Getting tested again as metals and miners move lower

October 15, 2019

As the charts will confirm, metals and miners have been moving lower again, testing my intestinal fortitude. While it can be uncomfortable, I try to focus on the things I can control, vs. the ebb and flow of markets, they give and they take. I have seen a good portion of my unrealized gains get forfeited, for the time being. People will ask, why not sell at the top and buy back lower, like where the miners are now? Well, if I knew it was a top I would sell, but nobody can know that, and if we see how many times I chose to stay in a trade that looked “toppy”, but kept on moving higher, we would see how the numbers work better by staying in a winning trade until you get your signal to exit. Anything short of your full signal to exit, will find you leaving more money on the table than you would like. In short, it’s costly to the bottom line trying to sidestep what seem like obvious areas to pull back. If it were that easy, all traders would be rich, but we know that is not the case!

Let’s look at a few charts, and start with SILJ, which is now coming back down to it’s 200 day MA, which should be a relatively low risk buy zone. I have funds to put to work down there, but have already started nibbling again today in the $9.20 area, give or take a few pennies.

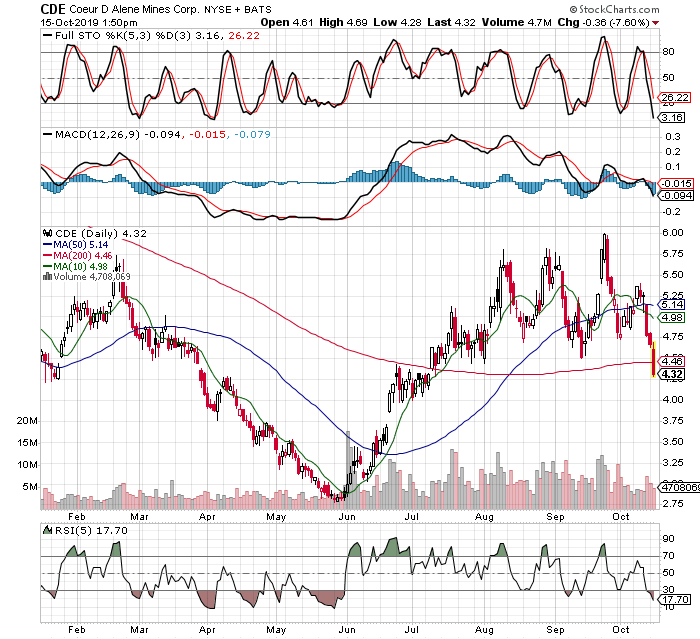

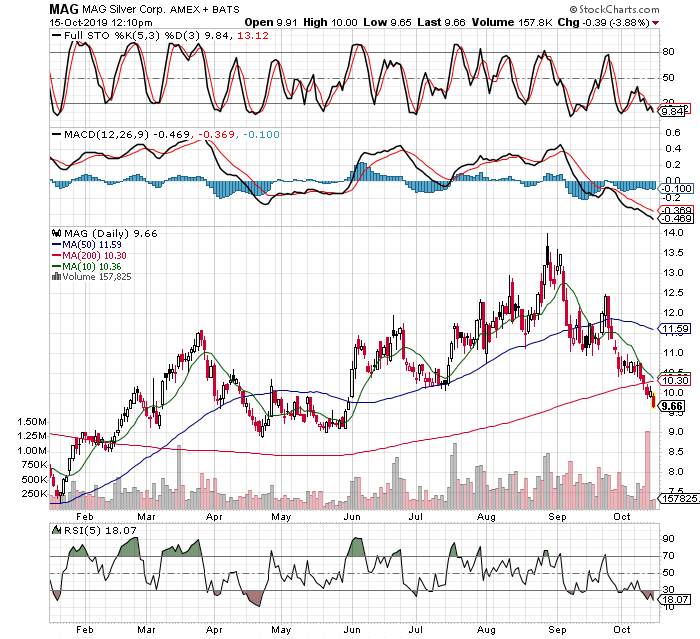

I like this setup, the only thing that I am keeping a skeptical eye on is the fact stocks like CDE, a component of the SILJ etf, didn’t even stop for coffee at it’s 200 MA, instead it blew right through it today. We also see similar action in MAG, another component of SILJ. While one day is not a huge worry, I would like to see these two snap back soon above their 200 MA’s.

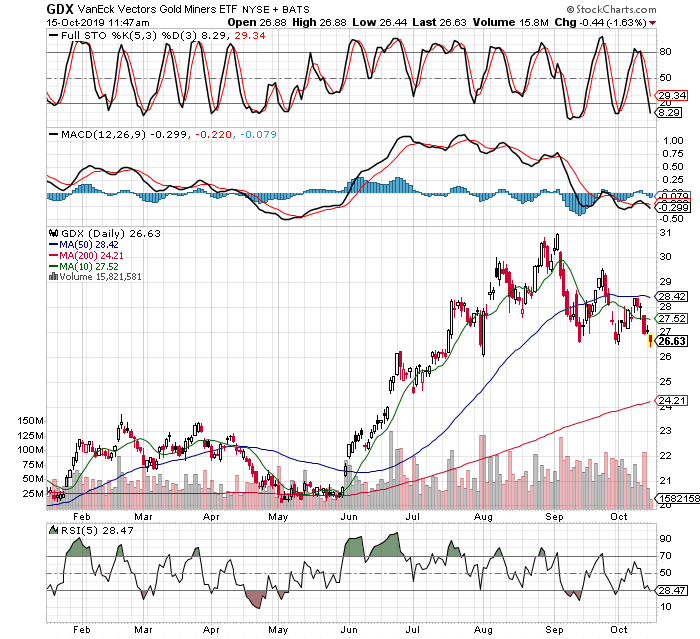

One other small concern is that GDX might not be done making it’s trip lower, and being its the largest mining etf, it can weigh on prices in the group if it wants to go lower before finding a bottom. Still, I see the $26 area as a potential pit stop, then $25.50 as another support, and lastly the 200 MA down in the $24+ area. Let’s hope it doesn’t have to visit $24 before turning higher, but it might so we need to be prepared.

And a quick look at GDXJ has me itching to buy. Yes, excited to start adding to miners in the face of all the negativity I am reading now on the group. So many people are looking for $1340-$1370 on gold to be tested that I feel it is unlikely to happen, even if it is a logical area. The fundamentals or new QE money printing, geopolitical risks, and a weakening world economy all support higher gold prices. In addition, my reading on the internet forums shows many of the smaller players not only shorting miners or looking to add to the short side, they have almost abandoned the search for an area to buy and get back on the side of the longer term trend. While many groups appear washed out, like the MJ etf or XOP (energy stocks), they are not yet in uptrends like the metals and miners, as defined by the 50 day MA above the 200 MA, and both sloping upwards. For that reason alone, I will stick with miners and buy/add into these dips. The goal is to have more shares than at any other point in the trade, with positive marks (unrealized gains) so can hold strong, for the next leg up in a bull market.

The general stock market continues to close in on new highs, but if it doesn’t respond to QE like it did the first three times, a weaker market could send miners flying. Not to mention the dollar is starting to wobble up here after a run lasting several years. Lastly, bonds are a flight to safety like gold typically, but even the treasury market seems to be tired running higher after a 30 year bull market. We can’t know what day things change, but we can be positioned in front of it, then enjoy the ride. So while I am getting tested, bruised up a bit and wishing I had sold a bunch of my holdings over a month ago, I still know that feeling is an impediment to greater gains if I let it rule my decision-making. I will stay long and am eagerly waiting to add some sizable positions in the very near term. I did add today very lightly, buying some more SILJ and long term LEAP options on SLV out to 2021, but the sizes are nothing compared to the orders I am readying should we get GDX down to $25 and change.