July 10, 2021

July 9, 2021

Members of the site already know I added to MUX again this morning, please check the Stops and Daily Account Statement tabs for details and how new trades affect overall numbers, stops, etc. Since almost all my holdings are taking a nice jump higher today, but have been in a weak trend lower overall, I have decided not to chase and add or buy many new positions as yet.

A quick review shows UROY up near 10% today, MGMLF (Maple Gold) up 6%, and almost everything else is in the green as well. Its a welcome performance after a tough week, and right before the weekend. In a few minutes the new COT report will be out, showing us what moves have been made in the futures markets, I pay attention to the gold and silver figures, though I do not use this data as a timing tool for trades.

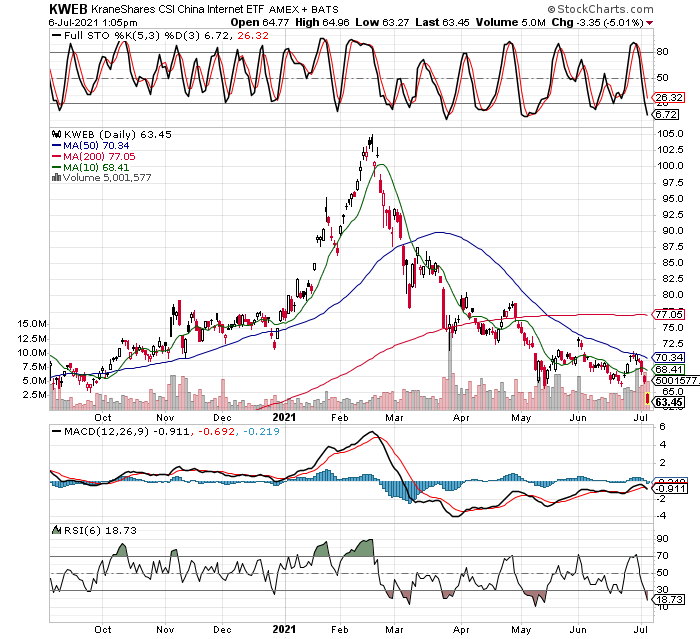

Its also good to see my recent KWEB buys getting some upside today as well, turns out overnight that China’s central bank eased monetary policy again. It’s almost comical, being just two weeks ago they were whining about inflation and claiming they will fight it at any cost (higher rates?). This is a great example of why we MUST ignore the news. It’s good to be aware of what is happening, but what they say is typically a better fade, that to take their words at face value! So KWEB is up 4.5% today and looking like it might want to make a substantial bounce. In any case, my signal is longer term (6-10 months on this etf), so I won’t be jumping up and down if my LEAPS gain another 50% in a few days, they are already gaining 16.4% as I type. I’m still looking to add to this position, but there is no rush, patience is a virtue. A couple charts to consider…

Is it time to bounce for SILJ and the silver miners?

Being a stock like AG (First Majestic, I own it individually, as well as in the SILJ etf) is the largest holding in the SILJ etf, with a chart like the one below where it’s now sitting on its 200 day MA, is what has me thinking its time for a bounce in the silver miners group. It will either break down soon, or resume its uptrend, we will find out soon!

It appears the precious metals miners will define their next path very soon. Either the bull is done, and they are heading lower for a long time to come, or one believes the bull is very much alive and just catching it’s breath for the next big move up. Buckle up, and get ready to find out!

July 8, 2021

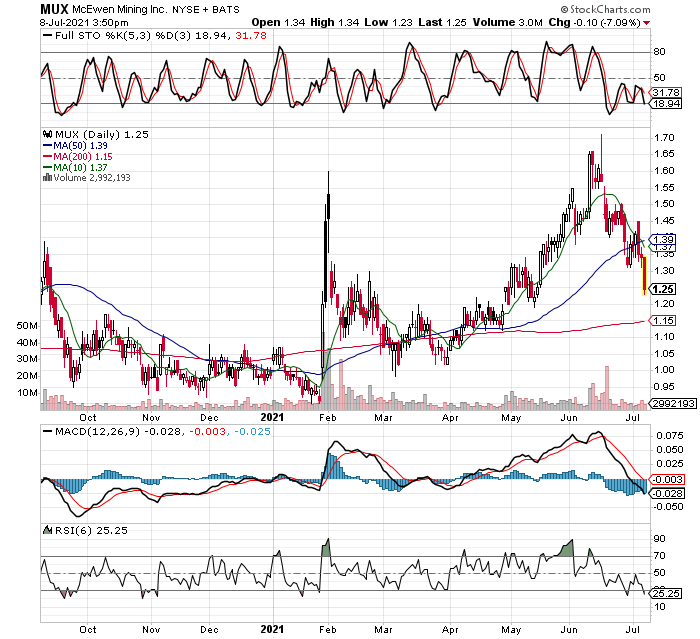

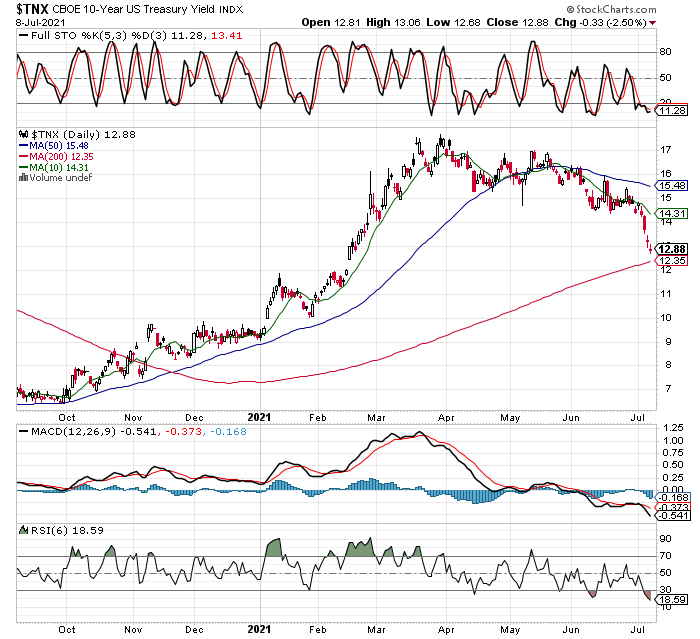

As MUX gets dragged lower with the miners, now down over 7% on the day, I am stepping in to add more. I posted the daily chart below, and yes, I am well aware an obvious support point is 200 day MA at roughly $1.16, where I will also look to make a larger buy, if it gets there. Other than that, I haven’t made many changes today, it’s been a day to wait and lick my wounds. It’s a bit surprising to see miners continue down day after day, considering the yield on the 10 yr note is getting hit pretty hard this week, down almost 10% so far. At times like this I have to maintain faith in my system, and wait for things to straighten out, return to making sense. In the meantime, I maintain my protective stops and continue to look for opportunities. Below I posted the $TNX also, the chart of the 10-yr note yield, and a bonus video of CEO Rob McEwen on the future of McEwen Mining.

Rob McEwen on youtube…

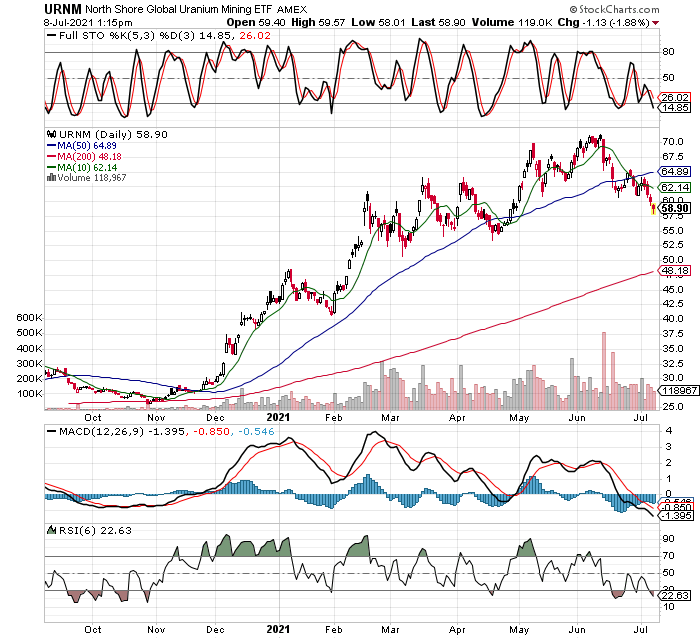

I haven’t made an changes to holdings today so far, but wanted to take the free time to show you some charts of interest, specifically in the copper and uranium sectors, since the continue to work lower today, bringing us closer to areas we might want to start accumulating.

First lets look at the URNM etf, its the most representative of the uranium stock group in my opinion, and we can see it continues to work lower. In fact, it’s now made new lows for the pullback. Its getting into a price range where I would like to start buying it just on price, but we need the technicals to confirm the idea, and offer up a buy signal before taking a stake. The chart…

I would like to pick some URNM shares up in the $55 area, but that is just a guess by looking at support areas. It might or might not get there, but I have learned in many years of trading, just be patient and wait for the setup. If it occurs, great, if not, there will always be another idea, as long as one remains patient! I will try and wait for $55, but that isnt the most important factor in my buy decision, I am more interested in getting a technical buy signal, such as oversold stochastics on the WEEKLY chart. My point is I could buy into URNM well before we get to the $55 level, even at a price above current levels, when the buy signal comes. We dont have the signal yet, but are closing in quickly, so be ready to press the BUY button before long.

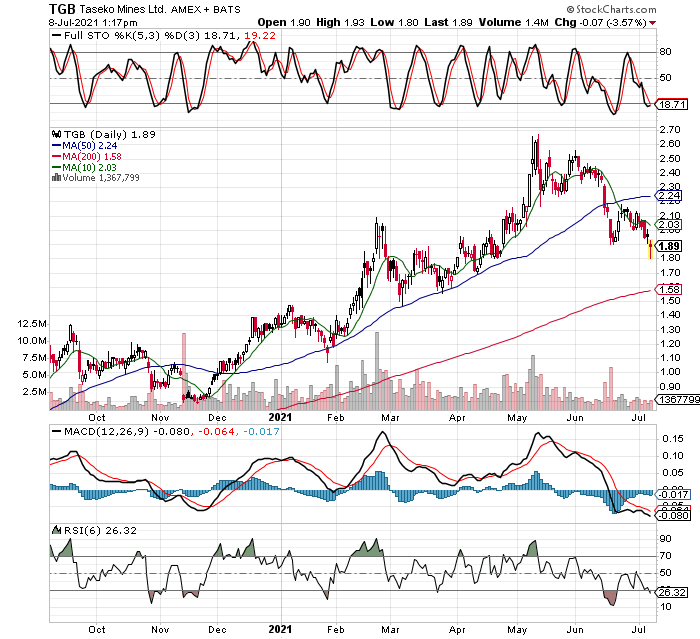

Now, lets take a peek at the copper mining and exploration stocks. Specifically, I am going to post charts on copper junior stocks, since they seem to be pulling back the hardest. I am not yet sure on how much I will buy of the junior copper stocks, but several are in the buy range already, I am just waiting for this economically sensitive group to show strength vs the stock market. The S&P 500 and QQQ’s are just getting weak today for the first time in a long while, so I prefer to see more weakness there, that could bring down things like copper quite easily, this would be an ideal setup if it occurs. If not, I can double back and buy some of the bigger, heavily traded copper stocks which are also pulling back (just not as much as the juniors), like FCX, HBM, TRQ, etc. In any case, I think the group does well over time, along with the whole commodity complex. Some copper juniors I’m considering are posted below, but know ahead of time I’m not in love with any of these juniors, they are just another trade!

First is TGB, Taseko Mines…

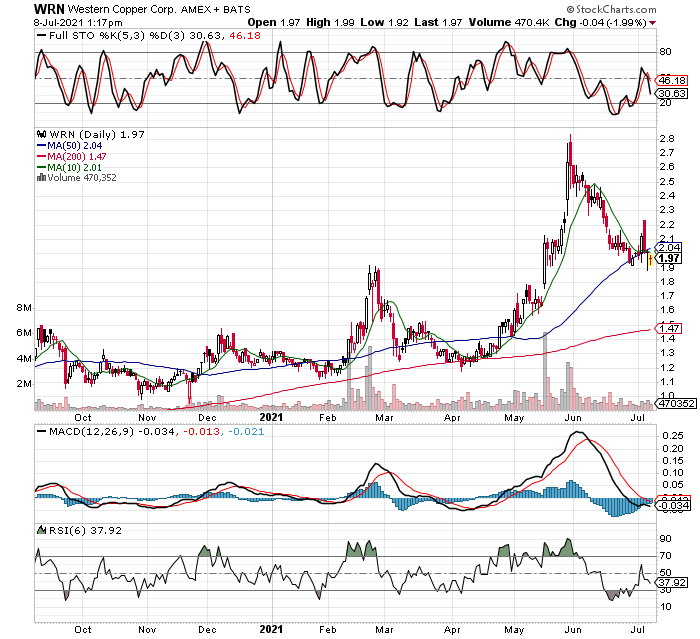

Now lets look at Western Copper and Gold (WRN)…

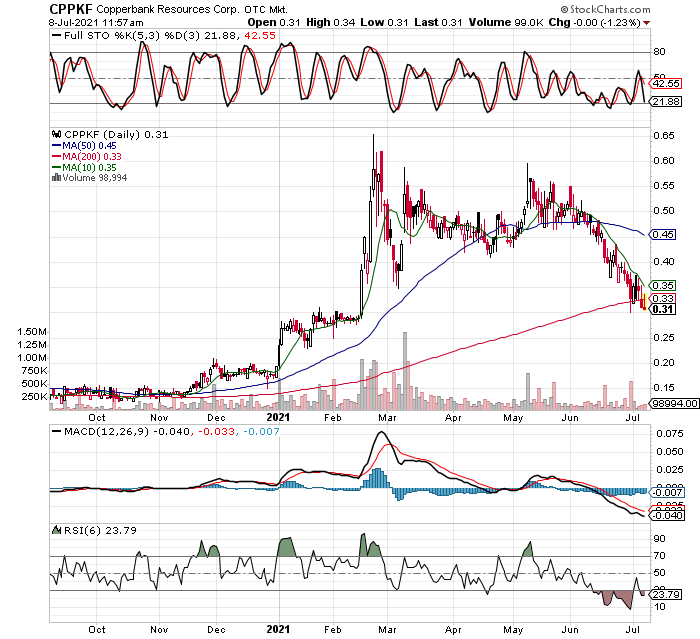

Some smaller junior copper stocks, like Copperbank (CPPKF)…

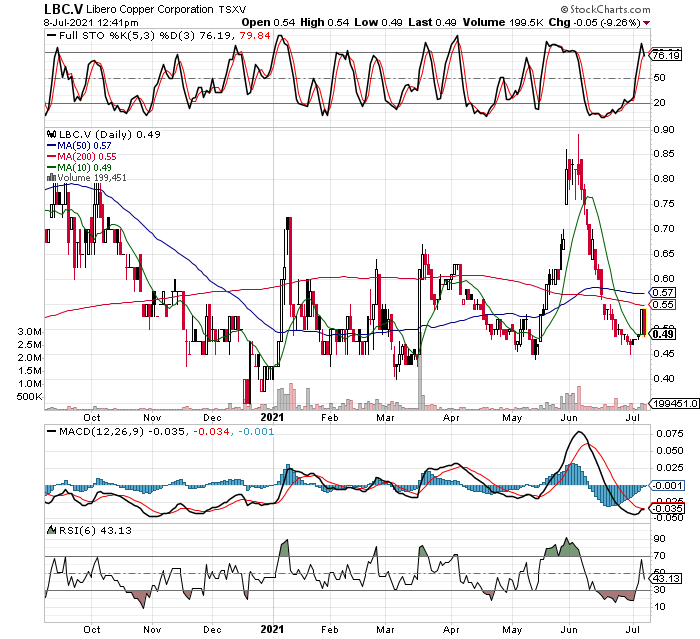

Libero Copper (LBC.V)

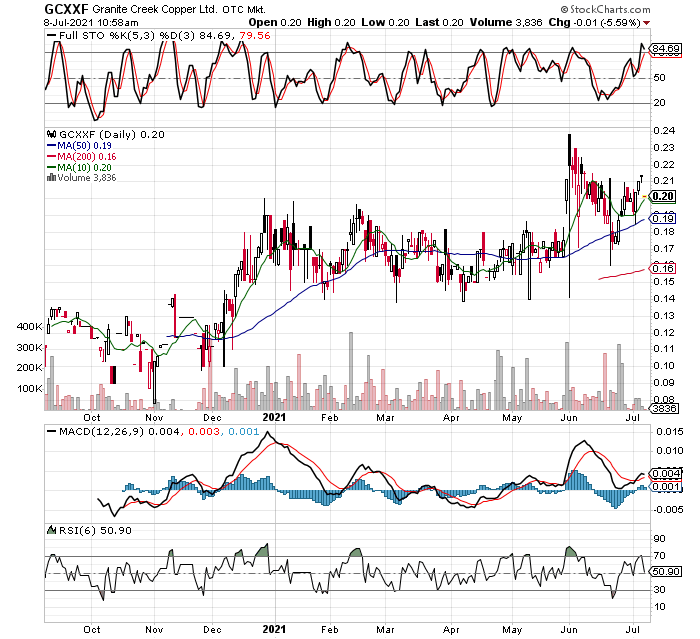

How about GCXXF, Granite Creek Copper? It hasn’t corrected like the others, then again it has shown great strength through the pullback in the group. I will keep my eyes on this one as well, and look to pick it up on the bid (rather than pay up) when I decide to get involved.

There are many others to consider, and I will cover them in future posts or whenever I take a position. As always, the most important decision in our trading, assuming we have at least a mediocre signaling system, it the size of out positions. Members should keep abreast of position sizes and stops levels on each holding, which can be found in the tabs above (Stops, and Daily Account Statements). These numbers are the ones that work for me, but every individual has their own needs and goals, so should adjust accordingly.

July 7, 2021

As always, it’s best to check my current, actual holdings with average prices paid and unrealized gains or losses on ALL positions, under the Daily Account Statement tab. Also, as positions get added (or trimmed), its a good idea for members to check how the stop prices change with new transactions. Changes in stop prices are affected more by larger orders, so one has to know how much I bought or sold for it to all make sense. I will say it forever, position sizing is the most important aspect for a trader to learn, as its necessary for proper risk control.

So, I’m stepping up and adding to MUX in this continuing pullback. I will continue to add into the decline, until I get to my stop out level, where I require myself to focus on new ideas and dumping a losing trade. I have stink bids in at different levels below the current price, and hope to get filled on as many shares as the weaker hands want to give me. It’s nothing personal, but we must learn to buy low and sell high if we are to make (and keep) money from the markets.

I try not to let past successes or failures in a stock influence my trading decisions, and MUX is no different. I will share that in 2016 I was more heavily invested in MUX than I normally go in any one idea, but it was justified by the fact I was already in the green (up on the trade), so I was keeping my overall TR (total risk) fixed, barring some news disaster. I will get to that topic, new disasters in another post, but suffice to say one probably shouldn’t bet as heavily as I did on MUX back then, because a gap lower through my stop levels could still devastate my accounts. Long story in short form, the stock ran up around 400-500% and I was fortunate to capture most of it, using the same charts and indicators I use here. I won’t let that fortunate turn of events influence my trading decisions now, but it requires a conscious effort to remind myself that 2016 has little to do with today’s action in MUX. This time I’m posting the weekly chart for MUX. Nothing about the chart say one must buy the stock today, but notice the stochastics are getting oversold, and that we are getting a big red bar (lower prices) this week, so if the markets closed the week right here, MUX would be well oversold in the new charts printed next Monday. Notice the stock was rejected at the 200 WEEK moving average, and has now backed up to take another run at breaking through.

I’m ok adding here, as I’m still not quite up to a fully loaded position, and I already have decent unrealized gains. I love adding to my holdings from a position of strength, which is the case here. I add to losing positions too, at times, but its never as aggressive or happily as when I have already been proven correct on an idea.

With KWEB now down over 40% from its all time highs, I can’t see how owning the best and biggest technology companies in China will prove to be a mistake. Earlier I posted a daily chart as I was buying to add to my LEAP calls on KWEB, now I’m posting a weekly chart to show the longer term view. It looks to me like we should be coming into support in this area, but if not, my stops will limit the losses. It could take awhile to turn higher again, but since this signal is on a MONTHLY buy (along with the shorter time frames), I expect to be in this trade for 6-10 months, possibly a little longer.

Its odd the Chinese leaders have been hit with a full blown bear market, while the S&P 500 and Nasdaq just hit new all time highs today. This is not typical action, there might be something lurking under the surface that is bigger than I can imagine, but that’s the great thing about trading, its just taking the odds when they are in your favor. Limit our risk, and open our upside.

I made this post because I have placed “stink bids” to add to my LEAPS. That is where we pick a price away from the market that won’t likely get filled, but if it does, we got a great price (or a low price, I should say, since we don’t know if its great or not until the trade is closed!). Members should check my Stops tab, and Daily Account Statements to see changes in overall position sizes, adjusted stop levels, and how the positions are doing since I started accumulating. If I get any fills, the new additions and average prices paid will show up in those tabs. All changes are in the ACTUAL account statements, there should be nothing to hide from a person asking for your trust, that is why I put the statements out there for my subscribers to see the facts.

After a 20% spike in one day last week, UROY (Uranium Royalty Corp.) has been down several days in a row, take peek at the daily chart. I am still working into full position on this one, so welcome the pullback, but might have to adjust my “full position size” if the volatility stays elevated. This would force me to bring down the number of shares I intend to own, but for now I am keeping things as originally planned. I will update the stop levels and desired position size in the tabs above, for subscribers to the site. You can also see my total position sizes and unrealized gains and losses under the Daily Account Statements tab. I was up on UROY, now sitting on a slight loss, but still looking to get bigger position.

Long time readers know how important position sizing is, in fact its the most important aspect of any trading plan. This stock illustrates the point perfectly, had I been already too heavy in the trade, this pullback might shake me out (stop me out), rather than being viewed as an opportunity. Of course, as always its the size of my orders and positions that matter most, so keep up with me on the tabs mentioned above, they are critical to a trader and wile different for each individual, very similar in many ways no matter who makes the trade. The principles fo risk control apply to everybody!

I added to my KWEB etf LEAPS again, as I work up to a full-sized position. No need for a chart, just posted one yesterday, and the etf continues lower by another 1% or so. Members should check the Stops tab and Daily Account Statement to see my full position sizes and prices I will stop out if things drop to those levels.

URNM, the uranium etf, looks like its breaking down to new correction lows today. I’ll post a chart because I’ve been waiting for a buy signal in this group to add to my UROY (Uranium Royalty Corp). The time to buy is getting closer.

July 6, 2021

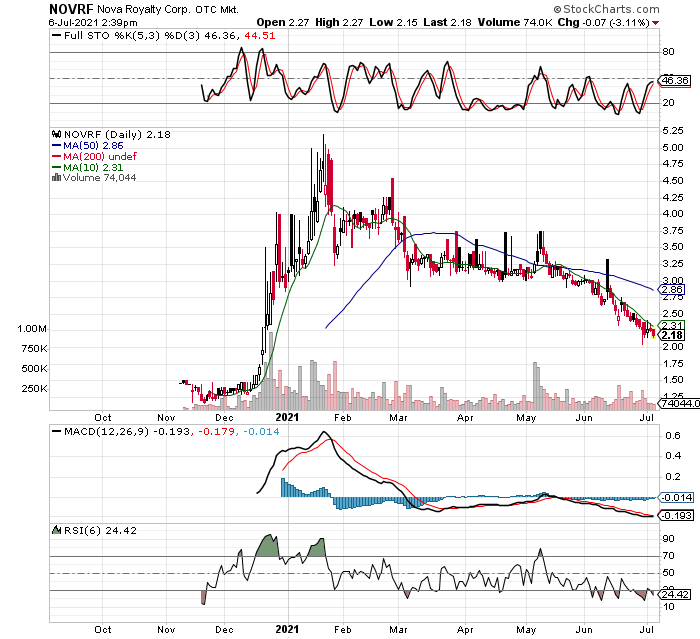

Newer issues like NOVRF can be harder to manage entries and exits, as there is less data to paint the charts with sufficient information, so as to make more reliable decisions. That does not mean we can take a trade, just that we have discipline with regards to position size and stop out levels, but we should ALWAYS be disciplined in any case anyway. I will re-post the daily chart here for those that missed it recently, because I stepped in as planned to add to my copper royalty NOVRF today.

As always, members should check my adjusted stop levels for the position, as well as my overall position size and unrealized gains and losses in my daily account statements posted on the site. Please take advantage, as nobody I know of that writes newsletters like this publishes their REAL positions each day, in an account statement. For some reason, the closest they come is to type it on the site, but that is just more work and subject to fudging the numbers, so make no sense at all for a legitimate trader to make extra work for himself. That is, unless they are getting a benefit by telling others his trade price (and they NEVER mention POSITION SIZE, the single most important aspect to any trader’s results), meaning they wait all day to post then pick the optimal price to report to subscribers, instead of the actual price paid!

So the story is the same with NOVRF and the reasons I want to own it. I also find the CEO to be informative and entertaining, though I would not buy a stock just on those observations alone. His name is EB Tucker, and he has many video interviews out there on youtube, for those that are interested. When I get some free time, I will post some of the videos here for readers. Here is the daily Nova Royalty Corp chart, once again.

As stated in previous posts, I have been patiently waiting to add to my KWEB etf that represents the biggest and best chinese internet companies. I will admit I dont like how hard the stock is pulling back, I prefer it to be more soft and controlled, but the etf is getting clobbered several days in a row now. That alone is not enough to change my opinion on the trade, but also it warrants paying attention and having a clear, defined stop out level. Members can check my stop-out levels for all holdings, as well as total position sizes and unrealized P+L in my daily account statements. One a trade like this, it pays to know when you will get out to cut losses.

For now we are not near that area, so its still time to accumulate. It could also be this shrap pullback is a gift, giving us much better entry prices on the remainder of our buys. I bought LEAP calls on KWEB that expire in Jan 2023, so I have lots of time in case it takes awhile for a strong uptrend to resume. I like lots of time to expiry when buying options, since things can take longer than we would like, at times. I still have room to add more in the context of my limited total risk numbers, which are taken into account when determining my stop-out levels. Here is the KWEB daily chart again.

KWEB daily, added this morning