Setting up as buys?

July 8, 2021

I haven’t made an changes to holdings today so far, but wanted to take the free time to show you some charts of interest, specifically in the copper and uranium sectors, since the continue to work lower today, bringing us closer to areas we might want to start accumulating.

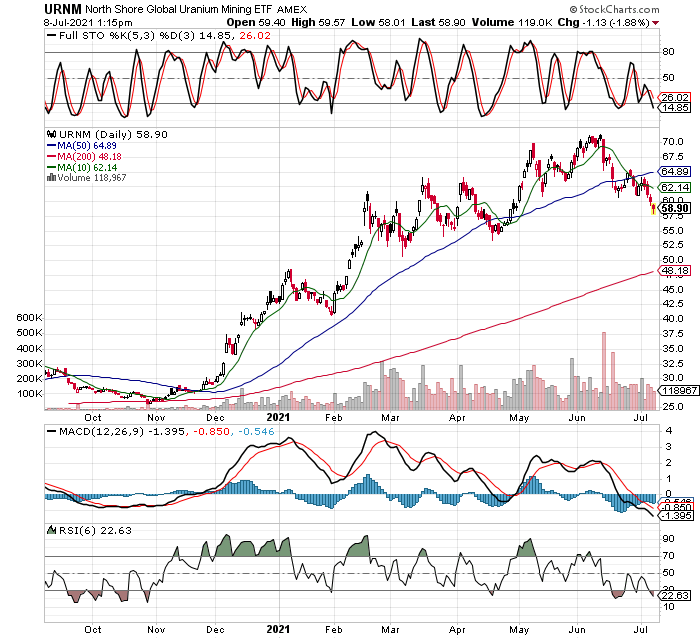

First lets look at the URNM etf, its the most representative of the uranium stock group in my opinion, and we can see it continues to work lower. In fact, it’s now made new lows for the pullback. Its getting into a price range where I would like to start buying it just on price, but we need the technicals to confirm the idea, and offer up a buy signal before taking a stake. The chart…

I would like to pick some URNM shares up in the $55 area, but that is just a guess by looking at support areas. It might or might not get there, but I have learned in many years of trading, just be patient and wait for the setup. If it occurs, great, if not, there will always be another idea, as long as one remains patient! I will try and wait for $55, but that isnt the most important factor in my buy decision, I am more interested in getting a technical buy signal, such as oversold stochastics on the WEEKLY chart. My point is I could buy into URNM well before we get to the $55 level, even at a price above current levels, when the buy signal comes. We dont have the signal yet, but are closing in quickly, so be ready to press the BUY button before long.

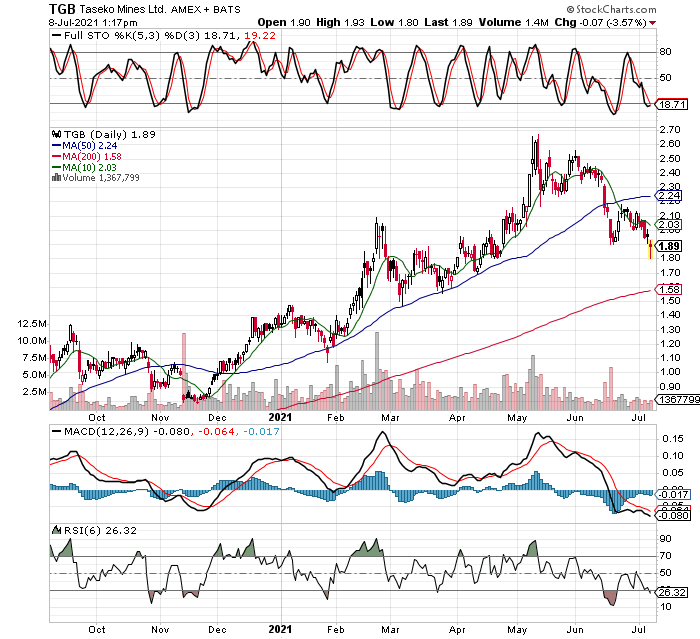

Now, lets take a peek at the copper mining and exploration stocks. Specifically, I am going to post charts on copper junior stocks, since they seem to be pulling back the hardest. I am not yet sure on how much I will buy of the junior copper stocks, but several are in the buy range already, I am just waiting for this economically sensitive group to show strength vs the stock market. The S&P 500 and QQQ’s are just getting weak today for the first time in a long while, so I prefer to see more weakness there, that could bring down things like copper quite easily, this would be an ideal setup if it occurs. If not, I can double back and buy some of the bigger, heavily traded copper stocks which are also pulling back (just not as much as the juniors), like FCX, HBM, TRQ, etc. In any case, I think the group does well over time, along with the whole commodity complex. Some copper juniors I’m considering are posted below, but know ahead of time I’m not in love with any of these juniors, they are just another trade!

First is TGB, Taseko Mines…

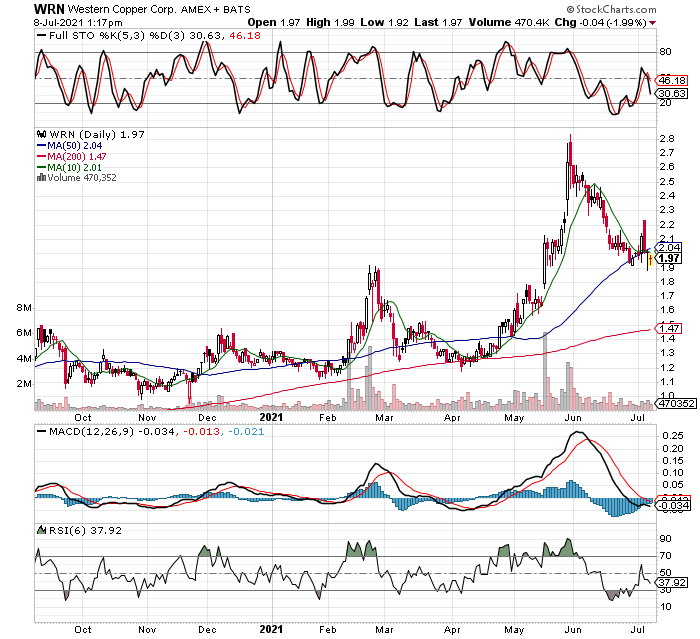

Now lets look at Western Copper and Gold (WRN)…

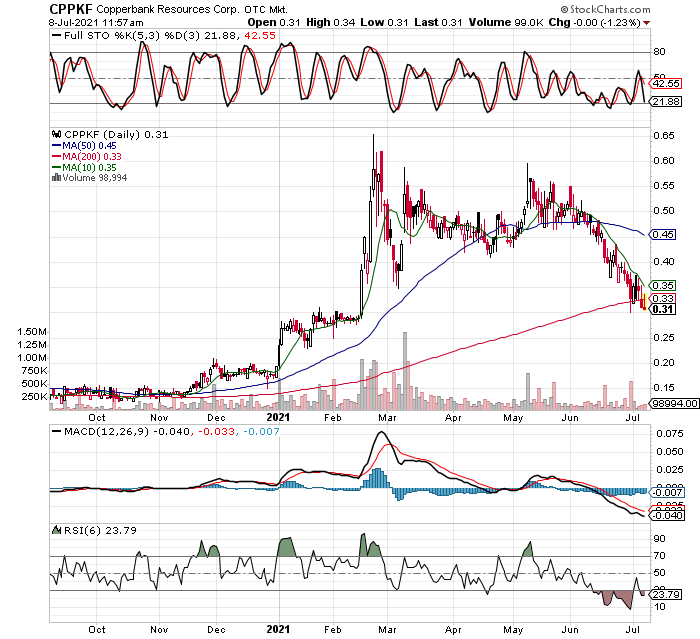

Some smaller junior copper stocks, like Copperbank (CPPKF)…

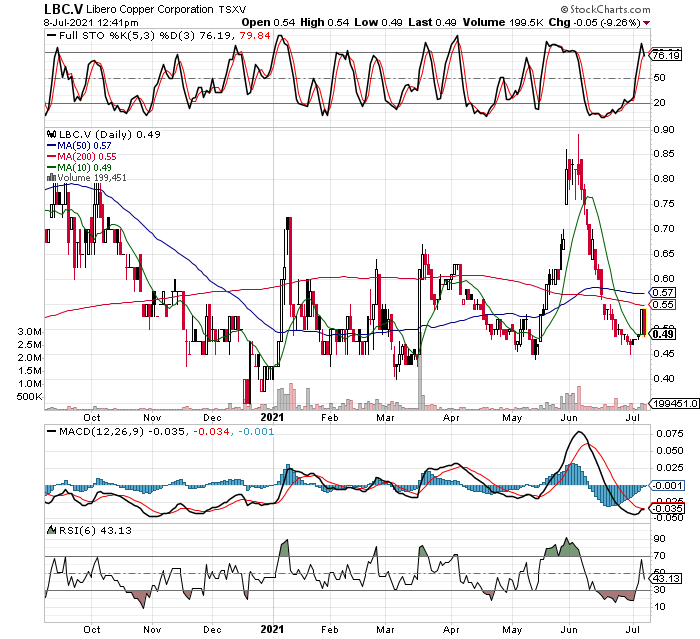

Libero Copper (LBC.V)

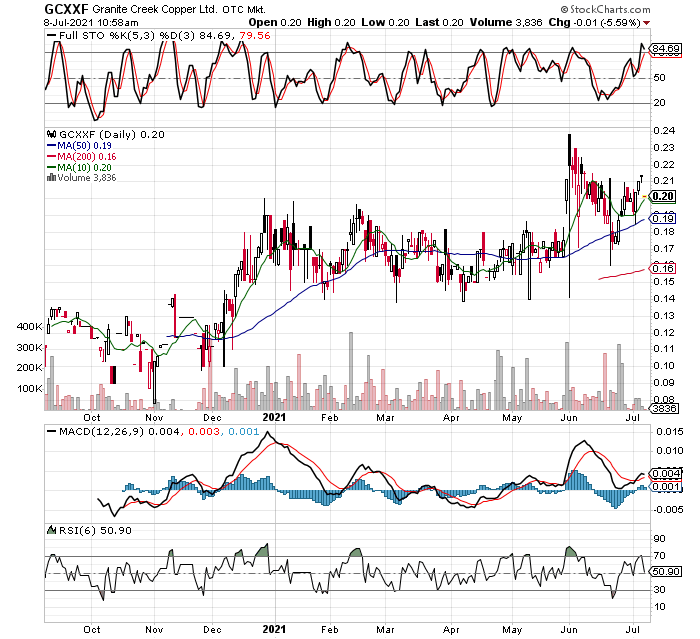

How about GCXXF, Granite Creek Copper? It hasn’t corrected like the others, then again it has shown great strength through the pullback in the group. I will keep my eyes on this one as well, and look to pick it up on the bid (rather than pay up) when I decide to get involved.

There are many others to consider, and I will cover them in future posts or whenever I take a position. As always, the most important decision in our trading, assuming we have at least a mediocre signaling system, it the size of out positions. Members should keep abreast of position sizes and stops levels on each holding, which can be found in the tabs above (Stops, and Daily Account Statements). These numbers are the ones that work for me, but every individual has their own needs and goals, so should adjust accordingly.