More on commodities, and one more miner

June 27, 2021

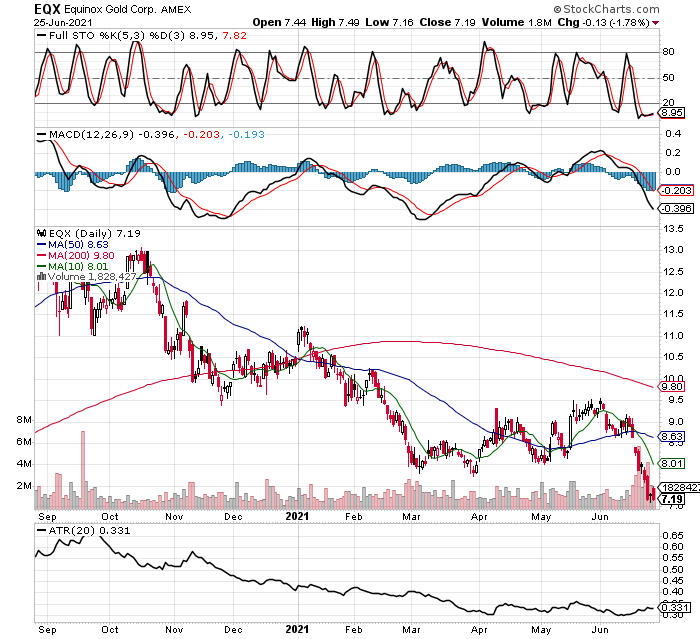

While I’m already loaded up in precious metals miners, I decided to take a stake in one that is being driven lower on news of a blockade on one of their Mexican properties. It could be risky, but Equinox Gold (EQX) has several excellent properties and was one of the best performing miners in the recent bull, until the news of these illegal blockades by the indigenous tribes took hold. Its always tough to gauge the overall effect of such events, it could blow over relatively quick, in which case this decline turned out to be a gift, or if it blows up into something more serious, I will just have to stop out with my fixed, pre-defined risk. Because I expect this stock to be more news driven in the short term, I’m playing it through LEAP call options that don’t expire until Jan 2023 (7.5 strike price), rather than tying up too much capital in a more speculative idea.

Let’s take quick look at EQX, it sure looks ugly! But with fixed risk we can afford to try and capture what could be spectacular upside if anything other than the worst possible outcome occurs. As always, check the link on the side to see actual purchase dates and prices.

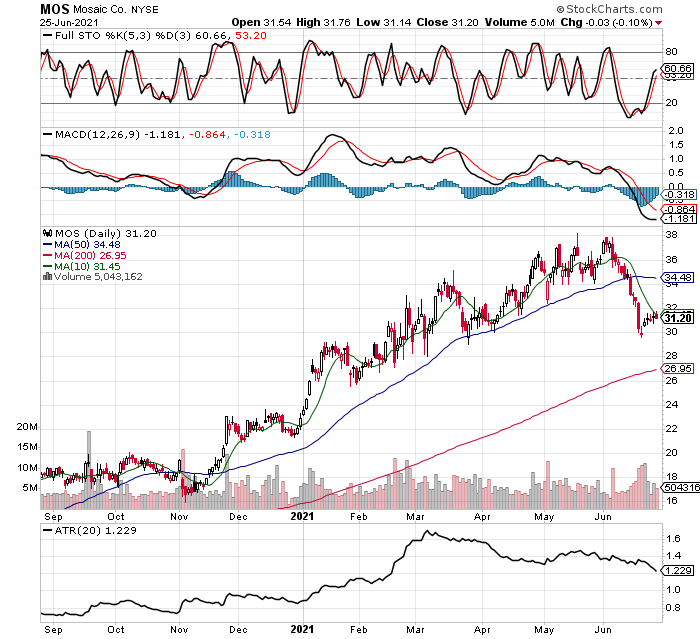

There are some other ideas approaching zones of action where I plan to buy, like some fertilizer stocks. Below I will show you Mosaic (MOS), but there are several others in the same group that might trigger a buy as well. I will let readers know when I buy, and what I buy, when I make my move. Agriculture stocks have had a nice run along with the whole commodity complex, and now many are pulling back, just what we are looking to buy into. There is almost always an opportunity setting up, if we keep our eyes open, and a level head. Here is MOS, I would love to pick it up down by its 200 day MA, but that might be wishful thinking, so lets keep it mind and see if sets up sooner for a good buy.