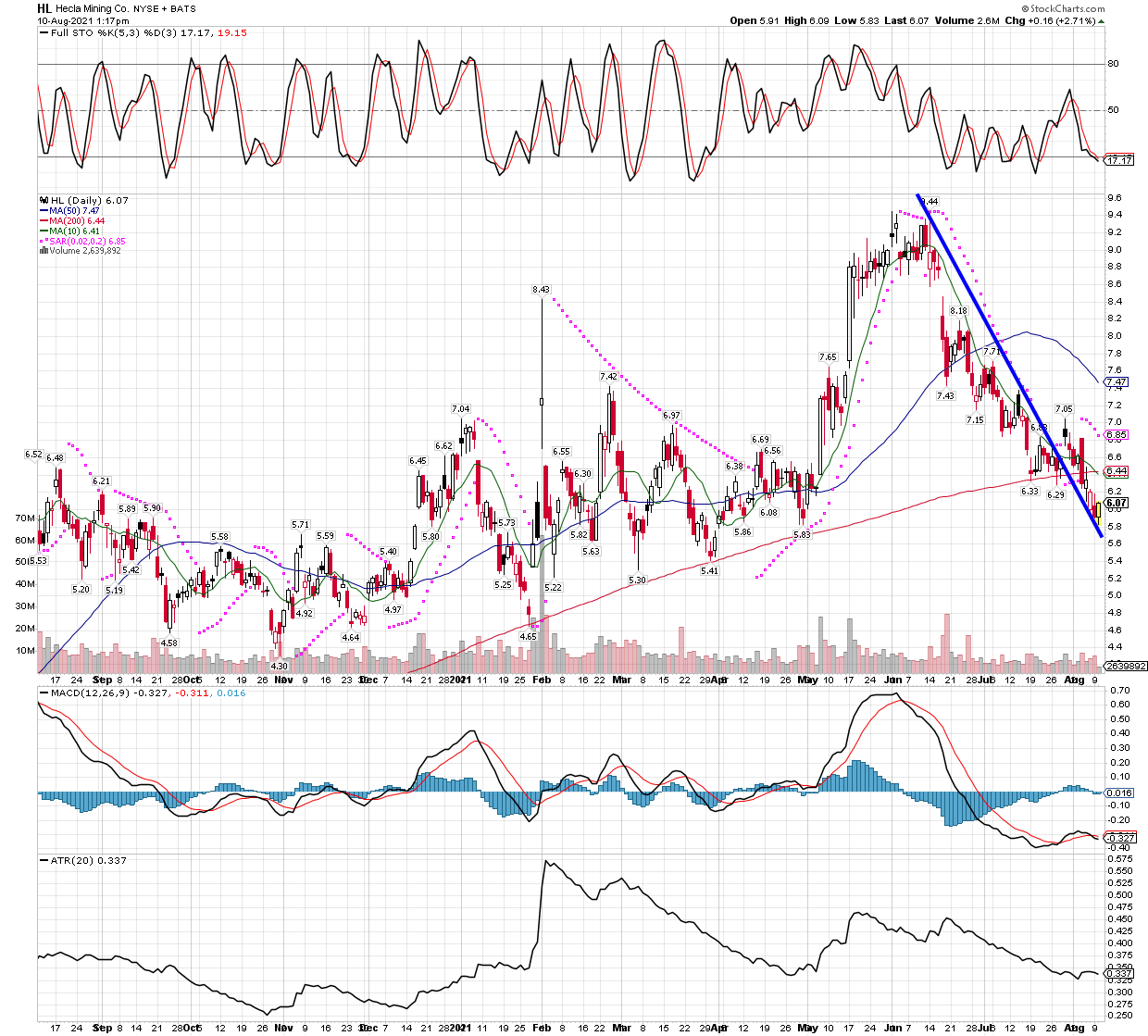

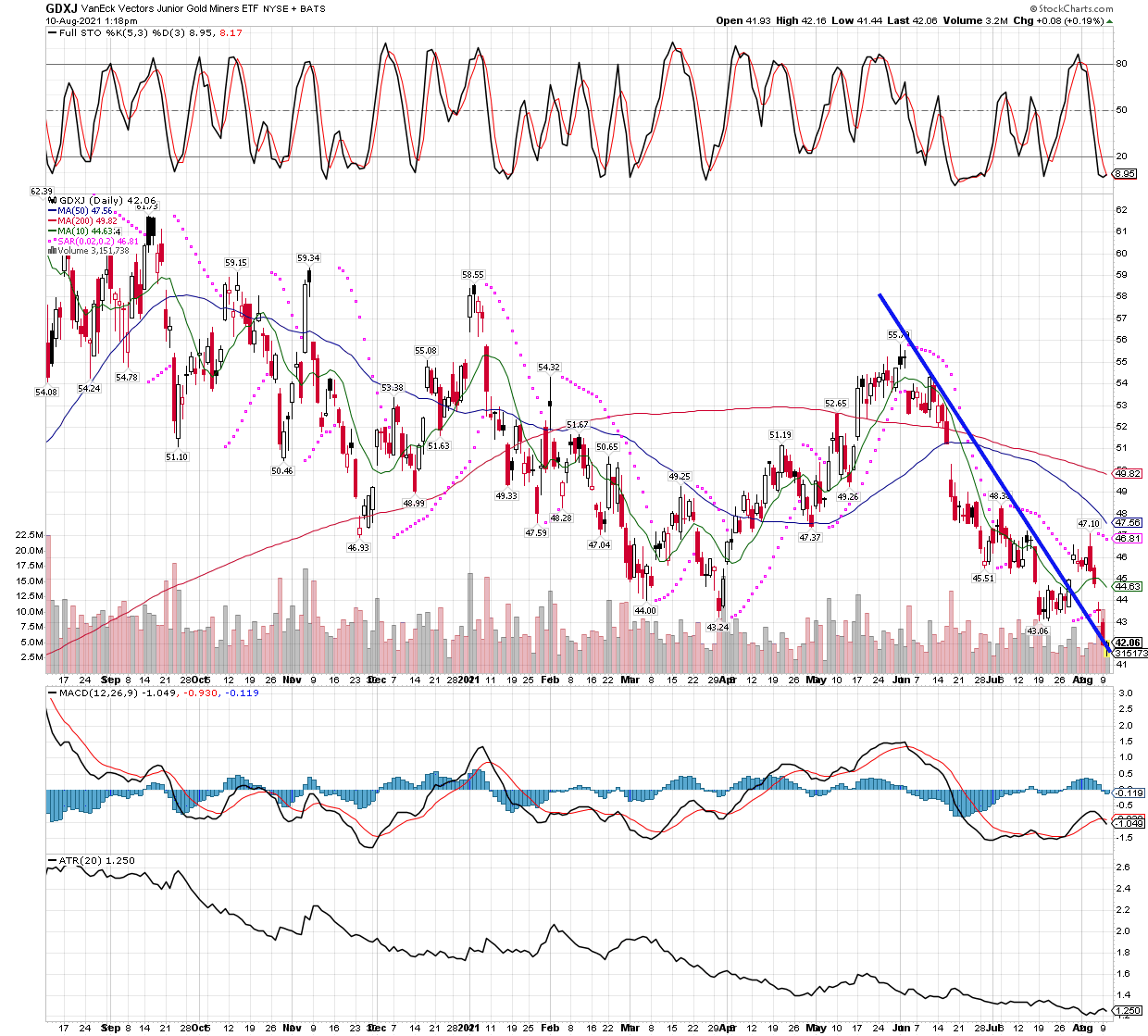

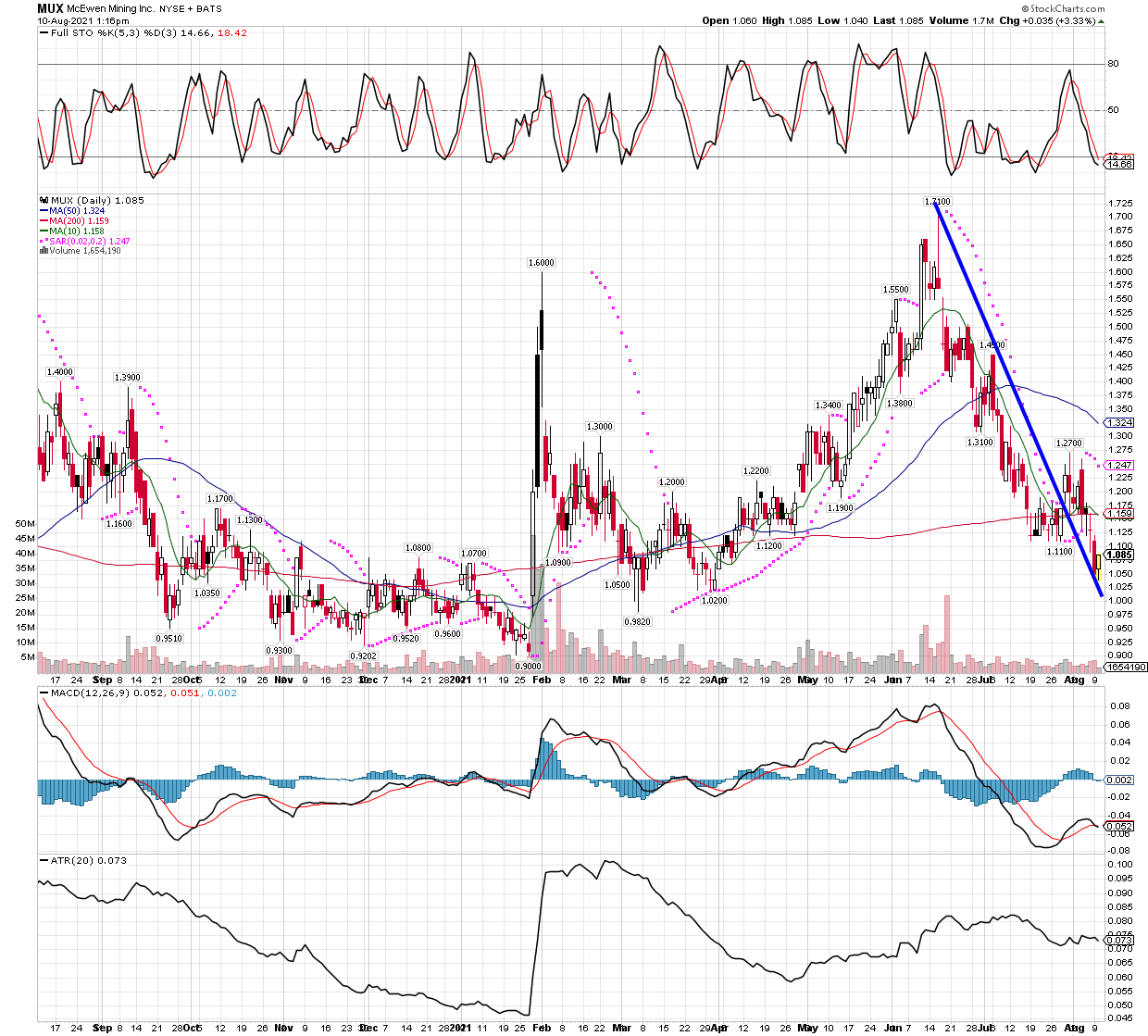

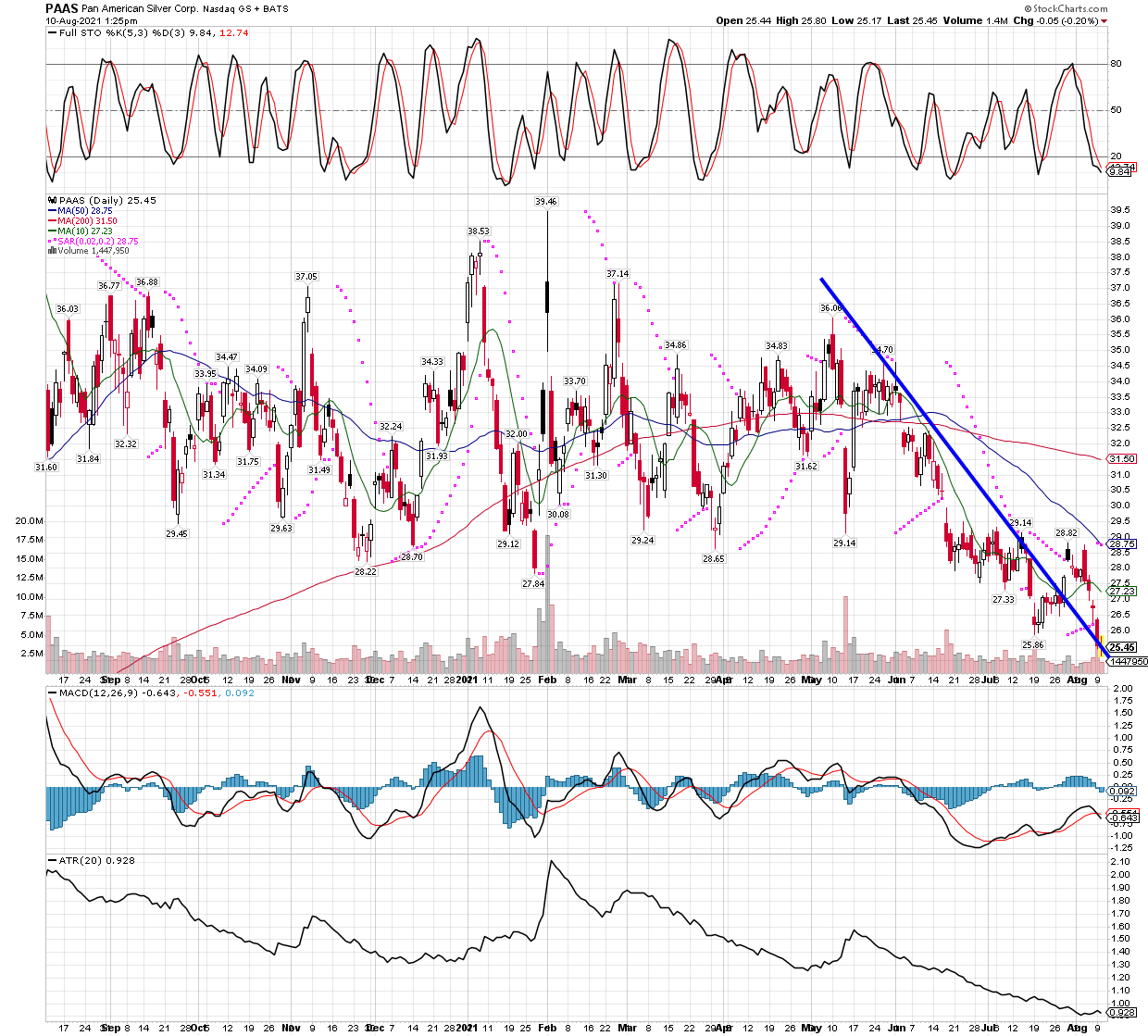

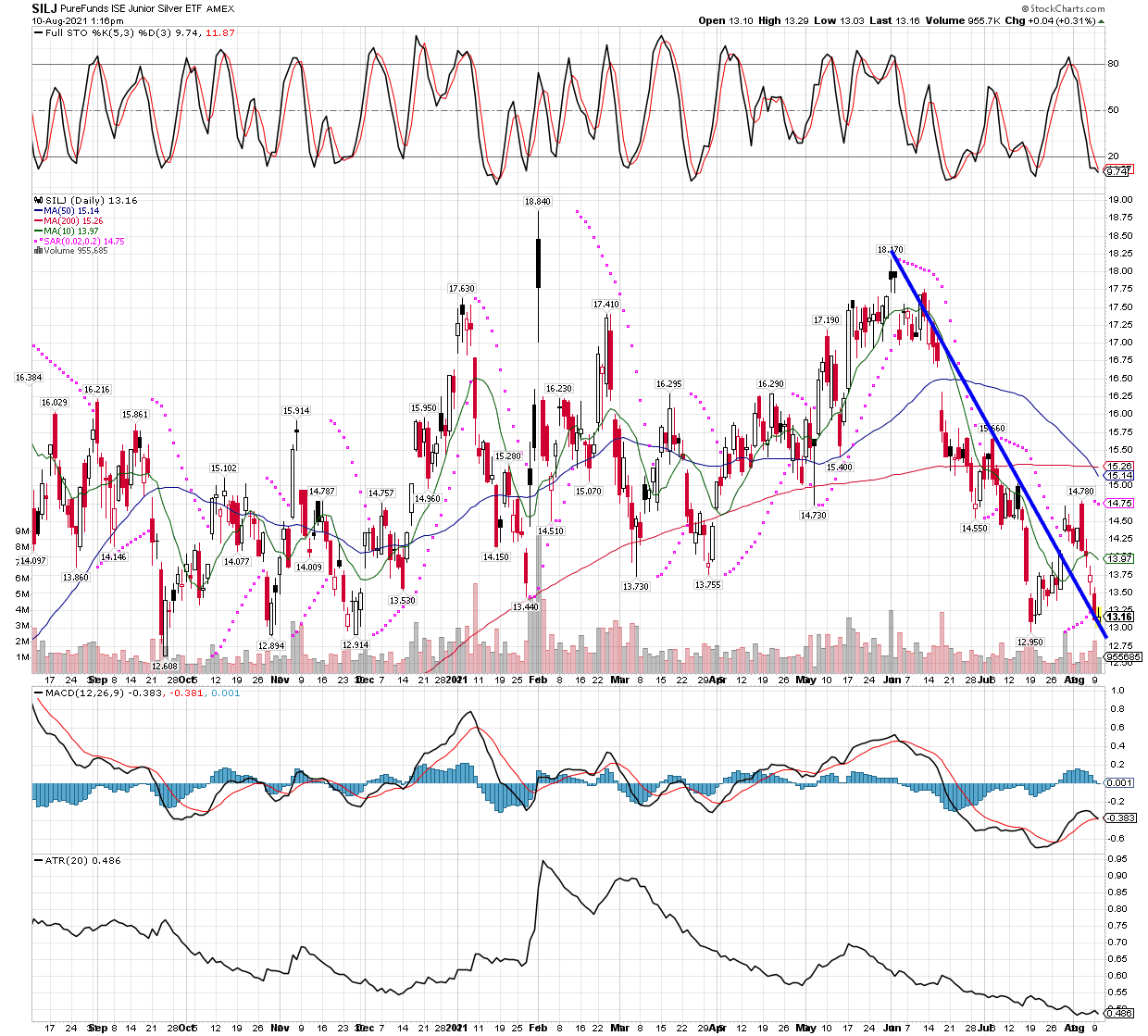

In the following charts, I am mostly trying to show you similarities in how the miners have come down quick and hard, forming their own downtrends, which have now been broken to the upside. It would be much preferred to see them break higher with force, but we will have to accept how they want to change their trend. Patience is required, but just because it might take longer does not mean the move will be any less significant by the time we decide to exit, and yes, I still think our holdings will be profitable overall.

As a side note, members should have received email alerts on buys made today, they include GDXJ and SILJ while others limit orders were not filled. Again, we waited until the intraday 30 minute bar charts worked their way down to oversold by late morning, before we made any buys. This strategy has worked well during this very difficult time, and did again today, and we were able to bring GDXJ holdings up to a full-risk position, it could turn out to be a very good buy at these levels.

Let’s get to the charts, note they all have a downtrend line that has recently broken to the upside. This does not mean they are going to scream higher, though it typically suggests the downward momentum has no broken. We should find a bottom in here somewhere, in other words. Here we go…

You get the point, I could go on for a long while being there are so many charts that appear almost identical. I like when so many charts in a sector look so similar, it makes it easier to play the group, and give us a chance to hop on some “laggards” at times, once we see a few names in the group start higher. That can be a good sign to do some buying ourselves. Hang tight and stay focused, this will pass and offer up great gains again, just like always.