May 20, 2019

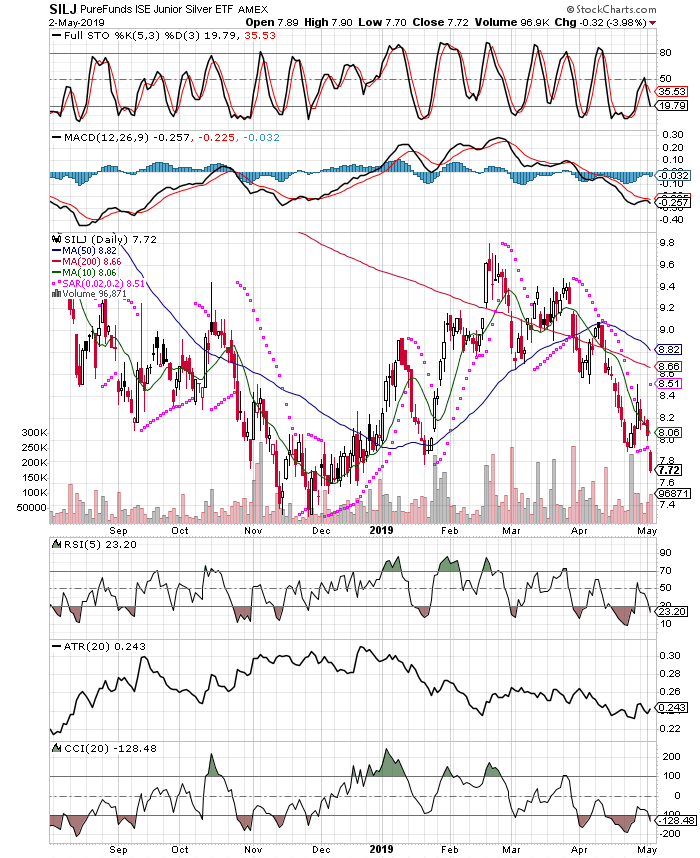

Let’s check in where we last left off, I am still in the process of accumulating the SILJ silver miners etf, and taking a good-sized drawdown. Perhaps it is best this site project started with a loser out of the gate, after all, one must manager losing trades properly, above all else, if they are to stay in the game. So why did I choose today to write an update? Well, besides taking a beating, I see several big things happening under the surface that will be things to look out for as opportunities, as well as possible catalysts to get my current trades kicking in gear. By the way, I mention the SILJ position as it’s my largest and my focus, but viewers can see from the my managed accounts that I have several other positions, and I can’t always mention them all, but one is a standout that deserves attention at the moment. I will address it in another post another time, but Irving Resources is a gold explorer in Japan, and this one just happened to play out correctly from the starting gate. On my first purchase, accounts are up over 150%, and when the markets took the stock down in a real swoon, I about doubled my position, and the second purchase is not up 60 to 70% as well, been in this one 6 months or so. I will let the chart do the talking, so we can get onto other business.

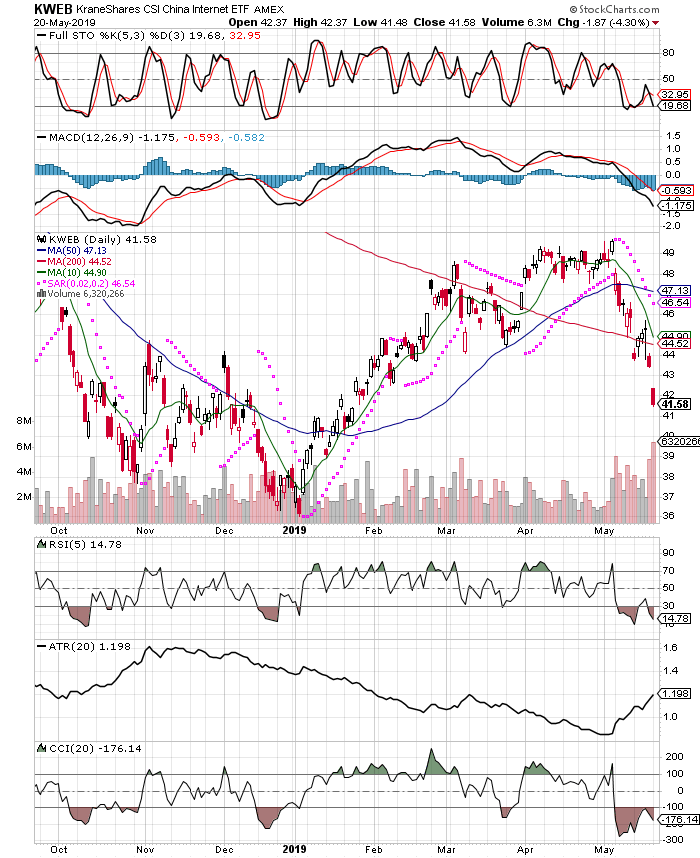

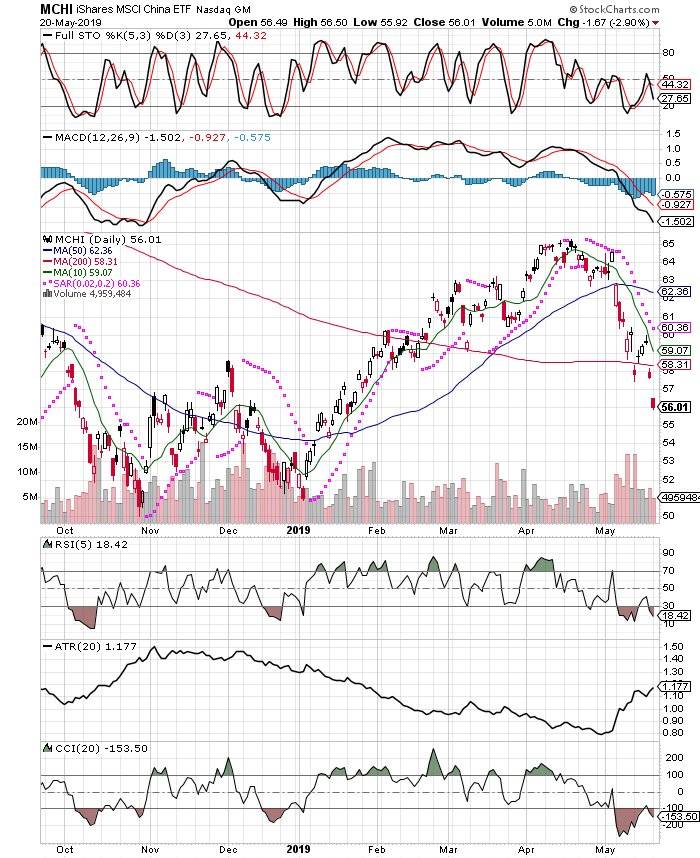

Back to miners, I expect to see them stabilize in here and then get working higher. Why? Not only have they sold off sharply, with the HUI down about 17% is just 2 months, we are starting to see weakness creep back into the general stock markets, and in the case of China it’s getting hammered lower. There might be some opportunity there to pick up cheap shares in the future, but I still feel it’s too early. Maybe I am wrong, but the back and forth between China and the US on the trade war does not seem to be subsiding, instead it’s escalating. If anything, China holds the cards on this issue, in my opinion, so its surprising to see US stocks right up at all time highs while China gets clobbered. Take a look at the KWEB or MCHI china etfs.

One can only guess if this is winding down so markets can resume going up forever like they have done, but if that is not the case, then in might just be getting started, and that is why I will patiently wait on the sidelines for longer term charts, like the monthly’s (not shown) to give a hint they are done going down. At the moment, they suggest this might have a long way to go, so even if I take a long side trade in the China shares, it will be a short term hold, and with smaller position size, thus relatively inconsequential. Anybody that knows me, knows that I like to get outsized positions on something I really have conviction on, rather than dabble in and out for a few percent here and there. It can work for some, but I find it takes about as much energy as a setup where one can really go in for the kill. I prefer, and will wait for those type setups far more often that taking a stab here and there just because I feel something has moved too far, too fast.

Before I forget, here is that chart of Irving Resources mentioned above. Not sure why WordPress wouldn’t let me add it above, but I’m just getting used to the software. This is a beautiful chart, and while volatile, appears that it could have lots more upside, so I am in no hurry to ring the register on this one. I will let you know when I’ve sold it, but for now I am more interested in waiting for another window to add to the position.

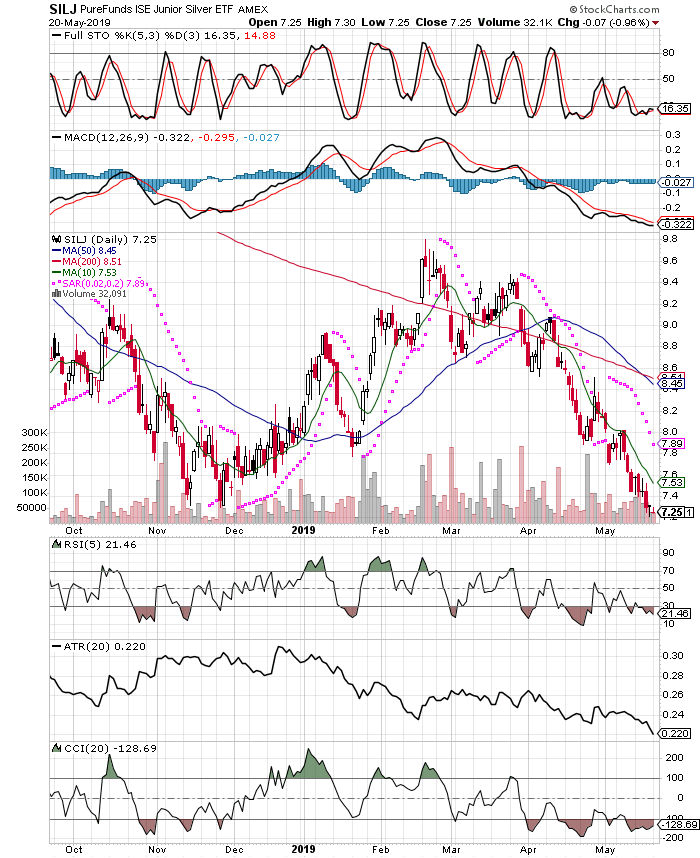

And now we come to SILJ, the etf putting my ass to the fire. Let’s take a peek. That is one ugly chart, unless one is looking to buy and add. Still, it suggests that even if I can get near the bottom prices, it might take awhile to work out for any sizable gains on the upside. Silver miners have underperformed gold miners by quite a margin lately, with some big name silver’s like HL, PAAS, and CDE making multi-year lows. This is the type of trade I refer to when I say going for the kill. While momentum is against the silver miners, commodities be their very nature turn at some point, for example as silver miners start to put less economical projects on the back burner until higher prices. This reduces supply, and eventually the market has to price silver higher to replenish supply, even meet new demand that can be created by low prices. In any case, these are longer term trades and many will get bored out of positions before they realize any gains. I like these setups the best because the allow one to get into big size positions as virtually nobody wants to be involved with something so horrendous, and these are where the biggest gains are made when one is correct. The richest most successful people in the investing world make big, concentrated bets when they see risk vs reward far in their favor. That does not mean they always win, it just means they win much more when they are correct, than they lose when they are wrong. I will explain more about the psychology of the trade as it matures, and why the vast majority of people tend to focus on short term trades even as they learn the big money is made in the big winners, not the day to day in and out, cut losses at 10 cents a share type stuff. The only “people” making money from the very short term trading these days are the “quants” that write programs acting in nanoseconds, and often breaking the law as well by strategies such as “front-running” and spoof orders (fake orders put out to influence market participants with no intention of ever being filled). I feel sorry for human daytraders with pipe dreams, those days are past and they will lose their money over time, if not very quickly. The facts are that even most brokerage houses trade against their clients, it’s just how the business works now, and the soon one accepts it, the sooner they can adapt their trading and investing style to minimize the odds of being pickpocketed.

Since I am trying to stay in this one for what I see as a longer term opportunity, I should include the weekly chart going back several years as well. Note the 2016 high up near $20, I expect this to get visited at some point, and I expect to be still in it when it does.

So while SILJ is oversold by many measures, we can’t know when it will turn higher with conviction. All we can know is ourselves, and what it takes to get us through the difficult part of the trade, then keep us in it for the ride higher once it starts. The trade is easy, managing one’s thoughts, emotions, and subsequent actions that result from emotions, is the difficult part.