Miners Making New 52 Week Highs

July 11, 2024

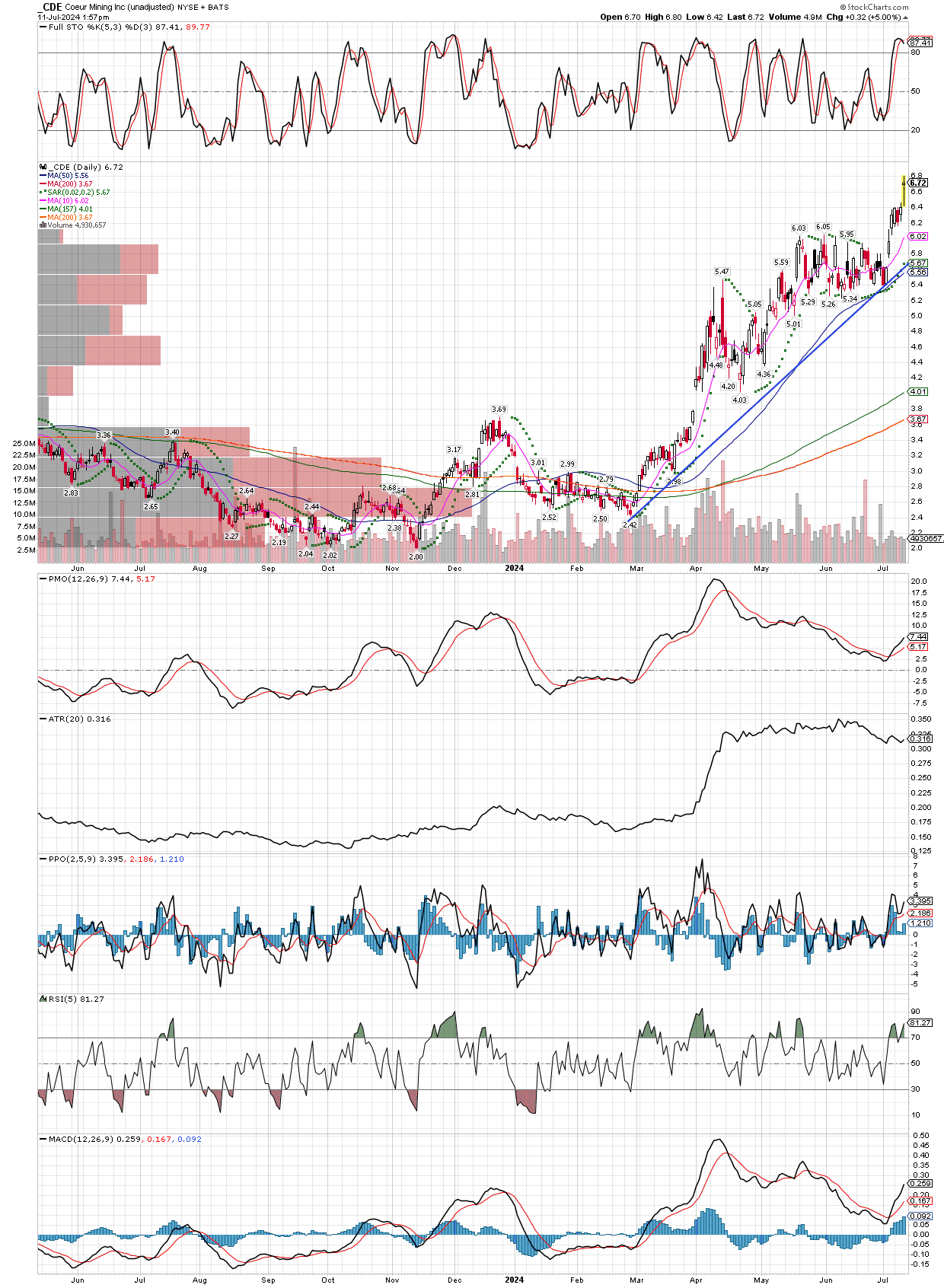

After several days of big gains back to back in our accounts, in the 6-8% range, I thought I would mention a few things. Many of our miners are taking out their 52 week highs again, supported but moving averages that are trending solidly higher. The GDX etf made a new high today with components like NEM, AEM, and WPM doing the same, while many of our individual holdings such as PAAS, CDE, GATO, JAGGF, EXK, SILV, NGD, and even our SILJ etf got within a penny of a new high for the year, as I type. This is a bull market action, if I were not already heavily long, I would get buying now.

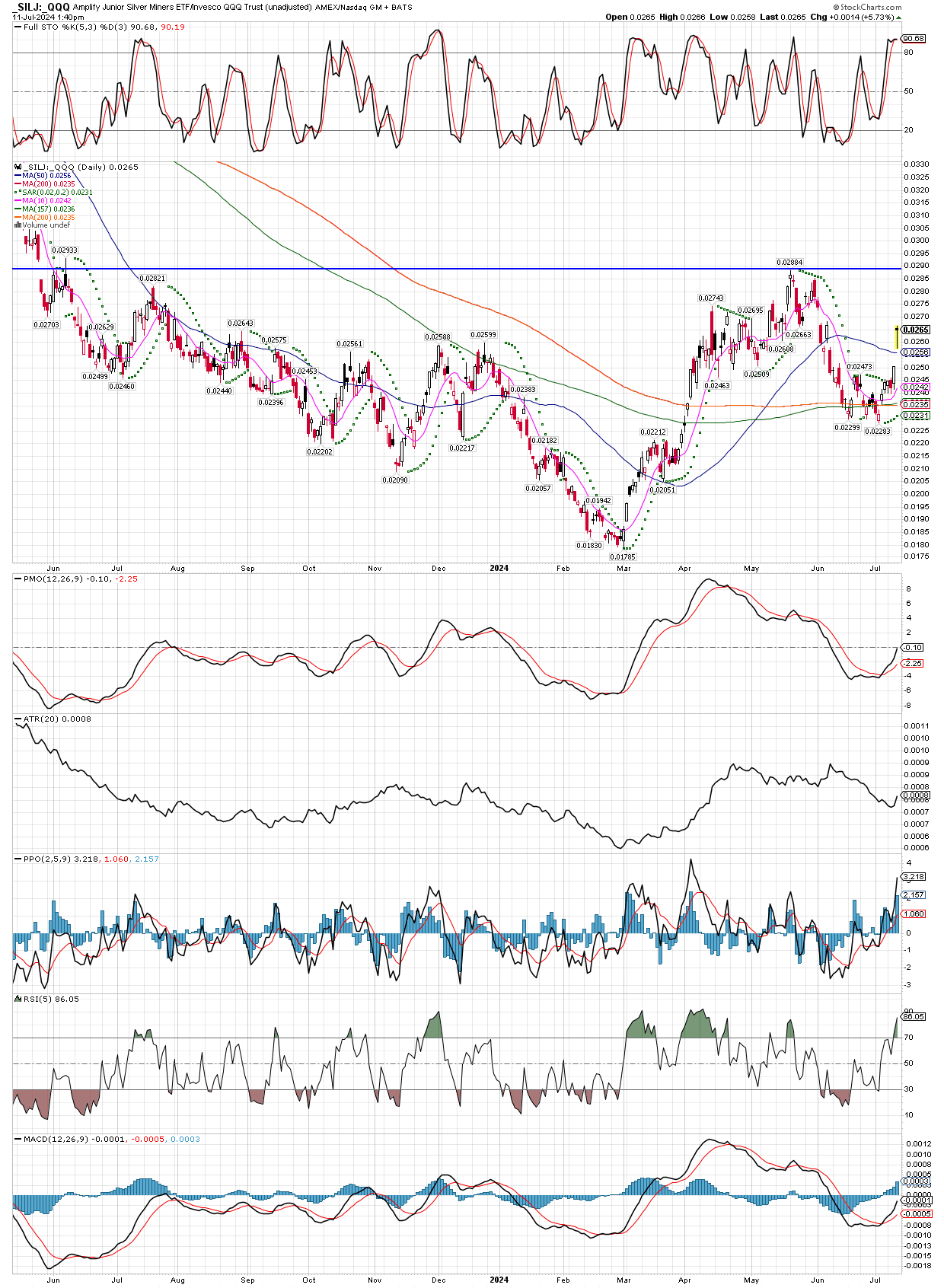

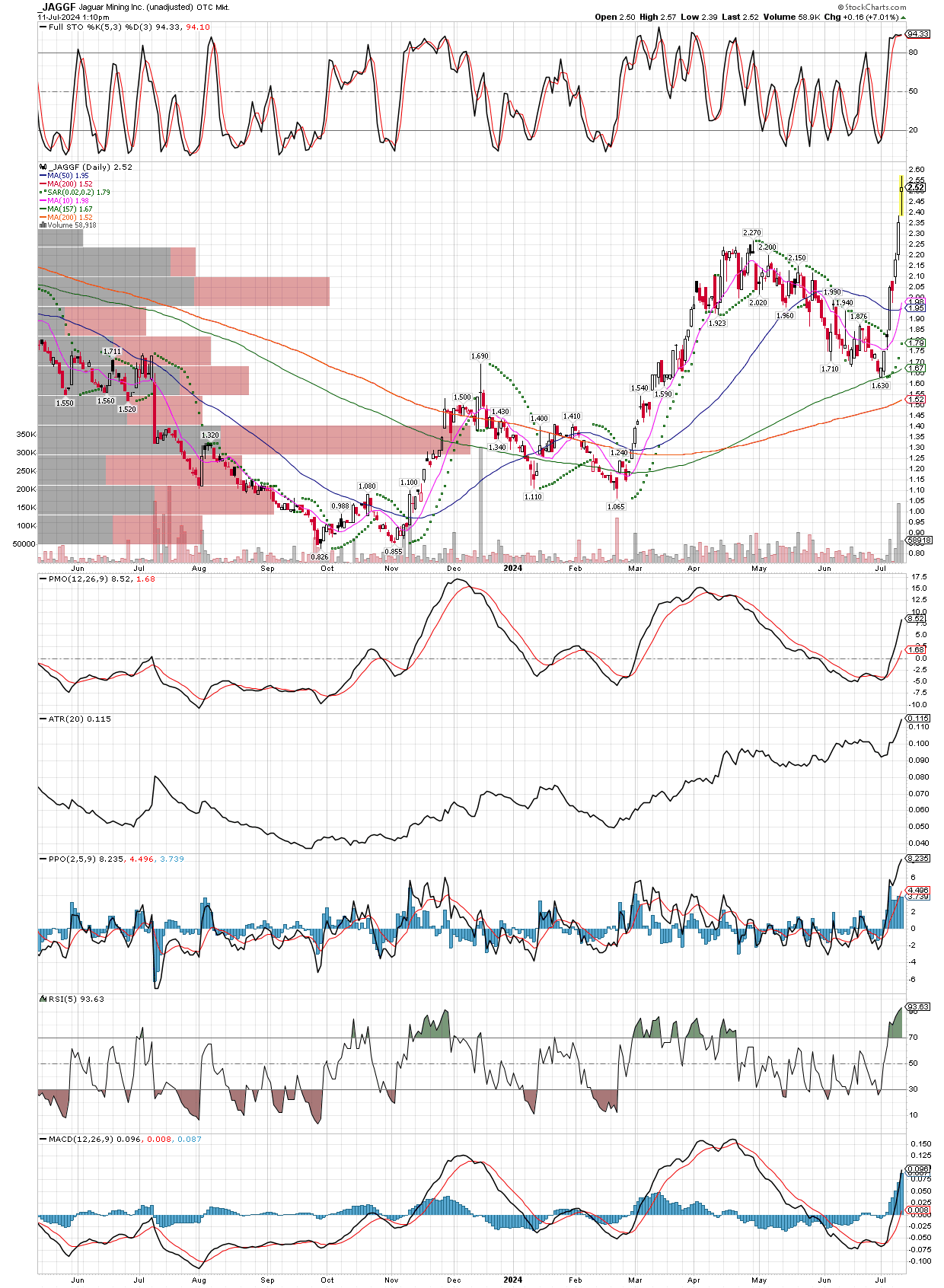

I will point out a few other things that might be showing us the way forward, for example, today is the first day in long time the tech stocks are won more than 2%. The fact miners are not getting dragged down with the general market is a big flashing BUY signal, I would not wait for a marker correction hoping miners drop with the market so I could buy them cheaper. It won’t likely happen, as we are already up 138% in CDE, 116% in GATO, with many more positions up 80-100% so far, and most investors still don’t acknowledge miners are in a bull market. This means there is a lot more to come, as they get converted to believers and start to chase the higher prices. I recently bought Silver futures (Sept contract), in the $29 range to add some more metal to our portfolios, and took advantage of the correction over the last month to add to most miner positions. So if the general stock market starts to weaken this summer, and we see more days like today, I would expect to see a lot more money flow into the precious metals and mining stocks. Take a look at the ratio chart of SILJ:QQQ, with a solid jump above all the moving averages, and note the 10 day moving average turning sharply higher as well. I expect this ratio to get over the horizontal line I have drawn above, very soon. What’s more, the junior explorers still have not kicked into serious bull mode yet, typical action in a new bull market is for the bigger, safer miners to make highs first like GDX has done, then new money flows into the mid-cap producers, later on the smaller, more risky juniors. This tells me there is still time for people to jump in now, I would focus on mid-caps at the moment, but I would not wait any longer. We have just passed the historically worst ime of the year for miners, they typically get strong after July 4th and run higher into September. Combined with the fact we are now beginning to see weakness in the general stock market, bitcoin and other competing investments, implies we could get a real rocket ride over the next few months. Remember that the biggest gains come in very short time periods. To illustrate, I will also post a chart of JAGGF (Jaguar Mining in Brazil).

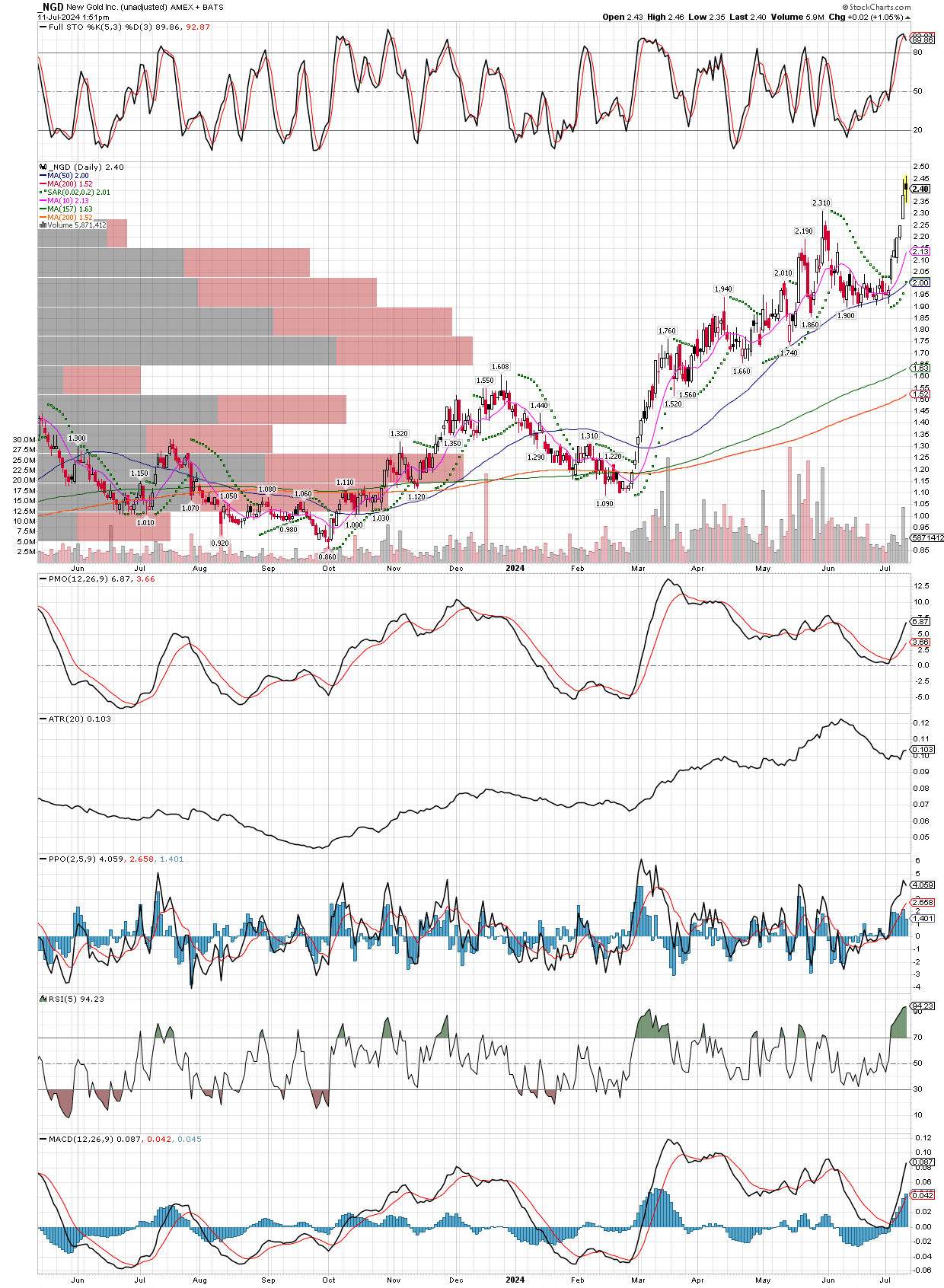

Sharp rallies occur that make it hard to buy into a stock, NGD is another example.

There is also the problem of what to do if one of the miners you want to by didn’t even pull back much in the one-month correction we rode through, like CDE. It won’t partake in the downside, but more than happy to join the party when the group is rising. What a beautiful chart, and with a 138% gain already in the position, it will now be easier to hold for the duration of the bull. This stock often gains 400-800% in bull markets for miners, so while these names are extended in the short term, I will not sell anything as they won’t make it easy for me to buy back in.

I realize a trend line with only three touches of the line is not always a reliable line, but I drew it to illustrate how steep the ascent has been, out of the March low. The takeaway is the miners rally sharper than just about any group, and one doesn’t want to miss bull markets in them because they can be life-changing events. The fact is we keep getting additional confirmation that a bull has recently started, and the things we want to see fall into place, like a weakening stock market and economy are now showing themselves as well.