Fasten your seatbelts, we’re experiencing turbulence!

October 2, 2019

All joking aside, this pullback in the metals and their miners has been quick and sharp, and we looked to be resuming the upside just before another drop back to the most recent lows. What does it all mean? Probably not much, and here is why. First, we are now in the Chinese Golden Week holiday, and since the Chinese are big players in the gold market and not going back to work until October 9, gold more often than not pulls back or goes nowhere until they return. Second, Monday was the 3rd quarter end, so there is some degree of ¨painting the tape¨ for shareholders of mutual funds and other investment vehicles. After these items pass, it’s back to business as usual. For example, the stock market held up and could not get much downside traction before they closed the books for the third quarter, but just today (Wednesday), the general stock market etfs in the US closed down 2%. Maybe it’s a turn to last for awhile, I don’t know, but nevertheless these things do affect markets in near term. I typically don´t try to sidestep these tendencies because there is always another one around the corner and trying to do so would require constant in and out trading that is very costly over time, especially if it causes one to lose focus of the big trade they are pursuing.

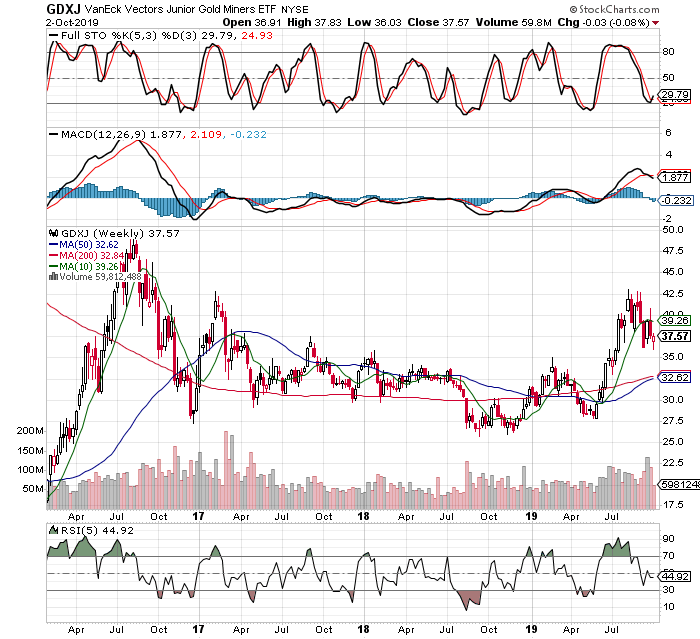

Let’s go to the charts. If we step back a little further than our usual timeframes, we can better see long term support and resistance zones. Here is GDXJ, the junior miner gold stock etf.

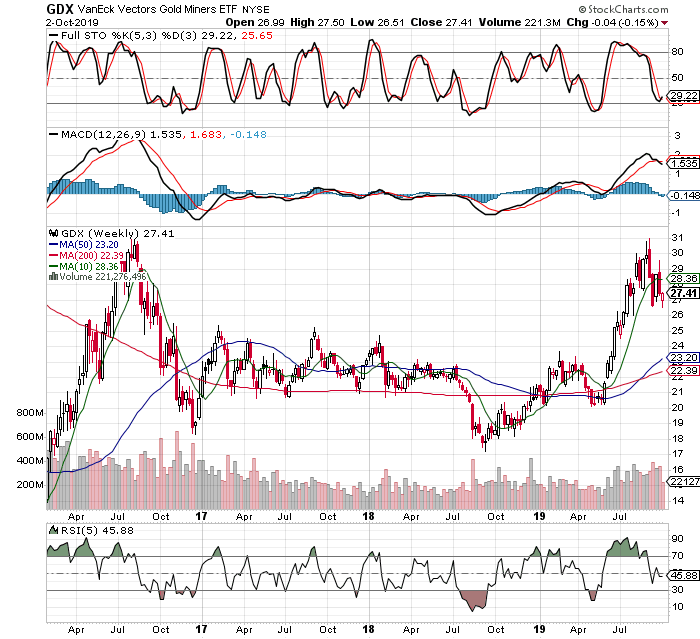

In the above charts we see both of the biggest gold mining etfs have come down to areas that might provide support, and should do so, if we continue to be in a bull market. I read all over the internet lately that short term ¨traders¨ have booked profits and are waiting for even deeper pullbacks that what I suggest might occur above, before jumping back in with both feet. Further, many are now entertaining the short side of these stocks, which is where I think they go terribly wrong. It’s not just the money they might lose being they are counter trend trading, but they will lose sight of the big picture and even if they can switch back to the long side and trend, will they be able to buy with conviction so that they can load the boat. In my experience it is very difficult to do, but don’t take my work for it, just look at the big fish and how often they jump in and out. I’ll save you some time, they don’t do it very often. Mostly because the big money is made by identifying emerging monster trends early, buying a good amount near the lows, then when they have confirmation they might be correct, they add heavily into the pullbacks like we are seeing now. So what am I doing, well I have nibbled here and there over the last week, but since I am very heavily invested already and sitting on big unrealized gains (albeit not as big as 2 weeks ago), I will wait until either we have violent down days to buy into, or the Chinese Golden Week passes. The third quarter close is already behind us, so I am only looking for places to buy down here, and anybody looking to ring the register on gains has already missed that window, in my opinion. It is time to buy, or sit tight, but definitely not sell if one thinks this is a bull trend that remains intact.

And what about my SILJ? Let’s take a look…

Second, let’s look at the weekly chart like we did with GDX nad GDXJ above.

While SILJ is not as clear about its trend on the weekly charts, if you compare it first to GDXJ, then to GDX, you can see it is very similar, just late. Both GDX and GDXJ have already turned their long term weekly moving averages to the upside, and GDX has already made it’s ¨golden cross¨ where the 50 MA crosses above the 200 MA. These are not only in uptrends that remain intact, so far, there are relatively early in that bull trend. These are markets where one wants to buy or add into pullbacks, not focus on selling rallies yet, if they wish to make and keep the big money.

All in all, while I agree we might go lower for awhile, from here the downside should be contained. We might not rocket higher just yet, but that is not important, what is important is that we are on for the ride when it occurs, and we have more shares than at any other time in the trade. Check!