Did I just get faked out?

September 13, 2019

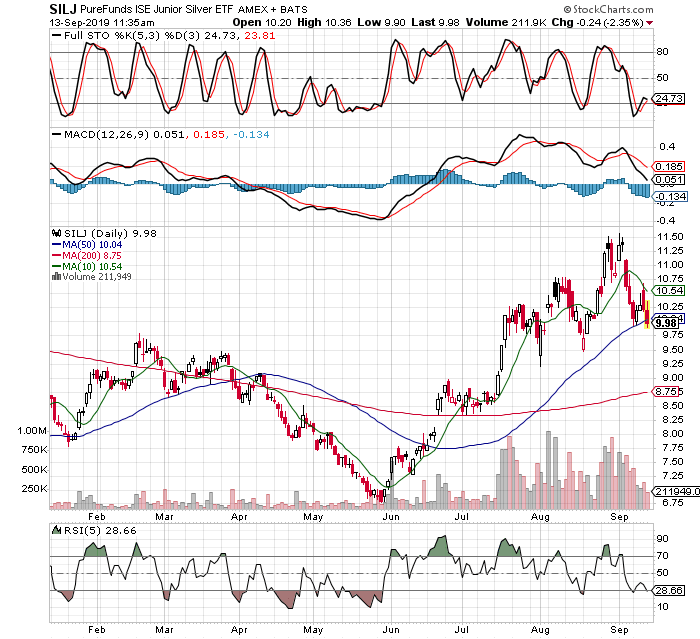

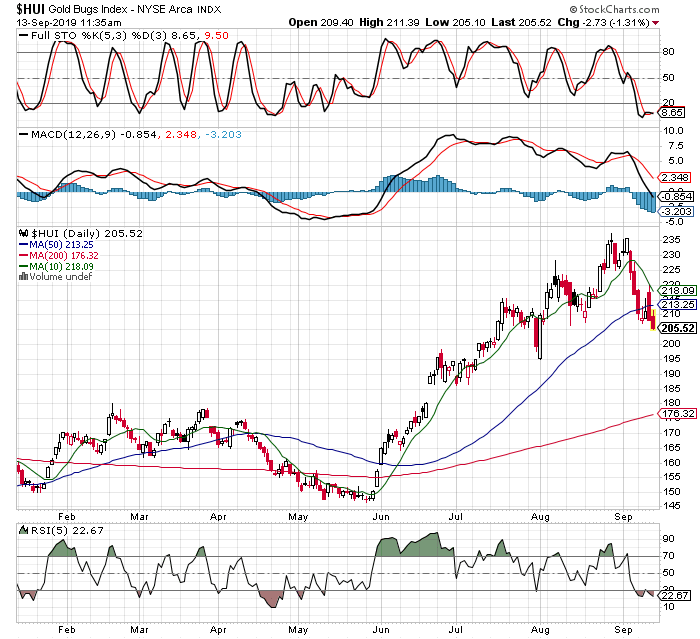

Just a day later, and everything that was bouncing not only closed on the lows yesterday, but made new lows for the pullback today! I am worried? No. Do I like it? No, except that I took the opportunity to add a little to my positions this morning, and will put in larger orders to buy if GDX gets down to the $26.20 area. That seems as good a place as any to start taking shares off the hands of capitulating bulls. Let’s take a look at the charts…

While these charts suggest there could be more short term weakness, it should be bought, as the miners are clearly in an uptrend. To quote well-known commodities investor Rick Rule, ¨this bull is more typical of bull markets, and we should expect to keep grinding higher¨. It is when we see blowoff type moves that go vertical, that signals we are near the end of the bull. For now, expect two steps forward, one step back, hopefully for several years to come.

Also of note, I see the TLT 20 yr treasury bond etf is down 5.5% this week, a rather large move for bonds. I wonder what the Fed is thinking before their meeting next Wednesday? See the weekly chart below…