SLV And EQX

May 6, 2024

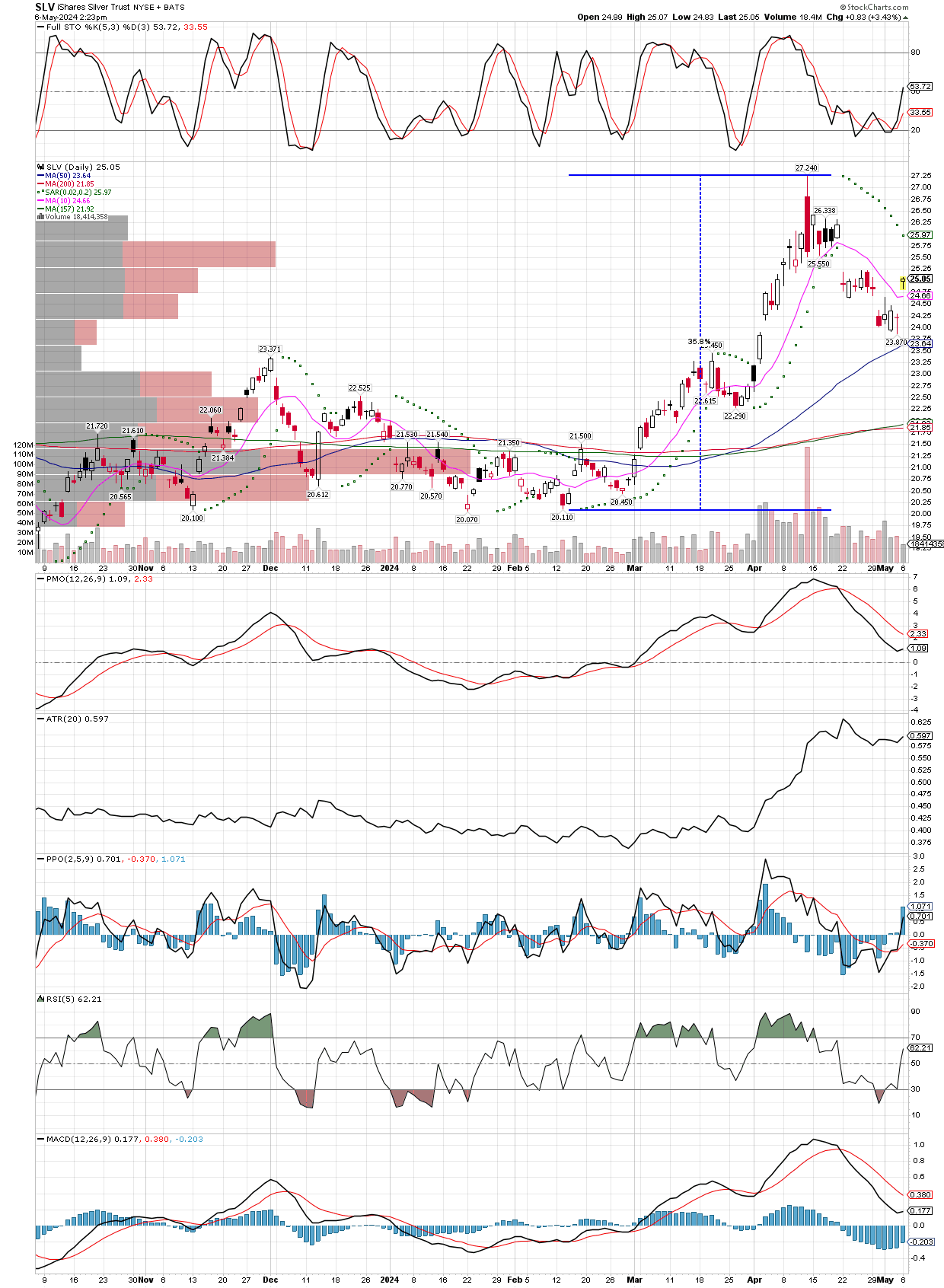

Just a couple charts to consider, first is the SLV silver etf to show how much silver rallied from the February low to the April high, in just two months it rallied 36%. Many people say silver and miners are lagging, but the charts say otherwise. By the way, in my opinion nobody should ever buy the SLV etf, as they don’t have to own physical silver. Lots has been written about this topic and its manager JP Morgan, for those that want to know more about why they should avoid the SLV etf. That said, silver (the metal) and it’s miners look like they are ready to make another move higher. I added to our SILJ leap options with a January 2026 expiry last Friday, and am looking to add to other individual miners as well.

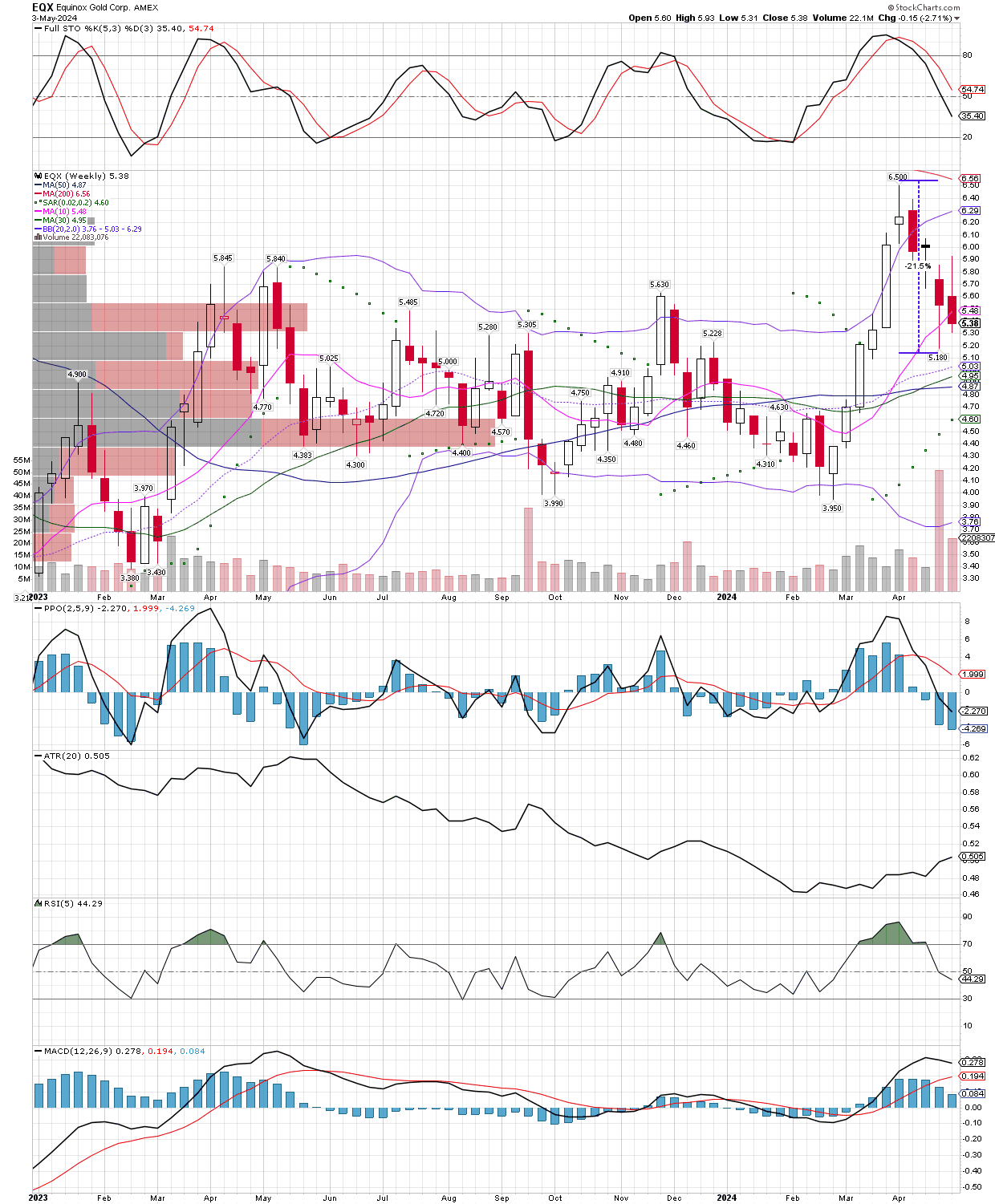

With that in mind, let’s look at EQX (Equinox Gold) on a weekly chart. The stock has now pulled back nicely after making a new 52 week high, is in an uptrend, and now sits on its 10 week moving average while stochastics are now closer to oversold than overbought. I don’t recall which firm it was, but a recognizable brokerage firm came out with a target near $30 (CAD), about $22 in USD! I’m not sure if it was a misprint or not, nor would I buy on a broker’s recommendation, but with the stock at $5.60 as I type, that would be some amazing upside potential. I will stick to my analysis and just say its a stock I am adding to either today or tomorrow, among several others including FSM, SVM, BTG, PAAS, HL, CDE, AG, AYASF, SILV, and possibly a couple juniors like AAGFF and LGDTF. I was prepared for another week of sideways to lower prices as the group corrects, but the open today (Monday morning) saw the group make big gains, so it appears the correction might already be over. I plan to add 10% across the board to each position.