A day later, and we are off to the races again.

July 10, 2019

I will try to post more frequently, but I hate to write just for the sake of putting up material, it’s a waste of everybody’s time. Perhaps in the future I will write about the many other aspects of life that are just as important as trading, and in fact influence my trading to a large degree. Things like exercise, keeping fit, eating habits, etc. are all considerations that affect all aspects of life, including our mental strength and ability to stay focused on the plan. Others might find these insights of use and adopt them for themselves.

Since this was intended to just be a quick update, let’s get right to the charts. The two most commonly traded mining etfs are GDX and GDXJ. I mentioned yesterday how I liked the setup, and was adding to my winning positions while they were pulling back. Today gives us the confirmation that miners indeed want to head higher, and they did with force. Many of the leaders broke into new 52 week highs, suggesting the group will follow, and that the upside is not nearly finished. We won’t know where they top out until we get there and we start to get conflicting signals, but a good place to start looking for the exit will be when the long term monthly charts start getting to overbought stochastics. For now and the foreseeable future, stay long and add on dips. Stay focused on the plan, and don’t let the wiggles scare you out of position.

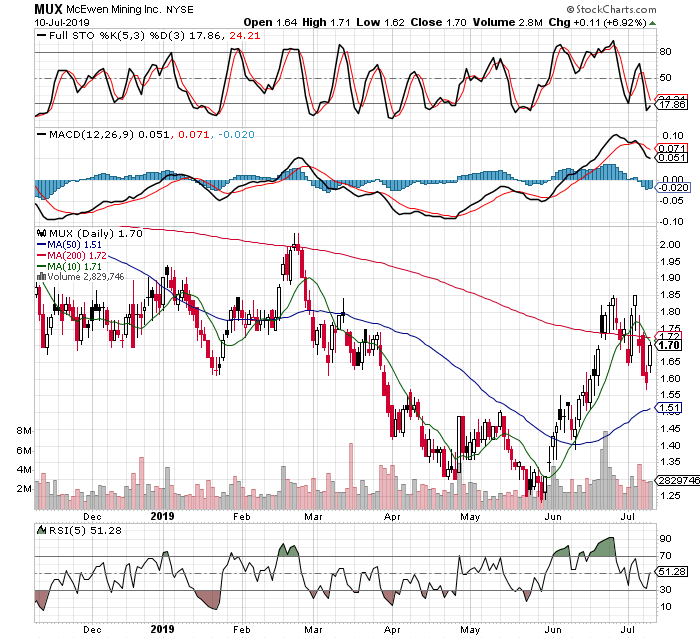

Before I forget, let’s take a quick look at MUX, which I was adding to yesterday while it was down and near the lows. I got lucky here, as it was one of the better performers today, after being one of the weaker ones yesterday. It managed to tack on close to 7% today. That´s nice, but I am not tempted to take small gains, when I am looking at a setup from the long term monthly charts that got me into the trade. The precious metals miners still have lots more potential upside!