January 2, 2020

Welcome to 2020, what opportunities will present in 2020? We already know I am heavily long the precious metals miners, and my focus remains there along with the money I manage, but what else is shaping up for possible investment?

I think commodities will see a good place to have money for at least most of 2020, and probably longer as in a few years. The US dollar seems to be breaking support levels, and while due for a bounce soon, the damage has been done on the longer term charts. Let’s take a quick look at the daily chart.

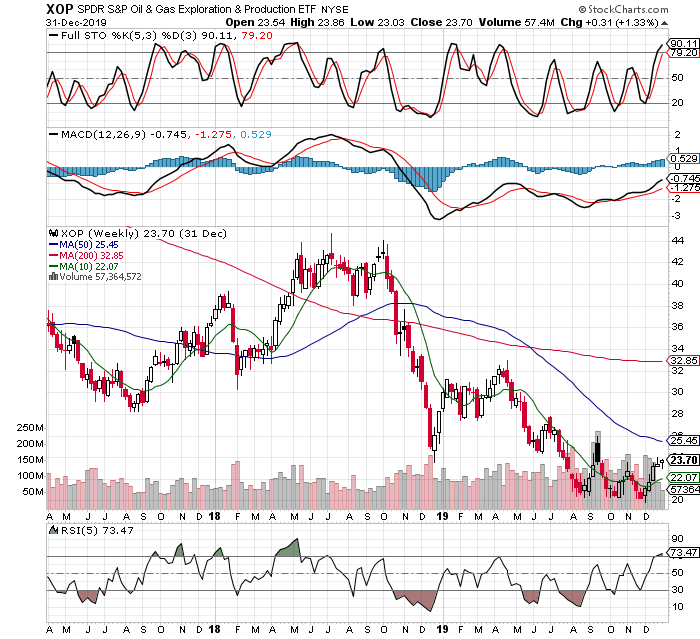

The above chart supports the long commodities thesis, and while I think all commodities will rise, some will of course do better than others. I will stay focused on those already in strong uptrends, like precious metals and their miners, while being ready to step into other areas once they can turn their moving averages higher on the long term charts, like oil exploration (XOP), and oil services stocks (OIH). I have mentioned these in the last few months but have yet to take a position despite their rallies. This doesn’t concern me, rallies in downtrends will fizzle out more often than not, so if they get away from me and keep rallying, I just have to look to setups in other groups to invest. Here is the XOP weekly, since they daily I can tell you has been basically straight up, but the weekly now is nearing overbought by my stochastics measure. Since the monthly chart is trying to turn higher and has already just recently come out of oversold, the trigger I like now to get long is to buy into the oversold WEEKLY stochastics, when and if they occur.

I have found that it can take a long time to turn a chart higher, not always, but usually this is the case. One pitfall to watch out for was shown this week with the midday bankruptcy announcement of the once mighty McDermott (MDR). It was experiencing a nice bounce off the recent lows after bottom-pickers came in looking for bargains, then by surprise they filed bankruptcy and the stock was taken out back and shot, losing over half its value in minutes. Expect to see more of these type events as the fundamentals in the group are still weak, yet keep an eye out to get long because it is exactly these type of news events that once slowing down will provide some of the best setups. Let’s look for the stocks to go up on bad news, as the moving averages flatten out or better, they turn and trend higher. One other reason to stay focused on miners for now is that the gold to oil ratio (GLD:USO) has potentially turned again, which would see gold outperform oil on a relative basis. However, the biggest reason to stay long metals and miners is the strong uptrend in which they remain.

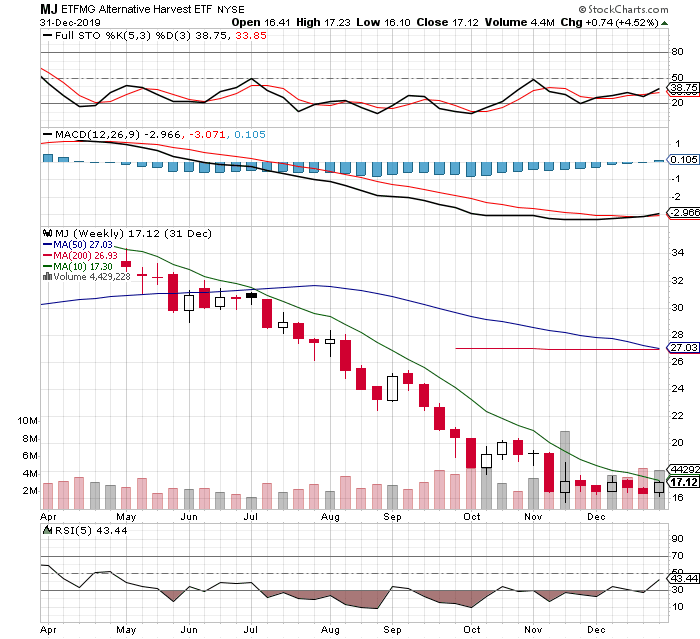

Outside of commodities, let’s take a look at the MJ etf (marijuana stocks). I have no particular opinion politically on this group, nor should anybody if they want to invest successfully. The MJ etf looks severely washed out, especially now that tax-loss selling season has just passed. While this is no guarantee that the MJ stocks are going higher soon, this is the time of year that big losers in the year prior can find buyers looking to get long at low prices. I won’t pretend to know enough about the fundamentals of this group, sure it’s a growth industry, but which players will take the lead or get bought out is something I do not know. What I do know is that big bounces, even longer term uptrends often initiate after a huge decline and then some sideways basing. I will look for this group to bounce over the next month or two, say into February or March, which I might look to trade in AND out of, but then look to get long again after a pullback, once the moving averages have turned higher again. The expected near term bounce aside, we cannot know how long it will take for a new bull to emerge in this group, but we will be comfortable going long the etf when it does. If I trade the bounce, it will be reflected in the posted statements elsewhere on this site.

I think 2020 will offer up some big gains in the precious metals and miners, and possibly both XOP, OIH, and MJ as well, but that latter ideas will require patience. I first mentioned them a few months ago, to give you an idea of how much patience we might need. Still, the gains come quick and furious once the market decides they are in favor again, well worth the wait!