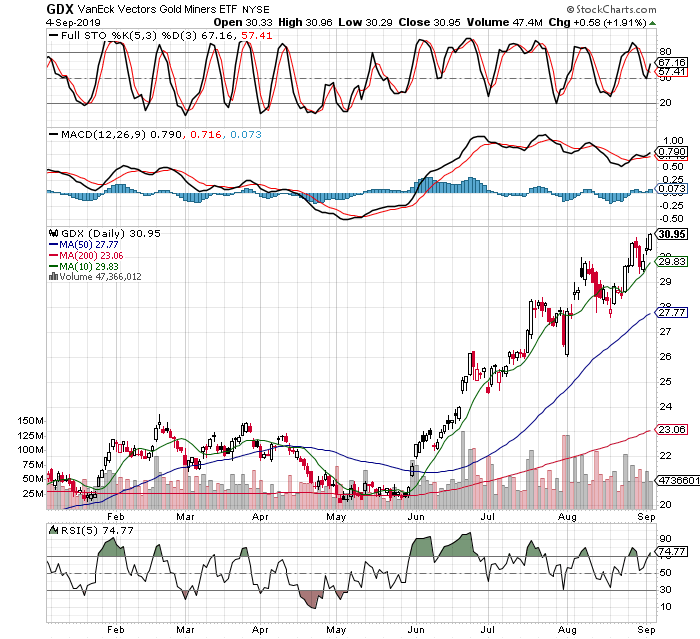

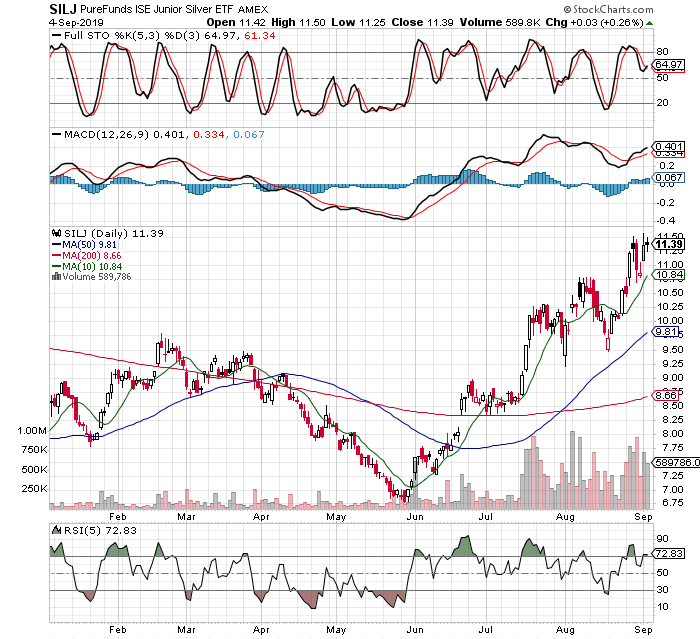

GDX confirms 2016 was the start of the bull market, and silver is now blasting higher as well.

September 4, 2019

First, a quick note on the GDX mining etf. Today it closed at a new high, eclipsing the 2016 high, and confirming that 2016 was the beginning of new bull which is now back in full swing. I have lots to cover here because I haven’t been posting much with all the action in the markets staying healthy in the gym, etc. Suffice to say, I haven’t added or sold anything since the last post which asked if that was a pullback to buy. We now know it was. It think putting the next few days or week aside, it is very significant that gold and miners are making new highs and it suggests more is to come on the upside. Let’s get to the charts…

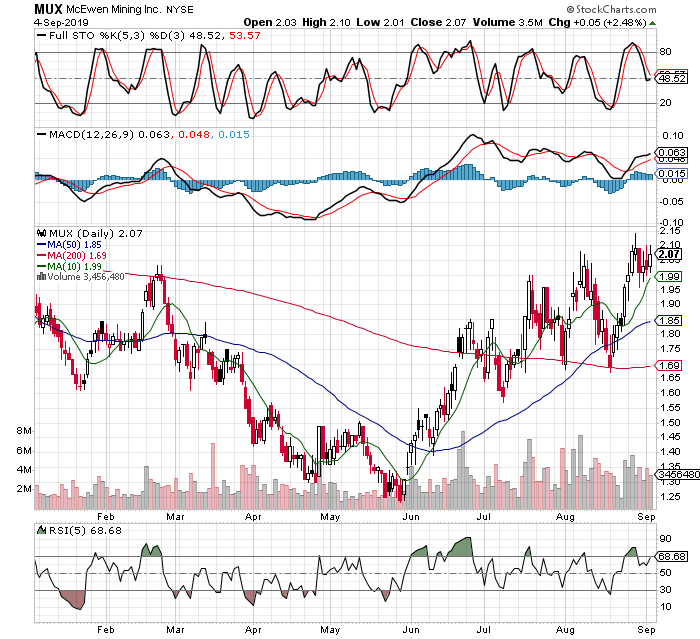

Week after week the precious metals and miners take turns leading the run into new high territory. This is a move not to be missed. I would not be buying into this sharp up movement, but if I were not fully invested and on sizable margin, I would be buying into dips that bring miners into oversold stochastics on the daily charts, or for those more conservative, on the weekly charts, which might occur in the next month or two. Until then, bulls stuck on the sidelines will find it painful to watch this rally work higher. To verify my trading claims, please see the account statements to back it up. I haven’t sold a share yet, but will let readers know when I do.

If some weakness can creep back into the general stock market, I suspect the afterburners will kick in on all the above and anything related. The gale force winds are at gold’s back, so don’t make the error of selling too early!