Another Leg Up?

October 15, 2024

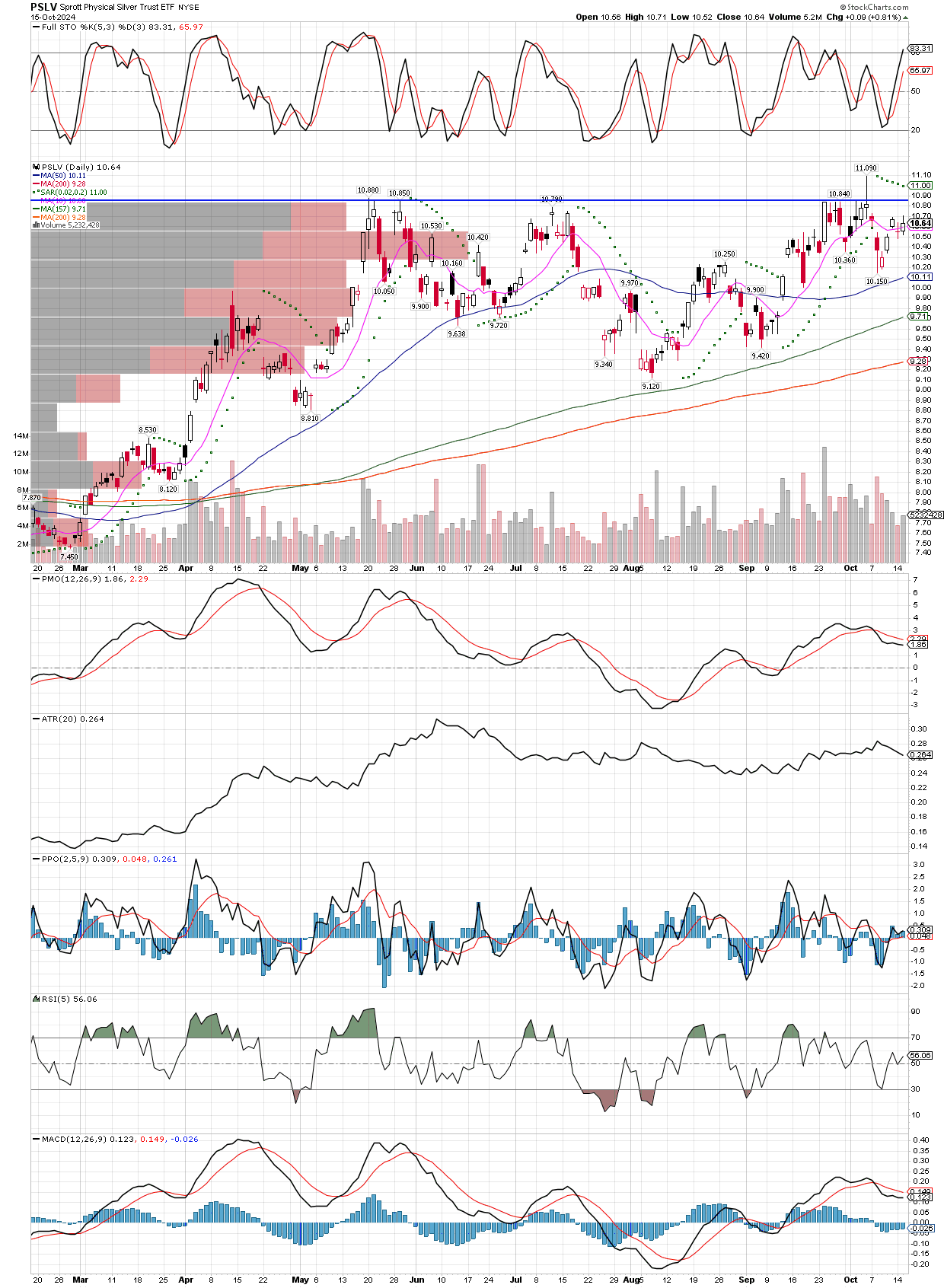

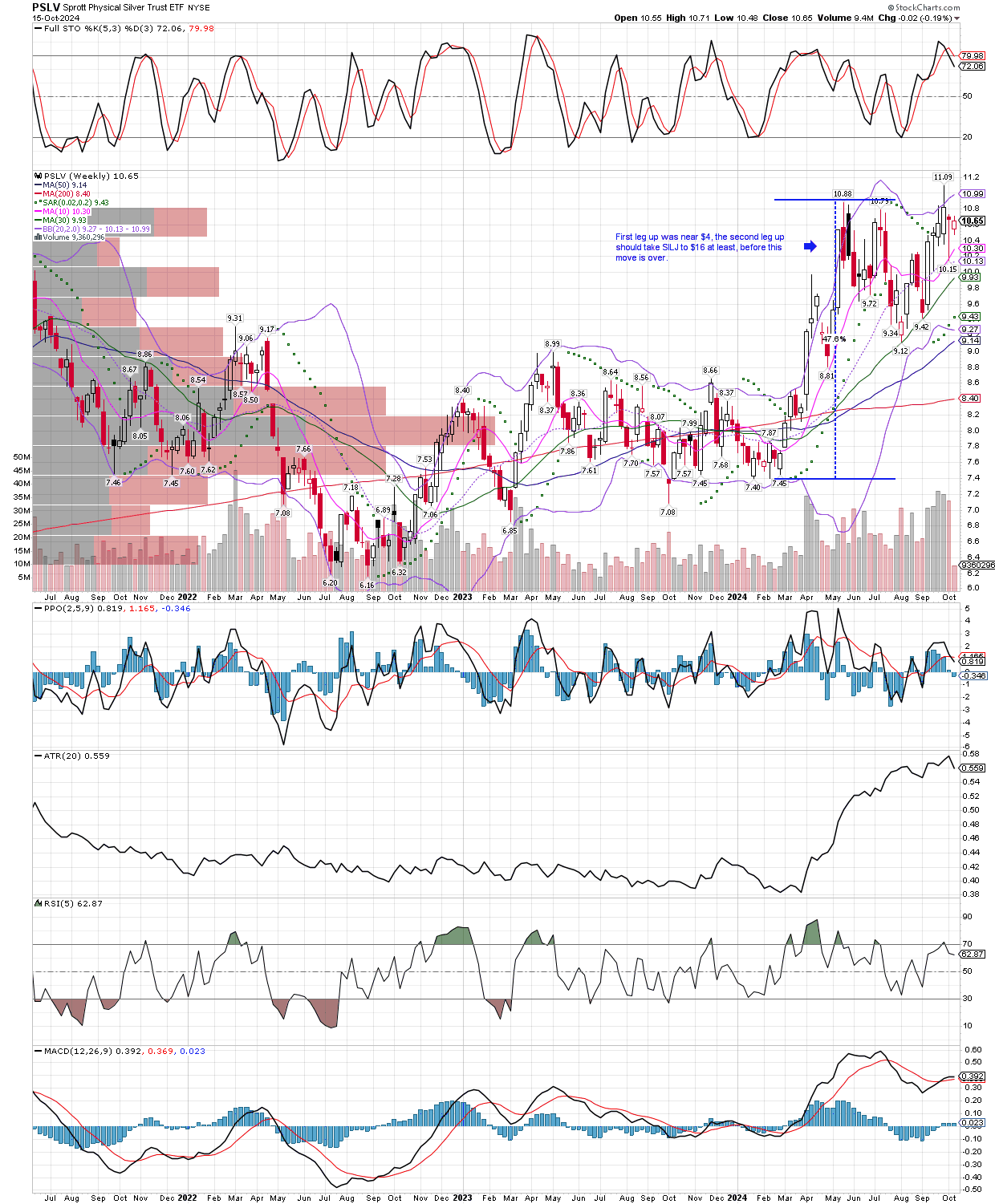

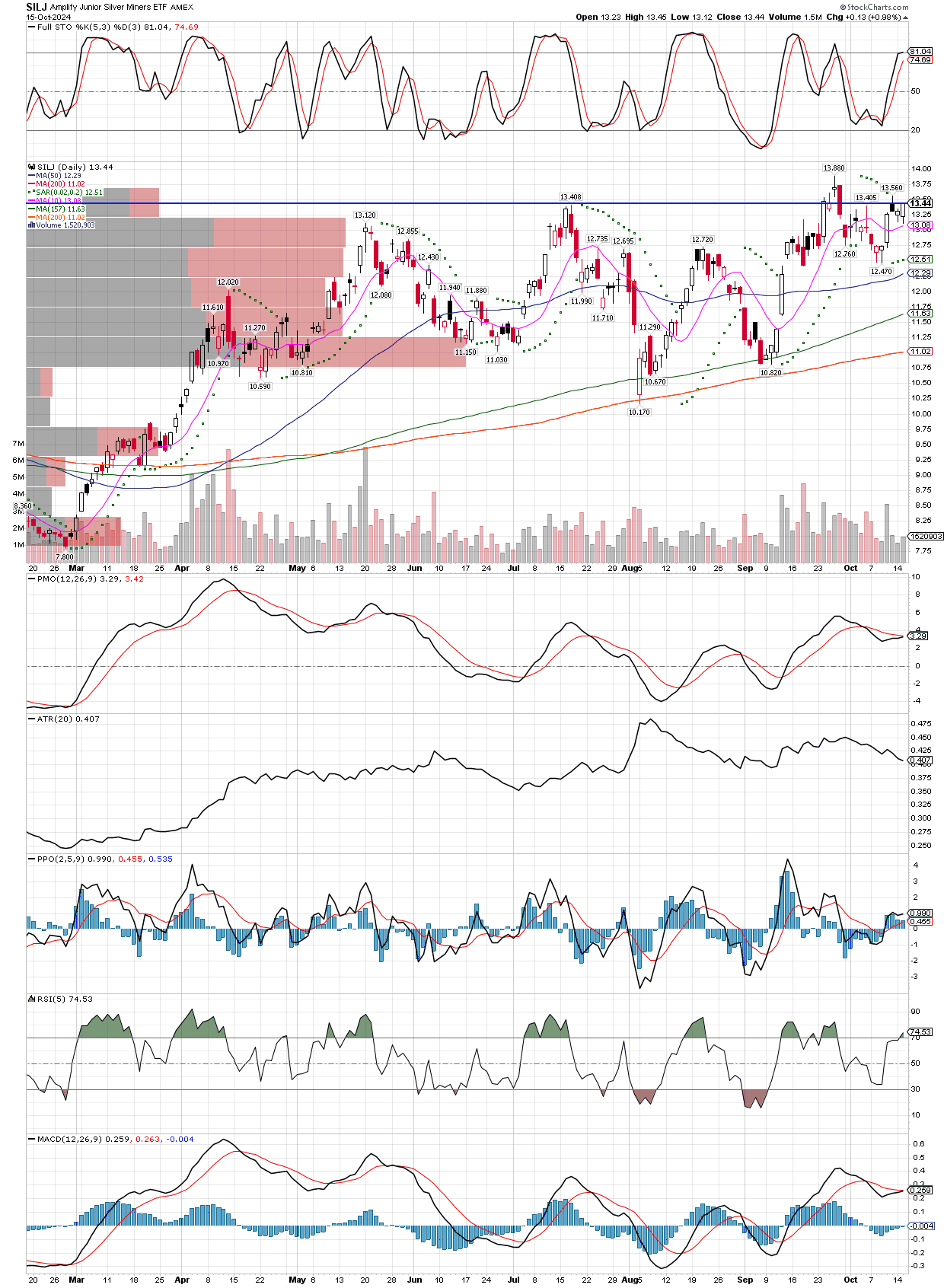

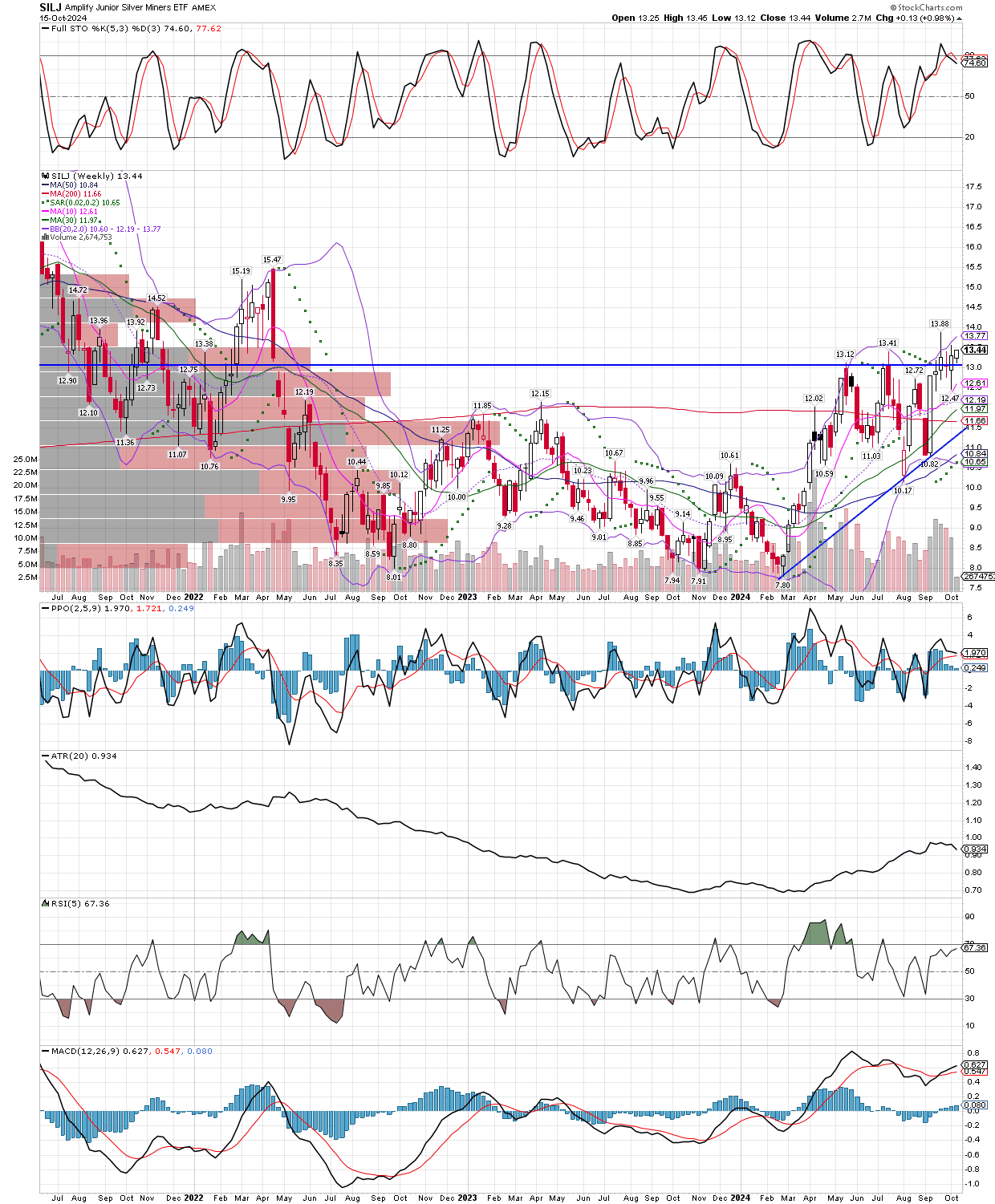

While its natural to fear a correction after a big move higher, we can let the charts tell us what to expect. Lately, silver and the precious metals miners have held very strong, after making some great gains this year. From late February until May, they basically went straight up. Then as they corrected, they formed a trading range for nearly four months until just recently poking into new highs for this bull, before being pushed lower again, back into the trading range. However, gold, silver and the miners have tipped their hand with that small breakout to new highs, especially gold which kept moving higher after its breakout. Furthermore, one just has to observe the trend of the moving averages, to see that the group is ramping up for another leg higher. The 50 and 200 day MA’s are not just trending higher, they are accelerating and spreading apart. This is a very strong signal we get more upside out of this move before any substantial correction takes place. I might decide to take some profits into this move higher, but its too early to say right now, and far too early to sell right now. So, we stay long and strong.

In addition to the very healthy-looking charts, we have several catalysts to drive the bull higher. Next week we see Putin lead a BRICs meeting, where alternatives to the US dollar as a reserve currency will surely be discussed. We have the US election in early November, and conflicts flaring up all over the place. Then we will get to the miners’ earnings season, where I expect we will see the best reports in a long time, maybe the best ever reported. In short, I keep our accounts comfortably invested in the precious metals area, as we wait for other groups to present opportunities, which I will discuss in my next posts. For now, note the moving averages on each of these charts, as well as where the price sits, currently perched up near the highs. To me, they are itching to make another big run higher.