Upside in miners resumes, and crazy action across many markets

September 24, 2019

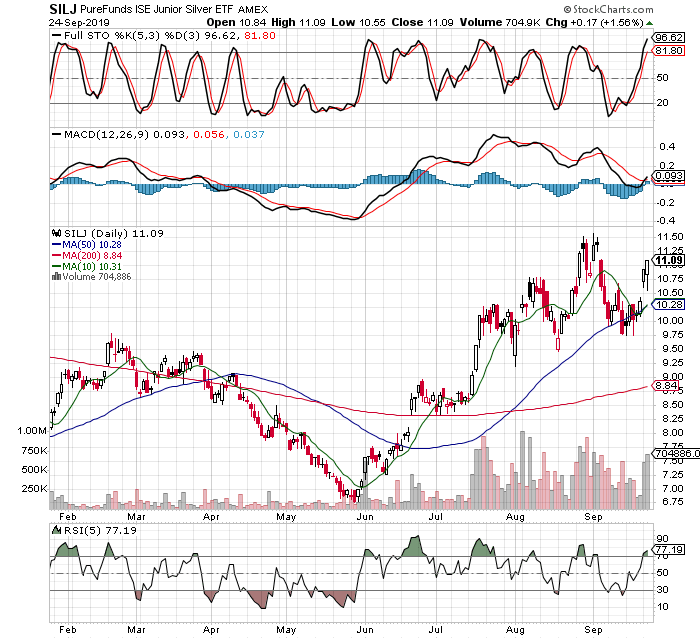

It appears the bull market in precious metals and their miners is back on track, after a short correction of a few weeks, in which I did add to positions, albeit lightly as I’m already very heavily invested. SILJ in particular is very close to it’s bull market highs, and even GDX is not too far away from breaking out again.

Today and yesterday were notable in that silver was up 5% yesterday, then after opening lower by 1.5%, closed the today about unchanged. Miners had similar action, though not as pronounced. This is typical bull market behavior, bucking people off after sprinting higher, only to finish strongly again. I like where I sit, and continue to press the long side, realizing it will get more volatile as the bull matures. I am keeping an eye out for my technicals to flash a sell signal and when they do, I will sell with no questions asked. There are great fundamental arguments to stay in the trade, like QE4 around the bend, repo markets freezing up last week needing Fed bailout, even the stock market seems to be finally weakening, which should help gold and silver miners. Every time the media whispers about a trade deal, the stock market bounced, until the last few days where I have noticed good news is being ignored. In fact, today was the first weak day (-1.3% on the QQQ’s) that closed near the lows in many weeks, and during the weakest time of year historically.

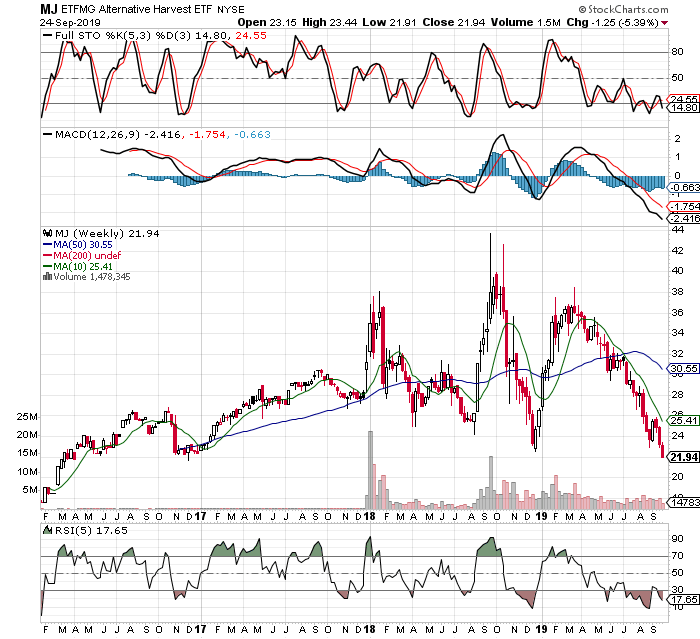

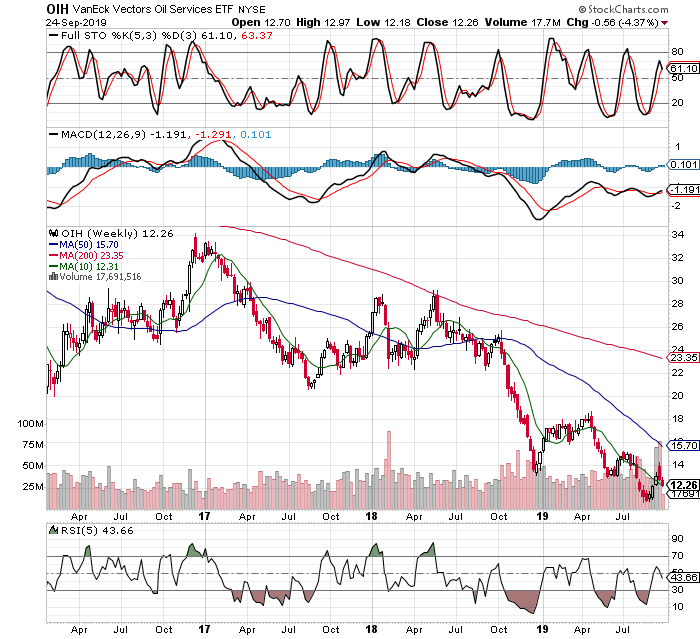

Also of note, Bitcoin got smacked for a 15% loss. MJ is the marijuana etf, it continues to break into new yearly lows, dropping another 4.5% today, and even oil can’t hold that war premium it gained from the Saudi oil refiner attack, it lost another 3% today and the OIH oil services etf is not far from making new multi year lows again. In short, metals and miners were the only green (UP) group today, and that despite a very weak start, they remain the only game in town, unless somebody wants to buy a negative yielding bond, which I do not! See the charts below…

To sum up, my biggest concern right now is that my signals get me out of this mining trade too soon, because everything else is firing on all cylinders and they clearly want to go higher. I’ve learned to ignore the noise and day to day news items as far as investing, but I don’t ever ignore my signals. I will keep you posted when I make any changes, or have something else to share.