Blasting off higher!

December 4, 2019

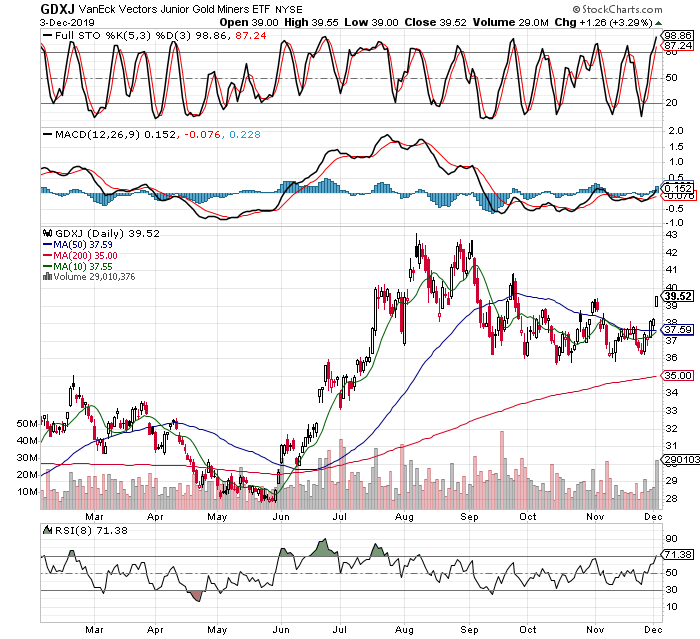

Sure enough, our hunch that miners were just testing the bulls before moving higher has now been confirmed with conviction, as the whole group is blasting higher. Note that many of the silver miners are already making new 52 week highs, and while most miners are doing well, including gold miners, they are not as strong as the silver miners as they charts below will show. The SILJ etf is closer to making new 52 week highs than the GDXJ etf, though both are rising in tandem. What’s better, we are heading into the seasonally strongest time of the year for precious metals and their miners, so stay long and hold strong.

In addition, we the US dollar and the stock market appear to be rolling over, which could put added wind in our sails. I did add to SILJ a few days ago and forgot to post because it wasn’t a large buy order as I am already very heavy and on margin in all the accounts I manage for friends and family. As always, I tell the truth and you can verify these “after the fact” statements by simply going through the account statements posted on this site. After all, claims mean absolutely nothing in this world, if they cannot be independently verified.

Potentially more fuel for the fire, I still see lots of bulls on the group that are either uninvested, or have ver small positions compared to what they wanted to buy on a further dip in gold that never came. I think after a few weeks of disbelief and waiting, they might also decide to chase prices higher as miners now appear to be the only game in town. In short, I’am looking forward to very good gains over the next several months, at the least, for my miners, gold, and silver.

Regarding other opportunities, my system has luckily kept me out of the XOP and energy stocks, despite my having interest from a value perspective. I will discuss this more in future posts, but suffice to say that as soon as my indicators flash a buy signal, I will be getting involved there as well. I mention it now because this could happen soon, then again I was getting prepared a couple months ago for a signal that never came, so we will just wait patiently. I fully realize the fundamentals are terrible and worsening in the oil and gas sector, but the real question is how much of this is already factored into the stock prices. We cannot know for sure, so will let the charts tell us when some more well-connected investors and insiders believe the upside is worth the risk. My hunch is we are close, but keep in mind I am also a longer term trader and often have to wait a month or two, or more to start making the big gains. No problem for me, as long as they materialize.

For now, I’m staying laser focused on silver miners, gold stocks (juniors), and the metals, in that order. It’s still early enough in the intermediate cycle (lasting several months), that I will continue to look to add on dips and pullbacks.